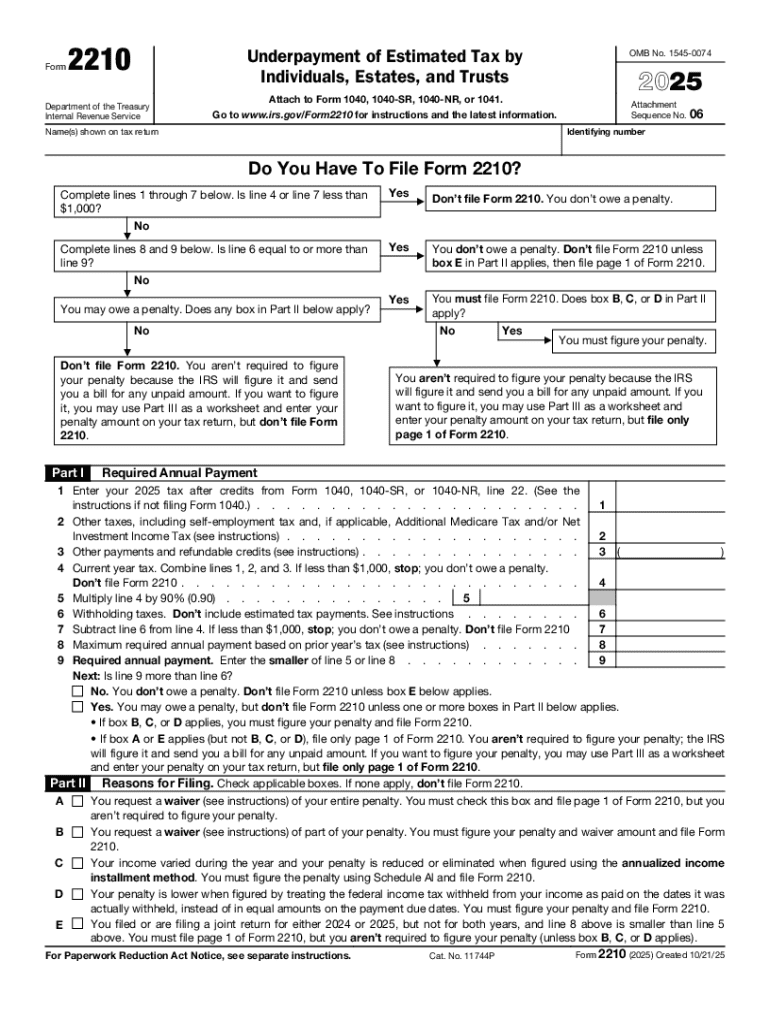

IRS 2210 2025-2026 free printable template

Get, Create, Make and Sign IRS 2210

How to edit IRS 2210 online

Uncompromising security for your PDF editing and eSignature needs

IRS 2210 Form Versions

How to fill out IRS 2210

How to fill out 2025 form 2210

Who needs 2025 form 2210?

2025 Form 2210 Form: A Comprehensive Guide to Understanding and Filing

Understanding IRS Form 2210: Purpose and importance

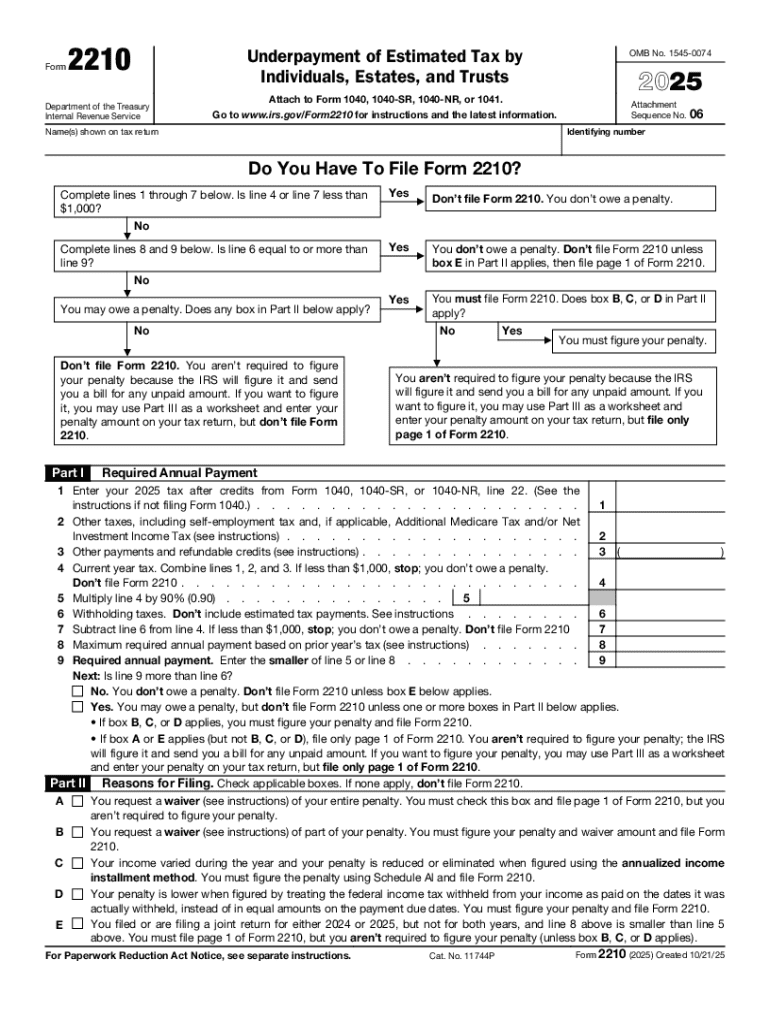

IRS Form 2210 serves as an essential document for taxpayers who have underpaid their estimated taxes throughout the year. This form not only determines whether you owe a penalty for underpayment but also provides a calculated approach to rectify any discrepancies. Understanding its purpose is crucial for maintaining tax compliance and preventing unexpected tax bills.

Failure to estimate tax payments accurately can lead to significant penalties. This is particularly important for self-employed individuals and small business owners who may not have taxes withheld from their income. By accurately completing the 2025 Form 2210, these taxpayers can mitigate penalties and ensure they meet their tax obligations.

How the IRS calculates the underpayment penalty

The underpayment penalty is a critical aspect of tax compliance, serving to discourage inadequate tax payments during the fiscal year. Taxpayers need to comprehend the implications of underpayment, including the potential penalties that can significantly increase their total tax liability.

The IRS employs a methodical approach to calculate these penalties, typically based on the amount underpaid and the number of days the payment was overdue. Understanding this calculation process is vital for taxpayers to manage their tax obligations effectively.

Key dates and timelines for filing

Filing deadlines for IRS Form 2210 typically align with the tax filing season, which runs from January 1 to April 15. Understanding these critical dates helps taxpayers avoid late penalties and ensures they file accurately and promptly.

Taxpayers should be mindful of the implications of late filings. The IRS enforces consequences for those who fail to file on time, and it's essential to be aware of how to apply for extensions when necessary, whether through the submission of Form 4868 or via other methods.

When does the IRS waive the underpayment penalty?

Certain criteria allow the IRS to waive penalties associated with underpayment. Understanding these conditions can provide significant financial relief to taxpayers who find themselves facing an unexpected penalty. Common situational criteria include natural disasters or significant income fluctuations that may affect a taxpayer's ability to pay.

To formally request a waiver, taxpayers often need to file additional documentation with the IRS. Clarifying the necessary steps can help streamline this process and facilitate the potential for penalty elimination.

Step-by-step instructions to complete Form 2210

Completing Form 2210 requires diligent preparation of documentation. Prior to filling out the form, taxpayers should gather pertinent information such as their total income, tax payments made during the year, and any deductions they intend to claim. Creating a checklist of these documents helps reduce errors in reporting.

The form is structured into several sections, including general information, underpayment calculation, and penalty computation. Each section should be filled with utmost accuracy, as errors can lead to unnecessary penalties. Utilizing tools provided by pdfFiller can simplify this process considerably.

Utilizing pdfFiller for your Form 2210 needs

pdfFiller stands out as a comprehensive solution for handling IRS Form 2210. This platform empowers users to edit forms seamlessly, facilitating digital completions. Features like eSigning and real-time collaboration make pdfFiller an invaluable tool, especially when addressing complex tax situations.

Using pdfFiller to complete Form 2210 is a straightforward process. Users can upload their form and easily fill in required fields, ensuring accuracy and compliance. The robust security measures in place also protect sensitive tax information, which is vital for taxpayer confidence.

Related forms and additional considerations

Taxpayers may encounter various forms that accompany Form 2210, especially when claiming deductions or credits. Familiarizing yourself with related forms not only aids in accurate filing but also ensures that you are taking advantage of all available tax benefits. Forms such as Schedule C for business income or the various deductions claimed can significantly affect the overall tax landscape.

Future legislative changes could influence the structure or requirements around Form 2210, keeping taxpayers on their toes. Regularly reviewing IRS announcements regarding potential updates is crucial for compliance and effective tax management.

Interactive tools for managing your taxes

Utilizing interactive features like those available on pdfFiller enhances the taxpayer experience. These tools not only simplify the process of filing but also provide valuable insights into tax management strategies. Tools such as calculators for estimated taxes or reminders for payment deadlines can greatly reduce the stress associated with tax responsibilities.

Leveraging these technological capabilities allows both individuals and teams to streamline their tax preparation workflows. This efficiency can lead to more accurate filings and potentially lower tax burdens.

People Also Ask about

How do I avoid penalty for underpayment of estimated taxes?

What triggers IRS underpayment penalty?

What exempts you from underpayment penalty?

Who needs form 2210?

What is form 2210 for?

What is the form 2210 underpayment penalty?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 2210 in Gmail?

How do I make changes in IRS 2210?

How do I edit IRS 2210 in Chrome?

What is 2025 form 2210?

Who is required to file 2025 form 2210?

How to fill out 2025 form 2210?

What is the purpose of 2025 form 2210?

What information must be reported on 2025 form 2210?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.