Get the free FORM TPR 7

Get, Create, Make and Sign form tpr 7

How to edit form tpr 7 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form tpr 7

How to fill out form tpr 7

Who needs form tpr 7?

Form TPR 7 Form - How-to Guide

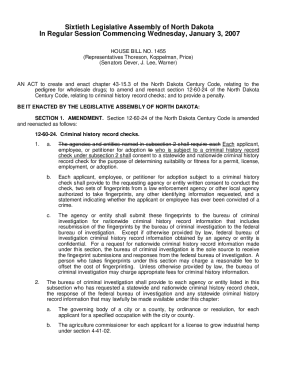

Understanding the TPR 7 Form

The TPR 7 form is a crucial document used for specific tax-related purposes, particularly within the realms of business and personal finance. Its primary function is to facilitate accurate reporting and claims, ensuring compliance with local laws and regulations. Understanding the nuances of this form is vital for anyone who needs to interact with the tax system, as it holds significant implications for tax filings and any potential refunds.

The nature of the TPR 7 form can vary depending on the user's circumstances, whether they're individuals claiming personal deductions or businesses reporting earnings and expenses. By streamlining the information provided, the TPR 7 form helps simplify complex tax processes, ultimately contributing to more accurate and efficient tax management.

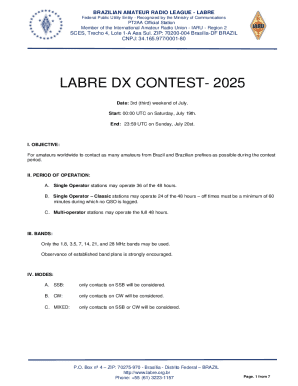

Preparing to fill out the TPR 7 Form

Before diving into the details of the TPR 7 form, it’s essential to gather all necessary information that will facilitate an accurate completion. Key personal details typically required include your name, address, and taxpayer identification number. Furthermore, businesses will need their Employer Identification Number (EIN) along with financial data such as revenue, expenses, and prior tax filings.

In addition to personal and business details, it's advisable to have supporting documents readily available. This may include receipts, prior tax returns, and any supplementary information that can substantiate your claims. Having these documents on hand not only streamlines the process but also minimizes the risk of errors that could delay submissions.

To enhance your filling experience, choosing the right tools matters significantly. Leveraging platforms like pdfFiller not only simplifies the completion of the TPR 7 form but also allows for a flexible and efficient document management process. Its cloud-based features enable users to access their forms from anywhere, making it easier to collaborate with team members or consultants who may require input on the completed document.

Step-by-step instructions for completing the TPR 7 Form

Understanding the structure of the TPR 7 form is vital for accurate completion. The document typically consists of several critical sections. The first is the header information, which usually requires the user to input their name and contact details. Following this, the personal details section will ask for more specific information that classifies the user—individuals may input personal identification while businesses provide corporate details.

Next comes the claim information, where users detail their specific claims, whether they are deductions or refunds. Providing thorough and accurate information in this section is crucial, as it directly impacts the processing speed and correctness of tax filings. Finally, the form culminates in a signature and date section, where the user must affirm the authenticity of their submission.

While filling in the TPR 7 form, it’s easy to overlook certain fields or make mistakes. Common pitfalls include missing required information or confusion about claim categories. Best practices suggest reviewing each section carefully and utilizing tools like pdfFiller, which offer prompts and field-specific guidelines to enhance accuracy during the completion process.

Editing and customizing the TPR 7 Form

Once the TPR 7 form is filled out, there may be a need for further editing or customization. Platforms such as pdfFiller provide various editing tools that allow users to adjust text, add custom fields, and even insert images or supporting documents to enhance clarity and presentation. This flexibility is valuable, especially when collaborating across teams, where specific information may need to be tailored to different stakeholders.

Additionally, pdfFiller’s collaborative features enable sharing of the TPR 7 form with colleagues or consultants for input and review. Real-time editing capabilities allow multiple users to contribute, ensuring that all viewpoints and details are incorporated, leading to a more comprehensive final document.

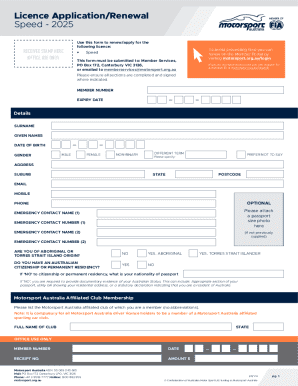

Signing the TPR 7 Form

After completing the TPR 7 form, the next crucial step is signing it. Several eSignature options are available through platforms like pdfFiller, which provide an easy way to authenticate your document without the need for physical signatures. Users can opt between typing their names, drawing their signatures, or uploading an image of their signature, all of which are valid methods for electronic signing.

It’s important to understand that digital signatures maintain legal validity in most jurisdictions, given they meet specific criteria. pdfFiller ensures compliance with legal standards, offering users peace of mind that their digital signatures will hold up in court should any disputes arise regarding the authenticity of the document.

Submitting the completed TPR 7 Form

Once the TPR 7 form is complete and signed, determining how to submit it is the next step. Users should identify appropriate submission channels based on their specific situations. In many cases, tax agencies provide online submission portals where the completed form can be directly uploaded. Alternatively, individuals or businesses may need to print and mail the document to the corresponding office.

Tracking the submission is crucial to ensure that it has been received and is being processed. pdfFiller offers tools to manage document tracking, allowing users to receive confirmations of receipt and monitor the status of their submissions. Staying informed about the progress can alleviate some of the stress associated with waiting for tax-related confirmations.

Managing TPR 7 Forms with pdfFiller

Managing TPR 7 forms efficiently is crucial for individuals and businesses alike. With pdfFiller, users can store and organize their forms in one secure location, reducing the chances of misplacing important documents. Best practices for organizing TPR 7 forms include creating folders by year or tax type, and utilizing tags for easy retrieval.

Ensuring future accessibility is another key factor in effective document management. With pdfFiller’s cloud-based approach, users can access their stored forms anytime, from any device. This accessibility is especially important as tax deadlines approach, allowing for prompt retrieval of documents when required.

Addressing common issues with the TPR 7 Form

While filling out the TPR 7 form, users often encounter common issues that can complicate the process. One frequent problem is insufficient information provided in certain fields, which can lead to delays or rejection of submissions. Other issues may involve formatting errors or misinterpretations of claim sections, causing confusion during the completion process. Addressing these issues quickly is essential to ensure timely tax filings.

To support users, pdfFiller provides access to a FAQ section that outlines troubleshooting steps for common problems. If further assistance is needed, users can contact support through the platform, ensuring that any complications can be resolved promptly without causing unnecessary stress.

Advanced tips for frequent users of the TPR 7 Form

For those who frequently utilize the TPR 7 form, maximizing efficiency through templates can significantly reduce the time and effort required for each submission. By creating reusable templates within pdfFiller, users can standardize their information, speeding up the filling process for subsequent forms. This approach not only saves time but also minimizes the likelihood of errors.

Staying informed about any updates or regulatory changes that might impact the TPR 7 form is also vital. Regulatory frameworks can evolve, and keeping abreast of these changes ensures that users continue to file compliant forms. Sign up for updates or newsletters from relevant tax bodies to remain in the loop.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the form tpr 7 electronically in Chrome?

Can I create an eSignature for the form tpr 7 in Gmail?

How do I complete form tpr 7 on an Android device?

What is form tpr 7?

Who is required to file form tpr 7?

How to fill out form tpr 7?

What is the purpose of form tpr 7?

What information must be reported on form tpr 7?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.