Get the free Form 8615: Tax for Certain Children with Unearned Income

Get, Create, Make and Sign form 8615 tax for

How to edit form 8615 tax for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8615 tax for

How to fill out form 8615 tax for

Who needs form 8615 tax for?

Form 8615 Tax for Form: Understanding the Kiddie Tax and Its Implications

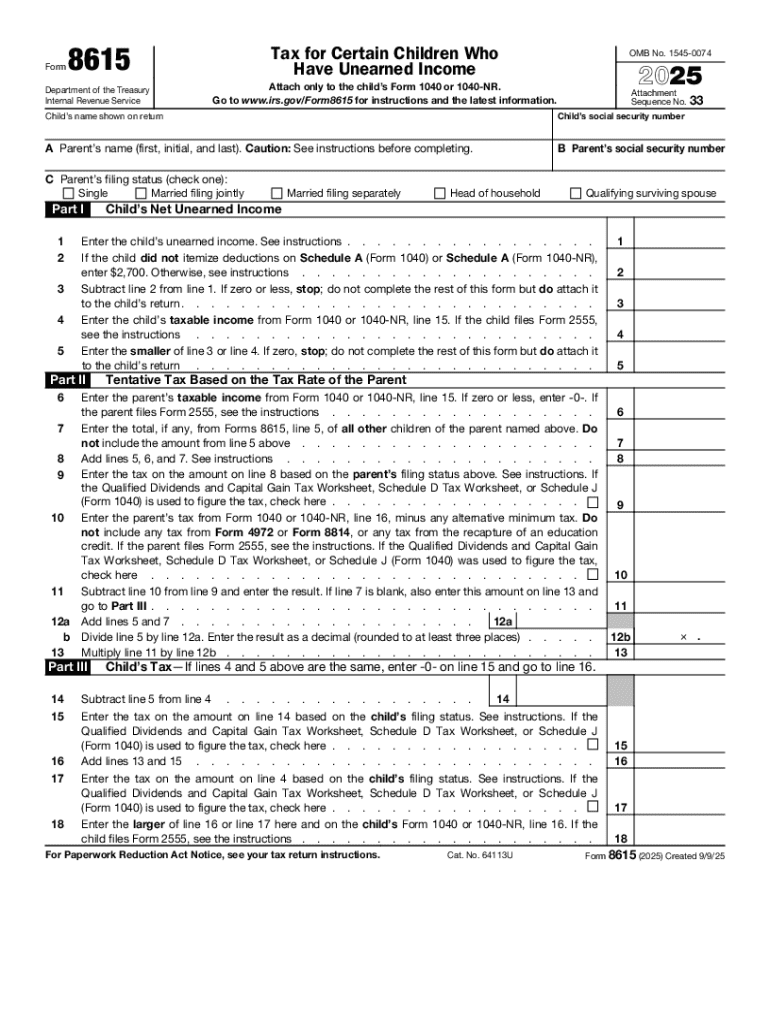

Understanding Form 8615

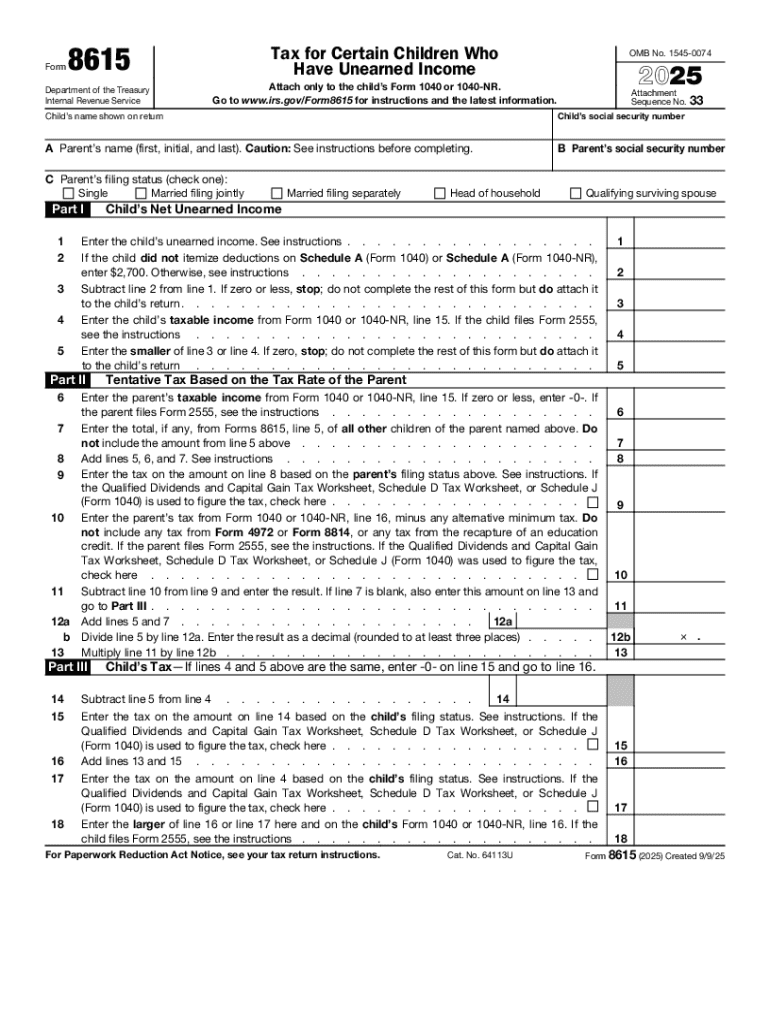

Form 8615 is a crucial tax document designed for certain children who have unearned income. This form addresses income tax responsibilities that arise from a special set of rules known as the kiddie tax. It is primarily used to determine the taxable income of dependents under the age of 18, covering aspects of their investment income that exceeds specific thresholds.

The primary purpose of Form 8615 is to ensure that children with significant unearned income are taxed appropriately—avoiding potential tax avoidance by shifting income from parents to children. Taxpayers included under this mandate must remember that this filing is not just an additional step but a critical part of their overall tax obligations.

Who should use Form 8615?

Children aged 18 or younger with unearned income exceeding a certain limit must file Form 8615. Specifically, the unearned income threshold is pegged at $2,300 for the tax year 2023. Those eligible may include children who receive dividends, interest from savings accounts, or capital gains from investments.

Dependents who qualify to use this form often have unearned income that is a product of parental investments or inheritances. It's important to differentiate between these categories since financial responsibility and tax obligations shift significantly depending on income type. A typical scenario triggering the kiddie tax might be a teen who has a stock account under their parents' guardianship, earning dividends over the threshold.

Preparing to fill out Form 8615

Before diving into Form 8615, it’s essential to gather all necessary information and documentation. Key documents include tax returns from the prior year, any documentation of investment income received, and details regarding unearned income categories for accurate reporting.

Important considerations include effectively identifying tax-exempt interest, which needs to be reported separately, any dividends, and capital gains. Broad also needs to consider utilizing pdfFiller’s interactive tools. These can simplify the compilation of information and enhance your ability to assess the kiddie tax implications before submission.

Step-by-step guide to filling out Form 8615

Filling out Form 8615 accurately requires careful attention to detail, broken down into clear sections. In Section 1, you'll enter essential taxpayer information, which includes name, address, and Social Security Number (SSN). Ensure all details are current to avoid confusion or processing delays.

In Section 2, reporting investment income is crucial. Specific lines call for detailing dividends, interest, and other forms of unearned income. Lastly, Section 3 requires calculations of taxes owed based on provided income data. A tax table for kiddie tax rates facilitates this process, making it efficient to determine potential liabilities.

Tips for successfully filing Form 8615

Filing Form 8615 can be straightforward, but avoiding common mistakes is key to a successful submission. For example, incorrectly reporting income or neglecting tax-exempt interest can trigger unnecessary complications. Always review your numbers meticulously to ensure accuracy—especially since kiddie tax rates differ from regular rates.

Additionally, consider your filing options. Electronic filing is often more efficient if you want to expedite processing time, while paper filing still holds value for record-keeping. Utilizing pdfFiller’s services can simplify the entire filing process, allowing for easy editing and collaboration.

Managing tax obligations after filing

After submitting Form 8615, taxpayers should understand potential notifications or audits from the IRS. Maintaining copies of submitted forms and your calculations can safeguard against future queries. If the IRS needs clarification, they will typically send a notice detailing the issue.

Long-term planning is also crucial, especially for maintaining visibility on future income levels. Tracking changes in investment income or maintaining dependency status will greatly affect tax obligations in subsequent years, making it wise to incorporate these considerations when planning.

Related forms and resources

Often, Form 8615 is filed alongside other relevant tax forms, with the most notable being Form 1040. This primary tax form captures all income and deductions, allowing taxpayers to summarize their total tax burden. Understanding the relationship between these forms ensures that you remain compliant and accurate in reporting.

For further resources, individuals can explore sites like the IRS for official guidance and updates regarding the kiddie tax law. Additionally, pdfFiller provides access to various forms and templates that facilitate related tax considerations.

Real-life scenarios and case studies

Understanding Form 8615 can be better grasped through real-life applications. For instance, consider a case where a 17-year-old child receives substantial dividends from a custodial account. Filing Form 8615 would be essential for calculating taxes owed on this unearned income to prevent tax liability that could reflect poorly on the parents' tax filings.

Testimonials from users of pdfFiller highlight how easy the form-filling process becomes when utilizing innovative document management tools. These tools not only streamline the preparation of Form 8615 but also enhance the overall clarity and organization of financial documentation. Users have reported an increase in confidence regarding their tax filings, freeing them from burdensome paperwork.

Q&A section: Frequently asked questions

Common inquiries about Form 8615 generally revolve around its necessity and implications. Taxpayers frequently ask whether they must file even if their unearned income is under $2,300—a requirement underpinning the need for clarity in tax rules regarding dependency. Understanding these nuances can prevent misfiled returns and potential penalties.

Moreover, recommendations from tax professionals suggest ensuring that all taxable income, exemptions, and deductions are accurately reported to avoid complications in the future. These insights are especially vital for first-time filers navigating parental or custodial tax obligations.

Interactive features offered by pdfFiller

pdfFiller enhances the Form 8615 experience through advanced interactive features. Live document editing allows users to fill out, correct, and submit the Form seamlessly, minimizing room for errors and maximizing efficiency. This platform also supports collaboration, where multiple users can work on the same document simultaneously, promoting a streamlined approach to tax filing.

Moreover, being cloud-based means you can access your documents anywhere, facilitating easy management and retrieval during tax season whenever decisions must be made quickly. The combination of easy signing and editing makes pdfFiller an essential tool for families managing complex tax situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 8615 tax for?

How do I edit form 8615 tax for online?

How do I edit form 8615 tax for straight from my smartphone?

What is form 8615 tax for?

Who is required to file form 8615 tax for?

How to fill out form 8615 tax for?

What is the purpose of form 8615 tax for?

What information must be reported on form 8615 tax for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.