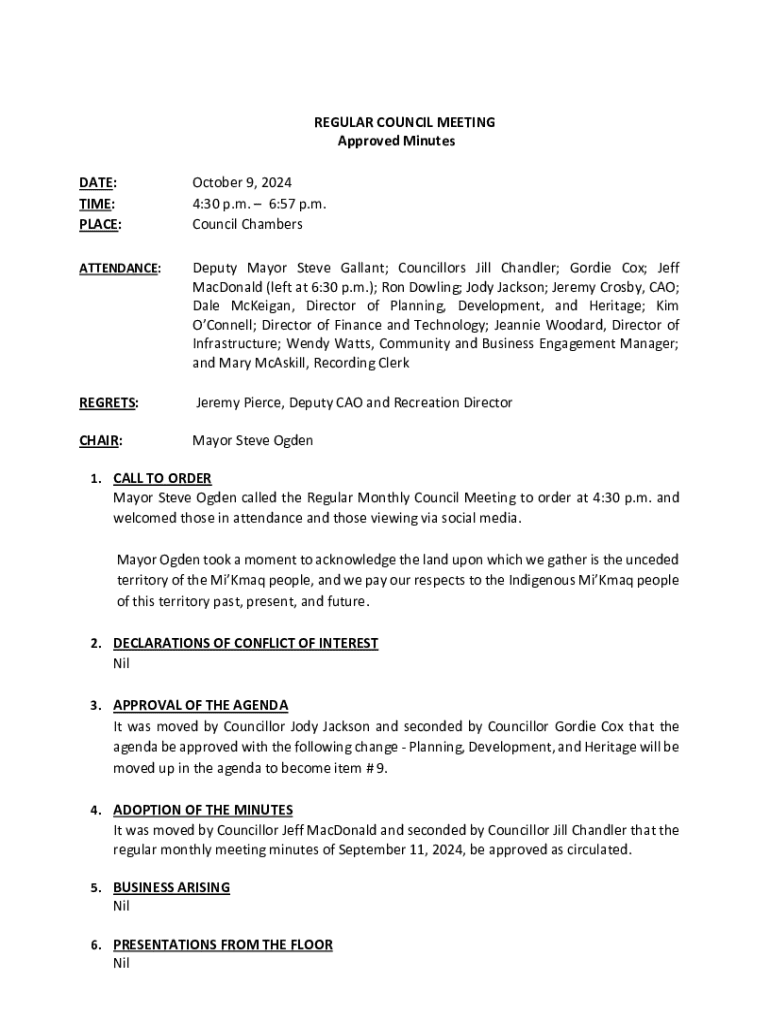

Get the free 6:57 p

Get, Create, Make and Sign 657 p

How to edit 657 p online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 657 p

How to fill out 657 p

Who needs 657 p?

Comprehensive Guide to the 657 P Form: Your Essential Resource

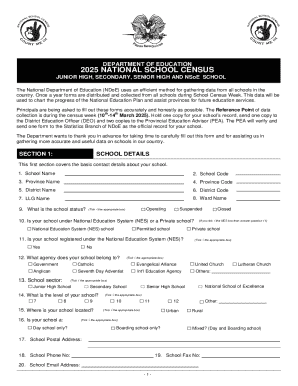

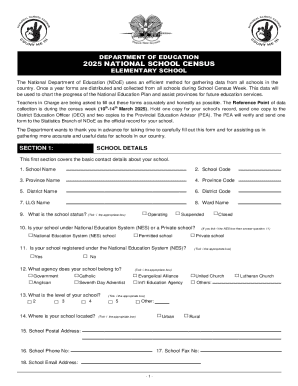

Overview of the 657 P Form

The 657 P Form serves a vital role in streamlining official documentation processes. Specifically designed for various applications, this form aids in the accurate and efficient collection of necessary information in a standardized format. As such, the 657 P Form reduces the likelihood of errors and enhances the compliance of submissions to required legal standards.

Moreover, the importance of the 657 P Form cannot be overstated; it acts as a foundational document that supports broader administrative processes within organizations, such as human resources, finance, and legal departments. By facilitating uniform submissions, this form sets a clear standard against which the accuracy and completeness of information can be measured.

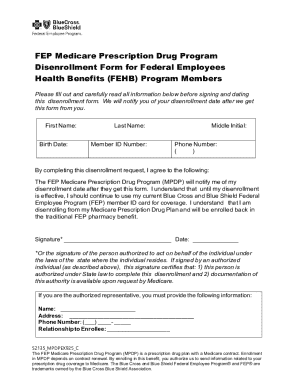

Understanding the requirements for the 657 P Form

Before filing the 657 P Form, it’s essential to understand the eligibility criteria. Generally, individuals who are required to submit this form must meet certain conditions, including being a part of an organization or institution that mandates this documentation. Additionally, you must ensure that the purpose for submission aligns with the stipulated guidelines.

Along with eligibility, gather the required documentation and information needed for completion. Key personal identification requirements include government-issued identification, proof of address, and any relevant identification numbers that pertain to the submission context, such as Social Security numbers or tax IDs. Furthermore, you may need supplementary documents such as employment verification letters or financial statements, depending on the specifics of your case.

Step-by-step instructions for completing the 657 P Form

Completing the 657 P Form involves a few key sections, each requiring careful attention to detail. The first section requests your personal information. Ensure that your name, address, and contact details are entered accurately—this information is critical for the processing of your application.

The second section outlines the purpose of filing. Here, you’ll find a list of options; make sure to select the one that corresponds accurately to your reason for submission. This choice impacts how your application will be reviewed and processed.

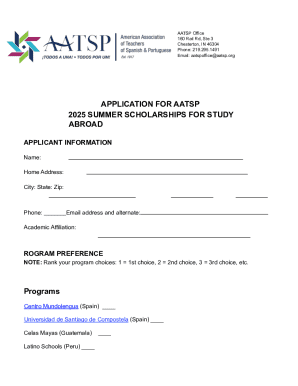

The third section involves submission details. Follow the on-screen prompts to outline how and when you’re submitting the form, as well as any preferences for communication regarding the submission process.

Finally, review and verify all entries before submission. Double-check personal details and submission choices to avoid common errors such as typos or incorrect selections, which can lead to unnecessary delays in processing.

Editing the 657 P Form

If you need to edit an existing 657 P Form, the pdfFiller platform makes it easy to modify your documents. Simply upload the existing form from your device, and take advantage of the user-friendly editing tools provided. With features like text boxes, highlighting, and annotations, you can make necessary adjustments smoothly.

When considering your editing options, remember the distinction between saving your edits locally and submitting the revised form. You can choose to keep a version of the edited document for your records or proceed to submit the changes as part of the formal process.

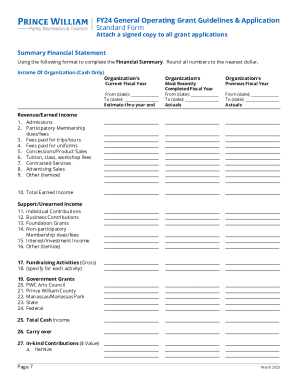

eSigning the 657 P Form

Integrating eSigning into your submission process enhances the security and legitimacy of your documentation. By eSigning the 657 P Form, you provide a legally binding signature that confirms your identity and your intent to submit the information provided.

To eSign using pdfFiller, locate the eSignature function at the appropriate section of the 657 P Form. Follow the prompts to create or upload your signature, ensuring it complies with legal requirements. It’s crucial to understand the legal implications of eSigning, as it holds the same weight as a handwritten signature in most jurisdictions.

Managing the 657 P Form post-submission

After submitting your 657 P Form, tracking its status is key. You can log into your pdfFiller account to check for updates on your submission's review process. This transparency helps you stay informed, allowing prompt follow-ups if necessary.

In cases where re-submission or amendments are required, pdfFiller offers simple guidelines for making those adjustments. Additionally, it is paramount to securely store a copy of your submitted form for personal records, ensuring easy access when needed.

Interactive tools for the 657 P Form

pdfFiller provides a host of interactive features designed to enhance the user experience when dealing with the 657 P Form. With user-friendly templates, you can easily fill in your details without the hassle of formatting the document manually. The platform also offers guided tutorials that walk you through each aspect of form completion and management.

Utilizing the available tools effectively can save time and reduce frustration throughout the documentation process. Whether you're filling out forms on your phone, tablet, or computer, pdfFiller’s interactive features are optimized for seamless use across devices.

Frequently asked questions (FAQs) about the 657 P Form

Common concerns often arise concerning the 657 P Form, especially regarding eligibility, submission timing, and required documentation. For instance, many users wonder what qualifies as acceptable identification or if certain supplementary documents can be submitted digitally.

In response to these inquiries, it's vital to consult the guidelines provided on the pdfFiller platform and refer back to the form’s instructions. This ensures clarity and avoids potential mistakes that could lead to delays in your application.

Troubleshooting common issues with the 657 P Form

Users occasionally encounter problems during the completion or submission of the 657 P Form. Common issues might include difficulties with online submissions or trouble accessing features of the pdfFiller platform. Recognizing these challenges is the first step towards resolving them.

To address concerns, pdfFiller provides a robust support system. Users can find quick-fix solutions through the help section or contact customer support for more complex issues. This resource empowers users to troubleshoot effectively and streamline their form submissions.

Seeking help and support for the 657 P Form

For those needing additional help or personal assistance with the 657 P Form, there are various contact options available through pdfFiller’s customer support. Whether you prefer online chats, emails, or user forums, assistance is readily accessible.

Moreover, pdfFiller’s online support resources, including video tutorials and FAQs, ensure users have access to the information they require to navigate the complexities of the 657 P Form effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 657 p?

Can I edit 657 p on an Android device?

How do I fill out 657 p on an Android device?

What is 657 p?

Who is required to file 657 p?

How to fill out 657 p?

What is the purpose of 657 p?

What information must be reported on 657 p?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.