Get the free 7:17 p

Get, Create, Make and Sign 717 p

How to edit 717 p online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 717 p

How to fill out 717 p

Who needs 717 p?

A Comprehensive Guide to the 717 P Form

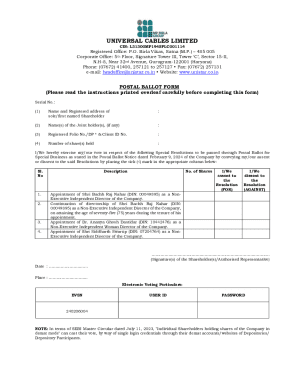

Understanding the 717 P Form

The 717 P Form is a crucial document used within the employment sector for verifying eligibility. Its main purpose lies in ensuring that employees meet specific employment eligibility criteria, often required by employers during the hiring process. This form acts as a safeguard against potential legal issues that may arise from hiring individuals who do not meet the eligibility requirements.

Accuracy in filling out the 717 P Form is paramount. Any discrepancies in the information provided can delay the hiring process or lead to complications in employment verification procedures, affecting both employers and employees.

Who needs to use the 717 P Form?

The target audience for the 717 P Form primarily includes job seekers and employers in various industries. Specifically, individuals applying for employment in organizations that require verification of eligibility should use the form. It's particularly relevant for those new to the workforce, such as graduates, as well as for seasoned professionals who might be transitioning between jobs. The legal landscape surrounding employment statutes makes it imperative for employers to utilize the 717 P Form to safeguard their hiring practices.

Key components of the 717 P Form

The 717 P Form consists of several critical sections that gather essential information from the applicant. Understanding these components allows for a smoother and more efficient filing process.

Step-by-step instructions for filling out the 717 P Form

To appropriately fill out the 717 P Form, preparation and organization are key. Before the actual filling, applicants should gather all necessary documents, such as identification, previous employment records, and any other supporting information.

Understanding the relevant laws and regulations also plays a crucial role in compliance and accuracy throughout the process. Familiarizing oneself with the legal context ensures that all information is provided in accordance with applicable jurisdictional requirements.

As you begin to fill out the form, follow these structured steps:

Common mistakes and how to avoid them

While filling out the 717 P Form, individuals often make several common errors that can impede verification processes. Misreporting personal or employment information stands out as one of the most significant mistakes. For instance, a minor typo in a name or incorrect employment dates can lead to confusion or rejection.

Another prevalent mistake is neglecting to sign or date the form, which is critical for confirming authenticity. An unsigned document may be dismissed entirely.

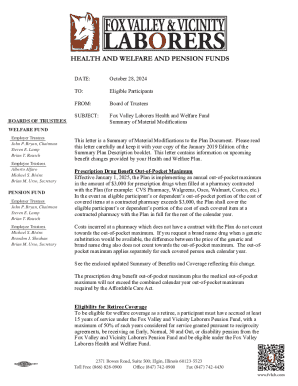

Editing and modifying the 717 P Form with pdfFiller

PdfFiller streamlines the editing process for your 717 P Form, allowing users to upload templates easily and utilize interactive tools for making real-time modifications. This feature is particularly useful for individuals who may need to update their form due to changes in employment situations or personal details.

Collaboration is also simplified with pdfFiller. Users can share forms securely, facilitating feedback collection from team members or advisors—essential for ensuring that the completed form meets all necessary requirements.

Signing the 717 P Form: Options and guidelines

Signing the 717 P Form can be accomplished through traditional means or electronically. Understanding the legal validity of e-signatures is essential, as many jurisdictions accept them, making the process more efficient.

In some cases, a physical signature may still be necessary, depending on the employer's particular requirements. It's crucial to check and comply with the requirements before finalizing the form.

Managing and storing your completed 717 P Form

The importance of secure document management cannot be overstated, especially in the context of personal and employment-related information. The 717 P Form often contains sensitive details that must be protected to avoid breaches of privacy.

Understanding data privacy and compliance considerations is essential for anyone dealing with forms like the 717 P. Utilizing cloud-based solutions like pdfFiller ensures that documents are stored securely and are easily accessible when needed.

Real-world applications of the 717 P Form

The 717 P Form has been instrumental in streamlining the employment verification process for many. Individuals have shared success stories detailing how filling out the form accurately led to greater job opportunities and swifter hiring timelines.

Additionally, teams have benefited from collaborative document management efforts through pdfFiller, enhancing efficiency and transparency in their hiring processes. Feedback from users highlights the tool's practicality and user-friendly interface, enabling those involved in document handling to focus more on their core tasks rather than administrative hurdles.

FAQs about the 717 P Form

Navigating the complexities surrounding the 717 P Form can raise several questions. Common queries often relate to correctly filling out the form, as well as specific aspects of using pdfFiller to manage this documentation.

Having clear answers to these questions reduces confusion and enhances the likelihood of a successful submission. Furthermore, access to additional resources and insights can significantly aid users in mastering the nuances of the 717 P Form.

Ensuring compliance with employment regulations

The legal context of the 717 P Form is intertwined with employment laws that govern hiring practices. Understanding these laws is essential for both candidates and employers to navigate the employment landscape effectively.

Compliance with these regulations also plays a significant role in the proper management of employment forms. pdfFiller provides users with tools for compliance tracking, aiding in audit readiness and ensuring that all documentation remains appropriate for regulatory scrutiny.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 717 p?

How can I edit 717 p on a smartphone?

How do I fill out 717 p on an Android device?

What is 717 p?

Who is required to file 717 p?

How to fill out 717 p?

What is the purpose of 717 p?

What information must be reported on 717 p?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.