Get the free Tax Year: 2025

Get, Create, Make and Sign tax year 2025

How to edit tax year 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax year 2025

How to fill out tax year 2025

Who needs tax year 2025?

Tax Year 2025 Form: A Comprehensive How-to Guide

Understanding the tax year 2025 forms

Tax forms for the year 2025 constitute the essential documents required by the Internal Revenue Service (IRS) to report income, claim deductions, and calculate tax liabilities. Each form serves a specific purpose, reflecting changes in income tax codes, deductions, and credits applicable for the 2025 tax year. It is crucial for taxpayers — both individuals and businesses — to be familiar with these forms to ensure compliance with federal tax laws.

Notably, 2025 has introduced key changes in tax regulations aimed at improving tax fairness and efficiency. This entails updates in deduction limits, tax brackets, and credits which directly affect how taxpayers prepare their filings. Understanding such modifications is vital more than ever, as the IRS will place increased scrutiny on accurately filled tax returns due to legislative shifts.

Overview of common 2025 tax forms

Several key forms will be particularly relevant for the 2025 tax year. Each of these forms targets different income reporting needs and offers various ways for taxpayers to file their income tax returns.

Form 1040: The standard individual income tax return

The primary form for individual income tax is the Form 1040. Any taxpayer, except those who qualify to use simpler forms, must utilize this comprehensive form. It helps taxpayers report their annual income in order to determine their tax liability.

Key sections of Form 1040 include personal information, filing status, income sources, adjustments, deductions, and tax credits. Additionally, taxpayers need to report various income streams such as wages, pensions, and investment earnings.

Form W-2: Wage and tax statement

Form W-2 is provided by employers to employees and reports annual wages, tips, and taxes withheld during the year. Understanding this form is crucial as it directly impacts the reported income on Form 1040.

To obtain your Form W-2, you should reach out to your employer, or check if they offer electronic access through payroll systems. Timely receipt of this form ensures that you can accurately report your income by the filing deadline.

Form 1099: Reporting other income

Form 1099 serves multiple purposes within the tax realm. Various types, including 1099-MISC and 1099-NEC, report income earned by independent contractors and other non-employee income. These forms must be provided by entities or individuals who pay you and can greatly affect your taxable income calculations.

Understanding who needs to issue a Form 1099 is essential, especially if you earn income outside of traditional employment. Depending on your situation, you might need to keep track of multiple 1099 forms, so proper documentation is key.

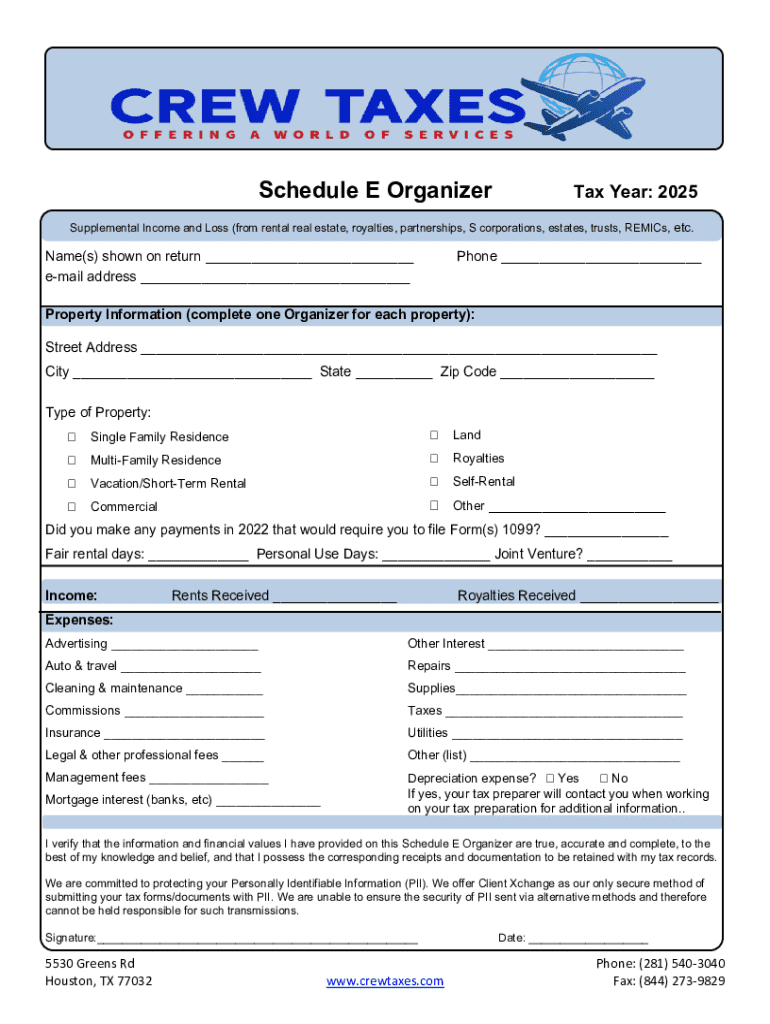

Essential schedules for 2025

In addition to the primary tax forms, taxpayers may also need to complete schedules to report specific types of income or claim certain deductions. Schedules offer the IRS detailed information pertaining to various aspects of your financial situation.

Schedule A: Itemized deductions

Schedule A is used by taxpayers who opt for itemized deductions rather than the standard deduction. This can yield higher deductible amounts if you have eligible expenses like mortgage interest, state taxes, or medical expenses exceeding a certain threshold.

Determining whether to use Schedule A hinges on whether your total itemized deductions surpass the standard deduction available for your filing status. Keep meticulous records of your expenses throughout the year to support your claims.

Schedule : Profit or loss from business

For self-employed individuals, Schedule C is crucial in reporting income and expenses from businesses. It essentially details your profit or loss, which ultimately affects the net income you report on Form 1040.

Knowing the criteria for using Schedule C, including the requirement to determine whether you actively run a business or operate as a hobby, is essential to accurate tax reporting. Common expenses might include materials, office supplies, and business travel costs.

Steps to fill out the tax year 2025 forms

To effectively complete the tax year 2025 forms, you need a systematic approach to preparation and execution. Establishing a methodical plan guarantees that you secure all necessary documentation and eliminate potential errors in your filings.

Prepare your financial documents

Begin by gathering relevant financial documents that contribute to your tax forms. Key documents include:

Accessing the tax forms

The next step involves accessing the necessary tax forms. You can download the 2025 forms from the IRS website or use pdfFiller to fill out the forms online. pdfFiller allows for easy editing and signing of PDFs, making the tax preparation process more efficient.

Instructions for completing each form

Following instructions carefully is crucial for accurate form submission. Start with Form 1040 by providing your personal information, then outline your income sources methodically, ensuring that all amounts align with supporting documents. For Schedule A or C, follow similar guidelines, focusing on organization and clarity.

Common mistakes to avoid

When completing tax forms, many errors can arise that may hinder proper filing. Avoid these common mistakes:

Using pdfFiller to manage your 2025 tax forms

Leveraging pdfFiller’s cloud-based platform enhances experience in managing your tax documents. The following capabilities reshape how taxpayers approach tax filing.

Editing PDFs easily

PdfFiller simplifies the task of editing any PDF document, including tax forms. Users can easily input data, correct previous entries, or modify documents without physically printing forms, saving valuable time.

eSigning your tax forms

Incorporating a digital signature is straightforward with pdfFiller. Users can follow step-by-step instructions to add a secure digital signature, meeting IRS submission requirements without the need for paper.

Collaborating with financial advisors or teams

PdfFiller allows for collaborative functionalities, enabling you and your financial advisor to streamline workflows on tax forms. You can share documents electronically, ensuring efficiency in reviewing forms before final submission.

Managing and storing your completed forms

Another key advantage of pdfFiller is the ability to manage and securely store completed tax forms. This fosters organization and easy access should queries arise in future years or during potential audits. Digital backups serve as a safeguard against document loss.

eFiling your tax forms for 2025

eFiling represents the most effective method for submitting your tax return to the IRS. It streamlines the process and can expedite your refund wait time.

What is eFiling?

eFiling refers to electronically submitting your tax return via authorized tax preparation software or selected online platforms that comply with IRS standards. Utilizing eFiling minimizes paper usage and potential errors in data entry, leading to a smoother process.

How to eFile using pdfFiller

To eFile using pdfFiller, once all forms are completed, you can submit your tax return directly from the platform. PdfFiller makes it easy to compile your forms and ensure everything aligns correctly for submission.

Deadlines for eFiling in 2025

For the 2025 tax year, be mindful of the IRS deadlines for eFiling, typically due on April 15. Staying ahead of the deadline ensures that you avoid penalties and potential interest on unpaid tax liabilities.

Additional insights and tips for a successful tax filing

To maximize your tax return for the 2025 tax year, understanding available deductions and credits is essential. Various changes from previous years introduce new opportunities to save money.

Tax deductions and credits available in 2025

Stay informed about the updated tax deductions and credits that can minimize your tax burden. Consider the following:

Resources for tax help

The IRS provides numerous resources for individuals navigating tax concerns. Additionally, consider engaging a tax professional for personalized assistance, especially if your financial situation is complex.

Common questions about tax year 2025 forms

Many taxpayers have questions regarding the forms required for their specific situations. Popular inquiries include how to amend a tax return, claiming missed deductions, and reporting changes in employment status — these are crucial areas to clarify to avoid issues.

Special considerations for business entities

Should you operate a business, understanding the relevant tax forms is paramount. Corporations and LLCs face unique requirements that vary from those of typical individual taxpayers.

Tax forms specific to corporations and LLCs

Businesses must utilize specific forms such as Form 1120 for corporations and Form 1065 for partnerships. Each of these forms has rigged deadlines, and adherence to these stipulations is vital to avoid increased penalties.

Unique deductions available for businesses in 2025

Market trends for 2025 have produced new deductions for business owners. These unique opportunities include increased deductions for remote work expenses, equipment purchases, and advertising costs. Successful business tax planning should reflect awareness of these deductions.

Key takeaways for tax year 2025

As you prepare for the 2025 tax year, gaining a robust understanding of the various tax forms, schedules, and regulations is paramount. Leveraging tools such as pdfFiller allows you to navigate the complexities of tax filing seamlessly while promoting organization and compliance.

By focusing on correct filings and proactive measures to track your deductions and credits, you set yourself up for a successful tax season that maximizes potential refunds while ensuring adherence to tax law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax year 2025 in Gmail?

How do I edit tax year 2025 in Chrome?

How can I edit tax year 2025 on a smartphone?

What is tax year 2025?

Who is required to file tax year 2025?

How to fill out tax year 2025?

What is the purpose of tax year 2025?

What information must be reported on tax year 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.