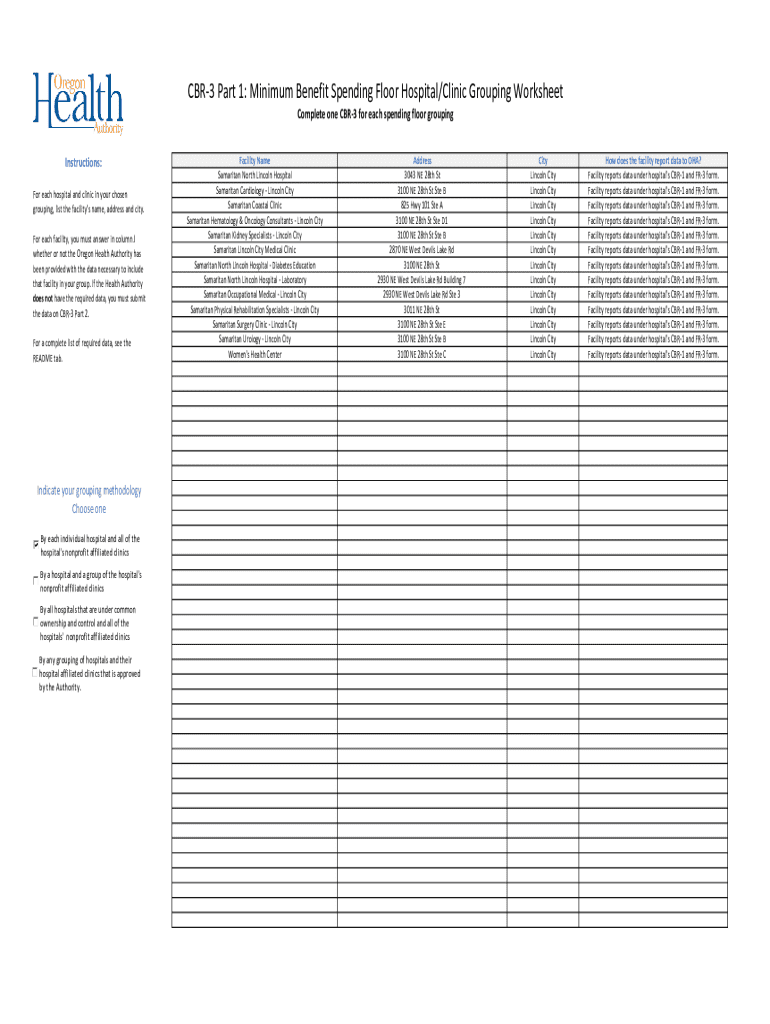

Get the free FY21 CBR-3 Form Samaritan North Lincoln Hospital.xlsx

Get, Create, Make and Sign fy21 cbr-3 form samaritan

Editing fy21 cbr-3 form samaritan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fy21 cbr-3 form samaritan

How to fill out fy21 cbr-3 form samaritan

Who needs fy21 cbr-3 form samaritan?

Comprehensive Guide to the FY21 CBR-3 Form Samaritan Form

Understanding the FY21 CBR-3 Form Samaritan Form

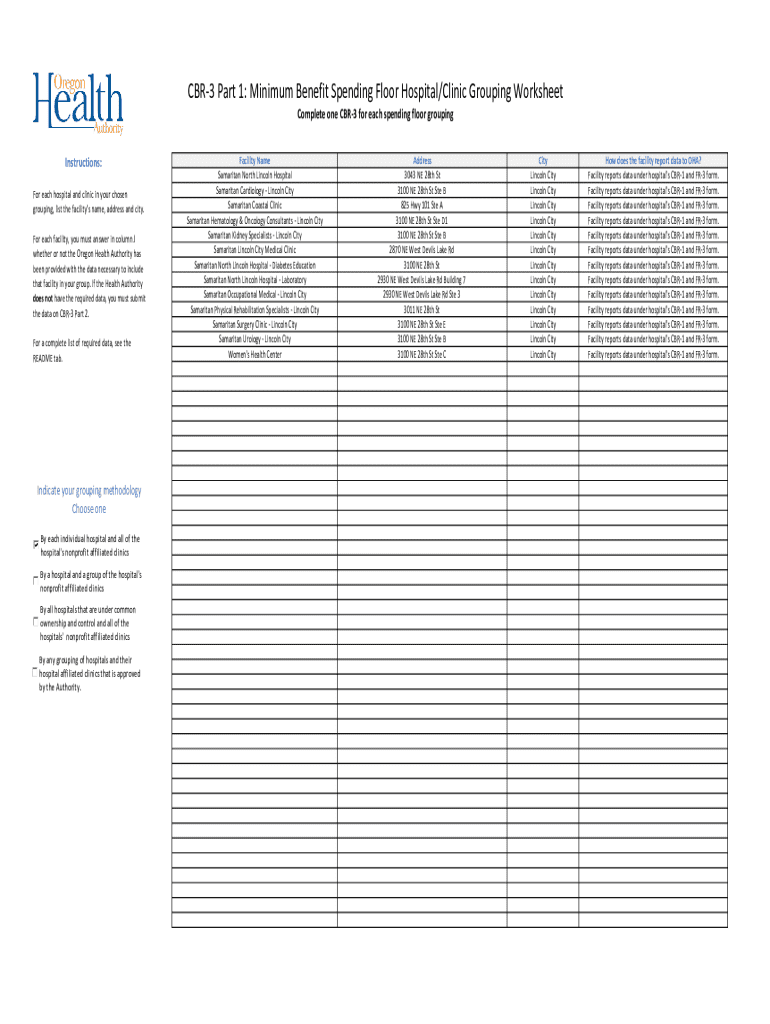

The FY21 CBR-3 Form, often referred to as the Samaritan form, plays a crucial role in the administrative processes of Samaritan organizations. It is designed to collect essential data on service provision, funding, and financial information for various programs. By effectively utilizing this form, organizations can ensure compliance with federal and state regulations, facilitate funding relationships, and accurately report on their operational activities.

For Samaritan organizations, understanding the nuances of the FY21 CBR-3 Form is vital. It not only affects the organization’s ability to secure funding but also impacts its reputation and accountability to stakeholders, such as grantors, board members, and the communities served. Thus, comprehending the form's requirements and implications is a priority.

Who needs to use the FY21 CBR-3 Form?

The primary users of the FY21 CBR-3 Form include individuals and teams directly involved in the management and delivery of Samaritan services. This typically encompasses grant administrators, financial officers, program managers, and compliance officers. Each of these roles is relevant in ensuring that the data submitted through the form adheres to both organizational goals and external funding requirements.

Key features of the FY21 CBR-3 Form

The FY21 CBR-3 Form is structured to facilitate streamlined reporting. It includes several sections that encompass critical data points necessary for comprehensive analysis. Each section is carefully designed to gather pertinent information, ensuring an organized collection of data that meets reporting requirements.

The form consists of various sections, including identifying information, financial reviews, and service information. Each part has specific terminologies and acronyms that must be understood to ensure accurate completion. For example, terms such as 'CBR' may refer to Capacity Building Resources, which highlights the type of services offered and evaluated.

Interactive elements

To enhance user experience, the FY21 CBR-3 Form may include interactive elements. These are designed to guide users through the form dynamically and may provide tooltips, example answers, and validation checks to help ensure accuracy as users proceed. Engagement with these elements can significantly simplify the form-filling process, making it more intuitive for all involved.

Cloud-based accessibility

One of the key advantages of the FY21 CBR-3 Form is its accessibility via pdfFiller’s cloud-based platform, allowing users to access and edit the document from anywhere. This flexibility is especially beneficial for organizations with remote teams or personnel who travel frequently. By leveraging cloud technology, users can ensure that they are always working on the most current version of the form, and they can collaborate in real-time.

Step-by-step guide to filling out the FY21 CBR-3 Form

Filling out the FY21 CBR-3 Form requires a carefully structured approach. Preparation is vital to ensure that all necessary information and documents are at hand before starting the process. Consider gathering financial statements, previous reports, and relevant service delivery metrics to streamline the completion.

A systematic approach allows for efficient filling across various sections. Below is a detailed, section-wise guide to assist you in accurately completing the form.

Common mistakes to avoid

Even seasoned professionals can make errors when filling out forms. Common mistakes include failing to read instructions carefully, missing deadlines for submission, or inadequate documentation of financial data. To prevent these issues, double-check your entries, and consider having a second person review the completed form before submission to ensure accuracy.

Editing and signing the FY21 CBR-3 Form

After filling out the FY21 CBR-3 Form, it is often necessary to make edits. pdfFiller provides a range of tools to facilitate modifications. Users can easily add text, delete content, and adjust formatting as needed without compromising the integrity of the original document.

Ensuring compliance while making edits is paramount; thus, utilizing pdfFiller’s features for tracking changes can be beneficial. This assistive tech allows teams to see what modifications have been made, promoting transparency and accountability.

eSigning the document

With pdfFiller, users can electronically sign the FY21 CBR-3 Form, simplifying the approval process. Electronic signatures are not only efficient but also legally binding, thus enhancing the submission’s validity. The process is user-friendly: after filling out the form, simply select the eSigning option, input your signature, and save the final document.

Managing your FY21 CBR-3 Form history

Tracking changes and managing versions of the FY21 CBR-3 Form effectively is vital for organizations that often update this form. pdfFiller offers version control features, allowing users to save different iterations of the form and compare changes over time. This capability helps in maintaining an accurate history of submissions and responses.

Additionally, secure document storage options ensure that completed forms are safely preserved. pdfFiller complies with data protection regulations, providing a reliable solution for keeping sensitive information away from unauthorized access while ensuring ease of access for authorized users.

Frequently asked questions about the FY21 CBR-3 Form

Many users encounter similar questions regarding the FY21 CBR-3 Form. Some of the most common inquiries involve the correct submission process, what to do if errors are made after submission, and how to handle deadline concerns.

For tech-related challenges, users often seek assistance on using pdfFiller’s functionalities. Comprehensive support is available through tutorials, FAQs, and dedicated customer service to address any challenges that may arise during the form filling process.

Best practices for utilizing the FY21 CBR-3 Form

To maximize the efficiency of using the FY21 CBR-3 Form, organizations should establish standardized procedures for completing and submitting the form. This includes training staff members on the importance of accurate reporting and best practices for handling the form.

Moreover, long-term management of forms is essential. Keeping an organized repository of completed forms allows for quick reference in the future. pdfFiller’s file management system simplifies collaboration among teams. Utilizing features such as shared access and commenting can enhance teamwork on form-related tasks.

Related forms and documentation

In addition to the FY21 CBR-3 Form, organizations should also be aware of other crucial forms related to service reporting and funding applications. For instance, the CBR-1 and CBR-2 forms are often utilized in conjunction with the CBR-3 for comprehensive reporting.

Resources for further exploration may include legal guidelines, templates, and past completed forms, which can serve as references. It's advisable to familiarize users with these materials to enhance the understanding of data requirements across various forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find fy21 cbr-3 form samaritan?

How do I edit fy21 cbr-3 form samaritan in Chrome?

Can I edit fy21 cbr-3 form samaritan on an iOS device?

What is fy21 cbr-3 form samaritan?

Who is required to file fy21 cbr-3 form samaritan?

How to fill out fy21 cbr-3 form samaritan?

What is the purpose of fy21 cbr-3 form samaritan?

What information must be reported on fy21 cbr-3 form samaritan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.