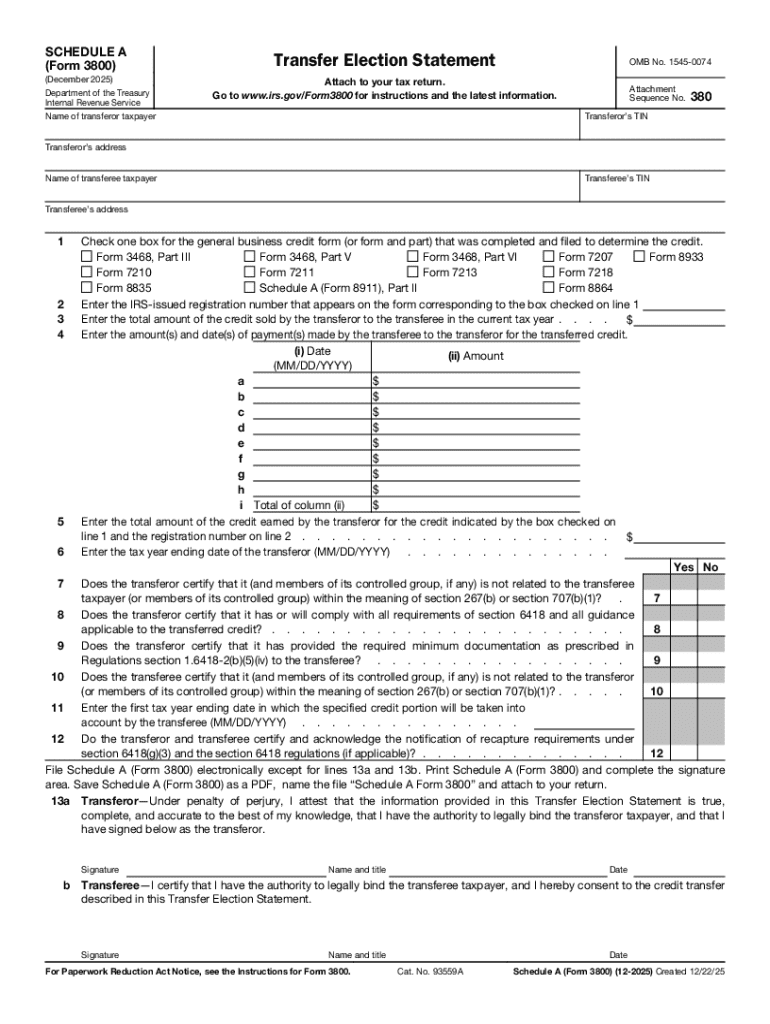

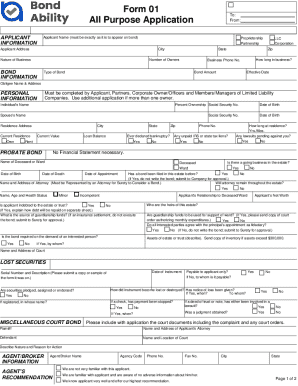

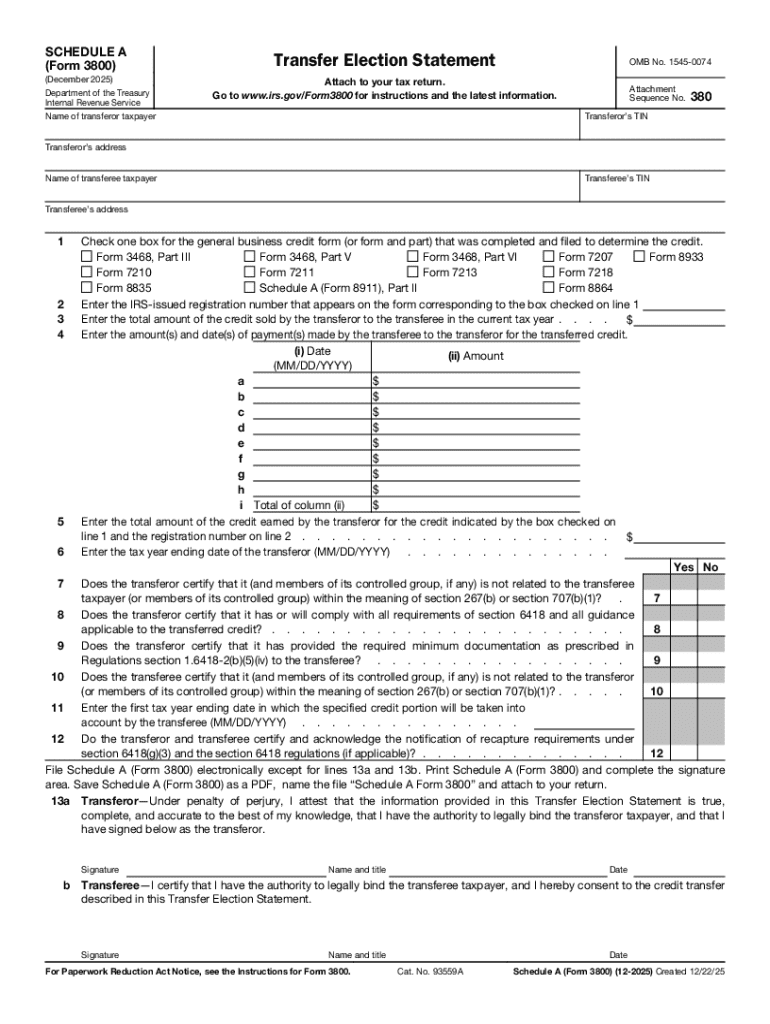

Get the free Schedule A (Form 3800) (December 2025). Transfer Election Statement

Get, Create, Make and Sign schedule a form 3800

How to edit schedule a form 3800 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule a form 3800

How to fill out schedule a form 3800

Who needs schedule a form 3800?

Schedule a Form 3800 Form: A Comprehensive Guide

Understanding Form 3800: A comprehensive overview

Form 3800, officially titled the 'General Business Credit', is a critical document for taxpayers seeking to take advantage of various tax credits. This form is essential for reporting business credits, ensuring individuals and businesses can maximize their tax savings. The importance of scheduling Form 3800 arises particularly during tax season, as it consolidates multiple credits into a single filing, simplifying the tax preparation process.

Scheduling Form 3800 is not just about filling out a form; it’s about strategically managing your tax liabilities. Various tax credits, such as the renewable diesel fuels credit, the foreign tax credit, and others are reported through this form. By ensuring you schedule Form 3800 correctly, you can significantly reduce your overall tax burden, making it a beneficial step for taxpayers.

Key features of Form 3800

Form 3800 is structured with several key components that make it vital for tax reporting. Updates in the latest drafts may include new parts detailing eligibility for specific credits and clearer instructions for taxpayers. Each section provides a breakdown of different credits that individuals or businesses may qualify for, thus allowing taxpayers to strategize better.

The form typically includes sections such as the total credits available, specific lines for different types of credits, and a summary of credits you’re claiming. Eligibility criteria can vary by credit type, encompassing individual taxpayers, businesses structuring tax credits, and charitable organizations.

Who should schedule Form 3800?

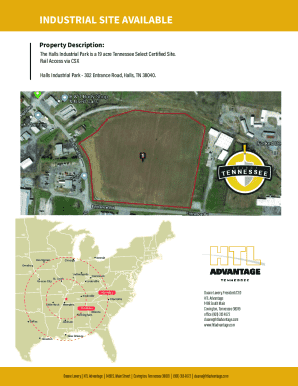

A wide range of taxpayers may find themselves needing to schedule Form 3800. Individuals who run small businesses often utilize this form to maximize tax benefits, helping them claim significant credits they would otherwise overlook. Additionally, charitable organizations frequently qualify for specific credits that can help reduce their liabilities, making Form 3800 an essential tool in their tax preparations.

In essence, anyone who is engaged in activities that generate business income or deductions should consider scheduling Form 3800. This includes freelancers, entrepreneurs, and even larger businesses looking to leverage tax credits effectively. Understanding who should schedule Form 3800 can illuminate the path towards maximizing potential tax savings.

Timeline for scheduling Form 3800

The timeline for scheduling Form 3800 is crucial. Taxpayers must be aware of important deadlines, particularly because the IRS has specific cut-off dates for credit claims. Generally, these deadlines coincide with your regular tax return submission; however, they can vary based on the type of credit you are applying for.

Taxpayers should adopt best practices during tax season by organizing documentation ahead of time to facilitate a smooth filing process. Missing deadlines can result in lost credits and missed opportunities, ultimately impacting your financial standing. Therefore, understanding this timeline ensures you can maximize available credits and avoid costly errors.

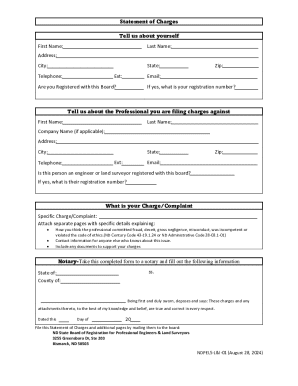

Interactive tools for preparing Form 3800

pdfFiller offers a user-friendly document creation solution, enabling users to fill out Form 3800 seamlessly. The platform provides a comprehensive suite of tools to manage your Form 3800 efficiently, meeting the diverse needs of individuals seeking effective document management. Users can access various templates tailored for Form 3800, ensuring compliance with IRS requirements.

Key features include the ability to complete forms online, automated prompts guiding you through each part of the form, and options for eSigning. By using pdfFiller’s interactive tools, you can enhance your tax filing experience, reducing stress and streamlining the preparation process for Form 3800.

Step-by-step guide: scheduling Form 3800

Scheduling Form 3800 requires careful preparation. Here’s a step-by-step guide to streamline the process:

Common mistakes to avoid when scheduling Form 3800

When scheduling Form 3800, many taxpayers could fall into common pitfalls that may affect their filing accuracy. Missing due dates, providing inaccurate information, or failing to include necessary documentation can lead to delays and lost credits. Being diligent during the preparation stage is crucial to avoid these errors.

Using pdfFiller can help mitigate these risks considerably. Automated checks and easy access to templates reduce the likelihood of submission mistakes, ensuring compliance with tax regulations and enhancing your chances of a successful filing. Learning from common mistakes can lead to more successful tax credit claims in the future.

Maximizing your tax benefits with Form 3800

Form 3800 offers an array of tax credits that can significantly reduce your tax exposure. These credits are crucial for individuals and businesses alike, enabling them to offset a portion of their income tax. Understanding how to apply these credits effectively can result in substantial tax savings.

Case studies show that taxpayers who plan strategically around their credits see a marked improvement in their tax situations. For instance, small businesses that utilize the renewable diesel fuels credit not only support green initiatives but can save substantial amounts during tax season. Maximizing your tax benefits via Form 3800 is a strategic approach that can pay dividends.

Support and resources for scheduling Form 3800

For users navigating the complexities of Form 3800, pdfFiller provides a hoard of support options. From comprehensive tutorials guiding you through each stage of form completion to customer service helping with form-related queries, pdfFiller equips users with necessary resources.

Utilizing the support available ensures that you can tackle any issue that arises during your filing process. Engaging with these resources enhances your understanding and confidence when it comes to scheduling Form 3800, promoting a smoother tax preparation experience.

Conclusion: The empowerment of efficient document management

In conclusion, scheduling Form 3800 effectively can transform your tax experience. Leveraging pdfFiller’s capabilities allows taxpayers to navigate the complexities of tax forms effortlessly and efficiently, from preparation through submission. The empowerment that comes from effective document management is not just in filing—it’s about maximizing your financial advantages.

Using pdfFiller’s platform ensures you have the tools needed to manage, edit, and submit your tax forms securely and conveniently. Engage with pdfFiller today to gain control over your tax forms, making sure you reap the full benefits available through Form 3800.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the schedule a form 3800 in Gmail?

How do I edit schedule a form 3800 straight from my smartphone?

How do I complete schedule a form 3800 on an Android device?

What is schedule a form 3800?

Who is required to file schedule a form 3800?

How to fill out schedule a form 3800?

What is the purpose of schedule a form 3800?

What information must be reported on schedule a form 3800?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.