Get the free STATEMENTS FOR THE SIX-MONTH

Get, Create, Make and Sign statements for form six-month

How to edit statements for form six-month online

Uncompromising security for your PDF editing and eSignature needs

How to fill out statements for form six-month

How to fill out statements for form six-month

Who needs statements for form six-month?

Understanding and Preparing Statements for Six-Month Form

Overview of the six-month form statements

Statements for the six-month form serve as crucial reports for individuals and businesses to summarize their financial standing and activities over a six-month period. Their primary purpose is to maintain transparency with government organizations and ensure compliance with applicable laws. These statements can play a vital role in fiscal responsibility, helping users track revenues and expenses efficiently.

For businesses, especially in the United States, timely submissions of these forms can prevent penalties and protect their operational licenses. Freelancers and independent contractors also utilize six-month statements to substantiate their earnings and file taxes effectively. Thus, keeping accurate records and submitting these statements is essential for compliance and financial health.

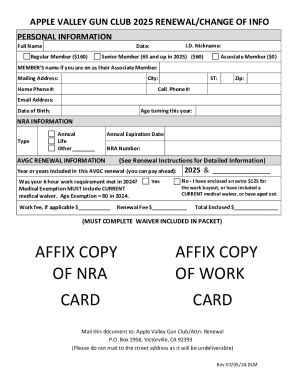

Requirements for filing six-month form statements

Filing six-month form statements comes with specific statutory obligations. Understanding these obligations, including deadlines, is essential for avoiding late submissions which can incur fines. In most states, including Wisconsin, these forms need to be filed every six months on specified dates. Keeping track of these due dates is critical for compliance.

Potential issues that arise from incomplete filings can result in not only delayed processing but can also trigger audits. Thus, maintaining a checklist of necessary documents can help prevent common filing errors.

Detailed steps to prepare your six-month form statements

Preparing to fill out the six-month form is a methodical process, starting with gathering essential information. Identification data is paramount, including your business registration details or Social Security number if you are a freelancer.

Additionally, compiling accurate financial records such as income statements, expense reports, and invoices is crucial for completing the form.

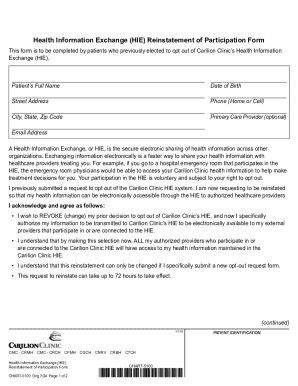

Once you have your information, the next step is completing the statement template. Tools like pdfFiller offer interactive templates that simplify this process, guiding users through sections such as revenue, expenses, and net income.

After filling out the template, a thorough review is vital. Look for discrepancies and ensure all information is accurate and complete to avoid any challenges during submission.

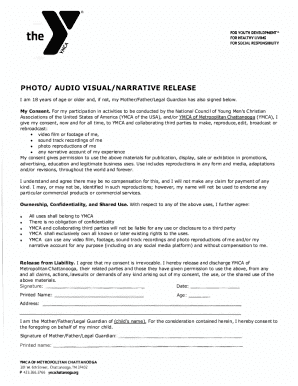

Electronic submission and esigning

The process of electronic filing is streamlined and efficient, which is crucial for maintaining timely submissions of your six-month form statements. Following guidelines for digital submission not only ensures compliance but also provides a tangible record of your filing.

Filing electronically through platforms like pdfFiller allows users to benefit from automation, quick retrieval options, and electronic signatures which add a layer of security and validity to the process.

These steps not only enhance the accuracy of your submission but also instill confidence in your compliance measures.

Managing your six-month form statements

Using advanced document management features in pdfFiller can greatly ease the process of organizing and managing your six-month form statements. For example, storing forms in specific folders allows for quick retrieval when needed.

Moreover, tools for tracking your submission status provide peace of mind. Being proactive about deadlines can prevent last-minute rushes and mistakes, ensuring a streamlined approach to filing.

The ability to share documents easily with colleagues and include comments facilitates collaboration, especially in larger teams processing multiple forms.

Common mistakes and how to avoid them

Mistakes made during the filing of six-month form statements can lead to costly repercussions. Common errors include providing incomplete information and misreporting financial figures.

By practicing these tips, users can expect smoother filing experiences and more accurate six-month form statements.

Resources and tools for filing assistance

pdfFiller offers a broad range of resources to assist in the preparation and submission of your six-month form statements. From tutorials to help with using specific features, the platform is designed for user-friendliness.

Regularly updated FAQs regarding six-month form statements can also guide users encountering specific difficulties.

These resources ultimately bolster the efficiency of your filing process, allowing for more confident submissions.

Industry-specific considerations

Different business entities, such as corporations, partnerships, and sole proprietorships, have tailored requirements when it comes to the preparation of six-month form statements. Each business model provides unique tax obligations, which may require different documentation or reporting states.

Freelancers and independent contractors need to be particularly meticulous as their earnings can vary widely, necessitating precise record-keeping for accurate reporting.

Keeping up with regulatory changes

Filing requirements can evolve, making it essential for users to stay informed about any changes in laws or regulations affecting six-month form statements. Subscription services or updates from pdfFiller keep users notified and ready for adjustments.

A proactive approach ensures that your filing remains compliant with evolving standards, avoiding future complications.

User account management

Managing your pdfFiller account can significantly enhance your efficiency in filing six-month form statements. Setting up notifications will alert you about upcoming deadlines, ensuring that you stay organized.

Accessing and retrieving past filings helps users maintain an organized filing history, allowing them to amend previous forms if necessary.

Integrating these management features not only saves time but also enhances the overall experience of handling your six-month form statements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my statements for form six-month in Gmail?

How can I send statements for form six-month for eSignature?

How do I edit statements for form six-month on an Android device?

What is statements for form six-month?

Who is required to file statements for form six-month?

How to fill out statements for form six-month?

What is the purpose of statements for form six-month?

What information must be reported on statements for form six-month?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.