Get the free Instructions for Form 8866, interest computation under the look ...

Get, Create, Make and Sign instructions for form 8866

Editing instructions for form 8866 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 8866

How to fill out instructions for form 8866

Who needs instructions for form 8866?

Instructions for Form 8866

Overview of Form 8866

Form 8866 is a critical tax form that taxpayers must understand to navigate the complexities of the IRS regulations. Specifically designed for the Election to Defer Inclusion of Income Under Section 451, this form enables eligible entities to postpone the reporting of certain types of income, providing a valuable financial strategy under specific conditions. For both individuals and organizations, comprehending Form 8866 can result in potential tax benefits, allowing strategic financial planning.

Key definitions and terms

Understanding the terminology associated with Form 8866 is essential for accurate completion. Key terms include:

Who needs to file Form 8866?

Form 8866 primarily concerns partnerships and corporations that are eligible for deferring the inclusion of certain income as specified under the IRS regulations. Specifically, if an entity qualifies as an eligible entity and chooses to defer income recognition, then the owners, including partnerships and corporations, must ensure that Form 8866 is filed with their income tax return. This requirement typically arises in complex financial situations such as restructuring, mergers, or acquisitions where immediate income recognition could lead to unfavorable tax consequences.

Step-by-step instructions for completing Form 8866

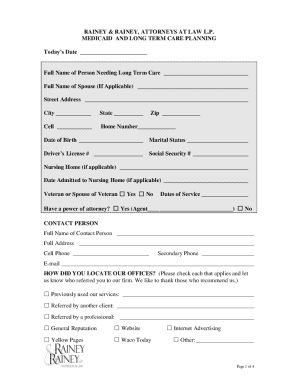

Section : Identification Information

The first step in completing Form 8866 involves providing identification information. You must accurately enter the owner’s name, entity type, and Employer Identification Number (EIN). Inaccuracies here can lead to delays in processing your form. Double-checking this section ensures that the IRS can efficiently match your submission with the appropriate tax records.

Section : Tax Year Information

In this section, indicate the tax year that corresponds with the income deferral. It’s crucial to select the correct year as per your accounting method. Report whether you operate on a calendar year or a fiscal year. Misreporting can trigger penalties or unwanted audits by the IRS.

Section : Selection of Eligibility

Here, you’ll need to confirm your eligibility status. This section is vital, as it requires a selection regarding your qualifications under the related IRS regulations. Make sure to understand the eligibility criteria beforehand—this step often involves selecting the proper checkboxes accurately.

Section : Election Statements

This section allows you to provide election statements that substantiate your request to defer income. Clearly articulate your reasons and complete any required outlines provided by the IRS. These statements are central to your application and can directly impact the approval process if they are comprehensive and clear.

Section : Signature and Date

Finally, signing and dating the form validates your submission. A missing signature can lead to processing delays or outright rejection of your filing. Ensure that the individual completing the form is authorized to sign on behalf of the entity and that the date reflects when the form was completed.

Video walkthrough for completing Form 8866

For a visual reference, a comprehensive video tutorial can be very helpful. This walkthrough covers each section of Form 8866 explicitly, enabling users to follow along as they fill out their forms. [Insert link to video tutorial here]. This resource is ideal for visual learners and can enhance understanding of how to navigate the form effectively.

Common mistakes to avoid when filing Form 8866

Filing Form 8866 isn't without its challenges. Here are common pitfalls to avoid:

Frequently asked questions

What if made an error on my Form 8866?

If you discover an error after submission, it’s essential to act promptly. You should amend the submission by following the IRS guidelines for amending forms, which usually involves completing a new Form 8866, noting the changes in Section IV.

Can eFile Form 8866?

Yes, electronic filing of Form 8866 is available through various tax software providers accredited by the IRS. eFiling can expedite your submission process and reduce paperwork.

How do amend my Form 8866?

To amend Form 8866, you typically need to file a new form with the necessary corrections and indicate it is an amended submission. Ensure you follow the IRS guidelines for amendments to avoid complications.

Are there penalties for not filing Form 8866?

Yes, penalties may apply for failing to file Form 8866 when required. The IRS may assess fines, and unfiled forms could trigger audits or additional scrutiny on your overall tax returns.

Where can find Form 8866 and related documents?

You can easily access and download Form 8866 directly from the official IRS website. Additionally, supplementary documentation and guidance documents can also be found there, which help clarify the instructions. Direct links to IRS resources can support your filing process.

Related tax articles

For those looking to expand their knowledge around tax filings and regulations, consider these insightful articles:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my instructions for form 8866 directly from Gmail?

How do I edit instructions for form 8866 online?

Can I edit instructions for form 8866 on an Android device?

What is instructions for form 8866?

Who is required to file instructions for form 8866?

How to fill out instructions for form 8866?

What is the purpose of instructions for form 8866?

What information must be reported on instructions for form 8866?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.