Get the free Income Tax Preparation Service

Get, Create, Make and Sign income tax preparation service

Editing income tax preparation service online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income tax preparation service

How to fill out income tax preparation service

Who needs income tax preparation service?

The Comprehensive Guide to Income Tax Preparation Service Forms

Understanding income tax preparation

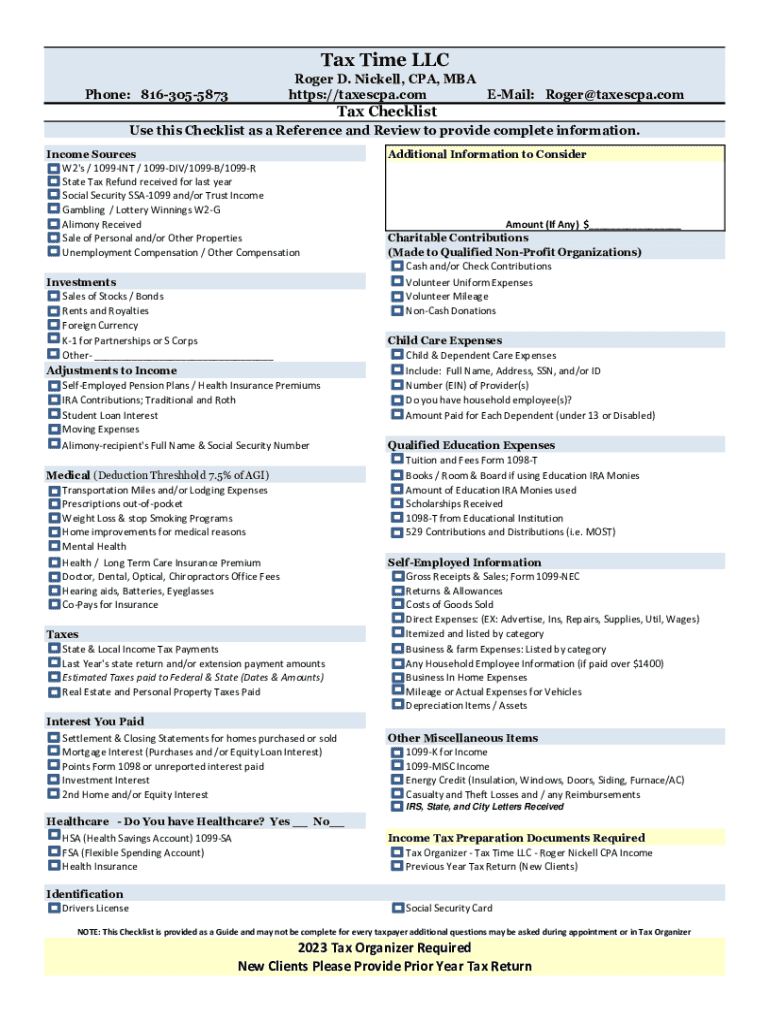

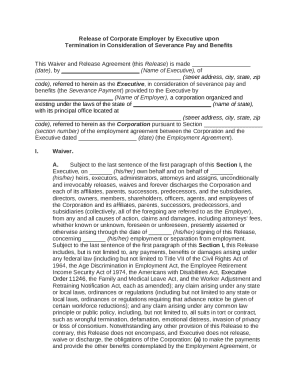

Income tax preparation is the process of organizing and filing a taxpayer's income tax return. It involves summarizing a taxpayer's financial information, including income, deductions, and possible credits, to determine their tax liability with accuracy. Proper income tax preparation is fundamental, as it helps individuals and businesses ensure they comply with tax laws, avoid penalties, and potentially secure refunds.

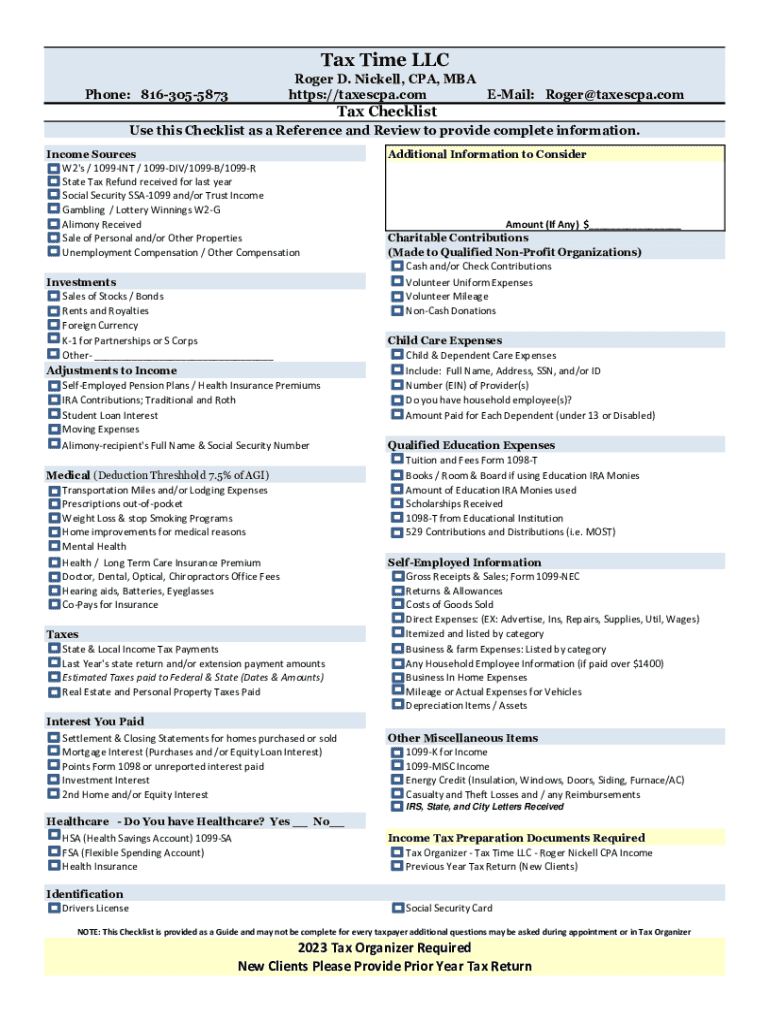

Accurate income tax preparation is crucial not only for compliance with IRS regulations but to maximize deductions and credit allocations. Many taxpayers overlook pertinent deductions that can significantly affect their overall tax liability, leading to lost savings. Familiarizing oneself with key terms, like W-2 and 1099 forms, taxation brackets, and the difference between credits and deductions, can streamline tax preparation.

Overview of income tax preparation service forms

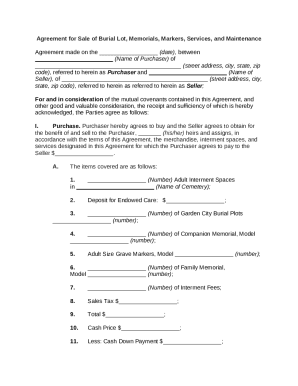

Income tax preparation service forms are classified primarily into two categories: federal tax forms and state tax forms. Federal forms, such as the 1040, are issued by the IRS and are used to report a taxpayer's overall income, calculate tax liabilities, and request refunds. State forms vary by state and often include additional information pertaining to state income tax regulations.

One vital distinction between state and federal forms lies in the rules governing deductions and credits, which may differ based on state laws. For instance, certain deductions available on federal forms may not apply at the state level and vice versa. Tax preparation often becomes particularly complex during peak seasons, with deadlines and forms changing.

Essential features of income tax preparation service forms

Modern income tax preparation service forms come with essential features that enhance the user experience. A user-friendly interface is paramount, allowing individuals to navigate easily regardless of their tech proficiency. Responsive web designs cater to different devices, making tax preparation accessible on the go.

Furthermore, secure document handling is critical. Encryption protocols ensure sensitive data remains protected from cyber threats. Cloud-based functionality means users can access forms from any location with an internet connection, allowing for ease of collaboration with tax professionals or team members.

Step-by-step guide to completing your income tax preparation service form

Completing your income tax preparation service form may seem daunting, but breaking it down into steps can simplify the process. Start by gathering necessary financial documents. This includes items like W-2s, 1099 forms, and any receipts that may support deductions.

Once your documents are gathered, organizing your information is essential. Categorize your income sources and keep track of deductions and available credits. Next, to fill out the form, access it online through your preferred tax preparation service. Enter your information step by step, making sure to double-check each section before submitting.

Upon completing the form, review your entries meticulously. Pay attention to common pitfalls, such as transposed numbers or skipped sections. Lastly, utilize the eSigning feature to finalize your document securely, ensuring it is stored safely in the cloud.

Utilizing advanced features of pdfFiller for tax preparation

pdfFiller's platform is equipped with advanced features that streamline the tax preparation process. Its real-time collaboration tools allow users to work alongside tax professionals, ensuring that forms are pre-filled accurately. Furthermore, users can share their forms with family members, making the tax process a collective effort.

Comprehensive editing capabilities enable customization of templates to fit unique financial situations, ensuring that all items are accounted for. Should any questions arise, pdfFiller offers unlimited free support. Simple options exist to initiate contact and resolve common inquiries that users might have.

Maximizing your tax return with the right form

Choosing the right income tax preparation service form can significantly influence your overall deductions and credits. It’s essential to understand how different forms can affect your tax liabilities and potential returns. Utilizing appropriate deductions can open avenues for greater savings, and this might vary between federal and state forms.

Strategies for selecting the best forms include reviewing eligibility for various credits and considering automatic beneficiary allocations, which can help designate where funds should go upon a taxpayer's passing. Familiarity with localized tax codes is also advantageous.

Maintaining compliance and accuracy

Understanding IRS regulations and requirements is vital for taxpayers aiming to maintain compliance. Tax laws are subject to frequent changes, so staying updated with any shifts in forms or regulations is necessary to avoid penalties. pdfFiller’s alerts and updates feature can keep users informed about relevant changes that may affect their tax preparation.

Ensuring accuracy in tax preparation requires diligence — double-checking every entry is non-negotiable. A minor mistake could lead to significant implications regarding penalties and interest on owed taxes.

Frequently asked questions about income tax preparation forms

Inquiries regarding income tax preparation forms often vary. Common challenges individuals face include difficulties with accessing forms, understanding deduction eligibility, and concerns about document security and privacy. Addressing these FAQs helps demystify the tax preparation process.

Beyond access issues, people are curious about the troubleshooting steps they can take if they encounter problems. Engaging with tax professionals frequently brings more clarity, and often, the knowledge gained contributes to improved future tax preparation experiences.

Conclusion: ensuring a smooth income tax preparation experience with pdfFiller

Utilizing a comprehensive tool like pdfFiller can significantly enhance the income tax preparation process. It offers various features designed to streamline documentation, improve accuracy, and allow collaboration when necessary. For a successful tax season, leveraging these tools ensures users can efficiently manage tax forms and maximize their returns.

Last-minute rushes and errors can be avoided by organizing documentation early and using intuitive online services such as pdfFiller. Keeping ahead of the curve with updates and alerts guarantees that users maintain compliance while navigating the complex world of tax preparation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my income tax preparation service in Gmail?

How do I edit income tax preparation service straight from my smartphone?

How do I fill out the income tax preparation service form on my smartphone?

What is income tax preparation service?

Who is required to file income tax preparation service?

How to fill out income tax preparation service?

What is the purpose of income tax preparation service?

What information must be reported on income tax preparation service?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.