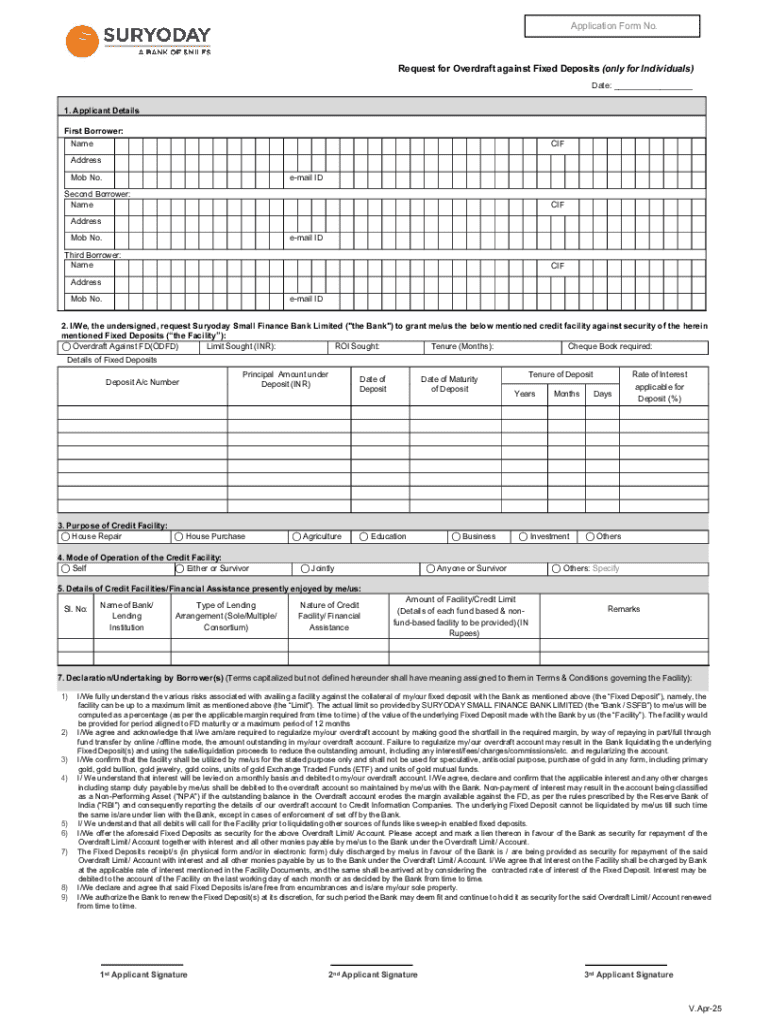

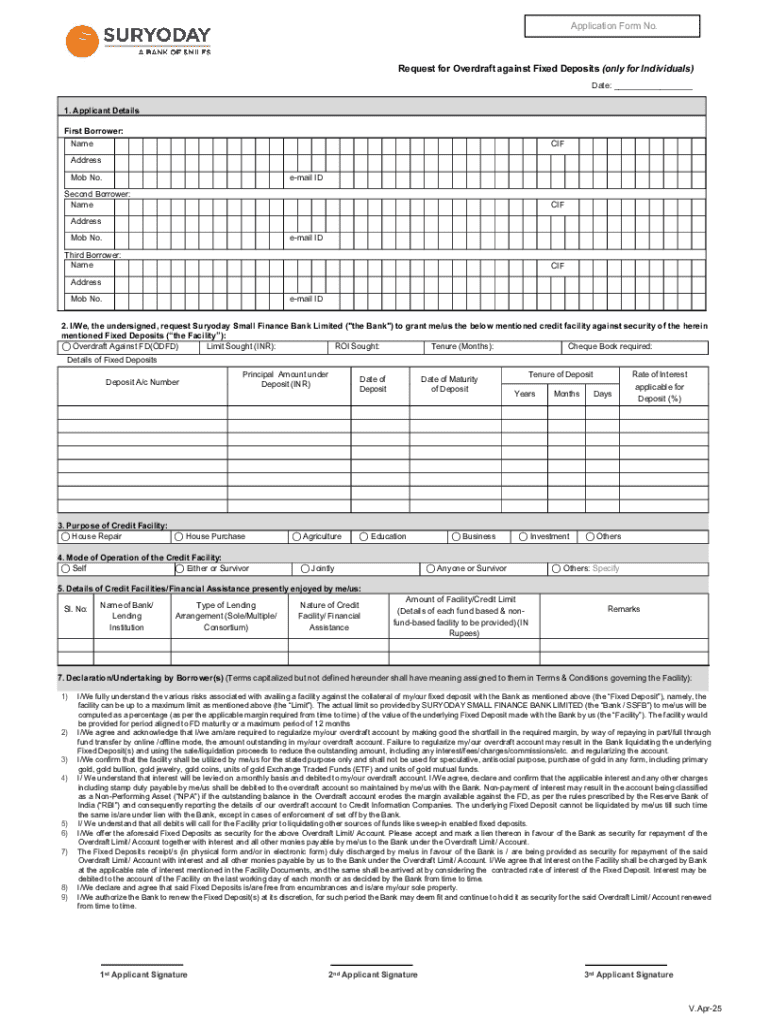

Get the free APPLICATION FOR OVERDRAFT AGAINST FIXED DEPOSIT

Get, Create, Make and Sign application for overdraft against

How to edit application for overdraft against online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for overdraft against

How to fill out application for overdraft against

Who needs application for overdraft against?

Application for Overdraft Against Form: A Comprehensive Guide

Understanding overdrafts: Definition and importance

An overdraft is a financial facility that allows an account holder to withdraw more money than is available in their bank account, effectively going into a negative balance. This service is primarily linked to checking accounts and provides users with short-term borrowing capabilities, typically intended for unforeseen expenses or emergencies. Understanding overdrafts can be crucial for maintaining financial health, ensuring that individuals have a buffer for unexpected expenses.

Overdrafts can offer significant advantages, such as providing peace of mind, access to funds when needed urgently, and flexibility in cash flow management. However, it is critical to utilize this service wisely, as it comes with costs like interest charges and potentially hefty fees if the overdraft limit is exceeded. Essentially, every overdraft facility carries a balance between convenience and cost, necessitating careful consideration.

Key components of the overdraft application form

Completing an application for overdraft against form requires attention to detail in several key components. Generally, the form is divided into several essential sections, each aimed at gathering relevant information about the applicant’s financial situation and needs.

Before submission, ensure you append all required supporting documents, such as proof of income, bank statements, and identification documents, to strengthen your application.

Step-by-step guide: Completing the overdraft application form

Filling out the application for overdraft against form may seem daunting at first, but following a clear, step-by-step approach will simplify the process. Start by gathering all necessary information to ensure you can provide complete and accurate responses to each section.

How to submit your overdraft application effortlessly

Submitting your application for overdraft against form can generally be done through multiple avenues, making it convenient for users. Depending on the bank or financial institution, applicants may have the option to submit the application both online and offline.

For electronic submission, ensure you follow the guidelines provided on the bank's website, as this can vary by institution. Always ensure that your executed submissions are secure, and consider enabling two-factor authentication where possible to protect your sensitive data.

Tracking your overdraft application status

After submitting your application for overdraft against form, it’s important to monitor its progress. Many banks provide a way to check the status online using reference numbers issued during application submission. You can also directly contact customer service for updates.

Once your application is processed, expect communication regarding approval, documentation requests, or denial. Prompt responses can help you understand what to do next and whether you need to provide additional information.

Common reasons for overdraft application denial

Banks have specific financial criteria that they use to evaluate overdraft applications. Understanding these requirements can help you improve your chances of approval. Some of the common reasons for denial include insufficient credit history, existing debt-to-income ratios that are too high, or incomplete application forms.

Managing your overdraft: Best practices

Once your overdraft is approved, responsible management is essential to avoid high fees and interest rates. Understanding how overdraft fees work and implementing effective management strategies will keep your finances in check. Overdraft fees can add up quickly, so having a clear plan can help prevent your account from spiraling out of control.

The role of cloud-based solutions in document management

In a digitally interconnected world, cloud-based solutions like pdfFiller play an essential role in document management. By using pdfFiller’s platform, you can easily create, edit, and manage your application for overdraft against form from any location, ensuring flexibility and convenience.

Additional considerations for overdraft applications

When applying for an overdraft, it’s crucial to consider various factors that could affect your application. Different banks may have unique policies regarding overdrafts based on account types, user history, and financial circumstances, making it vital to review these policies prior to submission.

The future of overdrafts: Trends and innovations

The landscape of overdrafts is continually evolving, influenced by changes in banking policies and advances in financial technology. Innovations in mobile banking and automated financial management tools are reshaping how individuals view and interact with overdraft facilities.

Creating and managing your financial documents with pdfFiller

pdfFiller offers an array of features designed to facilitate document management, especially for those navigating the application for overdraft against form. Users can harness its capabilities to create from templates, edit forms, and securely share documents.

Frequently asked questions about overdraft applications

Navigating the application for overdraft against form often raises numerous questions. This section addresses common queries, shedding light on the intricacies of the process to simplify the experience for applicants.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my application for overdraft against in Gmail?

How do I complete application for overdraft against online?

How do I edit application for overdraft against in Chrome?

What is application for overdraft against?

Who is required to file application for overdraft against?

How to fill out application for overdraft against?

What is the purpose of application for overdraft against?

What information must be reported on application for overdraft against?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.