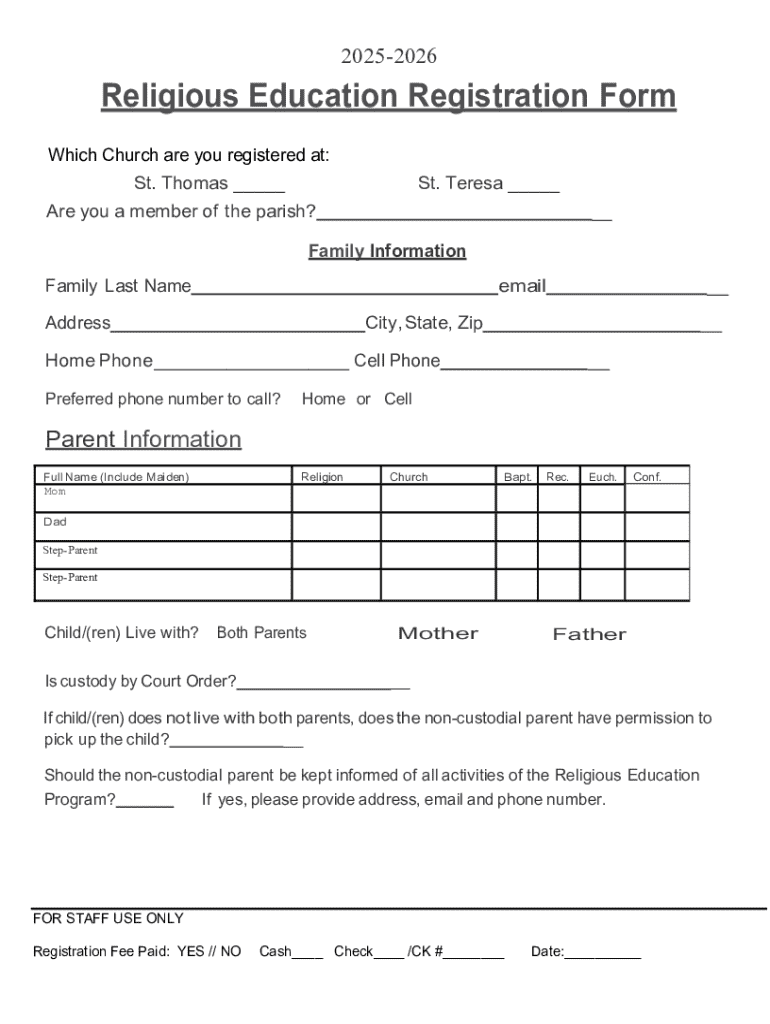

Get the free Registration Form - St. Therese Parish

Get, Create, Make and Sign registration form - st

How to edit registration form - st online

Uncompromising security for your PDF editing and eSignature needs

How to fill out registration form - st

How to fill out registration form - st

Who needs registration form - st?

Comprehensive Guide to the Registration Form - ST Form

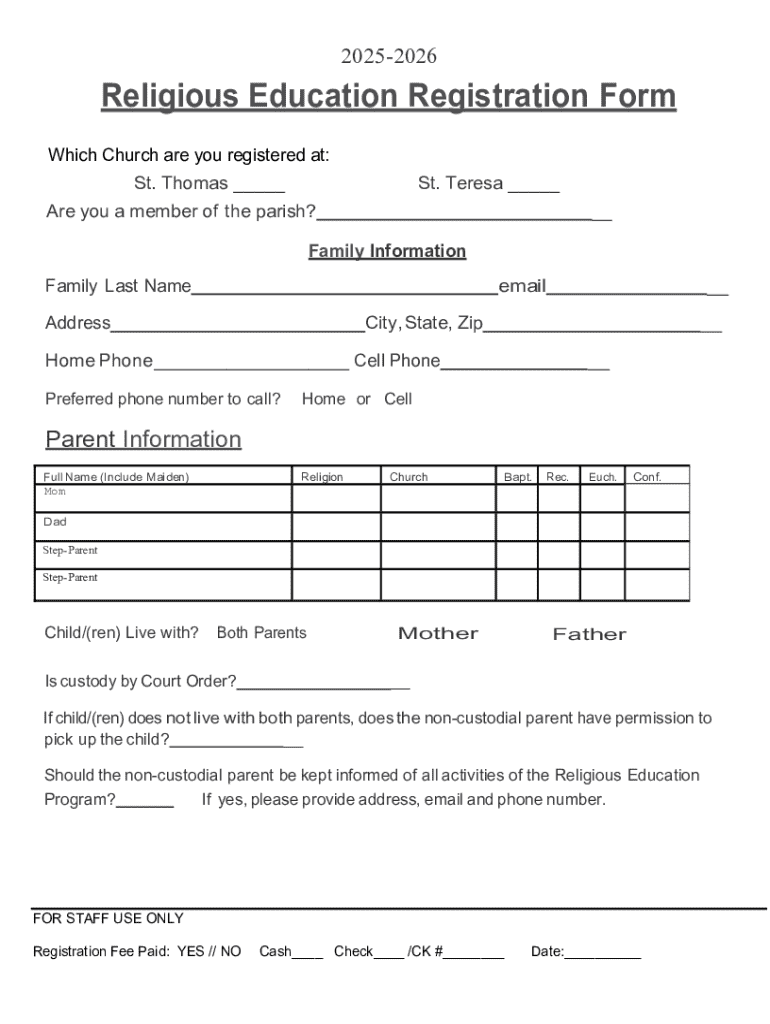

Overview of the registration form - ST form

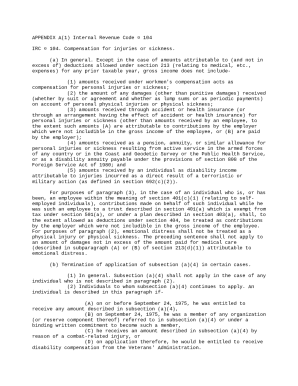

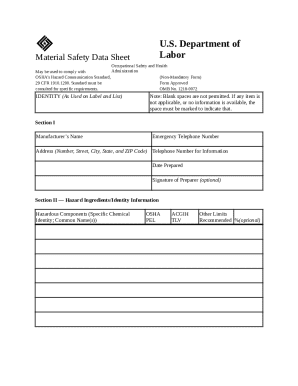

The registration form - ST form is a specialized document utilized primarily for various registration purposes, particularly in relation to sales tax applications. This form serves as a formal request to register a business or individual for sales tax purposes, enabling them to collect and remit sales taxes to the appropriate tax departments. Understanding how to accurately fill out this document is crucial for compliance with state tax regulations.

Accurate completion of the ST form is vital to ensure that the tax department processes the registration efficiently and correctly, thereby avoiding potential delays or miscommunications. It is commonly used by vendors, businesses, and individuals looking to maintain compliance with regional sales tax laws.

Common uses of the ST form extend to various business contexts, including individuals starting a new business, vendors registering for sales tax to collect tax on sales, and property owners who need to report sales tax on property transactions. Each context has its unique requirements, making it essential to understand the specific use case before filling out the form.

What you will need before filling out the registration form

Before diving into the ST form, it is vital to gather all requisite information and documents. This preparation will ensure a smooth and efficient filling process, minimizing the likelihood of errors, which can delay your registration.

### Personal Information Requirements

### Supporting Documents

Having access to PdfFiller’s tools will facilitate editing of the form seamlessly, allowing for effortless integration of your information into the document.

Step-by-step guide to filling out the registration form - ST form

Filling out the ST form through PdfFiller can be completed in a few straightforward steps. Here’s a detailed guide to help you through the process.

### Step 1: Accessing the ST form online via pdfFiller

Navigate to the PdfFiller website and search for the ST form template in the forms section. You can easily find it using the search bar.

### Step 2: Entering personal information

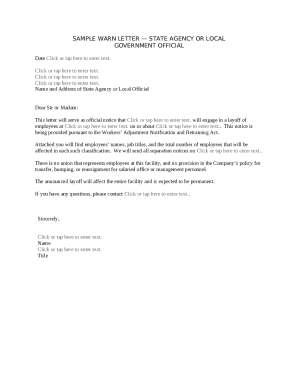

Begin by meticulously inputting your personal information. This section includes fields such as your full name, business name if applicable, and contact details. Ensure that the spelling and format match your identification documents.

### Step 3: Reviewing additional sections

Look for any additional sections that may request information about your business type or operational details. This is crucial if you have specific requests or conditions related to your sales tax registration.

### Step 4: Final review of your entries

Once you’ve filled in all appropriate sections, it is essential to review all entries for inaccuracies. This helps ensure that there are no errors that could lead to registration issues.

### Step 5: Saving your progress using pdfFiller features

Make use of PdfFiller’s save functionality to retain your progress, allowing for easy retrieval later should you need to edit or finalize the form.

Tips for successfully completing the ST form

Completing the ST form accurately is essential for a successful registration. Here are some invaluable tips to ensure that you navigate the process without complications.

Editing and signing the registration form - ST form

Once your registration form is completed, you may need to make adjustments or finalize your entries. PdfFiller offers powerful tools for editing and signing documents.

### How to edit the form using pdfFiller’s tools

Use PdfFiller’s user-friendly interface to add text, images, and even your digital signature directly on the form. These tools facilitate making necessary changes quickly.

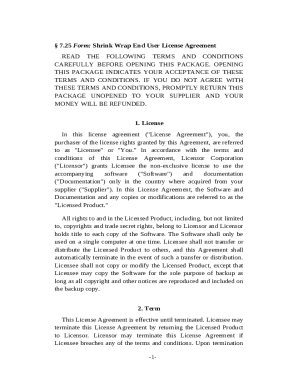

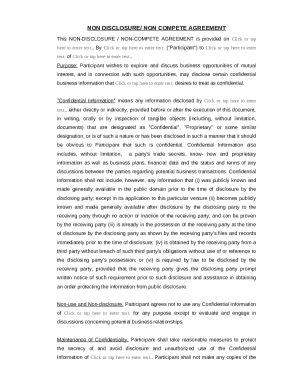

### Understanding eSigning options

Incorporating electronic signatures into your ST form is straightforward and legally accepted for most applications. PdfFiller ensures that eSignatures hold legal validity across many jurisdictions, thus eliminating the need for cumbersome physical signatures.

Managing your completed registration form

Once you have filled out, edited, and signed the registration form - ST form, there are several management options available to you through PdfFiller.

### Saving your form as a PDF

You can easily save your completed form as a PDF for your records. PdfFiller allows users to download files securely to ensure you keep a copy on your local device.

### Sharing options via pdfFiller

### Archiving for future reference

PdfFiller facilitates archiving documents securely, making it simple to retrieve the registration form in the future, if needed.

Common mistakes to avoid with the ST form

While filling out the registration form - ST form may seem straightforward, there are several common pitfalls that can lead to complications. Awareness of these potential mistakes can help prevent registration delays.

Get help with the registration form - ST form

Should you encounter challenges while filling out the ST form, help is readily available. Knowing where to seek assistance can streamline your process.

### Customer support contact details

You can reach PdfFiller’s dedicated customer support team via email or phone for prompt assistance with your queries regarding the ST form.

### How to use PdfFiller’s help center and knowledge base

PdfFiller’s help center is an excellent resource, offering tutorials, FAQs, and troubleshooting tips. Utilize this platform to find answers quickly.

### Frequently asked questions about the ST form

A plethora of common queries about the ST form can be addressed through the knowledge base, simplifying your completion process.

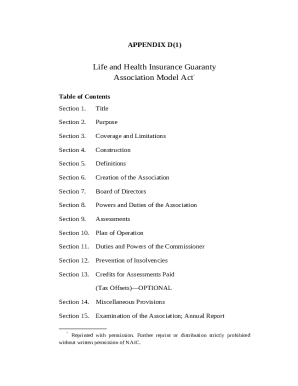

Other related forms

In many cases, the ST form is part of a suite of similar registration pertinent to sales tax and various obligations. Being aware of these forms can broaden your knowledge and preparation.

### Comparison table of related forms

Utilizing a comparison table can help users understand the nuances between these forms and their specific applications.

### Links to additional templates on PdfFiller

PdfFiller provides access to a wide variety of templates, streamlining completion and submissions. Explore these templates to ensure you have all necessary forms during your registration journey.

Connect with pdfFiller

Engage with PdfFiller on social media platforms to receive updates and best practices for using our document management solutions effectively. Being part of our community can enhance your experience and provide valuable resources.

Joining our community of users also allows you to share tips, tricks, and experiences, furthering your efficiency in utilizing PdfFiller's tools.

Language assistance for non-native speakers

PdfFiller understands that language barriers can complicate document completion for non-native speakers. Thus, various language support options are available.

### Options available through pdfFiller for language support

Explore the multilingual features within PdfFiller, which include support for translating documents and templates, aiding non-native speakers in navigating form requirements.

### Features supporting multiple languages in document creation

Utilizing PdfFiller's platform, users can easily create documents in various languages, fostering inclusivity and comprehension across diverse user bases.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete registration form - st online?

Can I create an electronic signature for the registration form - st in Chrome?

How do I fill out registration form - st on an Android device?

What is registration form - st?

Who is required to file registration form - st?

How to fill out registration form - st?

What is the purpose of registration form - st?

What information must be reported on registration form - st?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.