Get the free Mobile Home Insurance Quote

Get, Create, Make and Sign mobile home insurance quote

Editing mobile home insurance quote online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mobile home insurance quote

How to fill out mobile home insurance quote

Who needs mobile home insurance quote?

Navigating Your Mobile Home Insurance Quote Form: A Comprehensive Guide

Understanding mobile home insurance

Mobile home insurance is specifically designed to protect the unique structures and living conditions that mobile and manufactured homes present. Unlike traditional homes, mobile homes often face different risks and require specialized coverage, making it essential for homeowners to secure appropriate insurance tailored to their needs. This involves understanding how mobile home insurance policies differ in structure, coverage, and terms compared to standard homeowner policies.

The importance of seeking specific coverage for mobile homes cannot be overstated. These homes are often more vulnerable to specific types of damage, such as those caused by extreme weather conditions or accidents during relocation. It's crucial to grasp the key differences, especially since mobile home policies may have stricter provisions regarding natural disasters or personal property protection. Homeowners should familiarize themselves with the nuances of mobile home insurance to ensure they are adequately protected against potential risks.

Key components of mobile home insurance

Mobile home insurance comprises several key components that work together to provide comprehensive protection for homeowners. These components include structure coverage, personal property coverage, liability coverage, and additional living expenses.

Understanding these components is vital for homeowners seeking a mobile home insurance policy. Each component serves a distinct purpose in safeguarding against various risks associated with mobile living.

What does mobile home insurance cover?

Mobile home insurance covers a range of risks, ensuring comprehensive protection for homeowners. One of the most critical aspects of mobile home insurance is the protection it provides against natural disasters. Depending on the region, policies might specifically address coverage for fire, tornadoes, and in some areas, floods.

Policy limits and exclusions play a critical role in understanding mobile home insurance coverage. Homeowners must carefully read their policies to be aware of specific limitations, especially on perils like earthquake coverage, for which additional coverage may be necessary.

Factors influencing mobile home insurance quotes

Several factors can significantly influence the mobile home insurance quotes provided by insurance companies. Understanding these factors will help homeowners anticipate their premiums and optimize their coverage options.

By evaluating these elements, homeowners can provide accurate information on their mobile home insurance quote form, allowing insurance providers to deliver precise quotes tailored to individual circumstances.

How to request a mobile home insurance quote

Requesting a mobile home insurance quote is a straightforward process, particularly with the convenience provided by online tools. To begin, homeowners should gather necessary information to efficiently complete the mobile home insurance quote form.

Once gathered, homeowners can utilize online platforms to fill out quote forms, which will often prompt for this vital information. Many insurance providers now integrate online services making it easier than ever to receive quotes quickly and accurately.

Transforming your quote request into an insurance policy

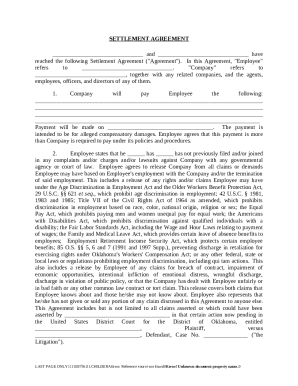

Once a homeowner receives their mobile home insurance quotes, the next step involves reviewing the insurance company's terms and conditions thoroughly. This critical step ensures that the coverage meets specific needs and aligns with homeowner expectations.

Finalizing coverage also involves saving all policy documents securely for future reference, making it vital for homeowners to retain copies for claims processing and renewals.

Discounts on mobile home insurance available for eligible customers

Many insurance companies offer various discounts on mobile home insurance policies to entice new clients. These discounts can significantly reduce premiums, making insurance more accessible for homeowners.

During the quote request process, inquiring about eligible discounts is a strategic move to enhance affordability while maximizing coverage.

How to compare mobile home insurance policies

When evaluating a variety of mobile home insurance quotes, having a standardized approach helps streamline decision-making. Households must consider several critical factors to compare policies effectively.

Utilizing online comparison tools can also assist homeowners in visualizing differences between mobile home insurance quotes, enhancing their understanding and decision-making process.

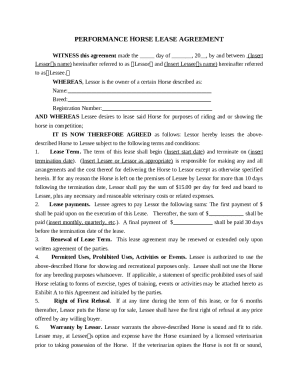

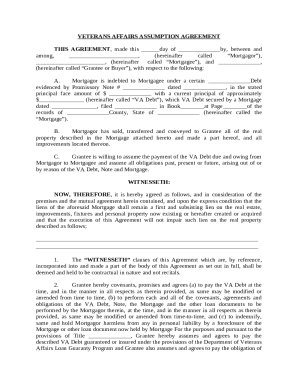

Why choose pdfFiller for your mobile home insurance quote form?

pdfFiller stands out as a premier platform for managing mobile home insurance quote forms. Its seamless integration with leading insurance providers allows users to efficiently obtain and customize quotes tailored to their specific needs.

Choosing pdfFiller promotes a streamlined process for homeowners seeking a convenient, centralized platform for managing their insurance needs.

Tips for managing your mobile home insurance documents

Efficient organization of mobile home insurance documents is vital for homeowners. Best practices in document management can ensure that critical information is easily accessible when needed.

These strategies enhance overall management of mobile home insurance documents, helping homeowners maintain optimal coverage and readiness in case of claims.

FAQs about mobile home insurance

As homeowners navigate mobile home insurance, several common questions often arise. Here, we address some frequently asked questions to demystify the process.

By addressing these questions, homeowners can gain a clearer understanding of their mobile home insurance journey and feel empowered to protect their investments.

Using interactive tools for your coverage needs

The use of interactive tools like those offered by pdfFiller can streamline the management of insurance forms, ensuring that the process remains efficient. With features designed for ease of use, navigating insurance documentation becomes less daunting.

Utilizing these tools can greatly enhance user experience, making the management of insurance quotes and policies seamless and user-friendly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mobile home insurance quote directly from Gmail?

How can I modify mobile home insurance quote without leaving Google Drive?

How do I edit mobile home insurance quote straight from my smartphone?

What is mobile home insurance quote?

Who is required to file mobile home insurance quote?

How to fill out mobile home insurance quote?

What is the purpose of mobile home insurance quote?

What information must be reported on mobile home insurance quote?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.