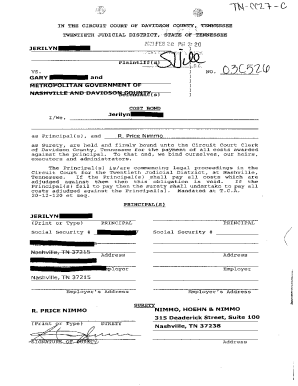

Get the free 2025 6166 Income Tax Form. Income Tax Form

Get, Create, Make and Sign 2025 6166 income tax

How to edit 2025 6166 income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 6166 income tax

How to fill out 2025 6166 income tax

Who needs 2025 6166 income tax?

Understanding the 2 Income Tax Form: A Comprehensive Guide

Understanding the 2 income tax form

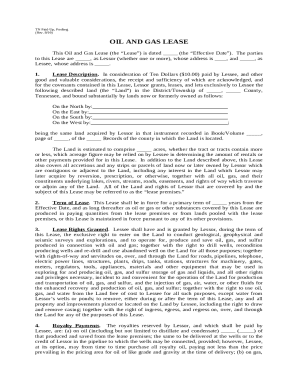

The 2 income tax form is a critical document for U.S. taxpayers, especially those residing abroad or with international tax obligations. This form plays a vital role in verifying a taxpayer's residency status for tax purposes. Notably, it helps individuals navigate complex international tax laws and fulfill compliance requirements in their respective countries.

Form 6166 serves as proof of residency and can be crucial for individuals seeking benefits under international tax treaties. Anyone who has income sourced from outside the U.S. or is a foreign resident but has American income must be aware of their responsibilities and determine if they need to utilize this specific form.

Key components of the 2 income tax form

The 2 income tax form contains several sections, each addressing unique aspects of a taxpayer’s information. The critical components include taxpayer identification details, income sources, and residency evidence. These sections are designed to efficiently collect and analyze essential taxpayer data to ascertain residency status.

In addition to the form itself, taxpayers often need to submit supporting documentation, like prior year tax returns or proofs of foreign residency. This additional context is vital for tax authorities to fully assess each filer’s situation.

Tax residency explained

Tax residency is defined as the requirement for an individual or entity to report taxes based on their country of residence status. Identifying one’s tax residency can have significant implications on tax liabilities and eligibility for certain deductions or credits.

The implications of residency on income tax obligations are far-reaching. For instance, U.S. citizens and resident aliens are generally taxed on worldwide income, while non-residents are taxed only on U.S.-sourced income. Hence, correctly determining residency status is fundamental not only for compliance but also for optimizing tax responsibilities.

Step-by-step guide to completing the 2 income tax form

Before filling out the 2 income tax form, it's essential to gather necessary personal information and supporting documents. Identify your tax residency status by reviewing Form 6166 guidelines and your income sources. Understanding your legal obligations will allow for a more accurate and compliant submission.

To fill out the form, consider the following steps:

Common mistakes include misreporting income or residency, which can lead to significant compliance issues. Therefore, always review your form for accuracy, and when in doubt, consult with a tax professional.

Submitting the 2 income tax form

Once the form has been filled out, submitting the 2 income tax form is the next crucial step. Taxpayers can choose between online submissions or paper submissions. Electronic filing tends to be faster and more efficient, allowing for immediate confirmation of receipt.

Keep in mind key deadlines for the 2025 tax year. Typically, the deadline for submitting tax forms is April 15 for most individuals. After submission, you should receive confirmation from the IRS regarding the status of your form, so keep an eye out for any correspondence.

Legalization and authentication of the 2 income tax form

For those looking to use the 2 income tax form internationally, understanding legalization is essential. Legalization typically involves getting the form officially verified for use in other countries, which may require an Apostille or specific authentication procedures.

To get an Apostille, follow these steps:

Common questions and troubleshooting

When dealing with the 2 income tax form, it’s common to encounter queries and issues. For instance, if errors are discovered post-submission, promptly addressing them is crucial. To amend your submitted form, you generally must file an amended return.

Interactive tools and resources

Utilizing tools can significantly streamline your tax form management. Platforms like pdfFiller enhance your experience with the 2 income tax form by providing interactive templates that simplify the completion process. This can be particularly beneficial for individuals and teams looking for an all-in-one cloud-based solution for document management.

Document management features, such as tracking submission statuses and easy editing, help users maintain organization. Moreover, eSigning capabilities allow for smooth collaboration, whether for tax preparation or other critical documents.

Related topics and insights

Alongside the 2 income tax form, various other forms play a role in determining residency and tax obligations. Understanding forms like the W-7 and 8833 can provide expanded insights into international tax matters and compliance.

It’s also vital to stay updated on tax law changes for 2025. Recent adjustments may impact various aspects of income tax regulations, including deductions and credits that taxpayers can utilize. Keeping an eye on the IRS guidelines and provisions is essential for maximizing potential benefits and ensuring compliance.

Conclusion: Maximizing your tax filing efficiency

To navigate the complexities of the 2 income tax form efficiently, leveraging tools like pdfFiller can be game-changing. By utilizing cloud-based solutions for document management, users can streamline their tax filing processes, ensuring timely submissions and regulatory compliance.

The capabilities provided by pdfFiller enable individuals and teams to not only complete necessary forms but also collaborate seamlessly and maintain organized records of their tax documentation, essential for optimizing tax-related efforts in 2025.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2025 6166 income tax in Gmail?

How can I get 2025 6166 income tax?

Can I create an eSignature for the 2025 6166 income tax in Gmail?

What is 2025 6166 income tax?

Who is required to file 2025 6166 income tax?

How to fill out 2025 6166 income tax?

What is the purpose of 2025 6166 income tax?

What information must be reported on 2025 6166 income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.