Get the free 2023 Form 8453-LLC California e-file Return Authorization ...

Get, Create, Make and Sign 2023 form 8453-llc california

Editing 2023 form 8453-llc california online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023 form 8453-llc california

How to fill out 2023 form 8453-llc california

Who needs 2023 form 8453-llc california?

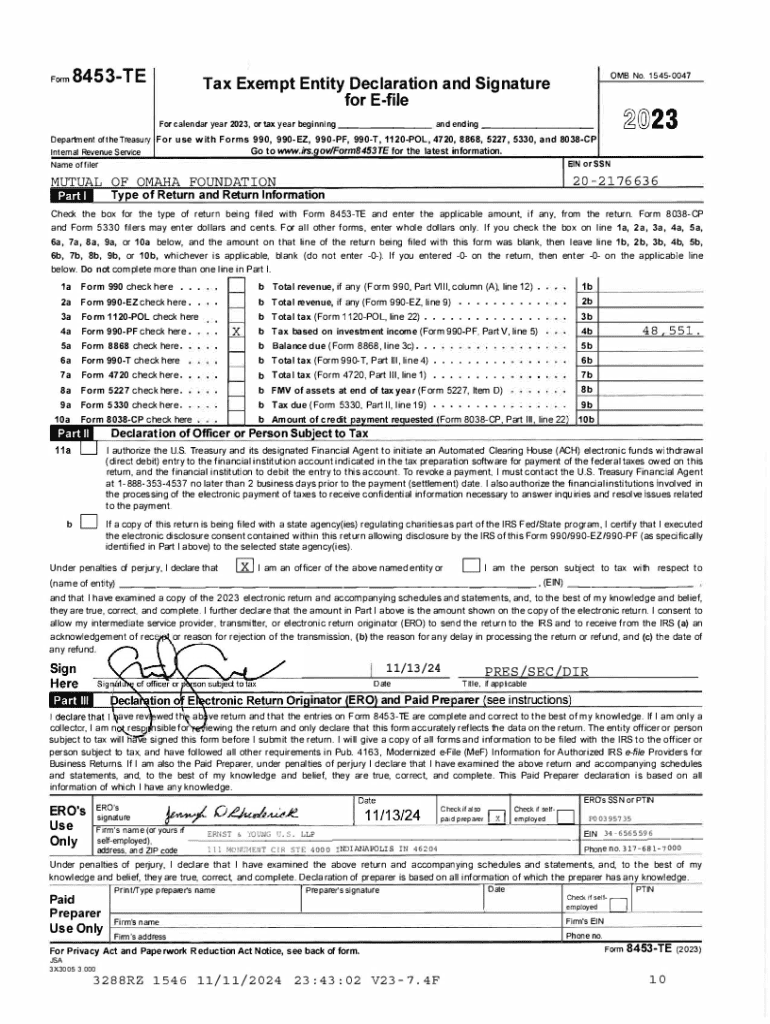

Understanding the 2023 Form 8453- for California LLCs

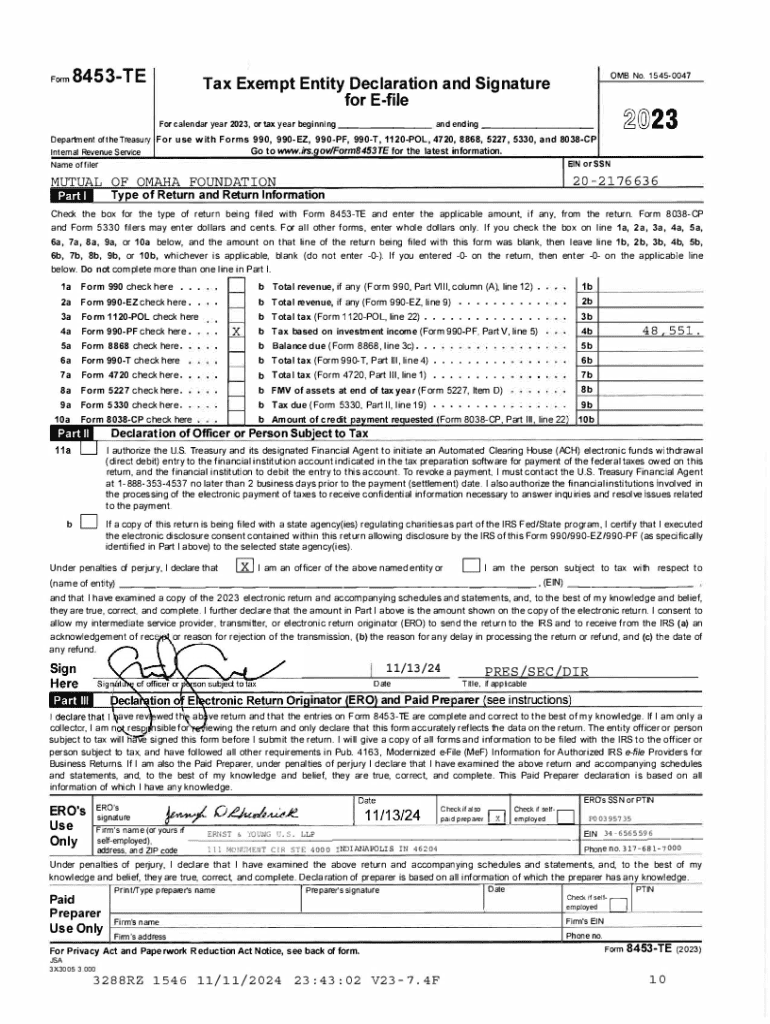

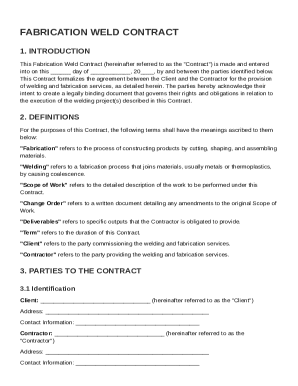

Overview of Form 8453-

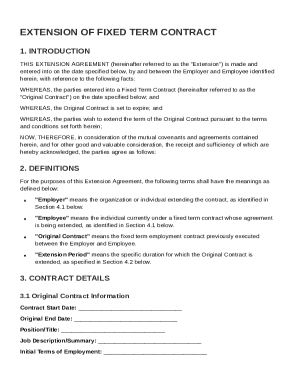

Form 8453-LLC is a crucial document for Limited Liability Companies (LLCs) in California that need to file electronically. This form serves as a declaration to the IRS, allowing businesses to authenticate and verify their electronic tax returns. For many, understanding the nuances of Form 8453-LLC is vital for compliance and avoidance of potential penalties.

The primary audience for Form 8453-LLC includes business owners and tax professionals who are responsible for ensuring accurate and timely filing of tax documents. This form is particularly significant for LLCs that opt for e-filing, as it enables them to authenticate their return data.

Filing electronically with Form 8453-LLC offers several advantages. First, it streamlines the submission process, reducing the likelihood of errors. Additionally, this method can expedite tax return processing, leading to faster refunds for LLCs.

Key features of pdfFiller for Form 8453-

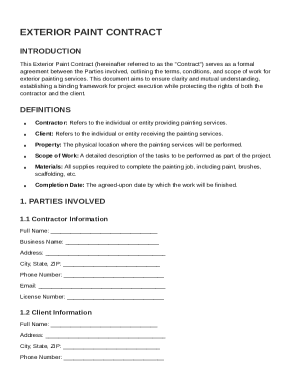

pdfFiller is an exceptional platform for managing Form 8453-LLC. Its features enhance the experience of both individual users and teams navigating their tax obligations. One of the standout capabilities is the seamless document editing and management system.

In addition, pdfFiller includes eSigning capabilities, simplifying the process of signing documents securely and legally. Users can easily eSign their Form 8453-LLC using a mouse or touchscreen, enhancing efficiency and convenience.

Collaboration tools also play a crucial role when working on Form 8453-LLC. Users can invite team members to review and edit the form, ensuring accuracy and compliance without the hassle of exchanging emails or multiple document versions.

Step-by-step instructions for completing Form 8453-

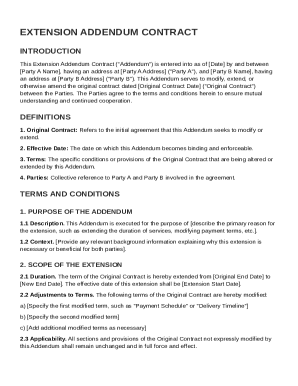

Completing Form 8453-LLC involves a systematic approach to ensure accuracy and compliance. The process begins with gathering necessary information, crucial in this phase to avoid mistakes.

Next, accessing Form 8453-LLC through pdfFiller is straightforward. Users can navigate the platform to find templates or start from a blank form. Once you have the form, filling it out meticulously is key. Each section should be double-checked against IRS guidelines.

Common mistakes include incorrect EINs or misreporting income. To avoid these errors, utilize pdfFiller's editing tools to ensure accuracy before finalizing. Once the form is complete, saving and downloading it for your records is essential.

Submission process for Form 8453-

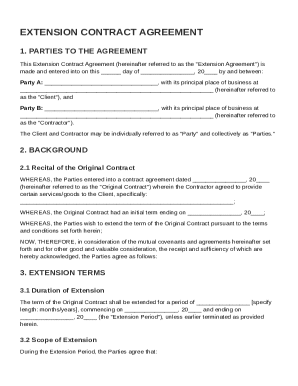

Submitting Form 8453-LLC involves several steps, primarily focused on electronic submission. Users must ensure that they submit their completed form through an e-filing platform approved by the IRS.

Once submitted, tracking your submission is crucial. Often, e-filing systems provide confirmation notifications. If utilizing mail, you may contact the IRS or check the status online to confirm receipt.

FAQs about the 2023 form 8453-

FAQ sections are particularly helpful for addressing common concerns surrounding Form 8453-LLC. One of the most frequently asked questions relates to filing deadlines. In general, Form 8453-LLC should be filed along with your annual tax return, which typically has an April deadline.

Addressing these FAQs can help ease concerns and provide clarity to business owners navigating the compliance landscape.

Advantages of using pdfFiller for form management

Using pdfFiller to manage your Form 8453-LLC offers numerous advantages, starting with the convenience of access from anywhere at any time. Being cloud-based means that you can work on your documents with ease, whether at the office or home.

Moreover, enhanced document security is a critical feature. pdfFiller employs advanced privacy practices to protect sensitive information, ensuring that your business’s financial data remains secure throughout the filing process.

Additionally, customer support is readily available for users who need assistance. Whether you're encountering technical difficulties or require guidance, pdfFiller provides resources to help simplify the entire documentation process.

Related California tax forms and regulations

Filing taxes in California entails understanding several related tax forms and regulations. Aside from Form 8453-LLC, there are other essential documents, including Form 568 for LLCs operating in California, and the corresponding state tax forms.

Utilizing resources that provide links to both IRS and California-specific forms is beneficial for continuous monitoring of changes in regulations that may affect your LLC.

Interactive tools for document management

pdfFiller offers interactive tools that facilitate effective document management tailored for forms like 8453-LLC. Features such as timeline tracking enable users to manage deadlines and ensure timely submissions.

These tools not only enhance productivity but also ensure that all associated documents, including Form 8453-LLC, are managed efficiently, meeting the needs of both individual users and teams.

Testimonials and success stories

Many users have successfully navigated the filing process of Form 8453-LLC using pdfFiller, sharing positive experiences about the platform's intuitive design and excellent support.

These testimonials illustrate not only user satisfaction but also how pdfFiller empowers individuals and teams to streamline their documentation process efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2023 form 8453-llc california from Google Drive?

How do I execute 2023 form 8453-llc california online?

How do I fill out 2023 form 8453-llc california on an Android device?

What is 2023 form 8453-llc california?

Who is required to file 2023 form 8453-llc california?

How to fill out 2023 form 8453-llc california?

What is the purpose of 2023 form 8453-llc california?

What information must be reported on 2023 form 8453-llc california?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.