Get the free "#$"%&'()*+

Get, Create, Make and Sign 039

Editing 039 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 039

How to fill out 039

Who needs 039?

039 Form: A Comprehensive How-to Guide

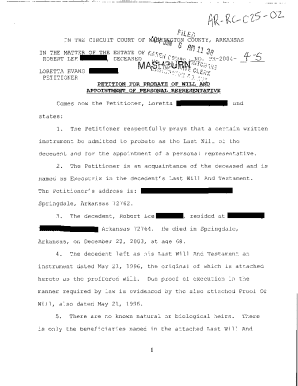

Understanding the 039 form

The 039 Form serves a specific purpose in a variety of contexts, particularly within financial reporting and transactions. This document is often required by governmental agencies, financial institutions, and businesses to collect information pertinent to tax reporting, compliance, and record-keeping. The importance of the 039 Form cannot be overstated; it plays a vital role in ensuring that individuals and organizations comply with legal and regulatory standards.

Individuals utilize the 039 Form primarily for personal tax matters or when applying for specific financial products. Businesses and organizations harness the 039 Form for operational needs like employee registration, tax compliance, and financial reporting. Understanding its requirements is crucial for avoiding penalties and ensuring seamless financial transactions.

Key features of the 039 form

The 039 Form contains several key features that are essential for accurate completion. It consists of required fields that must be filled out, such as personal identification information, financial details, and other relevant data. Some sections may also include optional fields which allow for additional context, providing a well-rounded view of the individual's or organization's financial situation.

Variation in the form exists based on state or particular requirements. Different jurisdictions may mandate specific versions of the 039 Form, and it's vital to ensure that the correct version is procured based on the location of submission. Always check for the most current form version to avoid any compliance issues.

Step-by-step instructions for completing the 039 form

Before completing the 039 Form, proper preparation is key. Collect all necessary information about your income, expenses, and any relevant documents that support your claims. This includes previous tax returns, financial statements, and identification documents. A thorough review of these supporting documents can prevent mistakes during the filling process.

When filling out the form, each section demands careful attention to detail. For instance, Section 1 focuses on personal information, where accuracy is paramount. Double-check spellings and numeric entries. Section 2 covers financial details; common errors include incorrect amounts or missing information. Lastly, Section 3 may ask for additional specifications—take your time to explain each field clearly.

Submitting the 039 Form can vary based on preferences. You can choose online submission for immediate delivery or opt for traditional methods such as mailing. Be aware of any deadlines; late submissions can lead to penalties or complications.

Editing and managing the 039 form

Utilizing tools like pdfFiller makes editing the 039 Form straightforward. Users can easily upload the form to the platform and utilize editing features to make necessary adjustments. Adding annotations or comments can clarify any discrepancies or provide additional context for information submitted.

Collaboration is also enhanced with pdfFiller, allowing multiple users to share and edit the 039 Form in real-time. This is particularly beneficial for teams needing to coordinate on financial data, ensuring everyone’s input is captured effortlessly.

eSigning the 039 form

The landscape of document management has evolved with the rise of electronic signatures. The legal validity of eSignatures ensures that your signed 039 Form holds the same weight as traditional signatures, making the process of signing crucial documents more efficient.

To eSign the 039 Form using pdfFiller, follow these steps: upload your document, select the eSignature option, and follow the prompts to sign electronically. Depending on requirements, options for witnessing signatures can also be utilized to enhance the security and validity of the submission.

Troubleshooting common issues

Frequently encountered problems when filling out the 039 Form can include incorrect information submissions or technical issues during the electronic filing process. These errors can be preventable through careful review and by utilizing available editing tools to amend any mistakes.

If you face technical difficulties, seeking support from pdfFiller is recommended. They provide customer service that can assist with common issues ranging from document errors to submission problems, ensuring you’re not left in a difficult spot.

Best practices for managing your 039 form

Organizing completed 039 Forms is essential for effective record-keeping. Maintain a dedicated folder—both physical and digital—for all relevant documents to ensure you can quickly access past forms when needed. Implementing a systematic approach to filing will facilitate easier tracking of information for future reference.

Keeping abreast of changes in requirements for the 039 Form is equally important. Subscribe to updates from relevant authorities or services like pdfFiller to track changes in submission guidelines or form versions, ensuring continuous compliance.

Case studies and success stories

Real-life examples demonstrate the effectiveness of properly managing the 039 Form. Testimonials from users reveal that timely submission and accurate completion have led to significant savings in penalties and hassle-free transactions with financial institutions. Adhering to best practices enabled many users to navigate complex requirements efficiently.

Effective management, combined with the tools offered by pdfFiller, has resulted in streamlined processes, allowing individuals and organizations to focus more on their core operations rather than document management.

Interactive tools for the 039 form

pdfFiller’s interactive tools enhance the 039 Form experience. Features such as the ability to directly fill and save forms online, share for collaboration, and access templates make the overall document management process more user-friendly. Enhanced feedback mechanisms also allow users to share their experiences for continuous service improvement.

These tools greatly facilitate not just the completion of the 039 Form but also foster team collaboration, ensuring everyone involved is aligned and informed throughout the document preparation process.

Future developments and trends

As document management continues to evolve, anticipated changes to the 039 Form focus on integrating digital solutions to streamline processes further. Automation and AI tools are expected to become commonplace, allowing for smarter data collection and analysis.

pdfFiller is at the forefront of these advancements, evolving its platform continuously to stay ahead of technological trends. Expect improvements that not only simplify the completion of forms like the 039 Form but also enhance overall user experience, making document management more efficient and accessible for all.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 039 directly from Gmail?

How can I send 039 to be eSigned by others?

How do I fill out 039 on an Android device?

What is 039?

Who is required to file 039?

How to fill out 039?

What is the purpose of 039?

What information must be reported on 039?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.