Get the free 4890, 2024 Corporate Income Tax Forms and Instructions ...

Get, Create, Make and Sign 4890 2024 corporate income

How to edit 4890 2024 corporate income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 4890 2024 corporate income

How to fill out 4890 2024 corporate income

Who needs 4890 2024 corporate income?

Understanding the 4 Corporate Income Form: A Comprehensive Guide

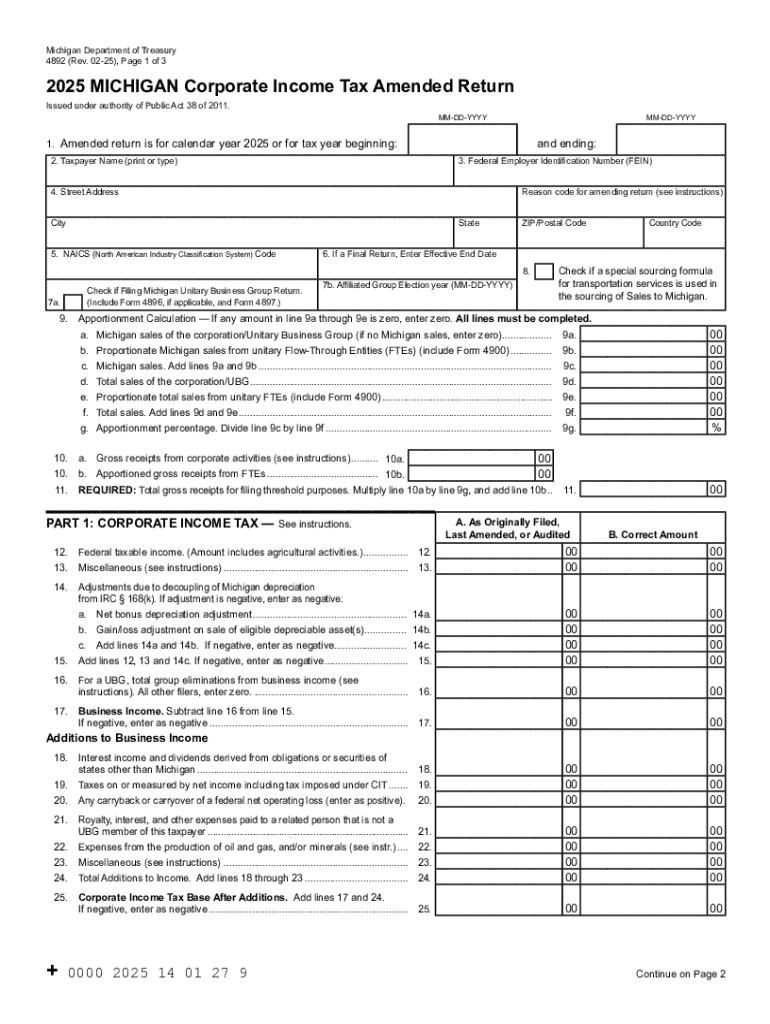

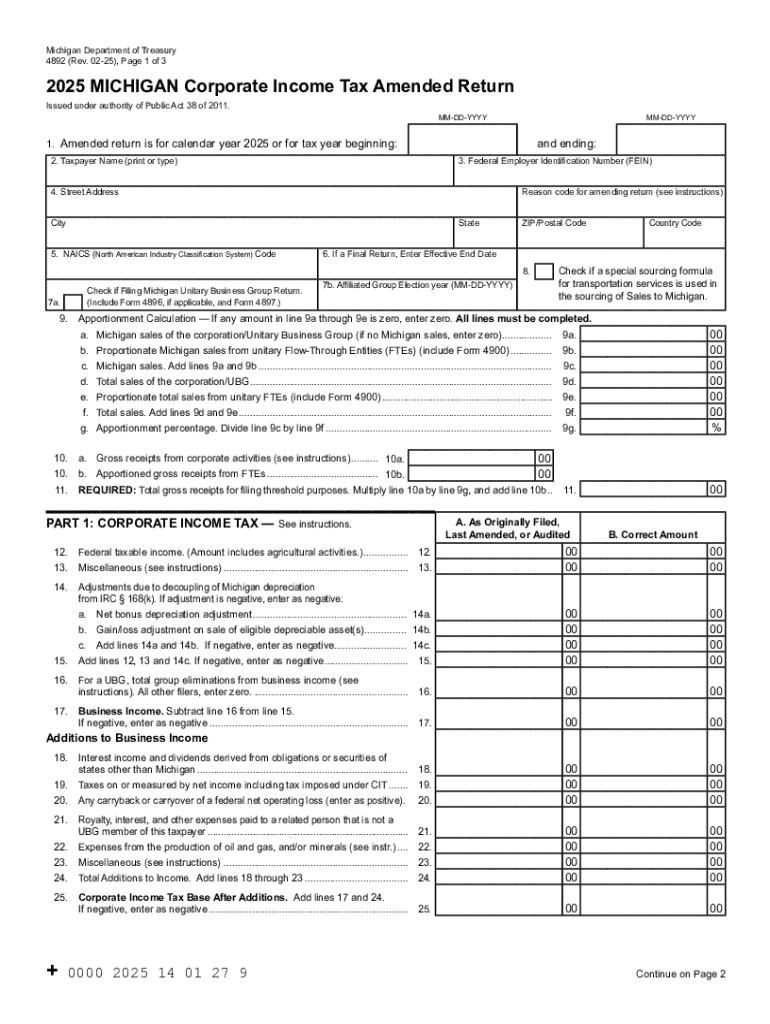

Overview of the 4890 corporate income form

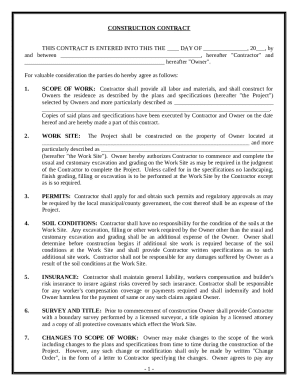

The 4890 corporate income form is a crucial tax document designed for corporations in the United States to report their income and calculate their tax liabilities. Its primary purpose is to provide the Internal Revenue Service (IRS) with a complete overview of a corporation’s fiscal activities throughout the year, ensuring that the appropriate amount of tax is paid based on reported income. As we enter 2024, understanding this form becomes even more essential for corporate compliance.

In 2024, corporations face a landscape that is continually changing due to modifications in tax regulations. The updated 4890 form incorporates several key changes, including new reporting requirements, alterations to tax rates, and additional guidelines on deductions. Staying informed about these changes is paramount to avoid penalties and ensure accurate filings.

Understanding key components of the 4890 form

The 4890 form is divided into several critical sections that capture various aspects of corporate income and tax liability. Each section serves a specific purpose, allowing the IRS to evaluate the corporation's tax obligations accurately.

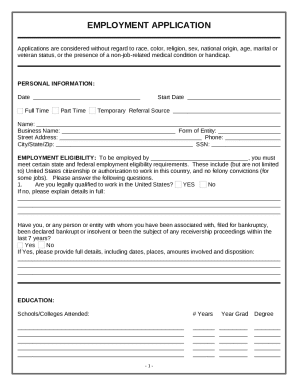

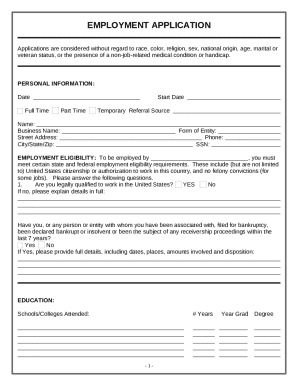

Step-by-step instructions for filling out the 4890 form

Filling out the 4890 corporate income form requires careful preparation and attention to detail. Before starting, corporations should ensure they have all necessary documentation, including financial statements, previous tax returns, and receipts for deductions. A solid pre-filing preparation can streamline the filing process significantly.

Common pitfalls include neglecting to double-check EINs, underreporting income, or misapplying deductions. Corporations should remain vigilant and consider consulting tax professionals to navigate complex situations.

Interactive tools available on pdfFiller for the 4890 form

pdfFiller offers a suite of interactive tools that can enhance the experience of completing the 4890 corporate income form. Its features are designed to simplify and expedite the filing process for users, especially valuable for teams managing multiple documents.

Leveraging these tools can lead to greater efficiency, particularly in tracking updates, managing revisions, and ensuring that necessary parties have access to the most current versions of the forms.

Tips for successful submission of the 4890 corporate income form

Choosing the right submission method for the 4890 corporate income form can impact the processing speed and overall experience. Corporations may opt for electronic submission or traditional paper filing, with electronic submissions generally being the faster route.

Important deadlines must be adhered to in order to avoid penalties; corporations should set internal reminders well ahead of the due dates to ensure compliance. Keeping track of submissions and communications with tax authorities also helps manage any potential follow-ups efficiently.

FAQs about the 4890 corporate income form

To further assist corporations navigating the complexities of the 4890 form, addressing common questions can clarify key concerns. Misconceptions about the form can lead to costly errors, making it essential to dispel these myths accurately.

Understanding the process for remedies post-filing ensures that corporations stay in compliance and act swiftly to resolve discrepancies.

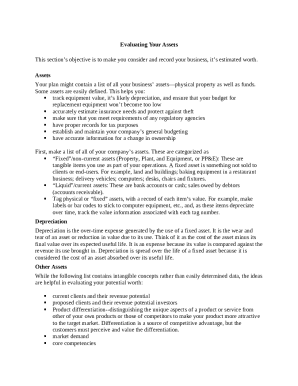

Additional considerations for corporations in 2024

In 2024, corporations must navigate recent legislative changes that impact corporate income reporting, including revisions to deduction eligibility and tax rate structures. Awareness of these changes is vital for financial planning and compliance, especially as tax strategies may need to adapt.

Corporations should proactively engage in tax planning discussions with financial advisors to anticipate how these shifts may affect their business operations and obligations.

Using pdfFiller for document management and compliance

Document management is an essential component of maintaining compliance with tax obligations. pdfFiller provides tools that facilitate efficient storage, retrieval, and management of critical tax documents, including the 4890 form and supporting materials.

By leveraging pdfFiller's capabilities, corporations can ensure they remain diligent in their document management processes, reducing the risk of errors and enhancing overall compliance.

Contacting support for assistance with the 4890 form

Utilizing pdfFiller’s customer support is a valuable resource for personnel needing help with the 4890 corporate income form. Whether you have a question about the filing process or need technical assistance, accessing support resources is straightforward.

Engaging with pdfFiller’s support ensures that corporations can address and resolve any issues related to the 4890 form efficiently, maintaining a smooth filing experience.

Analytics of filing trends: 4890 form data insights

As the filing deadline approaches, understanding trends in 4890 form submissions can provide valuable insights into corporate compliance and tax practices for 2024. Analysis of previous years’ filing data can highlight common challenges faced by corporations in maintaining compliance.

These insights allow corporations to adapt proactively to shifts in their filing environment, ensuring they remain positioned to meet their tax obligations effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 4890 2024 corporate income to be eSigned by others?

Can I create an electronic signature for the 4890 2024 corporate income in Chrome?

Can I create an eSignature for the 4890 2024 corporate income in Gmail?

What is 4890 2024 corporate income?

Who is required to file 4890 2024 corporate income?

How to fill out 4890 2024 corporate income?

What is the purpose of 4890 2024 corporate income?

What information must be reported on 4890 2024 corporate income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.