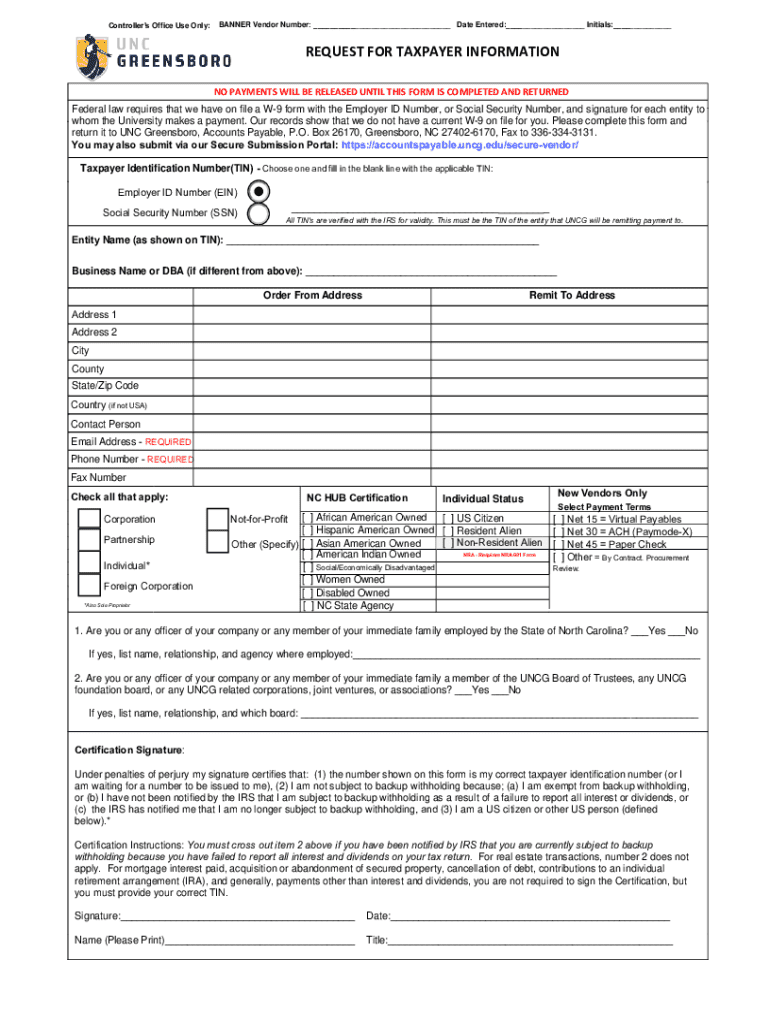

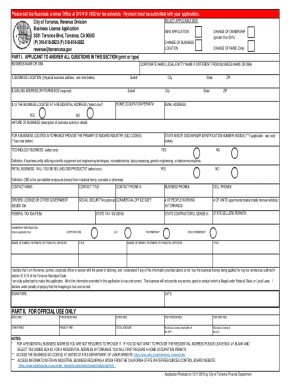

Get the free REQUEST FOR TAXPAYER INFORMATION - Accounts Payable

Get, Create, Make and Sign request for taxpayer information

Editing request for taxpayer information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out request for taxpayer information

How to fill out request for taxpayer information

Who needs request for taxpayer information?

Comprehensive Guide to the Request for Taxpayer Information Form

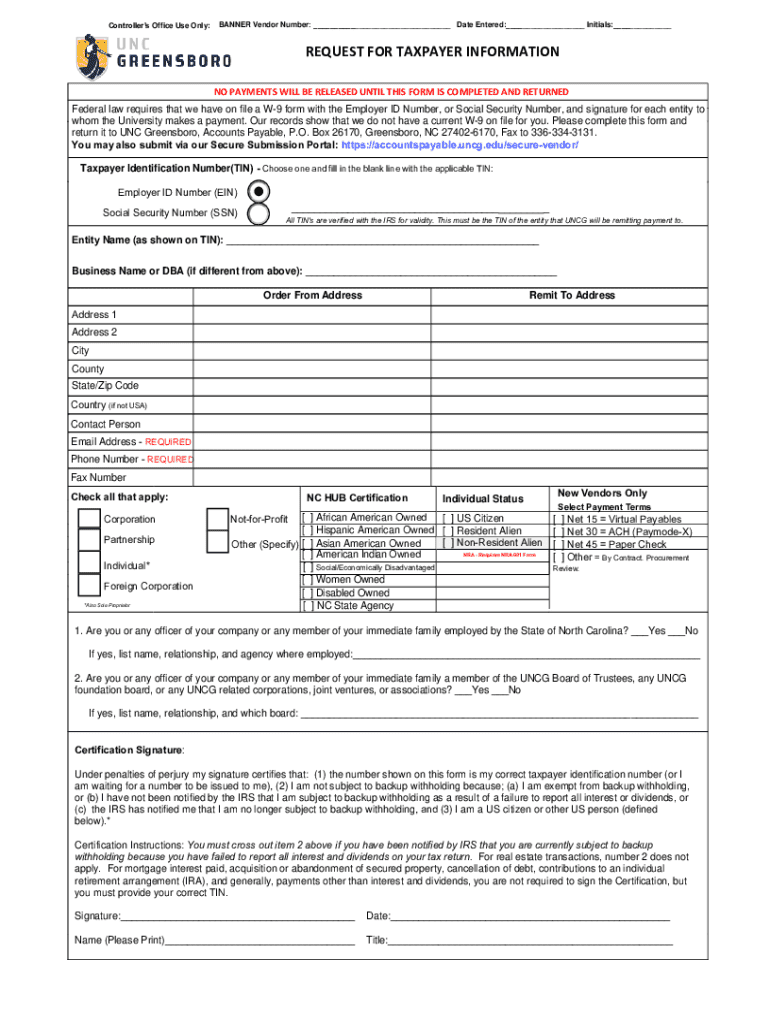

Understanding the Request for Taxpayer Information Form

The Request for Taxpayer Information Form is crucial for maintaining compliance within the tax system. It serves primarily to gather taxpayer identification credentials necessary for accurate tax reporting. Whether used by individuals or businesses, this form encapsulates essential data that helps prevent tax fraud and ensures that income is reported correctly to the IRS.

As such, understanding the contexts in which this form is utilized is vital. Common scenarios include contractor agreements, where businesses must ascertain the taxpayer identification information of independent contractors, or when the IRS requests sensitive information directly from taxpayers. Every instance in which this tax-related data is exchanged underscores the form's importance in upholding financial integrity.

Who needs to use this form?

The necessity to utilize the Request for Taxpayer Information Form extends to a wide range of individuals and organizations. Primarily, independent contractors and freelancers need to submit this form when businesses hire them for services rendered. Another prevalent situation arises when businesses engage in contracts that require accurate tax reporting between parties.

Types of taxpayer information forms

The Request for Taxpayer Information Form encompasses several types of tax forms, each tailored to specific reporting requirements. Understanding these variations is essential for ensuring compliance and accurate reporting.

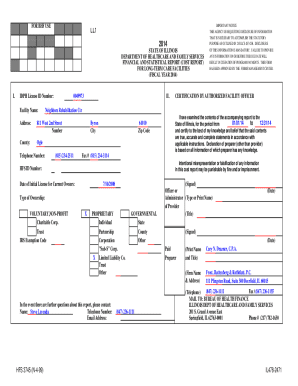

Form W-9: Request for taxpayer identification number and certification

Perhaps the most well-known of these is Form W-9. This document requests taxpayer identification numbers and serves as a means for businesses to collect the necessary information from individuals and entities. It is widely used for independent contractors and freelancers who provide services to companies.

Businesses utilize Form W-9 to gather the information required to report payments to the IRS accurately. Without proper documentation, companies may face penalties for misreporting or failing to withhold required taxes.

Other relevant tax forms

Aside from Form W-9, there are other forms related to taxpayer information, including Form W-8 and Form 1099. Form W-8 is designed for foreign individuals and entities to certify their foreign status, which can exempt them from certain U.S. tax withholdings.

Meanwhile, Form 1099 is an informational return that reports income received by contractors. Businesses need to understand the differences in usage of these forms to ensure they are meeting IRS requirements effectively.

Step-by-step process for completing the request for taxpayer information form

Completing the Request for Taxpayer Information Form can seem daunting; however, following a systematic approach can simplify the process significantly. Here’s how to tackle it effectively.

Gather required information

Before starting, it's essential to gather all necessary personal and business identification details. This includes your full name, mailing address, phone number, and your taxpayer identification number (TIN) or Social Security Number (SSN) if you are an individual.

Additional specifics may be required depending on the context of the request. For instance, businesses may need to identify their legal entity type or provide the name of the business associated with the TIN.

Detailed instructions for filling out the form

Filling out the form involves completing several sections carefully. Start by providing your name and the name of your business (if applicable) in the designated spaces.

Common mistakes to avoid

While completing the form may seem straightforward, common errors can lead to issues with tax compliance. One prevalent mistake is entering an incorrect taxpayer ID, which can result in potential discrepancies. Additionally, failing to sign and date the form renders it invalid, which can cause unnecessary delays in processing by the IRS.

Editing the request for taxpayer information form using pdfFiller

Using pdfFiller for editing the Request for Taxpayer Information Form enhances the process significantly. Its user-friendly interface and robust features allow users to complete their documents effortlessly.

Uploading your document

The first step in utilizing pdfFiller is uploading your document. This platform supports various formats, including PDFs, Word documents, and images. Simply drag and drop your file into the interface or use the upload button to select it from your device.

Leveraging pdfFiller tools to edit

Once your document is uploaded, pdfFiller provides an array of tools to facilitate editing. Users can modify text, insert annotations, and add comments where necessary. Moreover, electronic signatures can be added seamlessly, ensuring the document retains its formal integrity.

Signing the request for taxpayer information form

Signing the Request for Taxpayer Information Form not only validates your information but also adds a layer of legal protection. The signatures confirm that you attest to the accuracy of the revealed data.

Importance of a signature

Legal implications tied to signing such forms underscore the responsibility you hold to provide true and accurate information. Falsifying information can lead to severe penalties, making your signature an essential requirement.

eSignature options with pdfFiller

With pdfFiller, electronically signing documents transforms the traditional notion of signing paper forms. The platform ensures not only ease of use but also security measures to authenticate your identity. Follow the guided prompts on pdfFiller to complete your signature, maintaining the integrity of your document.

Collaborating on the request for taxpayer information form

Collaboration plays a pivotal role in completing the Request for Taxpayer Information Form, especially for teams and businesses requiring input from various departments. pdfFiller offers robust collaboration features to enhance teamwork effectively.

Sharing the form with others

Once the form is ready, sharing it with stakeholders becomes seamless through pdfFiller’s secure sending options. You can deliver the document via email, or share a secure link with recipients, ensuring confidentiality throughout the process.

Managing feedback and revisions

pdfFiller enhances collaboration further by allowing users to utilize comment features, enabling stakeholders to provide feedback directly on the document. This real-time interaction simplifies the review process and helps maintain an organized approach to tracking changes made.

Storing and managing your taxpayer information form

Managing the Request for Taxpayer Information Form doesn’t end once it is completed. Proper storage and organization are key factors in maintaining compliance and ensuring easy access when needed.

Cloud storage benefits

Utilizing cloud storage for your completed forms ensures accessibility from any device, making it easier to retrieve important documents. pdfFiller's cloud-based solutions also align with data protection regulations, affirming your adherence to compliance mandates.

Organizing and retrieving documents efficiently

To make document retrieval efficient, consider implementing a structured labeling and folder management system. pdfFiller allows you to create specific folders for different document types, helping streamline your document organization and enabling quick searches when needed.

Frequently asked questions (FAQs)

What should do if make a mistake on the form?

If a mistake is made on the Request for Taxpayer Information Form, it is advisable to correct it immediately before submitting. Use the editing features in pdfFiller to make the necessary adjustments, and ensure any revisions are properly signed to maintain their validity.

How often do need to submit this form?

The frequency of submitting the Request for Taxpayer Information Form largely depends on your specific circumstances. For example, if you frequently engage with new clients or contractors, you may need to resubmit the form for each arrangement. Conversely, if no changes in your taxpayer status occur, the form may remain valid until an update is necessary.

Where can find more help with taxpayer forms?

For additional assistance with taxpayer information forms, explore the resources on pdfFiller. Their platform provides comprehensive guides, templates, and customer support to help you navigate the complexities of tax documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the request for taxpayer information in Chrome?

How do I complete request for taxpayer information on an iOS device?

How do I fill out request for taxpayer information on an Android device?

What is request for taxpayer information?

Who is required to file request for taxpayer information?

How to fill out request for taxpayer information?

What is the purpose of request for taxpayer information?

What information must be reported on request for taxpayer information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.