Get the free REVOLVING LOAN FUND (RLF) GUIDELINES

Get, Create, Make and Sign revolving loan fund rlf

How to edit revolving loan fund rlf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out revolving loan fund rlf

How to fill out revolving loan fund rlf

Who needs revolving loan fund rlf?

Revolving Loan Fund (RLF) Form: A Comprehensive Guide

Understanding the revolving loan fund (RLF)

Revolving Loan Funds (RLFs) are financing mechanisms utilized to provide low-interest loans for specific projects, often targeted at economic development, environmental remediation, or community revitalization. Unlike traditional loans that deplete a fixed amount of funding, RLFs are designed to ‘revolve’ as repayments from previous loans replenish the fund, allowing for continuous lending.

The primary purpose of an RLF is to foster sustainable development by supporting projects that may not qualify for conventional lending due to perceived risks or lack of collateral. RLFs offer numerous benefits, including flexible repayment terms, lower interest rates, and the potential to fund multiple projects over time.

Projects commonly funded by RLFs include brownfields redevelopment, small business grants, home rehabilitation, and infrastructure improvements. These projects are typically aligned with community goals and environmental sustainability, helping to stimulate local economies while addressing specific societal challenges.

Importance of the RLF form

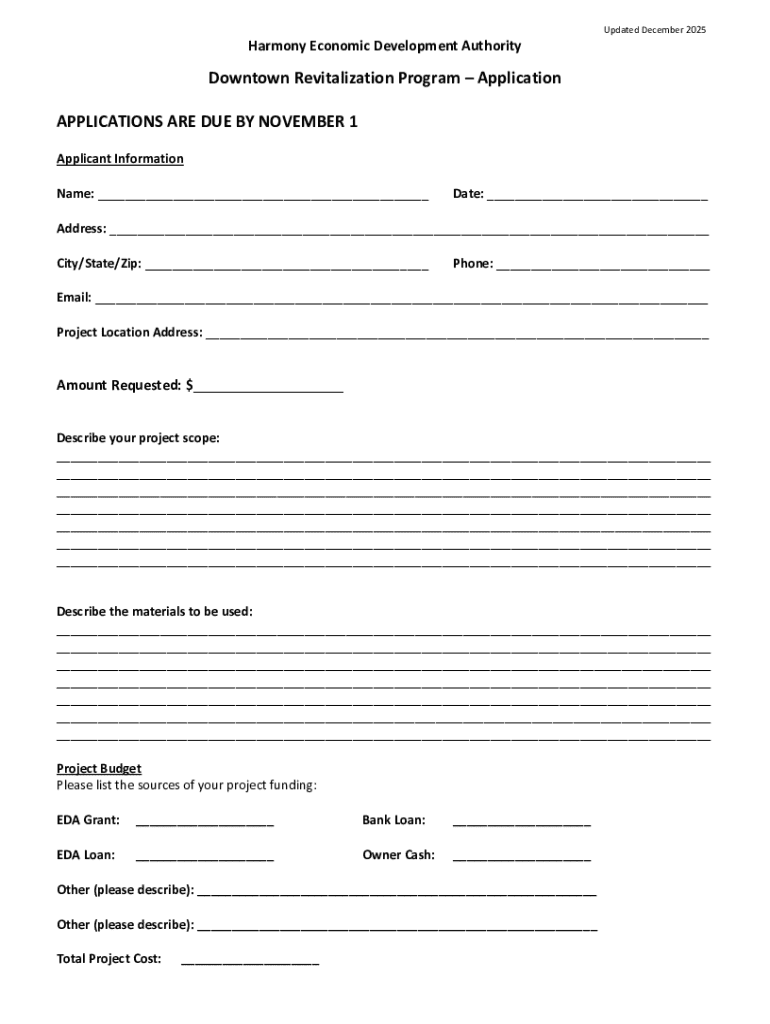

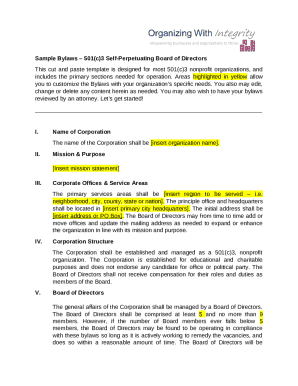

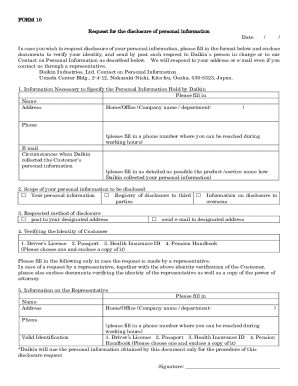

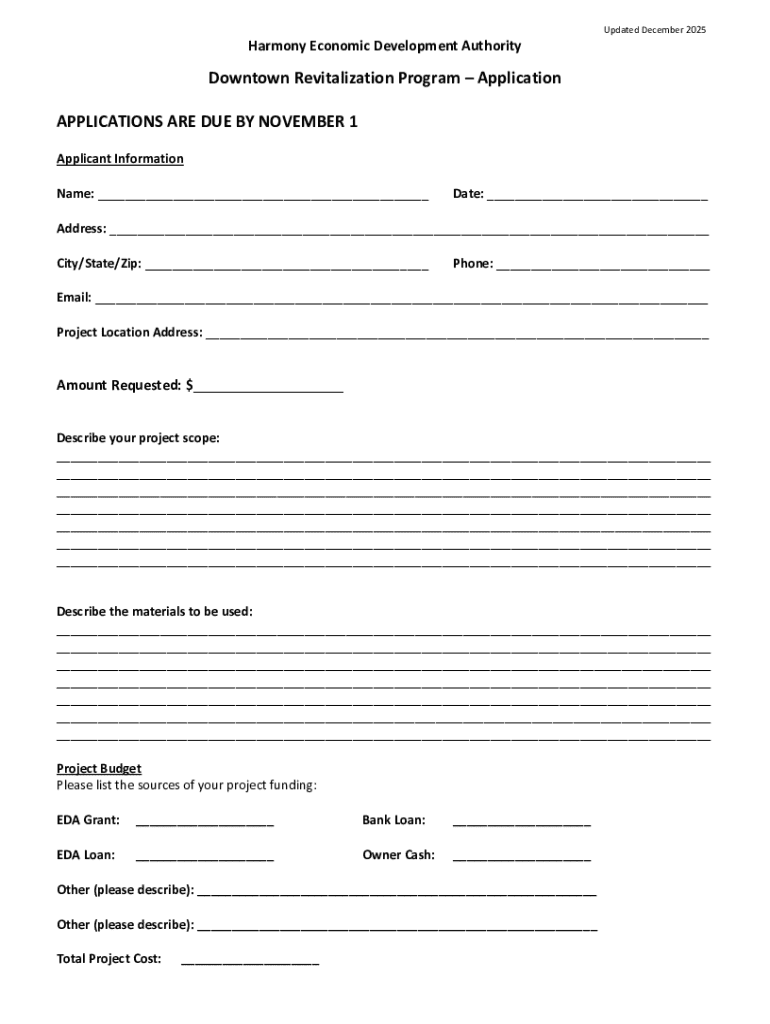

The RLF form is crucial for the funding process, as it collects all necessary information to assess the viability and potential impact of a proposed project. This form facilitates an efficient review by funding agencies, ensuring applicants provide key data that aligns with funding criteria.

It captures essential details such as project scope, budget, timeline, and compliance with local regulations. This establishes a transparent process so that reviewers can adequately evaluate and prioritize applications. Individuals or organizations interested in accessing RLF financing should prepare to complete the RLF form comprehensively, ensuring they meet eligibility criteria and represent their project effectively.

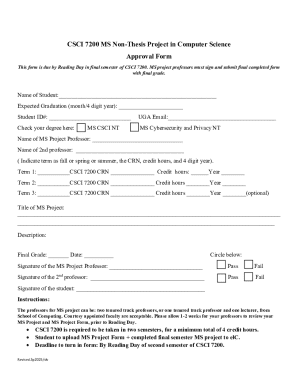

Components of the RLF form

The RLF form is typically divided into several components, each requiring specific information to guide the funding review process. Proper completion of these sections is vital to the success of the application.

Step-by-step guide to filling out the RLF form

Completing the RLF form requires careful preparation and attention to detail. The process can be broken down into distinct steps to streamline your efforts and enhance the likelihood of approval.

Editing and finalizing the RLF form

Once the RLF form is filled out, editing and collaboration become necessary. Tools like pdfFiller offer a range of editing functionalities, allowing users to refine their documents seamlessly. These tools become indispensable for ensuring clarity and accuracy in all submissions.

Utilizing pdfFiller, users can track changes, manage document versions, and facilitate collaboration with team members effectively. Before submission, a checklist should be employed to address all requirements and confirm the accuracy of the details provided, minimizing the chances of delays or rejections during the review process.

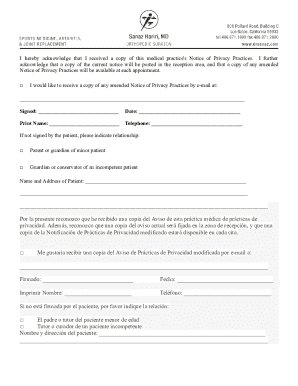

Signing and submitting the RLF form

The signing and submission stage is a critical final step in the RLF application process. Electronic signing, or eSigning, can streamline this process, providing an efficient way to certify the form without the need for printing and physical signatures.

Once signed, applicants should adhere to specific submission guidelines provided with the application instructions. Consideration of timelines for review and approval is also essential, as these can vary widely depending on the funding organization’s processes and capacity.

Managing your RLF application post-submission

After submitting the RLF form, ongoing management of the application is vital. Monitoring the status of your application allows you to stay updated with any developments or changes in the review process.

Responding to feedback or requests for additional information promptly is critical to maintaining good communication with funding agencies. If approved, it's essential to understand the next steps, including obligations surrounding loan use and repayment.

FAQs about the RLF form

To facilitate a smooth application experience, addressing common questions regarding the RLF form is crucial. This section provides clarity on topics like loan terms, eligibility criteria, and the overall funding process.

Leveraging pdfFiller for document management

Effective document management is central to the RLF application process. pdfFiller provides numerous features tailored specifically for working with RLF forms, from editing to collaboration.

Case studies: successful RLF applications

Examining successful RLF applications can provide invaluable insights and lessons for future applicants. Many funded projects demonstrate innovative uses of RLFs, from transforming underutilized properties to initiating small business ventures that revitalize local economies.

These case studies often highlight best practices, focusing on detailed planning, accurate financial projections, and effective presentation of project goals. Learning from previous recipients allows new applicants to enhance their applications, ensuring they present their projects compellingly.

Conclusion: the path to securing revolving loan fund financing

Securing financing through a Revolving Loan Fund requires diligence, precision, and thoughtfulness. As applicants navigate the complexities of the RLF form, they embark on a journey that has the potential to foster meaningful changes within their communities.

With the right strategies, tools like pdfFiller to assist in document management, and an awareness of best practices gleaned from successful case studies, individuals and teams can pave the way toward impactful projects. By taking that first step in utilizing RLF financing, they can contribute profoundly to community development and uplift those around them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send revolving loan fund rlf to be eSigned by others?

How do I execute revolving loan fund rlf online?

How do I edit revolving loan fund rlf online?

What is revolving loan fund rlf?

Who is required to file revolving loan fund rlf?

How to fill out revolving loan fund rlf?

What is the purpose of revolving loan fund rlf?

What information must be reported on revolving loan fund rlf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.