Get the free Funeral Benefit Beneficiary Form

Get, Create, Make and Sign funeral benefit beneficiary form

Editing funeral benefit beneficiary form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out funeral benefit beneficiary form

How to fill out funeral benefit beneficiary form

Who needs funeral benefit beneficiary form?

Funeral benefit beneficiary form: How-to guide

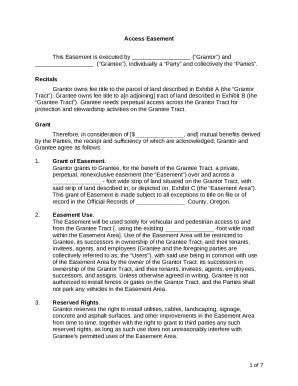

Understanding the funeral benefit beneficiary form

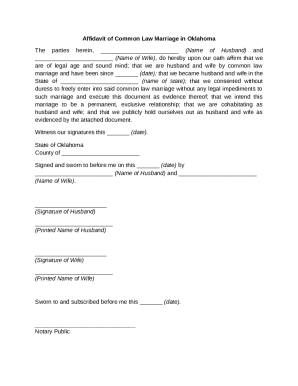

A funeral benefit beneficiary form is a document that designates individuals who will receive financial benefits from a funeral insurance policy upon the policyholder's death. This form is crucial for ensuring funds are allocated according to the policyholder's preferences, providing timely support for burial or cremation costs when families need it most.

In estate planning, this form plays a pivotal role as it not only dictates financial support but also helps in minimizing potential conflicts among family members regarding the use of funds. Understanding this document is vital for anyone looking to ensure their final wishes are honored and that their loved ones are financially secure.

The significance of naming a beneficiary

Designating a beneficiary on a funeral benefit beneficiary form is not just a bureaucratic step; it serves a vital function. By ensuring that financial support is readily available, individuals can allow their loved ones to focus on grieving rather than financial burdens. Having a clear beneficiary designation can alleviate tension that often arises during difficult times when families must make decisions quickly.

Additionally, naming a beneficiary often helps to bypass the probate process, which can be lengthy and complicated. With a designated beneficiary, the insurance proceeds can be directly accessed by the named individuals, ensuring that funds are available immediately when needed.

When selecting a beneficiary, consideration is key. Family dynamics must be understood thoroughly; relationships between potential beneficiaries can affect decisions on designations. Furthermore, implications for taxes and inheritance should also be factored in to ensure that financial constraints do not hinder the intended support.

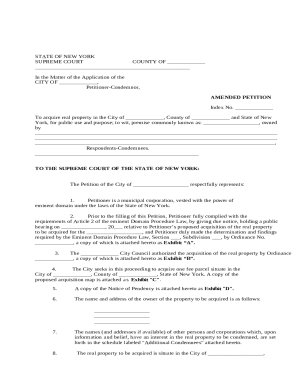

Step-by-step instructions for completing the form

Completing a funeral benefit beneficiary form requires meticulous attention to detail. Before diving in, gather necessary documents and personal information that will aid in the accuracy of the form. This includes identifying your full name, policy number, and personal identification like a Social Security number.

The next step is defining the beneficiaries. A primary beneficiary is the first in line to receive the benefits, while contingent beneficiaries are designated in case the primary cannot fulfill the role. Documenting their names, relationships to the policyholder, and relevant identification is necessary.

As you fill out the form, be methodical. Ensure that sections such as Policyholder Information and Beneficiary Details are completed accurately. One last but essential step is to provide your signature and date at the end to validate the document. Double-check the form to avoid common mistakes, like omitting details or not keeping the information current as family situations evolve.

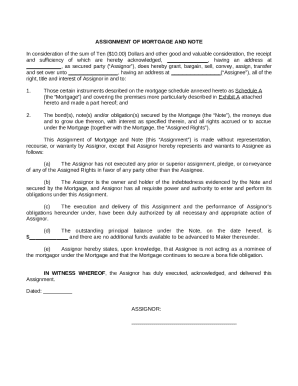

Editing and customizing your form with pdfFiller

Accessing the funeral benefit beneficiary form through pdfFiller is straightforward. Start by visiting the platform's website; once there, you can search for the specific form via its search bar. pdfFiller stands out due to its intuitive interface, which minimizes the learning curve typically associated with document management solutions.

Editing features available on pdfFiller enhance your form's usability significantly. You can add text fields for customization, checkboxes for easy selection, and even electronic signatures to finalize the document without the need for printing. Utilizing available templates can also streamline the completion process, saving time while ensuring all necessary information is included.

When you finish editing, pdfFiller also offers multiple saving and sharing options. You can choose to export your document in various file formats like PDF, Word, or Excel, and store it in the cloud for easy access. This ensures your document is safeguarded against loss and readily available for updates whenever necessary.

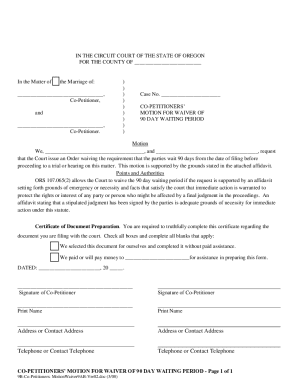

Signing and submitting the form

In today's digital age, electronic signatures are becoming increasingly prevalent, making it essential to understand eSign laws and compliance when submitting your funeral benefit beneficiary form. These laws govern the validity of signatures in legal and financial documents, providing assurance that electronic processes hold up in court.

Once you have signed the document, the method of submission is vital. You can directly submit the form to your insurance provider, ensuring that all details are accurate and complete. It is also crucial to retain several copies for your records and those of your beneficiaries, as this will help prevent misunderstandings or disputes later on.

Frequently asked questions (FAQs)

What happens if the beneficiary passes away before the policyholder? This situation requires immediate attention, as it may pose legal implications regarding the distribution of funds. It's advisable to review alternative beneficiaries and update the form accordingly to avoid delays in access.

How often should you review your beneficiary designation? A good practice is to review your funeral benefit beneficiary form every few years or after significant life events, such as marriage, divorce, or the birth of a child, to ensure it reflects your current circumstances.

Resources for further assistance

If you need help navigating pdfFiller’s features, their customer support is readily available through live chat or email. These resources ensure you can get immediate assistance should questions arise during the form-filling process.

pdfFiller also boasts a library of helpful articles and tutorials that cover various aspects of document management, equipping you with the skills to handle all your paperwork efficiently. Utilizing these resources can further enhance your understanding of the platform.

Conclusion: simplifying your document management experience

Completing a funeral benefit beneficiary form is an essential step in estate planning that can ease the financial burden on loved ones. Utilizing pdfFiller empowers individuals and teams to edit and manage these crucial documents effortlessly.

With an all-in-one platform, managing your beneficiary designations becomes a collaborative experience, whether you're handling your respective designations or working with organizational teams. By simplifying this process, pdfFiller allows you to ensure that your wishes are met, fostering peace of mind as you approach life's final chapter.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send funeral benefit beneficiary form for eSignature?

How do I make changes in funeral benefit beneficiary form?

Can I create an eSignature for the funeral benefit beneficiary form in Gmail?

What is funeral benefit beneficiary form?

Who is required to file funeral benefit beneficiary form?

How to fill out funeral benefit beneficiary form?

What is the purpose of funeral benefit beneficiary form?

What information must be reported on funeral benefit beneficiary form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.