Get the free Personal Guaranties

Get, Create, Make and Sign personal guaranties

Editing personal guaranties online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal guaranties

How to fill out personal guaranties

Who needs personal guaranties?

Personal Guarantees Form - A Comprehensive How-to Guide

Understanding personal guarantees

A personal guarantee is a legal commitment where an individual agrees to pay a debt or fulfill an obligation if the primary party defaults. This form is crucial in various financial transactions as it provides an additional layer of security for lenders and suppliers, especially when dealing with small businesses or startups. Without a personal guarantee, creditors might minimize their lending or require higher interest rates due to perceived risk.

Personal guarantees play a significant role in the context of financing and contracting. They are especially important when the borrower or lessee lacks substantial assets or credit history. Common scenarios requiring personal guarantees include business loans, commercial lease agreements, and contracts with vendors. In these instances, lenders or leases seek assurance that they can recover outstanding payments from a reliable source.

Types of personal guarantees

Understanding the various types of personal guarantees is essential for both borrowers and lenders. There are primarily four types of guarantees, each serving different purposes based on the agreement's structure. Unconditional personal guarantees hold the individual accountable for any outstanding balance, while limited personal guarantees restrict liability to a specific amount or time frame.

Individuals may also enter into joint personal guarantees, meaning two or more people share the obligation in a single guarantee agreement. Lastly, secured personal guarantees involve collateral to cover the obligation, whereas unsecured personal guarantees rely solely on the guarantor's promise. Knowing these distinctions is vital in evaluating the risks and commitments involved.

The personal guarantees form: overview

The personal guarantees form serves as the official document that delineates the guarantee agreement between parties. This form is crucial for ensuring that all parties understand their rights, obligations, and the scope of the guarantee. It formalizes the personal promise to cover debts in case the primary borrower defaults.

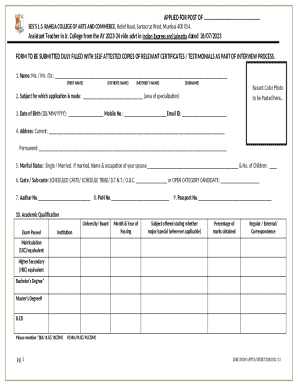

Essential components of the personal guarantees form typically include personal information such as the guarantor’s name, contact details, and identification numbers. Additionally, financial information must be included to verify the guarantor’s capacity to cover the liabilities. Finally, clear agreement terms outline the conditions under which the guarantee is invoked, enabling all parties to have a shared understanding of the commitments involved.

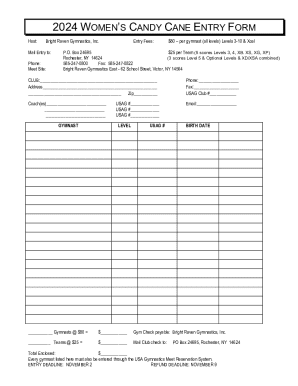

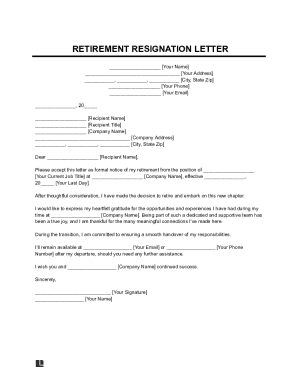

How to access the personal guarantees form

Accessing the personal guarantees form is efficient through platforms like pdfFiller. Users can find various templates tailored to different scenarios, ensuring compliance with legal requirements and personal needs. Navigating pdfFiller allows users to search specifically for the personal guarantees form to access their desired document quickly.

Once located, downloading and editing the form is simple. Users can leverage pdfFiller’s interactive tools for customization, allowing them to input necessary details without hassle. This makes it an ideal resource for individuals and teams focused on streamlined document management. Being able to fill and edit forms online also ensures that they can make updates from anywhere, which is vital for busy professionals.

Step-by-step instructions for filling out the personal guarantees form

Filling out the personal guarantees form involves a systematic approach to ensure accuracy and completeness. Here is a step-by-step guide for effectively completing the form:

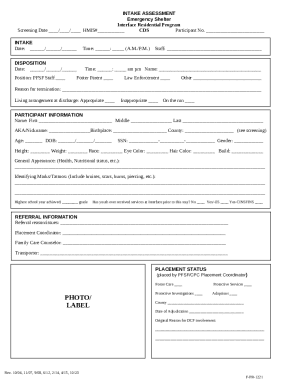

Managing your personal guarantees form

After completing the personal guarantees form, managing it properly is essential. Begin by securely storing your completed form in a cloud-based solution like pdfFiller, ensuring access and safety. This allows you to retrieve the document anywhere, anytime, which is particularly beneficial if you need to provide your guarantee to lenders or landlords.

Additionally, pdfFiller allows users to share their completed forms seamlessly with stakeholders. This can involve sending the document directly via email or sharing a secure link that others can access. Keeping track of changes and updates is also vital, particularly if modifications occur, which might affect your obligations.

Mistakes to avoid when completing the personal guarantees form

Completing the personal guarantees form requires attention to detail to avoid common pitfalls. Many individuals overlook vital information or fail to thoroughly understand the implications of the terms. It's crucial to avoid errors such as misspelled names, incorrect financial data, and misunderstood agreement clauses.

A proactive approach includes double-checking all entries against your documentation for accuracy and completeness. Consulting with a legal advisor before submission also strengthens your position, ensuring that the liabilities and obligations you are committing to are fully comprehended.

Frequently asked questions about personal guarantees

Questions regarding the implications of a personal guarantee often arise among those considering signing such documents. Understanding what happens if a guarantee is called upon plays a crucial role in decision-making. If default occurs, the guarantor may be pursued for the owed amount, affecting personal finances. Another common query addresses whether personal guarantees can be revoked; typically, they cannot be altered unilaterally, but negotiation is possible before execution.

The duration of a personal guarantee agreement varies based on the terms specified within the document. Some agreements remain in force for a fixed term, while others last until the debt is fully repaid. It's important to analyze the specifics in any agreement signed to ensure a full understanding of the terms involved.

Related documents and resources

Users can benefit from other relevant templates and articles available on pdfFiller. Whether you are looking for loan agreements, lease contracts, or liability waivers, these resources provide valuable insights into financial obligations and protections. Familiarizing yourself with such documents enhances your understanding of financial liability and personal accountability.

For those seeking tailored legal advice, connecting with professionals can help clarify complex situations related to personal guarantees. Accessing guidance from experts strengthens your knowledge and prepares you for potential negotiations or disputes in the future.

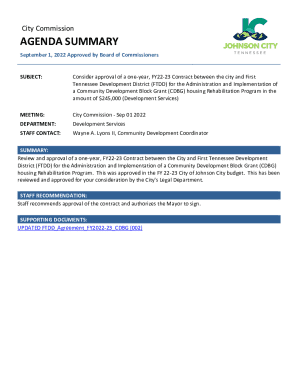

Insights on loan servicing and liquidation processes

Navigating the intricacies of loan servicing and potential liquidation processes involves understanding how personal guarantees interact within these frameworks. When a loan defaults, personal guarantees can lead to immediate recovery actions by lenders. This can strain relationships between the guarantor and the borrower, emphasizing the importance of knowing one's commitments before signing.

During liquidation, lenders may invoke personal guarantees to recover owed amounts. This process may involve legal steps and thorough documentation, potentially placing personal assets at risk. Therefore, it is crucial for any potential guarantor to examine how personal guarantees can affect one’s financial outlook and to safeguard personal assets through informed decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify personal guaranties without leaving Google Drive?

How can I send personal guaranties to be eSigned by others?

How do I fill out the personal guaranties form on my smartphone?

What is personal guarantees?

Who is required to file personal guarantees?

How to fill out personal guarantees?

What is the purpose of personal guarantees?

What information must be reported on personal guarantees?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.