Get the free Combining statement of financial position

Get, Create, Make and Sign combining statement of financial

How to edit combining statement of financial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out combining statement of financial

How to fill out combining statement of financial

Who needs combining statement of financial?

Combining statement of financial form: A comprehensive guide

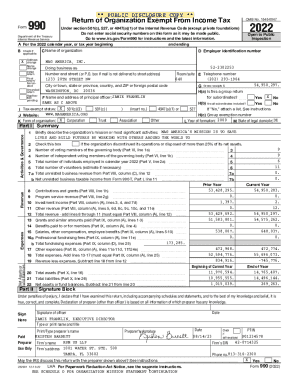

Understanding financial statements

Financial statements are essential documents that provide a snapshot of a company’s financial position, performance, and cash flows. These statements include the income statement, balance sheet, and cash flow statement, each serving a distinct purpose in communicating pertinent financial information to stakeholders. Understanding these documents is crucial for anyone involved in managing or analyzing business finances.

The purpose of financial statements extends beyond mere compliance with regulatory requirements; they facilitate informed decision-making among management, investors, and creditors. They reveal the profitability, liquidity, and operational efficiency of a business, serving as a baseline for historical comparison and future projections.

Combining statements: An overview

Combining financial statements provide a method to aggregate the financial results of multiple subsidiaries or segments within an organization. This approach allows for a clearer view of the overall financial performance, aiding in the seamless analysis of multiple business entities, especially in large corporations or groups.

The importance of combining financial statements becomes evident in multi-entity organizations where individual results must be presented together for a holistic understanding of performance. These statements are particularly useful during mergers, acquisitions, and consolidations of various entities, enabling stakeholders to assess the financial health of the combined organization.

Core components of a combining statement of financial form

A well-constructed combining statement of financial form should include key elements from both the income statement and balance sheet. This ensures that users receive a thorough overview of financial performance and position across all entities involved. The combining statement typically pulls together data for relevant line items, demonstrating a consolidated view of revenues, expenses, assets, liabilities, and equity.

When preparing a combining financial statement, financial professionals should include crucial line items while avoiding unnecessary details that may confuse stakeholders. Income statement components generally show total revenues, cost of goods sold (COGS), and net income, while the balance sheet should emphasize total assets, total liabilities, and shareholder equity.

Preparing a combining statement

Preparing a combining statement involves several systematic steps that ensure accuracy and clarity in presenting financial results. The process begins by gathering necessary financial data from each entity. It is critical for users to collect accurate and comprehensive information from all involved entities, maintaining a coherent approach to reporting.

Subsequently, aligning reporting periods and accounting policies becomes essential. Any discrepancies in dates or accounting methods can lead to misinterpretations and inaccuracies in the combining statement. Following this, structuring the statement for clarity allows for easy navigation and understanding by stakeholders.

Common pitfalls to avoid during preparation

Several common pitfalls can occur during the preparation of combining statements, often leading to compliance issues and flawed financial representation. Misrepresentation of financial data, whether intentional or accidental, remains a significant concern, as inaccuracies can lead to lost stakeholder trust and potential regulatory repercussions.

Ignoring inter-company transactions is another typical oversight when preparing combining statements. Each entity might have transactions with others that need to be accounted for accurately to present a true financial picture. Additionally, failing to maintain compliance with reporting standards can have serious implications, including fines or other regulatory measures.

Software tools for creating combining statements

Choosing the right software tools can streamline the process of creating combining statements. Various solutions provide essential features that enhance document creation and management. For instance, pdfFiller offers intuitive interfaces that simplify the completion and editing of financial forms—making it an excellent choice for businesses looking to manage their financial documentation efficiently.

Benefits of using cloud-based platforms, like pdfFiller, include easy access to documents from anywhere, robust collaboration options, and secure storage, which can significantly enhance the workflow of financial reporting processes. Interactive tools and templates are also available within these platforms, providing templates that can automatically calculate totals and organize financial data for clarity.

Best practices for effective financial combining

Adopting best practices in financial combining is pivotal for effective outcomes. Firstly, maintaining consistency in financial reporting across all entities involved enhances comparability and transparency. This consistency fosters trust among stakeholders who rely on these statements to make decisions.

Regular updates and reviews of combining statements allow businesses to stay current with changes in financial conditions and ensure accuracy in reporting. Lastly, engaging stakeholders during the combining process allows for feedback and insights that contribute to a comprehensive financial overview.

Navigating complex scenarios

There are multiple complex scenarios where using combining statements is more advantageous than consolidated statements. In mergers and acquisitions, for instance, companies may wish to analyze the performance of individual entities before formally combining their financial results into a consolidated statement. This approach provides valuable insights into the strengths and weaknesses of each entity involved.

Joint ventures may also require combining statements to separate the financial results of partnered entities. Moreover, segment reporting for large corporations is often enhanced through combining statements, allowing for a detailed understanding of financial health across different divisions or lines of business. Legal and compliance considerations also play a vital role in determining the appropriate use of combining versus consolidated statements.

Frequently asked questions about combining statements

Questions regarding combining statements frequently arise, particularly about their differences from consolidated financial statements. Combining statements aggregate results without eliminating inter-company transactions, while consolidated statements present a holistic view of a business as a single entity. Businesses typically prepare combining statements quarterly or annually, depending on their operational structure and stakeholders’ needs.

Additionally, various accounting standards govern the preparation and presentation of combining statements, ensuring compliance with established financial reporting frameworks. It is also worth noting that combining statements can undergo audits, similar to consolidated statements, affirming their reliability and standing in financial reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in combining statement of financial?

How do I edit combining statement of financial in Chrome?

Can I edit combining statement of financial on an iOS device?

What is combining statement of financial?

Who is required to file combining statement of financial?

How to fill out combining statement of financial?

What is the purpose of combining statement of financial?

What information must be reported on combining statement of financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.