Get the free ACCOUNT TRANSFER REQUEST FORM

Get, Create, Make and Sign account transfer request form

Editing account transfer request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out account transfer request form

How to fill out account transfer request form

Who needs account transfer request form?

Account transfer request form: Comprehensive guide

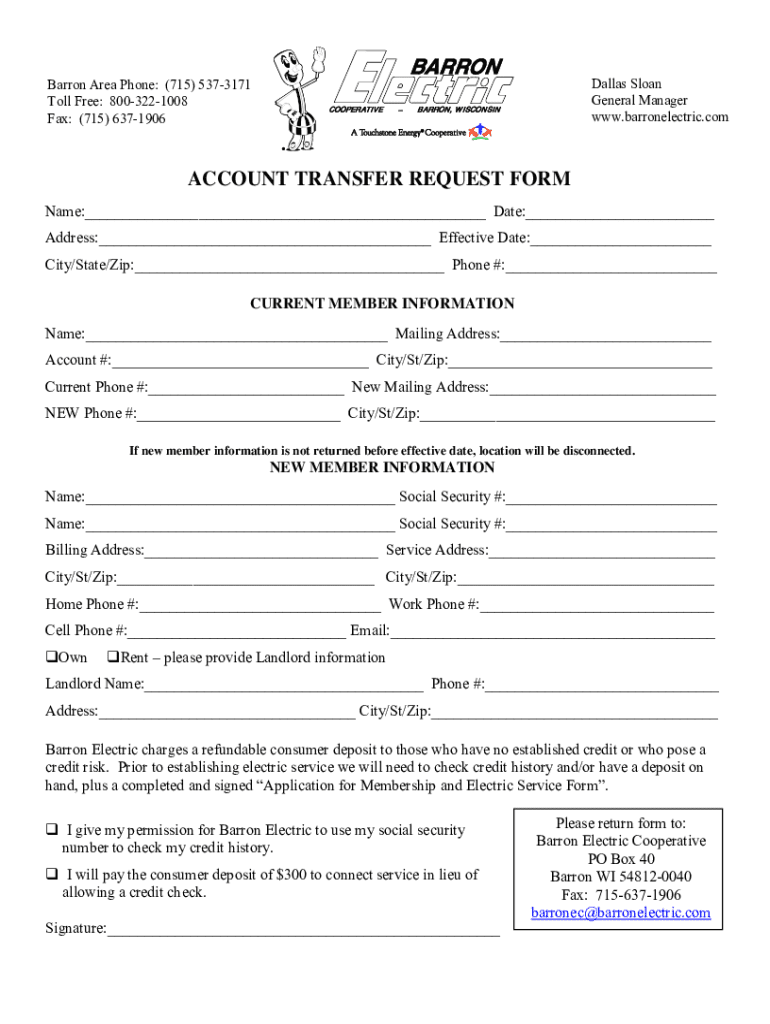

Understanding the account transfer request form

An account transfer request form is a crucial document that facilitates the transfer of accounts from one financial institution to another, or between different accounts within the same institution. This form serves to provide necessary details that allow banks or financial services to execute the transfer accurately and timely.

You might need this form in various situations, particularly when you want to consolidate accounts, relocate your banking service, or take advantage of better financial products available at a different institution. It's essential to understand the implications of transferring your account, including any potential fees or benefits.

Preparing to fill out the account transfer request form

Filling out the account transfer request form requires careful preparation. First, gather all necessary information and documentation to complete the form accurately and efficiently. This consistency helps avoid delays in processing your request.

Identification requirements typically include a government-issued ID and your account numbers. You should also have details of your current account and the new account you wish to transfer to, including the account type and institution name.

It's also critical to familiarize yourself with any fees and policies associated with the transfer. Some banks may impose charges for transferring your funds or closing an account. Checking these details beforehand can save you from unexpected costs later.

Step-by-step instructions for completing the account transfer request form

To ensure a successful transfer, follow these step-by-step instructions to complete the account transfer request form. Each section must be filled out with precision to facilitate smooth processing.

The first section generally collects your personal information, such as your name, address, and contact details, which are required to identify you as the account holder.

The next section will ask for your current account information. Be meticulous when entering details about your existing account, including your account number and the type of account, to avoid any processing errors.

Finally, in the transfer details section, specify the new account information accurately, including the institution’s name and any relevant identifiers. If you're uncertain about any section, consider using examples or reaching out for assistance.

To ensure clarity and accuracy in your entries, review your information thoroughly. Avoid common mistakes such as typos in account numbers or omission of required details, as these can lead to unnecessary delays.

Editing and modifying the form

Once you submit the account transfer request form, you may find that revisions are necessary. Understanding how to amend your submission is key to a smooth transfer process. Depending on the financial institution, you may have the option to make changes directly to the form if it's still under review.

If you need to modify your form, pdfFiller offers convenient PDF editing features to revisit your form easily. You can easily make changes within the platform, but ensure you are aware of specific policies related to changing submitted documents, as they may affect the transaction.

eSigning the account transfer request form

eSigning the account transfer request form is a significant step that authenticates your request and provides necessary legal acknowledgment. Many financial institutions now require a digital signature as part of their standard procedures for processing forms.

To eSign using pdfFiller, you can follow a straightforward process. First, you’ll need to select your preferred eSign option, whether it's a drawn signature, typed text, or uploading an image of your actual signature. Then, secure and validate your signature, ensuring it adheres to the requirements of your bank.

Submitting your account transfer request form

Submitting your account transfer request form can be accomplished through various methods - online, via mail, or in-person at a bank branch. Each approach has its benefits and may cater to different preferences depending on your schedule and accessibility.

Recommended practices for submission include sending the form in a secure manner if you're doing it through the mail and confirming that you have received the necessary confirmation from the financial institution when you submit online.

After submission, be proactive in tracking the status of your request. This can often be done through your bank's online portal or by contacting customer service directly for real-time updates.

FAQs about the account transfer request process

Several questions typically arise in the context of account transfers. The most common queries concern processing times, which can vary widely based on the institutions involved and the complexity of your transfer. Generally, transfers can take anywhere from a few business days to more than two weeks.

Understanding potential reasons for transfer denials is equally important. Some common reasons include missing information, discrepancies in your identification, or attempts to transfer funds without sufficient balance. If you find your request denied, follow up with customer service for guidance on rectifying the issues.

Leveraging additional features of pdfFiller for document management

pdfFiller enhances the account transfer process with a range of additional features for document management. Users can edit forms, collaborate on documents within teams, or store essential documents securely in the cloud. This versatility makes it easier to manage financial documentation efficiently.

Editing tools offered by pdfFiller allow users not just to fill forms, but also to adjust, sign, and share documents conveniently. This capability is especially beneficial for teams working collectively on mutual projects or finances, keeping communication open and transparent.

Unique benefits of using pdfFiller for your account transfer request

One of the standout benefits of using pdfFiller for your account transfer request form is the seamless user experience it provides. Users can edit PDFs, eSign, and manage their documents all on one cloud-based platform. This means no more hopping between different applications or tools.

Being cloud-based enhances accessibility, allowing users to manage their papers from anywhere with an internet connection. This feature greatly benefits individuals and teams seeking solutions that cater to flexibility and mobility. With a collaborative environment, pdfFiller ensures that all team members stay engaging with the latest versions of documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my account transfer request form in Gmail?

How can I send account transfer request form for eSignature?

How do I complete account transfer request form online?

What is account transfer request form?

Who is required to file account transfer request form?

How to fill out account transfer request form?

What is the purpose of account transfer request form?

What information must be reported on account transfer request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.