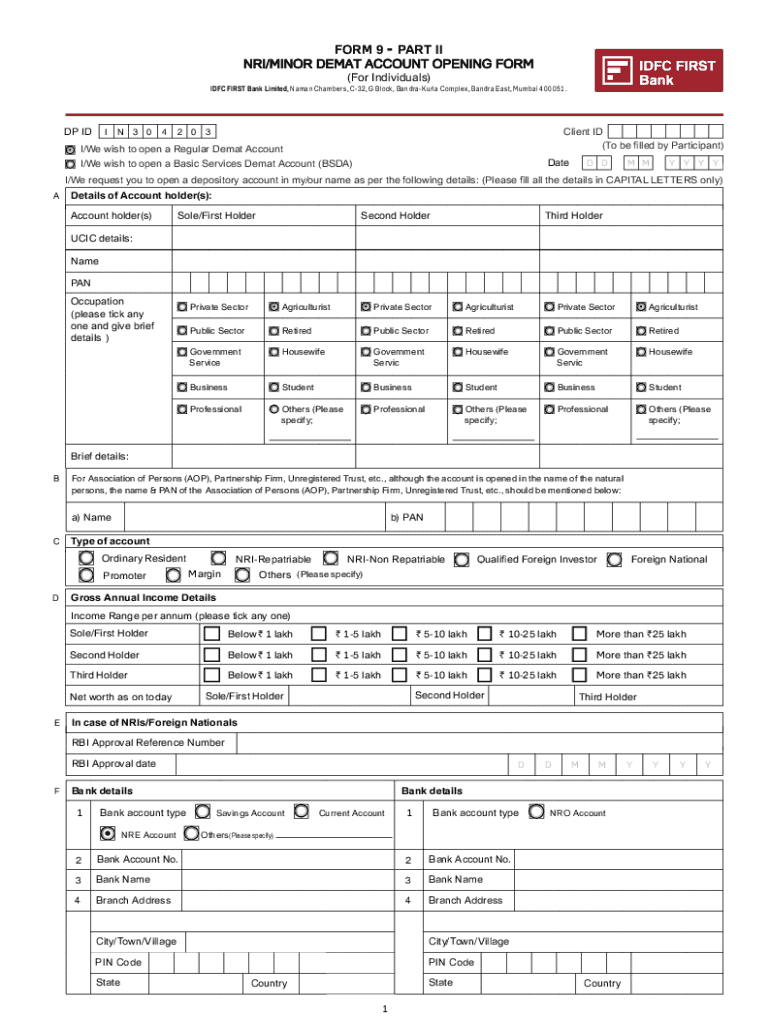

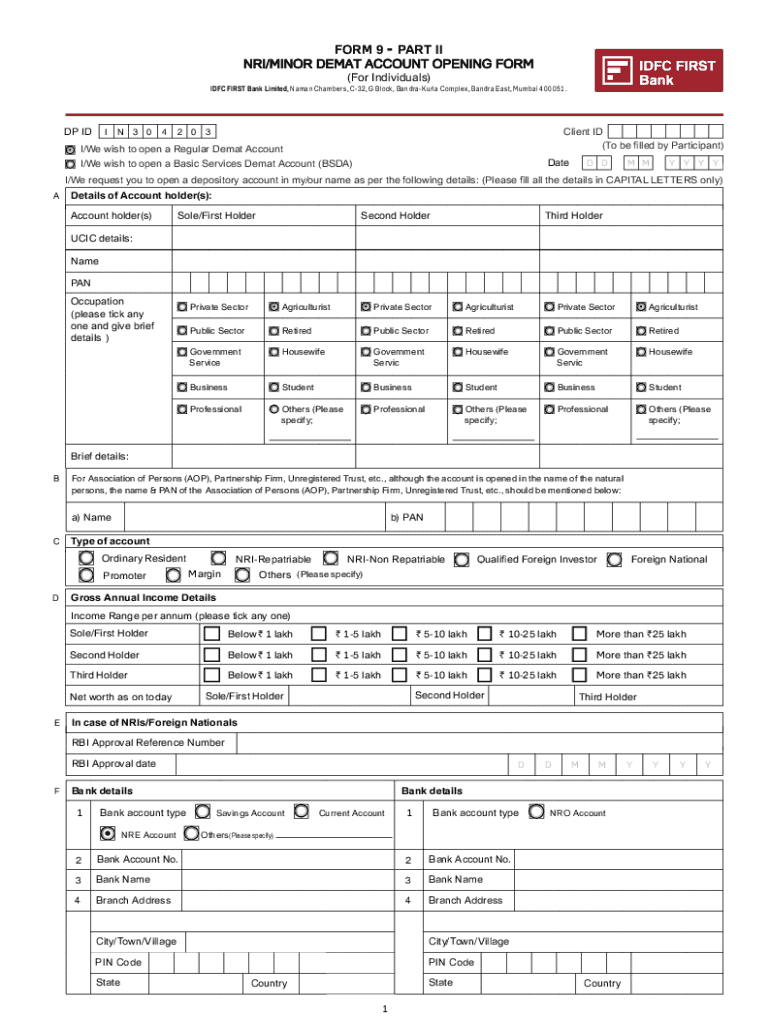

Get the free Demat Account Opening Form V3.cdr - IDFC FIRST Bank

Get, Create, Make and Sign demat account opening form

Editing demat account opening form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out demat account opening form

How to fill out demat account opening form

Who needs demat account opening form?

Demat Account Opening Form: How-to Guide Long-Read

Understanding demat accounts

A demat account is an electronic account that holds shares and securities in a digital format instead of paper. This revolutionary practice aims to simplify the process of buying, holding, and selling stocks. In stock trading, a demat account is essential because it seamlessly facilitates transactions, ensuring quick transfers and settlements.

The importance of having a demat account cannot be overstated. It allows investors to hold securities in an electronic format, making asset management far more efficient. Investors can easily execute trades and manage their portfolios in real-time, enhancing their trading experience.

Prerequisites for opening a demat account

Before opening a demat account, investors must meet certain eligibility criteria. For individuals, the primary requirement is age, where applicants should be at least 18 years old. For corporate accounts, additional regulations apply, and it’s advisable to consult a financial advisor for clarity.

Alongside eligibility, specific documents are essential for compliance with KYC (Know Your Customer) norms. This typically includes a photo ID, address proof, and a PAN card, which are crucial in establishing the identity of the applicant. Additionally, recent bank account statements might be requested to verify financial details.

How to fill out the demat account opening form

Completing the demat account opening form is straightforward yet crucial. This form typically includes several key sections that require precise information; inaccuracies can result in delays or rejections. Hence, it is vital to approach this process with attention to detail.

Let's break down the process step-by-step to provide a clear pathway to successful completion of the form.

Avoid common mistakes such as omitting essential details, misplacing your signature, or inaccurately submitting documents. These can hinder your application process.

Submitting the demat account opening form

Once you have accurately filled out the demat account opening form, the next step is submission. There are generally two methods: online and offline. Online submission allows for quicker processing and is typically more convenient, with many brokers offering user-friendly portals for form submission.

Utilizing platforms like pdfFiller provides several advantages, including the ability to easily upload, sign, and store documents securely. Additionally, online submission often allows you to track your application's progress in real-time.

After submission, you can typically check your application status via the broker’s website or customer service. Expect a processing timeframe of 7 to 14 days, depending on the broker.

Interactive tools for managing your demat account

Managing a demat account becomes significantly easier with the right tools. pdfFiller, for instance, offers a range of features tailored to document management throughout your demat account lifecycle. Users can edit forms, sign documents, and even collaborate with financial advisors in real time, making the process much more efficient.

These features not only enhance your user experience but also add layers of security to protect your personal and financial information. Adopting best practices such as using strong passwords, enabling two-factor authentication, and regularly updating your security settings will further safeguard your account.

Frequently asked questions (FAQs) about demat account opening

Navigating the demat account application process can often lead to questions. Here are some common inquiries that potential investors frequently ask.

Tips for successful document management with pdfFiller

To maximize your experience with pdfFiller, leveraging cloud-based solutions for document management is key. With features that allow you to access documents on-the-go, you can manage your investments and necessary documentation from anywhere with an internet connection.

It's also advisable to renew your demat account registration periodically, ensuring that your account remains compliant with current regulations. Keep your details updated, including changing addresses or personal identification, to avoid troubles during verification.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send demat account opening form for eSignature?

How do I make edits in demat account opening form without leaving Chrome?

Can I sign the demat account opening form electronically in Chrome?

What is demat account opening form?

Who is required to file demat account opening form?

How to fill out demat account opening form?

What is the purpose of demat account opening form?

What information must be reported on demat account opening form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.