Get the free 6 FINAL Income Eligiblity Forms. CACFP Income Eligibility Forms

Get, Create, Make and Sign 6 final income eligiblity

How to edit 6 final income eligiblity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 6 final income eligiblity

How to fill out 6 final income eligiblity

Who needs 6 final income eligiblity?

Navigating the 6 Final Income Eligibility Form: A Comprehensive Guide

Understanding the 6 final income eligibility form

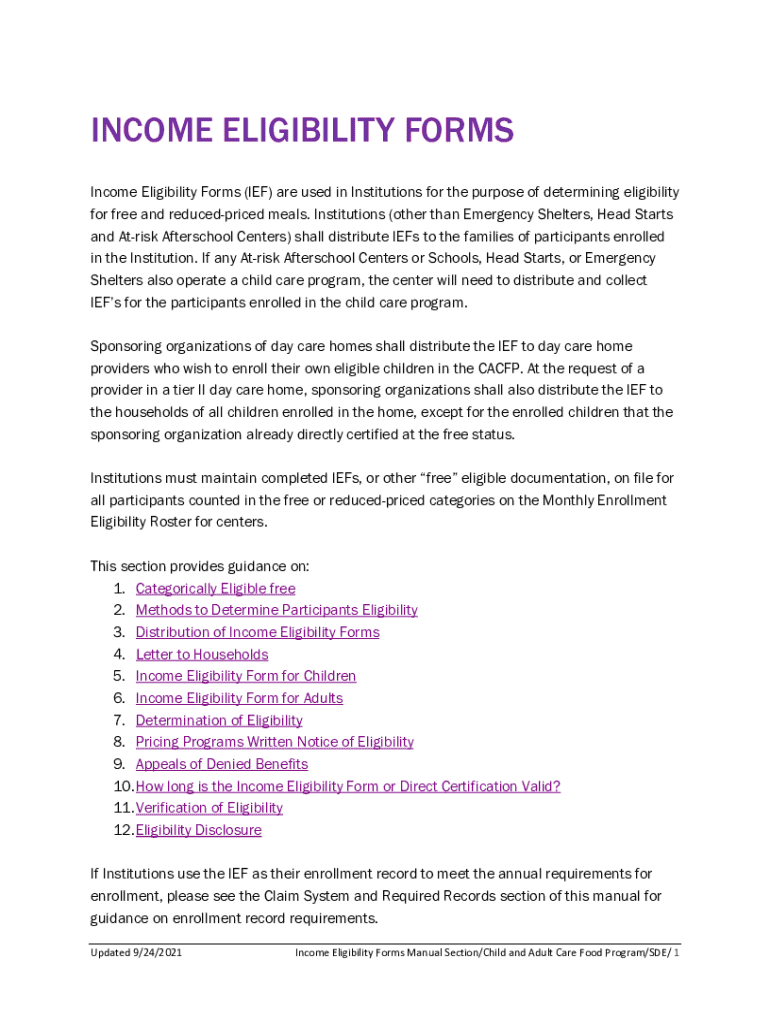

The 6 Final Income Eligibility Form is a crucial document that collects critical information about a household's income and expenses to determine eligibility for various welfare programs. These forms serve to assess whether applicants meet the necessary income thresholds as set by government guidelines. Understanding how to properly fill out this form is vital for individuals and families seeking assistance through government-sponsored programs.

Completing the 6 Final Income Eligibility Form accurately is essential, as it directly impacts a household's access to vital resources. For families in need, benefits may include food assistance, healthcare services, and educational programs. Hence, accuracy and thoroughness are paramount.

Key components of the 6 final income eligibility form

The 6 Final Income Eligibility Form is divided into key sections that allow for a comprehensive overview of a household's financial situation. The personal information section collects basic details such as names, addresses, and contact information of all household members. Meanwhile, the household income description section breaks down sources of income, which may include wages, benefits, and any other financial assistance received.

Another essential part of the form is the number of dependents section, where applicants need to indicate how many people rely on their household income. This demographic detail plays a significant role in assessing eligibility, as larger households may qualify for more assistance.

Definitions you must know

To navigate the form effectively, applicants should understand specific terms. Interpretations of income may vary, but generally, any income or monetary benefit that a household receives is considered. Thus, it’s critical to report all dollar amounts accurately to avoid penalties or delays.

Eligible expenses can significantly impact income calculations. These may include various costs such as childcare fees or educational expenses, which may be deducted from total income when determining eligibility for assistance.

Eligibility criteria

Understanding the eligibility criteria is essential for applicants aiming to maximize their chances of approval. Income thresholds are typically set according to federal guidelines, which may be adjusted based on the state of residence. Each state may have specific adjustments that reflect the local cost of living, thereby influencing total eligibility assessments.

Programs like the National School Lunch Program or the Supplemental Nutrition Assistance Program (SNAP) utilize the 6 Final Income Eligibility Form. Understanding how these programs interact with the form is key, as the information provided can affect an applicant's ability to access essential health and nutrition services.

Step-by-step guide to completing the form

Completing the 6 Final Income Eligibility Form requires careful preparation and understanding of required information. Begin by gathering essential documents that validate your household's financial status.

When filling out each section, it’s important to take your time to provide accurate information. Common mistakes often involve misreporting income sources or failing to include all dependents. To avoid such pitfalls, double-check figures and revise any unclear entries before submitting.

Calculating household income should be done carefully. Break down income into monthly amounts and include all sources. Be sure to factor in eligible expenses that can impact your total reported income, as they play a crucial role in determining your overall eligibility.

Editing and signing the form

After filling out the 6 Final Income Eligibility Form, it’s beneficial to edit and review the document for accuracy. Tools like pdfFiller offer an interactive platform for users to edit PDFs seamlessly. With various editing options, you can revise any section of the form quickly and efficiently.

Collaborating with team members can make the process more efficient. pdfFiller's cloud-based capabilities enable multiple users to access the document for shared editing or review, creating a collaborative environment that reduces the likelihood of errors.

Submitting the 6 final income eligibility form

Submitting the 6 Final Income Eligibility Form must be done through the proper channels to ensure timely processing. Various submission methods are available, including online submissions via designated government websites and traditional mailing options.

After submission, tracking the status of your form becomes important for peace of mind. Most government organizations provide a tracking system or contact point that allows applicants to check on the progress of their submissions.

Frequently asked questions (FAQs)

Applicants often have questions about the 6 Final Income Eligibility Form. For instance, what to do if a mistake occurs is a common concern. Typically, applicants can submit a corrected version of the form, provided it is sent in promptly along with an explanation.

The processing duration can vary, but applicants should expect a waiting period that can range from one to four weeks, depending on the workload of the processing agency. Understanding this timeline can help in planning and anticipating future steps regarding assistance.

After submission, applicants will typically receive a notification regarding approval or denial, which will outline next steps if accepted.

Follow-up actions after submission

Once the 6 Final Income Eligibility Form is submitted, it’s critical to understand the review process. Each submission should go through a formal evaluation by relevant government entities that validate the information provided. This review ensures that assistance is allocated fairly based on eligibility criteria.

For approved applications, the next steps might include scheduling appointments for benefits picking or enrolling in related programs. Resources like phone lines and local offices will help provide information about how to move forward and take full advantage of assistance successfully.

Case studies and success stories

Understanding how others have navigated the 6 Final Income Eligibility Form can provide insightful guidance. For instance, one individual reported successfully obtaining food assistance for their family after accurately filling out the form. Their comprehensive understanding of income sources and personal circumstances allowed for a smooth approval process.

Another success story involved a single parent who managed to enroll their child in a subsidized childcare program after submitting the 6 Final Income Eligibility Form. The detailed account of their income and dependents played a vital role in securing necessary support.

Additional tools and resources on pdfFiller

As you navigate the 6 Final Income Eligibility Form, pdfFiller offers plenty of tools and resources to help simplify the process. Users can access templates for related forms, ensuring that all necessary paperwork is at hand when needed. Additionally, tutorials on document management offer a step-by-step approach to effectively handle various forms.

Support access for users is also readily available. If you encounter challenges or have questions, pdfFiller provides resources to connect with support personnel who can assist with documentation concerns, ultimately empowering users to manage their documents effortlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 6 final income eligiblity in Gmail?

How can I get 6 final income eligiblity?

How do I edit 6 final income eligiblity in Chrome?

What is 6 final income eligibility?

Who is required to file 6 final income eligibility?

How to fill out 6 final income eligibility?

What is the purpose of 6 final income eligibility?

What information must be reported on 6 final income eligibility?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.