Get the free The Ultimate Personal Loan Application Checklist.

Get, Create, Make and Sign form ultimate personal loan

Editing form ultimate personal loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form ultimate personal loan

How to fill out form ultimate personal loan

Who needs form ultimate personal loan?

Form ultimate personal loan form: A comprehensive how-to guide

Understanding the personal loan landscape

Personal loans provide individuals with unsecured funds that can be used for a variety of financial needs. Defined as loans that do not require collateral, these loans are based on the borrower's credit profile and overall financial health.

In financial planning, personal loans play a critical role by allowing flexibility and access to cash flow during urgent situations. Unlike other loan types, such as mortgages or auto loans, personal loans can be utilized for almost any purpose—from consolidating high-interest debt to financing medical expenses and home improvements.

Recognizing common uses for personal loans helps borrowers strategize their financial decisions. A few popular applications include:

The importance of an ultimate personal loan form

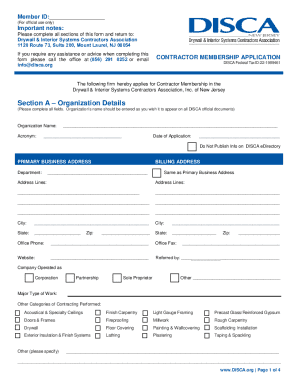

An ultimate personal loan form acts as the foundational document required to secure funding from lenders. This form gathers necessary information from borrowers, allowing lenders to assess risk and determine eligibility.

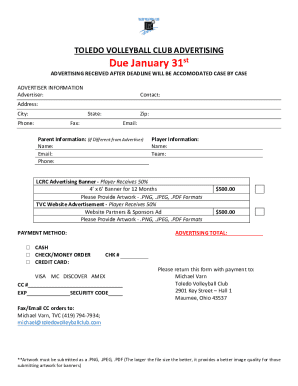

Typical information required on a personal loan application includes personal and financial details, employment information, the desired loan amount, and the specific purpose for the loan. Without this critical data, the loan approval process can face unnecessary delays or, worse, result in rejection.

Key features of an ultimate personal loan form

To cater to the complexities of personal finance, an ultimate personal loan form should incorporate the following key features:

Steps to create your ultimate personal loan form with pdfFiller

Creating an ultimate personal loan form with pdfFiller is straightforward and efficient. By following these steps, you can have a tailored form ready in no time.

Step 1: Accessing pdfFiller's template library

Begin by exploring pdfFiller’s extensive template library. Look for pre-made templates specifically designed for personal loans, choosing one that closely fits your needs.

Step 2: Designing the form

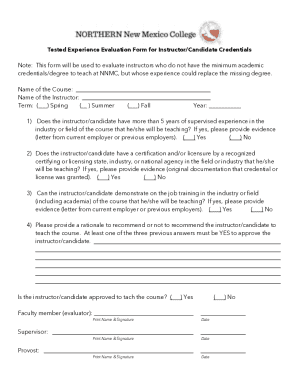

Once you have selected a template, customize the layout and sections as needed. Ensure that all necessary fields for personal and financial information are clearly included.

Step 3: Implementing document upload features

Make it easy for users to submit required financial documents by incorporating upload features. Provide guidelines regarding acceptable file types and size limits.

Step 4: Adding validations and permissions

Implementing validations can help ensure accurate data entry, such as input types and limits. Setting permissions will control who can view or edit the form.

Step 5: Collaborating with stakeholders

Utilize pdfFiller's collaboration features to invite team members to review the form in real-time, ensuring that all inputs and modifications are captured seamlessly.

Advanced tools and features for managing your personal loan form

Managing personal loan forms effectively requires an assortment of advanced tools. Consider these functionalities offered by pdfFiller:

Common challenges and solutions when filling out a personal loan form

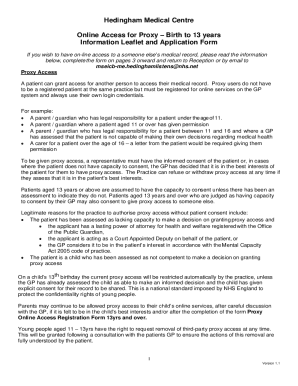

Applicants often face challenges while completing a personal loan form, which can result in rejections or delays. Misunderstandings around income reporting are common. Ensure that gross income is reported accurately, as lenders prefer to see the full picture.

Additionally, applicants frequently misdescribe the loan's purpose, which can affect approval chances. It's vital to be specific about how the funds will be used, assisting lenders in assessing risk. Providing accurate employment information is equally important, as discrepancies can raise red flags.

To navigate these common pitfalls, follow these strategies:

Leveraging pdfFiller to streamline your loan application process

Utilizing pdfFiller’s powerful features can greatly enhance the loan application process. With cloud-based access, you can manage your forms from anywhere, at any time. This is particularly beneficial for individuals and teams looking to stay organized.

Interactive tools enhance user experiences, providing smooth navigation through the application. Furthermore, pdfFiller simplifies document management for teams, allowing easy collaboration and quick adjustments to forms.

Final tips for a successful loan application

To increase your chances of approval, double-check all provided information on your form. Accuracy is paramount, as even minor errors can cause delays.

Additionally, ensure that you fully understand the loan’s terms and conditions, including interest rates and repayment schedules. Preparing for potential questions from lenders can also help streamline the process.

Conclusion and encouragement to utilize pdfFiller for your document needs

In summary, utilizing pdfFiller for creating an ultimate personal loan form not only simplifies the application process but also enhances your overall experience. With features designed for efficient document management, there's no better time to get started on your form creation. Embrace the power of pdfFiller as your go-to solution for seamless document handling.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the form ultimate personal loan in Gmail?

How can I edit form ultimate personal loan on a smartphone?

How do I complete form ultimate personal loan on an iOS device?

What is form ultimate personal loan?

Who is required to file form ultimate personal loan?

How to fill out form ultimate personal loan?

What is the purpose of form ultimate personal loan?

What information must be reported on form ultimate personal loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.