Get the free 8:42 p

Get, Create, Make and Sign 842 p

Editing 842 p online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 842 p

How to fill out 842 p

Who needs 842 p?

Comprehensive Guide to the 842 P Form: Everything You Need to Know

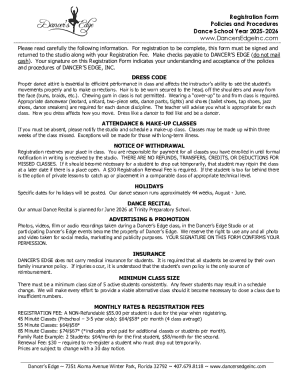

Understanding the 842 P Form

The 842 P Form is a crucial document in various legal and administrative contexts, primarily used for requests related to procedures in court. It serves a vital purpose in efficiently managing document submissions and ensuring that litigants provide necessary information for their cases. Anyone needing to navigate the complexities of legal affairs, such as family court proceedings, will find the 842 P Form indispensable as it acts as a cover sheet or declaration for pre-decree relief.

Key features of the 842 P Form

This form is designed with specific sections that facilitate the completion and processing of requests. The key sections typically include basic information about the filing party, details of the request or order being sought, and a declaration of filing fees or other relevant matters. Each section must be meticulously completed to avoid delays in processing.

Why use the 842 P Form?

Accurate completion of the 842 P Form is paramount for successful document processing. Any inaccuracies can lead to delays in your case. Using a dependable tool like pdfFiller not only enhances efficiency but also ensures that all information is stored securely in the cloud, allowing for easy access from any location. With pdfFiller's features, you can quickly edit your form and utilize eSigning capabilities, making the entire process smoother.

Step-by-step guide to filling out the 842 P Form

Before diving into the form, prepare by gathering all essential documents, including prior court orders and any supporting declarations. It’s vital to have all necessary information at hand to fill out the 842 P Form accurately.

As you move through filling out each section, ensure clarity and accuracy. Utilize pdfFiller’s tools to input text correctly. For example, taking time to read each section carefully can help avoid common mistakes like omitting essential details or providing misleading information.

Editing and customizing the 842 P Form

Editing the 842 P Form using pdfFiller is straightforward. You can modify existing text, add necessary annotations, or even insert comments for clarity. This functionality empowers users to tailor the document as needed for specific scenarios, ensuring that the final form aligns perfectly with the requirements.

Signing the 842 P Form

The use of electronic signatures is becoming increasingly accepted in legal contexts. When signing the 842 P Form electronically through pdfFiller, you can rest assured that your signature will hold legal validity equivalent to a handwritten one. This means you won’t have to worry about the logistics of printing and scanning your document.

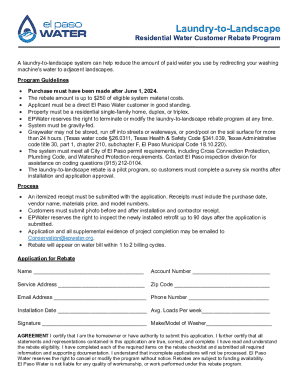

Managing your completed 842 P Form

Once the 842 P Form is completed and signed, proper management of the document is key. Utilizing pdfFiller's cloud-based features allows you to save your completed forms securely. If you need to share the form with team members or other stakeholders, pdfFiller provides several options for collaborative use.

Common questions about the 842 P Form

As users engage with the 842 P Form, several common questions arise. Queries about specific completion guidelines, understanding content requirements, and navigating pdfFiller functionalities frequently emerge. Troubleshooting issues may stem from formatting concerns or submission errors, which can often be resolved with a better understanding of the form's structure.

Success stories: Real-world applications of the 842 P Form

The effectiveness of the 842 P Form can be illustrated through real-world applications. Many users have successfully navigated family court proceedings by leveraging the insights and capabilities associated with the form. Case studies demonstrate how individuals and legal teams improved their filing efficiency and accuracy by integrating the 842 P Form into their workflow.

Final checks before submission

Before submitting the 842 P Form, it is imperative to conduct a thorough review. Key factors include ensuring all details are accurate and that supporting documents are attached when required. Establishing a submission checklist can significantly reduce errors, particularly for concerns related to misfiled forms or omitted information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 842 p from Google Drive?

How do I edit 842 p in Chrome?

Can I create an electronic signature for signing my 842 p in Gmail?

What is 842 p?

Who is required to file 842 p?

How to fill out 842 p?

What is the purpose of 842 p?

What information must be reported on 842 p?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.