Get the free Open NRI Demat and Trading Account - IDFC FIRST Bank

Get, Create, Make and Sign open nri demat and

How to edit open nri demat and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out open nri demat and

How to fill out open nri demat and

Who needs open nri demat and?

Open NRI Demat and Form: A Comprehensive How-to Guide

Understanding NRI demat accounts

A demat account serves as a digital vault that holds your securities like stocks, bonds, and mutual funds in an electronic format instead of physical certificates. It is essential for facilitating the buying and selling of securities in today's fast-paced market. The main purpose of a demat account is to simplify and streamline the investment process, ensuring security and efficiency. Unlike a regular brokerage account which combines trading functionalities, a demat account specifically focuses on holding and safeguarding your investments.

For Non-Resident Indians (NRIs), having a demat account is particularly critical. It provides simplified access to the Indian financial markets, enabling them to invest in their home country's stocks and securities even from abroad. By opening an NRI demat account, NRIs can also participate in the growth stories of Indian companies while managing their wealth effectively.

Eligibility criteria for opening an NRI demat account

Not every individual can open an NRI demat account. Specific eligibility criteria define who qualifies as an NRI, which includes Overseas Citizens of India (OCIs) and Persons of Indian Origin (PIOs). These categories encompass individuals whose status has shifted due to moving abroad or acquiring foreign citizenship, thereby allowing them to continue participating in the Indian financial market.

To initiate the process, interested NRIs need to provide necessary documentation. ID proofs such as a valid passport, valid visa, and proof of overseas address are critical. In addition, the Permanent Account Number (PAN) card, along with details of the NRE or NRO bank account where funds will be deposited, is mandatory.

Step-by-step guide to opening an NRI demat account

Opening an NRI demat account involves a few straightforward steps. The process begins with selecting an appropriate broker. When choosing a broker, consider factors such as fees and commissions, customer service, the technology they employ, and the trading platform's interface. It's important to ensure the broker aligns with your investment goals.

Once a suitable broker is selected, the next step is to fill out the NRI demat application form. Pay special attention to the personal information section where you'll need to provide comprehensive details regarding your identity and financial status. Common mistakes here include typos or supplying incomplete information, which can lead to processing delays.

After completing the form, you need to submit the required documents to your broker. Ensure that the documents are authentic and correctly verified to avoid any issues during approval. Typically, the submission can be done online, making the process further streamlined.

Types of NRI demat accounts available

NRIs have two main options when it comes to demat accounts: repatriable and non-repatriable accounts. A repatriable account enables NRIs to transfer funds abroad, thus giving them flexibility regarding their investment returns. In contrast, a non-repatriable account restricts this ability, making it a suitable choice for those who plan to reinvest within India.

Investors must choose based on their investment strategy; for instance, if they intend to regularly withdraw funds from India, a repatriable account tends to be more appropriate. Understanding the pros and cons associated with each type will guide you toward making informed decisions based on your long-term financial goals.

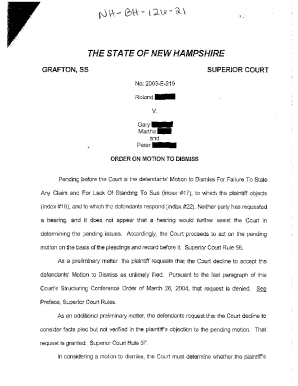

Understanding the compliance and regulatory framework

The Securities and Exchange Board of India (SEBI) regulates the functioning of the capital market, ensuring it operates efficiently and protects investors. For NRIs, understanding SEBI's regulations is crucial, as these laws dictate the compliance requirements that must be adhered to while investing in India. NRIs should ensure that they are aware of limits on the types and amounts of investments they can make to avoid unnecessary complications.

Tax implications also play an essential role in the NRI investment landscape. When capital gains are realized, NRIs are subject to different taxation rules, including TDS rates that may vary depending on the investments’ nature. Failure to understand these tax rates can impact overall returns, further emphasizing the necessity of informed investment.

Post-account opening: what’s next?

Once your NRI demat account is successfully opened, the next step is to fund your account. There are various methods to transfer money, including wire transfers, remittance services, or bank drafts. Understanding currency exchange rates is crucial, as fluctuations may affect the amount you can invest. Aim to transfer funds strategically to maximize your investment opportunities.

Linking your demat account with a trading account is another essential step. This ensures seamless transactions, allowing you to buy and sell securities easily. Efforts to maintain synchronized accounts facilitate efficient management of investments and timely execution of trades.

Managing your NRI demat account

Proper management of your NRI demat account hinges on effective monitoring of your investments and holdings. Regular reviews using various tools allow you to assess portfolio performance, identify underperforming assets, and make timely decisions to optimize returns. Staying informed of market trends and integrating various resources can also help mitigate risks and enhance your investment strategy.

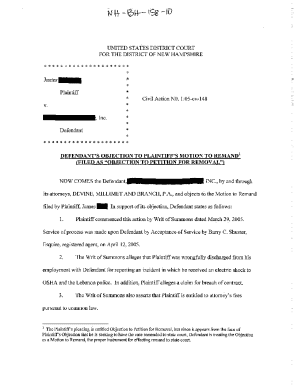

In addition to monitoring, you may occasionally need to edit and manage your holdings. Cloud-based platforms, such as pdfFiller, offer innovative solutions for consolidating documents, signing investment agreements, and managing essential paperwork. Utilizing such tools can save time and streamline operations, allowing you to focus on strategic investment decisions.

Leveraging technology for efficient investment

Embracing digital platforms enhances the investment experience for NRIs, making processes more efficient and accessible. Online platforms provide tools for document management, e-signature capabilities, and collaboration opportunities, facilitating smoother interactions with brokers or financial advisors.

pdfFiller exemplifies the power of technology through its cloud-based document management services. The ability to electronically sign documents not only speeds up the process but also offers enhanced security. Using collaborative features allows you to communicate with advisers easily and ensure all relevant agreements are updated with real-time information.

Common challenges faced by NRIs

NRIs often face unique challenges in managing their investments remotely. Navigating complex regulations, paperwork, and the nuances of the Indian financial market can be daunting. Without sufficient guidance, NRIs may struggle to keep their investments organized and compliant with regulations.

Overcoming these challenges is attainable through professional support and utilizing online resources. Seeking advice from financial advisors well-versed in NRI investments can be invaluable. Additionally, employing intuitive online tools can simplify document management, helping NRIs address issues efficiently while managing their portfolios.

Benefits of opening an NRI demat account through us

Choosing to open your NRI demat account with us promises a seamless investment experience. We prioritize an efficient process that allows you to focus on maximizing returns rather than getting entangled in procedures. Our platform is designed with user convenience in mind, simplifying the logistical aspects of account management.

Moreover, our commitment to providing enhanced customer support ensures you have 24/7 assistance for any queries you may have. This level of service permits you to invest with confidence. Plus, our automated systems take care of tax management, making capital gains tax settlement a hassle-free process for you, ensuring compliance with Indian regulations.

Conclusion

For NRIs, understanding the landscape of financial investments in India is crucial. As you embark on your journey to open an NRI demat account, remain informed about the procedural nuances and market dynamics. Adequately managing this account can lead to potential growth, enriching your financial portfolio while achieving financial freedom.

In summary, the investment opportunities available through proper management of NRI demat accounts can be significant. With a focus on education, leveraging technology, and receiving professional support, NRIs can harness the potential of the Indian market efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my open nri demat and directly from Gmail?

How can I fill out open nri demat and on an iOS device?

How do I edit open nri demat and on an Android device?

What is open nri demat and?

Who is required to file open nri demat and?

How to fill out open nri demat and?

What is the purpose of open nri demat and?

What information must be reported on open nri demat and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.