Get the free Form OR-41-V Instructions, Oregon Fiduciary Income Tax ...

Get, Create, Make and Sign form or-41-v instructions oregon

How to edit form or-41-v instructions oregon online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form or-41-v instructions oregon

How to fill out form or-41-v instructions oregon

Who needs form or-41-v instructions oregon?

Comprehensive Guide to Form OR-41- Instructions for Oregon Tax Filers

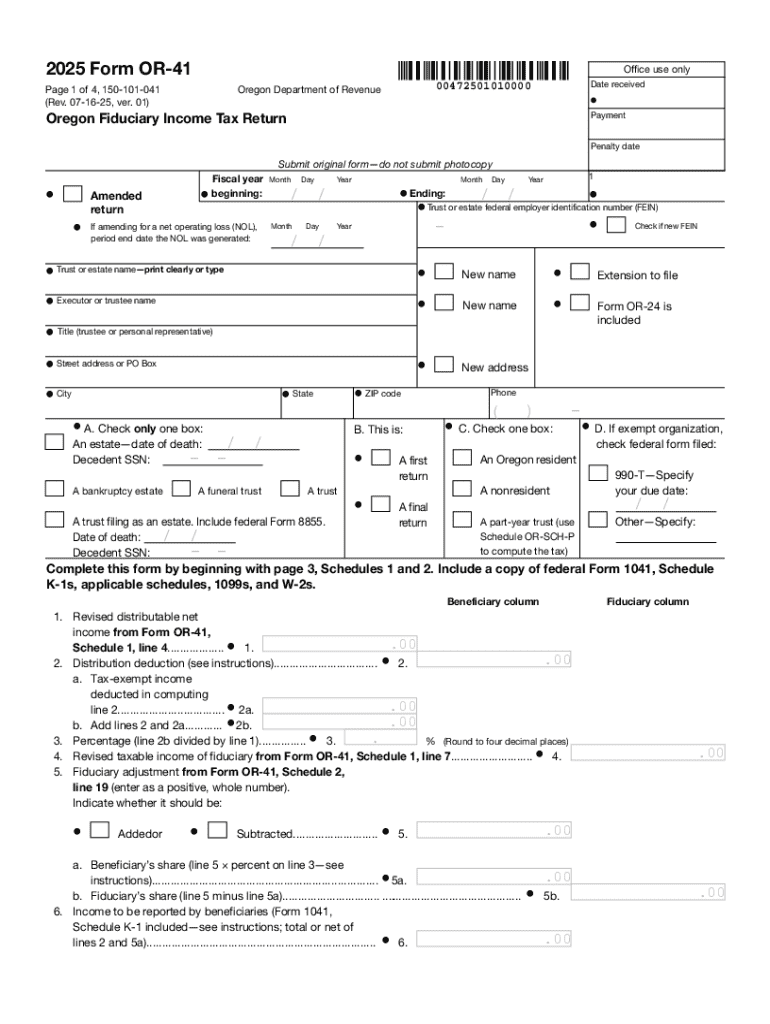

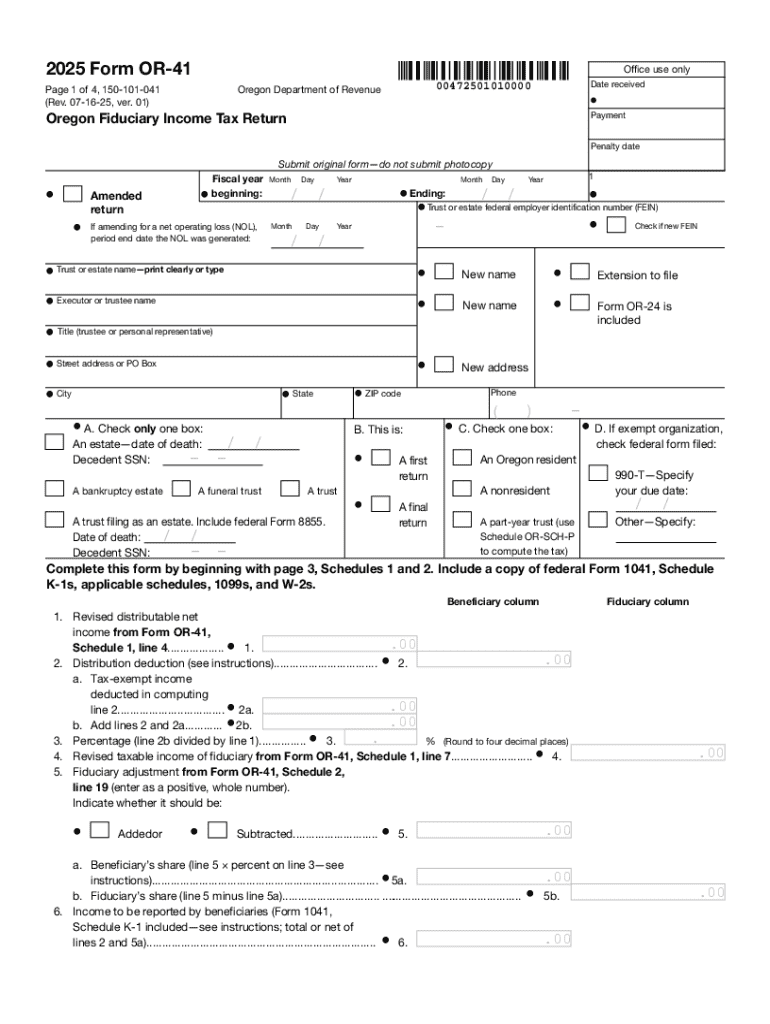

Overview of Form OR-41-

Form OR-41-V is a tax form specifically designed for Oregon taxpayers who are required to make a payment for their state income taxes, often after filing their annual return. This form acts as a voucher for individuals and businesses to submit payments, ensuring that the tax authorities receive accurate remittances for respective tax obligations.

The importance of Form OR-41-V cannot be overstated, as it helps taxpayers avoid penalties for late payments. Whether you are an individual with additional owed taxes or a business needing to pay estimated tax liabilities, understanding how to correctly use this form can save you from unnecessary complications and financial loss.

Eligibility and who should use this form

Any taxpayer in Oregon who finds themselves in a situation where they owe taxes post-filing their return needs to utilize Form OR-41-V. This can include individuals who earn income from self-employment, investments, or businesses that do not remit taxes throughout the year. Additionally, those making estimated payments, generally applicable to individuals with considerable additional tax responsibility, should also ensure they are using this form.

Step-by-step instructions for completing Form OR-41-

Completing Form OR-41-V requires gathering relevant financial documents to ensure accuracy and completeness. Key documents typically include your previous year's tax return, income statements, and any relevant financial records that pertain to your tax calculation for the current year.

Sorting through your financial papers can be overwhelming; however, keeping them organized by category helps simplify the process. Make sure all documents are easily accessible before starting to fill out the form to minimize errors.

Detailed instructions by section

Form OR-41-V consists of several sections that must be filled out accurately. Let’s break down each section:

By paying close attention to the specific requirements in each section, you can avoid common mistakes, such as entering incorrect figures or forgetting to include your Social Security number.

Tips for accurate reporting

To ensure your financial data's accuracy while completing Form OR-41-V, cross-reference your information with your prior tax returns and relevant payment records. Using a calculator or tax preparation software can also confirm that your computations are correct, further reducing the likelihood of mistakes.

How to edit and manage your Form OR-41-

Once you have completed Form OR-41-V, you may find that you need to make adjustments. pdfFiller offers powerful editing tools that enable you to make changes with ease. Users can fill out forms electronically, ensuring that all information is up to date before submission.

Using pdfFiller's editing tools

Editing your Form OR-41-V in pdfFiller is straightforward. Here’s how you can edit your form using this platform:

Collaborating with team members is also simple. Once your form is complete, you can share it with colleagues via pdfFiller, making it easier to get feedback or additional input before finalizing the submission.

Signing and submitting Form OR-41-

To finalize the process, signing your Form OR-41-V is crucial. pdfFiller allows you to eSign the document seamlessly, which is not only fast but also secure.

Options for eSigning within pdfFiller

eSigning your form can be accomplished through the following steps:

Benefits of using electronic signatures include convenience — allowing you to sign from anywhere — and legal validity in many jurisdictions, including Oregon.

Submission guidelines

After completing and signing your Form OR-41-V, it is important to submit it correctly. You can either mail the completed form to the Oregon Department of Revenue or may have an option to submit it online, depending on their guidelines. Always check the latest instructions from the Oregon Department of Revenue for specifics on submission and any associated deadlines to avoid late fees.

Frequently asked questions (FAQs) regarding Form OR-41-

Understanding commonly asked questions about Form OR-41-V helps demystify its completion process. Here are some typical queries:

For any problems you encounter, such as submission issues, contact the Oregon Department of Revenue or look for support within pdfFiller for immediate assistance.

Additional resources for Oregon tax forms

Navigating Oregon tax forms can be complex, and having additional resources can ease this burden. Not only can you find Form OR-41-V available on pdfFiller, but you will also discover other essential forms like Form 40 and Form 46, useful for filing income and business taxes.

Educational resources

Various online materials and resources are dedicated to educating taxpayers about the intricacies of tax filing in Oregon. Websites often provide guidance, tutorials, and tips that can assist you in understanding how to optimize your tax filings.

Utilizing the benefits of pdfFiller for your tax needs

pdfFiller streamlines tax form management by equipping users with cloud-based tools to edit, eSign, and collaborate on documents effortlessly. The convenience of accessing your tax forms anywhere makes the filing process not only more straightforward but also notably efficient.

Enhancing collaboration and document management

Moreover, pdfFiller enables teamwork by allowing multiple users to collaborate on the same document. The capability to comment and make suggestions within the document speeds up the review and finalization process. This feature is particularly beneficial for teams that manage multiple tax filings and necessitate clear communication.

Popular forms and templates to explore

Beyond Form OR-41-V, tax seasons see a range of forms frequently used by Oregon residents. Forms like the 40, the 40-N, and the 40-S allow taxpayers to report various types of income and deductions accurately.

How to access and manage various forms on pdfFiller

To access these complementary forms on pdfFiller, simply search within the platform or browse the available templates. The website's user-friendly navigation ensures that you can find any required form quickly, enabling you to manage your documentation efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form or-41-v instructions oregon online?

How do I fill out the form or-41-v instructions oregon form on my smartphone?

Can I edit form or-41-v instructions oregon on an iOS device?

What is form or-41-v instructions oregon?

Who is required to file form or-41-v instructions oregon?

How to fill out form or-41-v instructions oregon?

What is the purpose of form or-41-v instructions oregon?

What information must be reported on form or-41-v instructions oregon?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.