Get the free Occupational Accident InsuranceIndependent Contractors

Get, Create, Make and Sign occupational accident insuranceindependent contractors

How to edit occupational accident insuranceindependent contractors online

Uncompromising security for your PDF editing and eSignature needs

How to fill out occupational accident insuranceindependent contractors

How to fill out occupational accident insuranceindependent contractors

Who needs occupational accident insuranceindependent contractors?

Occupational accident insurance for independent contractors: A comprehensive guide

Understanding occupational accident insurance for independent contractors

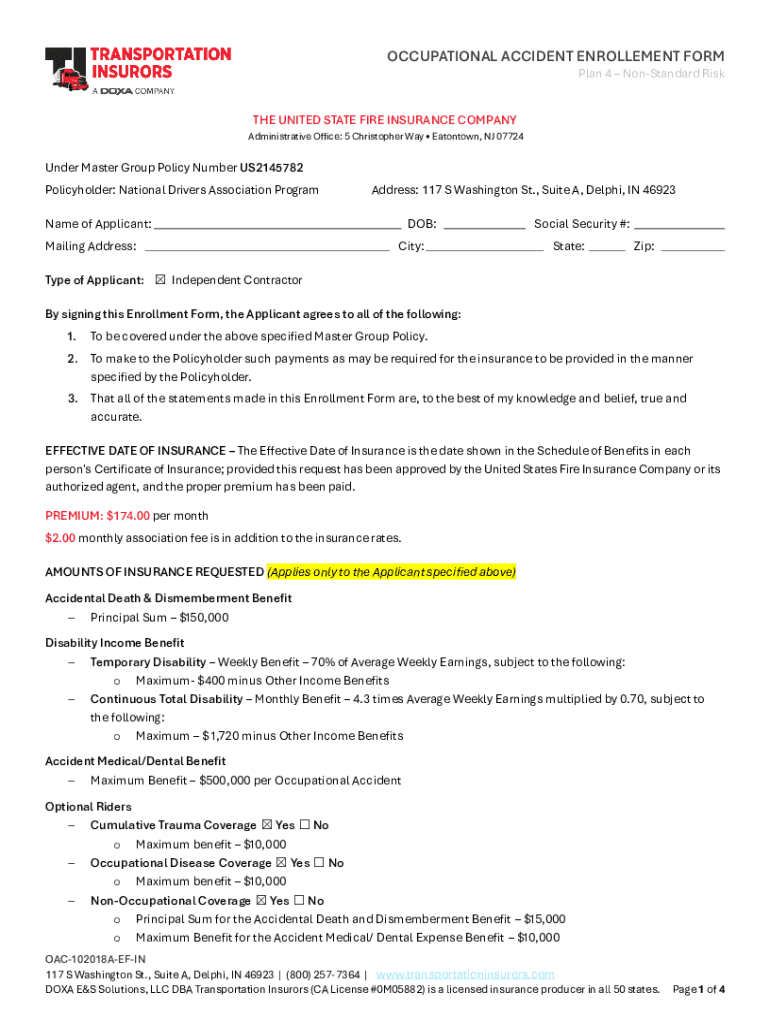

Occupational accident insurance serves as a safety net for independent contractors, providing financial protection in case of work-related injuries. Unlike traditional workers' compensation, which may not cover independent contractors, this insurance assists in covering medical expenses and lost wages stemming from accidents while performing job duties. Its importance cannot be overstated, especially as the number of gig workers continues to rise, highlighting the need for tailored protection.

Independent contractors operating in high-risk fields such as construction, transportation, and delivery are particularly in need of this coverage. However, any contractor engaged in tasks that could result in injury should consider obtaining this insurance. Crucially, there are distinct differences between occupational accident insurance and traditional workers' compensation: the former is designed specifically for independent contractors who are self-employed, while the latter typically covers employees under the direct supervision of an employer.

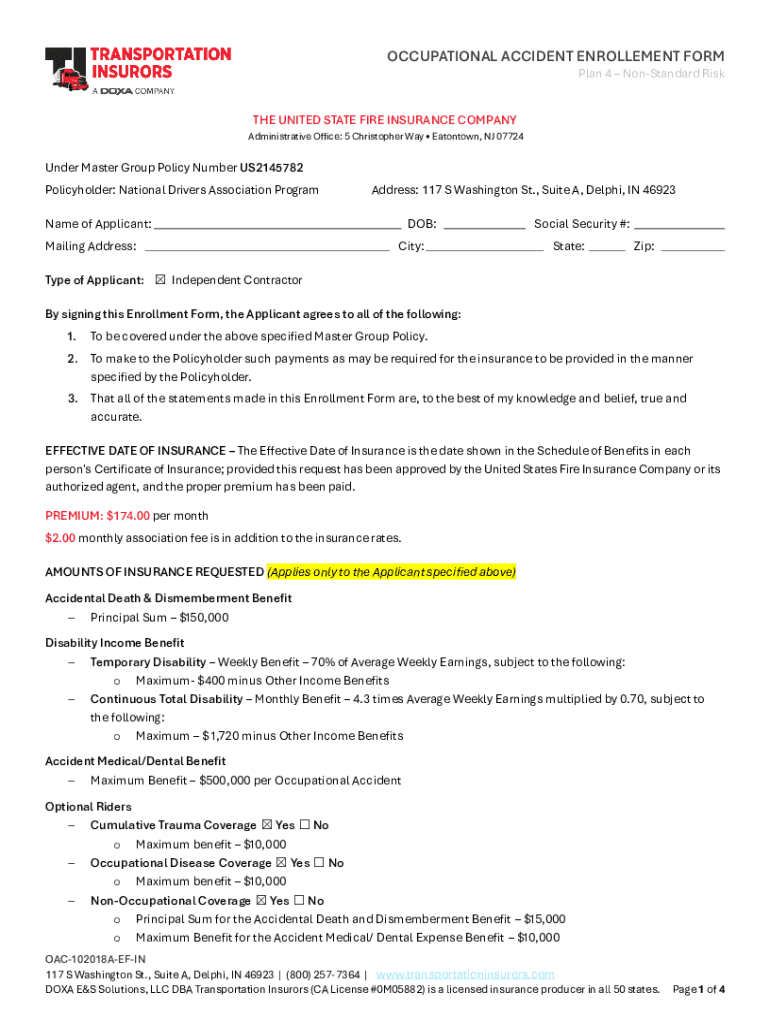

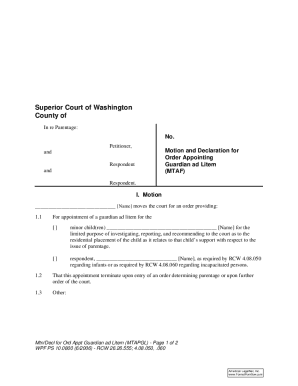

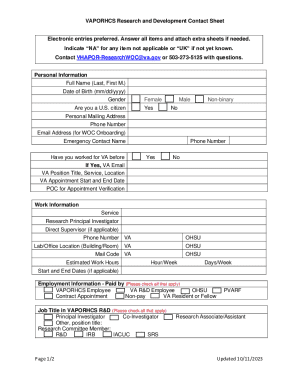

Overview of the independent contractors form

The independent contractors form is integral to securing occupational accident insurance. Its primary purpose is to collect essential information about the contractor's work habits, medical coverage needs, and the nature of the work being performed. Completing this form accurately helps insurance providers assess the risk and determine appropriate coverage levels.

Key elements of the form include sections for personal information, work details, and coverage options. The personal information section gathers data such as name, address, and contact information. The work details section focuses on job descriptions, types of projects undertaken, and the anticipated risk levels associated with these activities. Lastly, the coverage options section allows contractors to choose from varying levels of protection based on their specific needs.

Common mistakes include providing incomplete information or misclassifying job duties, both of which can lead to delays in processing or the risk of a denied claim. It’s crucial for independent contractors to thoroughly review the form before submission to ensure all entries are accurate and complete.

Step-by-step guide to filling out the independent contractors form

Filling out the independent contractors form requires careful preparation and attention to detail. Begin by gathering all necessary documents, which might include previous insurance records, tax identification, and any specific licenses or certifications relevant to your trade. Understanding your coverage needs is equally essential, as this will inform the choices you make in the coverage options section.

As you fill out each section, ensure careful attention to the personal information section; typically, you'll list your name, business name (if applicable), and contact information. In the work details section, provide a comprehensive overview of the tasks you perform, which will help underwriters assess risk. When selecting coverage options, match them carefully with your risk profile; remember that higher-risk jobs may require more extensive coverage.

Once the form is completed, review and verify all information to confirm its accuracy before submitting. Submission can typically be done online or via traditional mail; however, online submissions often facilitate faster processing. Ensure to keep a copy of the submitted form for your records.

Navigating the approval process

After submitting your independent contractors form, you may wonder what to expect next. Generally, the insurance company will process your application within a few weeks, depending on workload and the complexity of your submission. During this time, they may reach out for additional information or clarification on specific points that arise during their review.

Understanding common reasons for application denials can empower you to strengthen your case for approval. A frequent issue is insufficient documentation; make sure all required supporting documents are submitted. Should your application be denied, promptly request a detailed explanation from your insurer. This will allow you to understand their concerns and take corrective action, potentially appealing the decision or resubmitting your application with additional information to support your case.

Managing your occupational accident insurance

Once your occupational accident insurance is in place, proactive management is crucial. Keeping your information up to date with the insurance provider is essential, particularly if you change your job description, undertake new projects, or acquire new responsibilities that could alter your risk profile.

Understanding policy renewals and necessary changes is equally important; most policies require annual review. If your workload shifts significantly, you may need to adjust your coverage accordingly. Regular record-keeping and documentation of any incidents, communications, and claims can be invaluable should you need to file a claim in the future.

Utilizing pdfFiller for your insurance documentation needs

Navigating through the myriad of forms and documents associated with occupational accident insurance can be cumbersome. pdfFiller streamlines this process by offering a cloud-based platform that enables users to edit, sign, and manage PDF forms seamlessly. By utilizing tools that allow easy editing, you can fill out the independent contractors form without frustration.

Moreover, eSigning features within pdfFiller make it simple to sign forms securely and distribute them as needed. Collaboration tools help you work with your team in real-time, ensuring everyone is on the same page. The platform's accessibility allows you to manage your documentation wherever you are, whether from a desktop or mobile device.

Tips for independent contractors on staying safe and protected

For independent contractors, minimizing occupational hazards is critical for ensuring safety and reducing the likelihood of injury. Best practices include understanding the proper usage of equipment, undergoing regular safety training, and obtaining any necessary certifications related to your trade. From wearing protective gear to adhering to safety protocols, every precaution you take contributes to a safer work environment.

In addition to safety measures, understanding how and when to use your occupational accident insurance is vital. Familiarize yourself with the claims process, including any necessary forms or documentation. Pay attention to timelines for filing claims, as delays can complicate the recovery process. Knowing your rights as an independent contractor, as well as the specifics of your policy benefits, empowers you to confidently navigate claims when needed.

Frequently asked questions

As independent contractors explore their options for occupational accident insurance, several common questions arise. For instance, how does independent contractor insurance differ from other forms of insurance? This coverage is specifically designed for self-employed individuals, while other insurances typically cater to traditional employees.

Another common query involves evaluating whether one’s current insurance is sufficient. Reviewing coverage limits in correlation to the risks involved in day-to-day tasks can provide clarity. A contractor should also consider if their coverage aligns with industry standards to ensure adequate protection. Finally, many wonder about the ease of switching insurance providers; in most cases, it’s relatively straightforward, but independent contractors should ensure that there are no coverage gaps during the transition.

Case studies of occupational accident insurance in action

Real-life scenarios underscore the value of occupational accident insurance for independent contractors. In many cases, having this coverage has made a significant difference in recovery from work-related injuries. Success stories often highlight the timely financial aid these policies provide, enabling contractors to focus on healing rather than financial burdens.

Lessons learned from claims scenarios typically reveal the importance of documenting incidents properly and communicating clearly with insurers during the claims process. Evaluating challenges in getting claims approved can also lead to improvements in how one fills out future applications. Those who face approval hurdles can often identify key issues and adjust their approach as a result.

Conclusion of your journey with occupational accident insurance

Navigating the world of occupational accident insurance is critical for independent contractors who seek financial security while engaging in potentially hazardous work. The outlined steps for understanding, filling out, and managing the independent contractors form provide a structured approach for effective insurance management. Armed with knowledge and resources like pdfFiller, you can ensure that your documentation is comprehensive, organized, and accessible.

Embracing best practices in safety and insurance utilization can enhance your peace of mind and professional success. Always harness tools like pdfFiller to streamline your documentation process, allowing you to focus on what matters most — your work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get occupational accident insuranceindependent contractors?

How do I make edits in occupational accident insuranceindependent contractors without leaving Chrome?

How do I fill out the occupational accident insuranceindependent contractors form on my smartphone?

What is occupational accident insurance for independent contractors?

Who is required to file occupational accident insurance for independent contractors?

How to fill out occupational accident insurance for independent contractors?

What is the purpose of occupational accident insurance for independent contractors?

What information must be reported on occupational accident insurance for independent contractors?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.