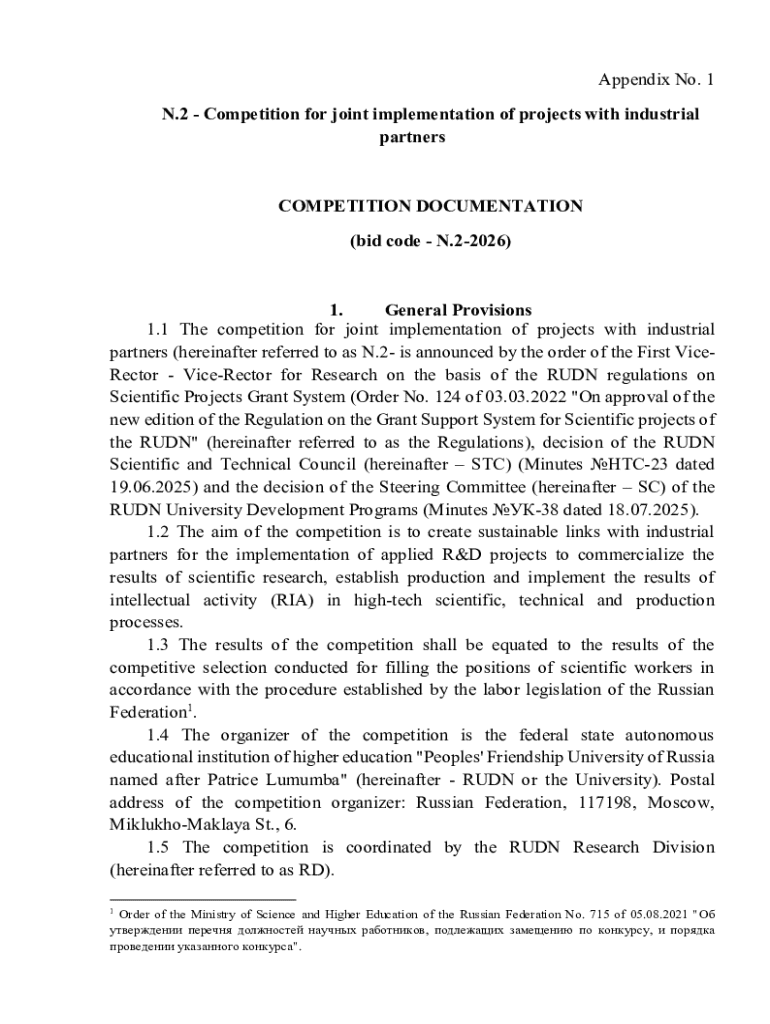

Get the free Appendix No. 1 N.2 - Competition for joint implementation of ...

Get, Create, Make and Sign appendix no 1 n2

Editing appendix no 1 n2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out appendix no 1 n2

How to fill out appendix no 1 n2

Who needs appendix no 1 n2?

Appendix No 1 N2 Form: A Comprehensive Guide

Overview of Appendix No 1 N2 Form

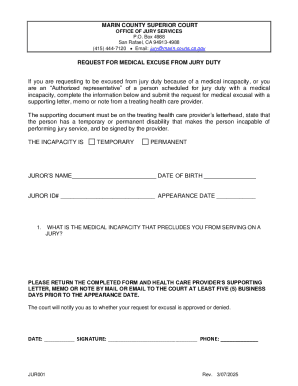

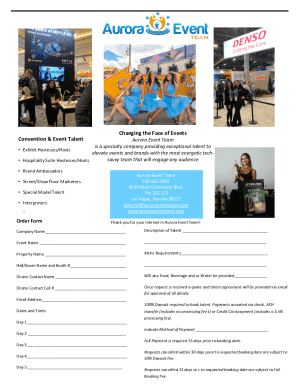

The Appendix No 1 N2 Form serves as a crucial document across various contexts, particularly in tax and financial reporting. Its primary purpose is to provide detailed information that supplements other forms or reports, ensuring that all necessary data is disclosed to the relevant authorities. This form becomes particularly significant for individuals and organizations navigating compliance requirements, as it can affect tax liabilities and reporting accuracy.

Key features of the Appendix No 1 N2 Form include its structured layout, which guides users through the required information systematically. The common use cases encompass various sectors, including finance, taxation, and legal documentation.

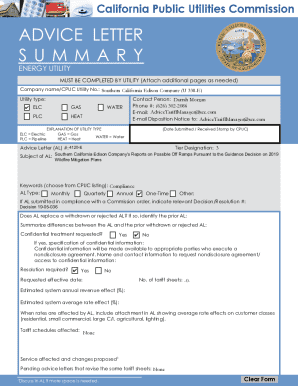

Understanding the structure of the Appendix No 1 N2 Form

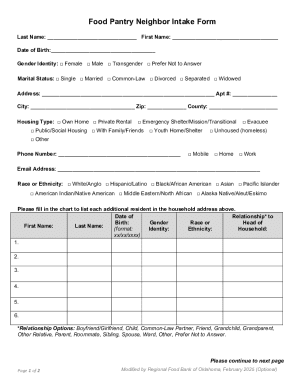

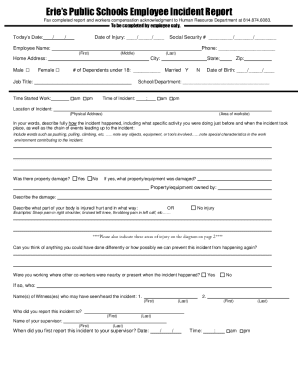

The structure of the Appendix No 1 N2 Form is designed to facilitate ease of completion and clarity in reporting. It typically consists of several sections, each pertaining to a specific category of information. A section-by-section analysis begins with the basic identifier information at the top, which includes the name and details of the individual or organization completing the form.

Following the identifiers, subsequent sections request detailed financial data, such as income, deductions, and expenditures. It’s essential to provide accurate figures, backed by the necessary documentation to validate the claims made within the form.

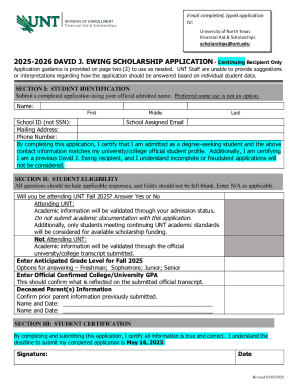

Step-by-step guide to filling out the Appendix No 1 N2 Form

Filling out the Appendix No 1 N2 Form can seem daunting, but with systematic preparation and attention to detail, it can be done efficiently. Here’s a step-by-step guide to ensure that your form is completed accurately.

Preparation Before Filling

Before beginning the form, gather all necessary documents and information. This includes previous tax returns, financial statements, and any other supporting documents that might be required.

Detailed instructions for filling out the form include:

Interactive tools for managing the Appendix No 1 N2 Form

In today's digital environment, pdfFiller enhances the experience of completing the Appendix No 1 N2 Form through its specialized features. Utilizing these can streamline your document management process.

Key functionalities of pdfFiller include:

Common challenges and solutions

While completing the Appendix No 1 N2 Form may seem straightforward, several challenges can arise. Users often encounter issues such as missing documents, incorrect reporting, and misunderstanding the form’s requirements.

Addressing these challenges involves digging into effective troubleshooting tips, including:

Resources for further assistance

For those seeking help with the Appendix No 1 N2 Form, various resources are at your disposal. These include online forums, official government websites, and customer support through pdfFiller, providing expert guidance on complex filing needs.

Staying informed about the latest updates and changes associated with the form is vital. This includes keeping an eye on any amendments to filing requirements or changes in the legal implications regarding its submission.

Working efficiently with the Appendix No 1 N2 Form

Efficiency is key when dealing with financial forms. Implementing best practices not only streamlines the process but also reduces the potential for errors. Consider adhering to these tips:

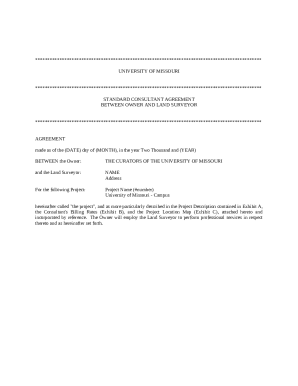

Legal considerations

Completing the Appendix No 1 N2 Form accurately is not merely a matter of convenience; it's a legal obligation. Incorrect filings can lead to serious consequences, such as financial penalties or legal ramifications.

Understanding the legal implications stresses the importance of being diligent and thorough. Potential consequences of errors may include:

Conclusion: maximizing your experience with the Appendix No 1 N2 Form

Successfully navigating the Appendix No 1 N2 Form requires attention to detail, comprehensive resources, and an understanding of your own documentation needs. Utilizing tools available on pdfFiller not only simplifies the process but also enhances accuracy. By leveraging these tools, users can ensure they meet their compliance needs effectively, allowing them to focus on their broader financial responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit appendix no 1 n2 straight from my smartphone?

How do I fill out appendix no 1 n2 using my mobile device?

How do I edit appendix no 1 n2 on an iOS device?

What is appendix no 1 n2?

Who is required to file appendix no 1 n2?

How to fill out appendix no 1 n2?

What is the purpose of appendix no 1 n2?

What information must be reported on appendix no 1 n2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.