Get the free Form 5 Annual Statement Of Changes In Benificial ...

Get, Create, Make and Sign form 5 annual statement

Editing form 5 annual statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5 annual statement

How to fill out form 5 annual statement

Who needs form 5 annual statement?

A Comprehensive Guide to the Form 5 Annual Statement Form

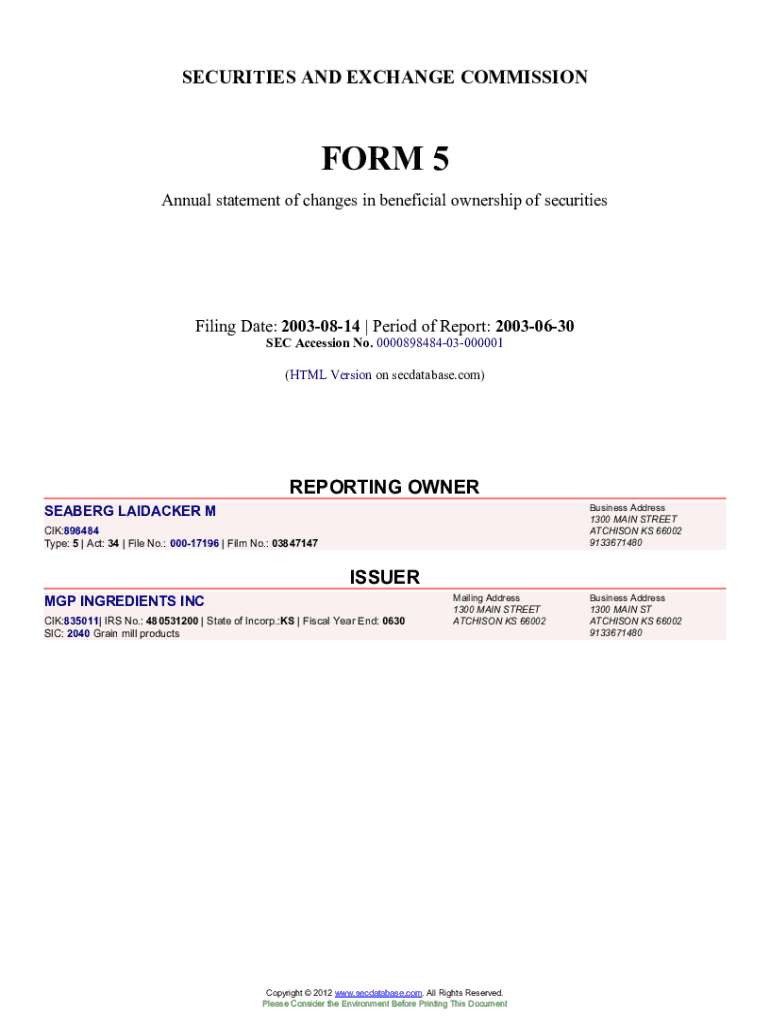

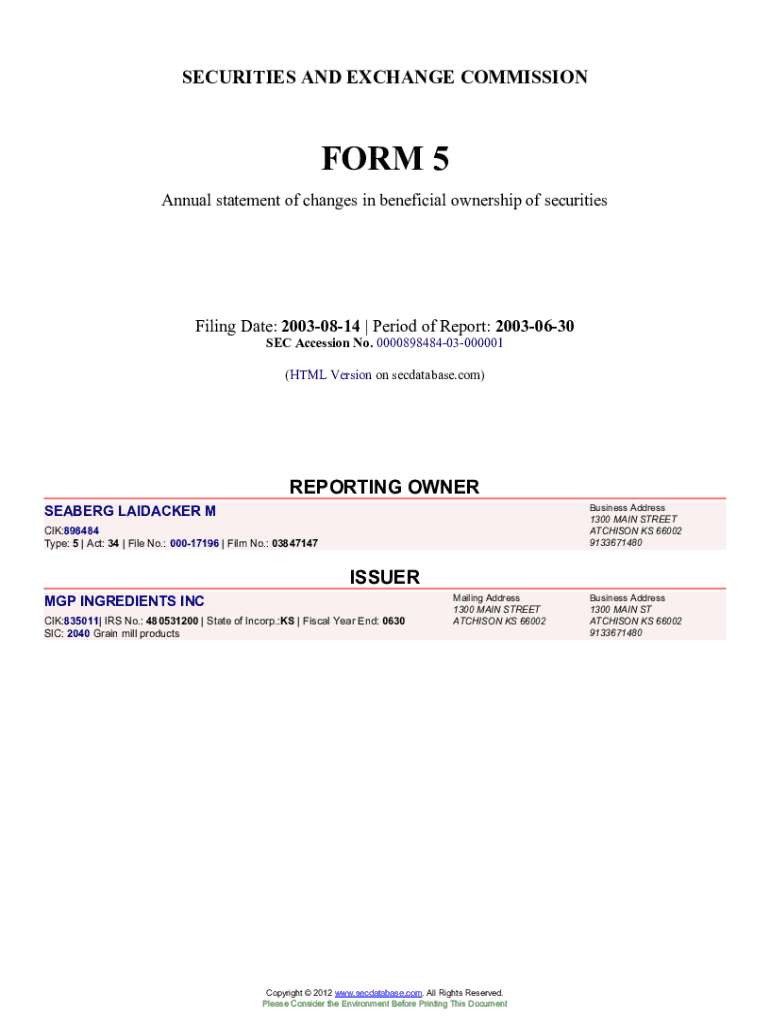

Overview of the Form 5 Annual Statement Form

The Form 5 Annual Statement is an essential document utilized primarily by corporations in the United States to report their financial activities over a fiscal year. It serves as a critical mechanism for the federal government and various regulatory bodies to assess corporate compliance, ensuring transparency and oversight within the financial landscape. Failure to submit this form can lead to penalties and other administrative repercussions, emphasizing its significance.

Any corporation, partnership, or limited liability company that meets specific income thresholds or operational criteria set forth by the U.S. government is required to submit the Form 5. This requirement is typically mandated by relevant acts or regulations established to maintain accountability among corporate entities. The deadline for submission usually falls on the last day of the fiscal year, although detailed requirements may vary by jurisdiction.

Detailed Breakdown of the Form 5

The Form 5 is structured to provide comprehensive insights into an entity's financial status, compliance with regulatory provisions, and operational specifics. Understanding the sections within the form is crucial for accurate and effective completion.

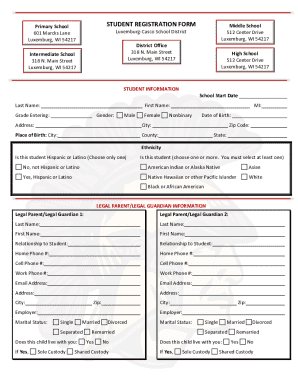

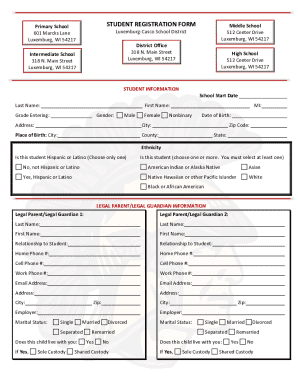

Sections of the Form 5

Common Terms and Definitions

Understanding the jargon used in the Form 5 is critical for proper navigation. Terms like 'net income,' 'gross revenue,' and 'compliance audit' are frequently used indicators that should be clearly understood by the individual or team filling out the form.

Step-by-step instructions for completing the Form 5

Filling out the Form 5 can seem daunting, but following a structured approach can streamline the process. Start by preparing necessary documentation to support the information you'll provide. This includes financial statements, previous years' tax returns, and compliance reports.

Preparing to fill out the form

Filling out each section

Begin completing the form by entering the Identification Details accurately. In the Financial Information section, ensure to provide up-to-date and precise figures, using rounding appropriately. Lastly, when answering Compliance Questions, be transparent and base your responses on the latest regulatory guidelines.

Reviewing your submission

Before submission, meticulously review each section to ensure accuracy. Double-check figures in the Financial Information section against your financial records, confirm that all identification details are correct, and ensure all compliance questions are answered completely to avoid delays in processing.

Editing and managing your Form 5 using pdfFiller

pdfFiller offers an intuitive platform for editing your Form 5. You can easily modify any field of the PDF, update financial figures, or adjust your compliance answers with just a few clicks.

Using pdfFiller to edit your Form 5

Collaborating with team members on your Form 5

When filling out the Form 5 as part of a team, pdfFiller facilitates collaboration. You can share the document for review and feedback, ensure everyone can contribute, and track any changes made by teammates.

Electronic signature on the Form 5

Adding an electronic signature to your Form 5 is essential for finalizing submissions. With pdfFiller, the process is straightforward and legally valid, ensuring that your document meets regulatory standards.

How to eSign your Form 5 through pdfFiller

Managing submission and responses

After your Form 5 is completed and submitted via the proper channels, tracking the status of your submission is crucial. pdfFiller offers tools to assist you with this monitoring.

Submitting the Form 5

Ensure that you use the designated submission portal for your entity type, whether it’s federal or state. Expect to receive a confirmation email upon submission, which serves as your reference.

Tracking the status of your submission

Utilizing pdfFiller's tracking tools allows you to confirm that your submission has been received and logged by the corresponding agency. Should there be any issues, proactive follow-ups can provide insights into the status of your Form 5.

Frequently asked questions (FAQs)

Common questions about the Form 5 Annual Statement include queries about the filing process, required data, and compliance deadlines. Understanding the nuances of these aspects can ease anxieties that may arise during the preparation phase.

Tips for best practices

Maintaining compliance with Form 5 requirements is essential. Regular review of governmental policies and updates can ensure adherence to changing regulations. Keeping documents organized plays a significant role in streamlining the submission process and makes retrieval easier in case of audits.

Conclusion

Utilizing pdfFiller for managing your Form 5 Annual Statement provides a multitude of benefits. Its user-friendly interface for editing, signing, and collaborating on documents simplifies document management, ensuring you meet compliance requirements efficiently. Embracing this platform allows for a seamless and organized approach to handling important corporate documentation, making it an invaluable tool for individuals and teams.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 5 annual statement to be eSigned by others?

Can I sign the form 5 annual statement electronically in Chrome?

How do I complete form 5 annual statement on an iOS device?

What is form 5 annual statement?

Who is required to file form 5 annual statement?

How to fill out form 5 annual statement?

What is the purpose of form 5 annual statement?

What information must be reported on form 5 annual statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.