IRS Publication 503 2025-2026 free printable template

Get, Create, Make and Sign IRS Publication 503

Editing IRS Publication 503 online

Uncompromising security for your PDF editing and eSignature needs

IRS Publication 503 Form Versions

How to fill out IRS Publication 503

How to fill out 2025 publication 503

Who needs 2025 publication 503?

Understanding the 2025 Publication 503 Form: Your Comprehensive Guide

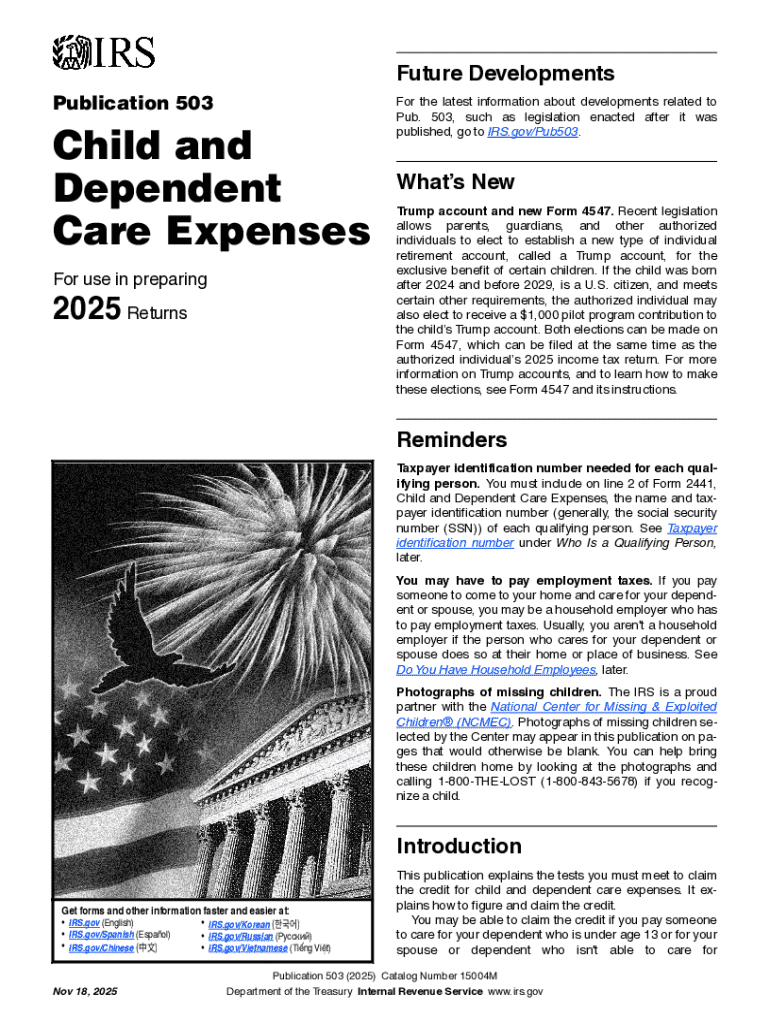

What is the 2025 Publication 503 Form?

The 2025 Publication 503 Form serves as a crucial document in the realm of tax reporting and compliance, specifically designed to assist employers in maximizing their employee benefits. This form is pivotal for ensuring that tax credits and deductions related to employee benefits plans are accurately documented. In essence, it helps employers provide the necessary details that the IRS requires to qualify for various tax incentives related to employee benefits.

The importance of the 2025 Publication 503 Form cannot be overstated, as it helps streamline the tax reporting process, ensuring compliance with the latest IRS guidelines. Businesses that fail to submit this form properly may face penalties or miss out on significant tax savings. For organizations embracing remote work, this form becomes even more essential, offering vital insights into benefit allocations tailored to today’s evolving workforce.

Key changes in the 2025 version

The 2025 edition of the Publication 503 Form introduces several key updates from its predecessors. These modifications reflect ongoing changes in tax law and employer requirements, which have been implemented to provide clearer guidance and simplify the tax reporting process. Notable adjustments include the adjustment of thresholds for benefit eligibility and expanded definitions around what constitutes qualifying employee benefits.

Such revisions are generally made to adapt to the shifting landscape of employee benefits and comply with recent legislative changes. Understanding these updates can significantly affect how employers design their employee benefits strategies, making it imperative for them to stay informed about the specifics of this form.

Who needs to fill out the 2025 Publication 503 Form?

The eligibility criteria for completing the 2025 Publication 503 Form primarily target employers offering specific employee benefits that are eligible for tax deductions. Employers who sponsor retirement plans, health insurance, or other benefits are generally required to complete this form. Additionally, organizations must meet certain thresholds for employee participation in these plans to qualify.

Common scenarios requiring the form include businesses aiming to claim tax credits related to contributions made toward health plans or retirement accounts. For example, a small business providing health insurance to its employees can utilize this form to demonstrate compliance and secure available tax benefits. Remote businesses, which have gained prominence in recent years, are also encouraged to use this form to ensure that employees are receiving appropriate benefits regardless of their work location.

Detailed instructions for filling out the 2025 Publication 503 Form

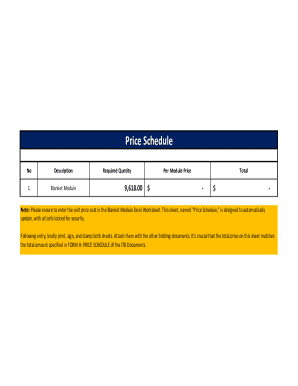

Completing the 2025 Publication 503 Form may seem challenging at first, but following a step-by-step guide makes the task more manageable. It is crucial to gather all necessary documents beforehand to streamline the process, ensuring all information is readily available and accurate. Below is a breakdown of the form's sections, highlighting important data to include.

Section 1: Basic information

The first section requests essential personal and business details, including the employer's name, address, and Employer Identification Number (EIN). It is important for employers to ensure that this information matches with IRS records to avoid discrepancies.

Section 2: Relevant financial data

In this section, businesses must report their income and detail the benefits offered to employees. This includes contributions made by the employer to retirement and health plans, along with any other qualifying benefit expenditures. Be meticulous here; inaccurate financial data can lead to significant tax implications.

Section 3: Additional information and attachments

Employers should also prepare to attach supporting documents, such as account statements for employee benefits and proof of contributions. These records serve as back-up evidence to support claims made on the form, facilitating a smoother audit process should the need arise.

Interactive tools from pdfFiller can significantly aid this process, such as cloud-based templates that streamline form completion and help reduce errors. Utilize the platform's auto-fill features to populate data quickly, minimizing the chance of human error. However, it is crucial to review all entries carefully to ensure compliance and accuracy.

Common mistakes and how to avoid them

Employers often make common mistakes when filling out the 2025 Publication 503 Form, which can result in delays or penalties. Some frequent errors include miscalculating benefit amounts, failing to attach supporting documentation, or entering incorrect identification information. To avoid these pitfalls, double-check all data entries, keep a checklist of required documents, and consult with a tax professional if uncertainties arise. Best practices for accuracy include ensuring all figures are rounded properly and correspond to appropriate fiscal years.

Editing and managing the 2025 Publication 503 Form

Using pdfFiller for document management simplifies the process of editing and completing the 2025 Publication 503 Form. The platform allows employers to upload the form and make necessary changes or updates from anywhere, offering a convenient solution for busy teams managing diverse employee benefits.

Employers can leverage collaboration features to work on the document with their teams simultaneously. This is particularly useful for organizations with multiple stakeholders involved in benefit planning and reporting. Additionally, after completing the form, it can be saved in various formats, including PDF and DOCX, facilitating compatibility with various software.

Secure sharing options allow employers to confidently send completed forms to clients, accountants, or tax advisors using encrypted links, ensuring that sensitive information remains protected. Keeping all stakeholders informed contributes to more effective benefits management and compliance.

eSigning the 2025 Publication 503 Form

Electronic signatures have revolutionized the way businesses handle documents. The benefits of eSignatures include faster processing times, reduced paper usage, and enhanced convenience. Legal acceptance of eSignatures has been firmly established, making them a valid option for signing forms like the 2025 Publication 503.

On pdfFiller, adding a digital signature is a straightforward process. Users can draw their signature, upload an image, or choose from a pre-set signature template. After signing, tracking and managing signed documents is easy, ensuring that all parties have access to final versions when needed. Efficient documentation management saves time and minimizes the risk of miscommunication regarding employee benefit offerings.

Frequently asked questions (FAQ)

Navigating tax documentation can raise numerous questions, especially regarding the 2025 Publication 503 Form. One common inquiry is, 'What if I make a mistake on the form?' Employers should be aware that corrections can usually be made by submitting an amended form, but timing is critical to avoid potential penalties.

Another frequent question is, 'How does this form impact my tax return?' The form plays a significant role in helping employers receive eligible tax credits and deductions, which can ultimately affect the amount owed or refunded during tax season. Additionally, if you're seeking clarification concerning the latest tax law changes, consider accessing professional tax resources or forums dedicated to sharing relevant information in real-time.

Getting help with the 2025 Publication 503 Form

Employers unsure about filling out the 2025 Publication 503 Form are encouraged to seek support from tax professionals or consult their plan administrators for personalized guidance. Tax experts can provide insight into current legislative interpretations and help ensure compliance, preventing potential issues down the line.

Furthermore, online communities and forums can be excellent resources for sharing knowledge and experiences with fellow employers regarding employee benefits and tax implications. For additional assistance, pdfFiller's support services are readily accessible, offering customer support options, tutorials, and webinars aimed at navigating document creation and management efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IRS Publication 503 on an iOS device?

How do I edit IRS Publication 503 on an Android device?

How do I fill out IRS Publication 503 on an Android device?

What is 2025 publication 503?

Who is required to file 2025 publication 503?

How to fill out 2025 publication 503?

What is the purpose of 2025 publication 503?

What information must be reported on 2025 publication 503?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.