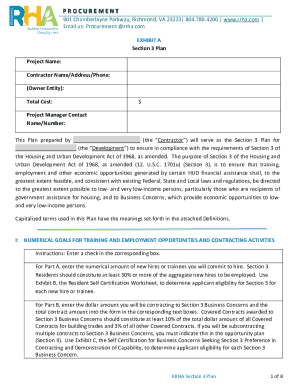

Get the free Payroll Tax FormsNewark, NJ

Get, Create, Make and Sign payroll tax formsnewark nj

How to edit payroll tax formsnewark nj online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll tax formsnewark nj

How to fill out payroll tax formsnewark nj

Who needs payroll tax formsnewark nj?

Payroll Tax Forms in Newark, NJ: A Comprehensive Guide

Understanding payroll tax forms in Newark, NJ

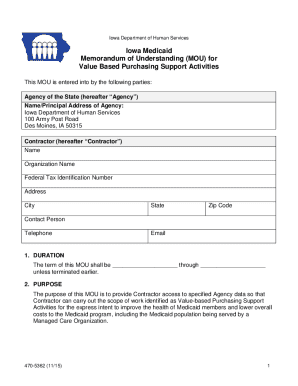

Payroll tax forms serve as essential documentation for both businesses and employees. They ensure compliance with federal and state tax regulations by providing details about wages, withholdings, and contributions. Particularly in Newark, NJ, being familiar with the correct payroll tax forms can simplify payroll management and enhance organizational efficiency.

Employers are mandated to submit various forms that report their employees' earnings and the taxes withheld. This not only fosters transparency but also helps the state and federal government track taxable income and ensure that tax liabilities are met accurately.

What are payroll tax forms?

Payroll tax forms are standardized documents that businesses use to report wages paid and taxes withheld from employee paychecks. Their importance cannot be overstated, as inaccuracies could lead to penalties and increased scrutiny from tax authorities.

Types of payroll tax forms specific to Newark, NJ

In Newark, NJ, specific payroll tax forms that employers frequently use include the NJ-941, NJ-W-2, and NJ-1040. Each of these forms has a distinct purpose and is crucially related to the larger context of payroll processing.

Understanding these forms is vital; while federal forms follow a common structure, state-specific forms like those in New Jersey may have additional requirements, examples, and stipulations.

The importance of accurate payroll tax form submission

Submitting payroll tax forms accurately is not merely about compliance; it directly impacts your business’s financial health and reputation. Errors can not only lead to penalties but also require time-consuming corrections and revisions, ultimately harming your organization’s operations.

Understanding the consequences of errors

Failure to submit accurate payroll tax forms may incur substantial fines, potentially reaching thousands of dollars. Additionally, employers might face audits from the IRS or state tax authorities, leading to an expensive and distracting examination of financial records.

Businesses must ensure that all forms are filled out correctly, emphasizing the need for a thorough review process before submission.

The role of deadlines

Under New Jersey law, forms like the NJ-941 must be submitted quarterly, while the NJ-W-2 is generally due by January 31st of the following year. Understanding these deadlines is crucial as late submissions can trigger penalties and interest charges.

Timely submissions help maintain a good standing with tax authorities, avoiding unnecessary complications down the line.

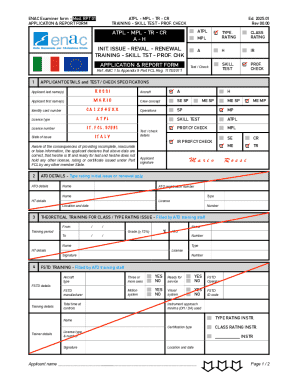

How to fill out payroll tax forms

Filling out payroll tax forms accurately is essential for smooth payroll operations. Below, we provide a detailed guide on completing some of the most common payroll tax forms.

Step-by-step guide for NJ-941

The NJ-941 form is a quarterly reporting document that details wages and tax withholdings. To complete it correctly, follow these key steps:

Common pitfalls include neglecting to double-check the EIN and entering incorrect wage figures, so always ensure that these entries are accurate.

Detailed instructions for NJ-W-2

The NJ-W-2 form requires detailed employee information. When filling it out, be sure to:

Completing the NJ-W-2 accurately is crucial as it directly impacts both employers and employees.

Filling out NJ-1040

For freelancers and self-employed individuals, the NJ-1040 form is essential. Gather necessary documents, such as:

Take your time with this form; ensuring all accurate income details are reported can significantly impact tax liability.

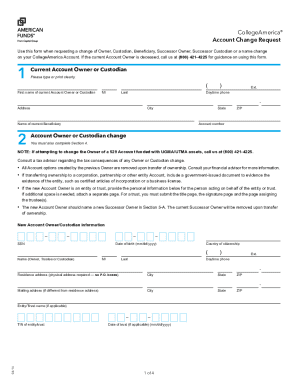

Tools for managing payroll tax forms

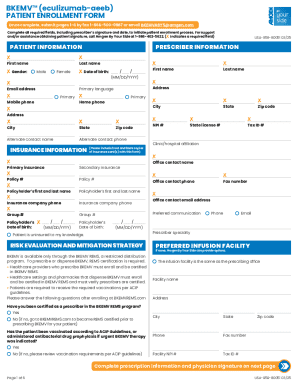

Managing payroll tax forms can be streamlined using technology. One platform that stands out is pdfFiller, which offers a variety of tools for document management.

Interactive tools provided by pdfFiller

pdfFiller allows users to edit, eSign, and manage payroll tax forms efficiently. Its user-friendly interface simplifies the entire process.

Live editing features

With pdfFiller’s live editing capabilities, multiple team members can collaborate in real-time. This feature facilitates quick reviews and updates, ensuring that forms are filed accurately and timely.

Annotation features for clarity

Utilizing pdfFiller’s annotation tools can enhance clarity. Marking specific fields for intended use and explanations ensures all team members are aligned, minimizing errors associated with communication gaps.

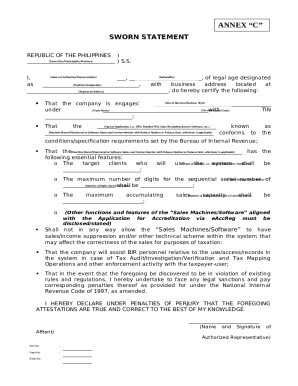

Common mistakes and how to avoid them

Navigating payroll tax forms can be challenging, but several common mistakes can be avoided with careful attention. Awareness of these pitfalls is the first step toward effective completion.

Incorrect information entry

One of the most common mistakes is entering incorrect information, such as the Employer Identification Number (EIN) or employee details. Ensure that this information is double-checked, as discrepancies can complicate matters with tax authorities.

Failing to keep copies

Another often-overlooked point is the necessity to retain copies of all filed forms. This is critical for audits and verifying previous submissions.

Misunderstanding state-specific requirements

Every state has its own tax laws and regulations. For New Jersey, understanding these nuances is vital for compliance. Utilizing resources available through NJ’s Division of Taxation can help stay informed about any changes.

Frequently asked questions (FAQ)

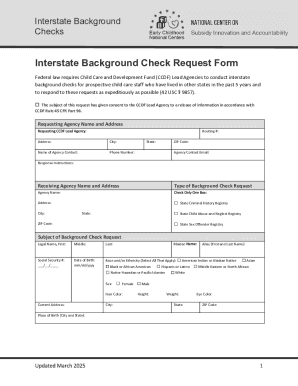

Can submit these forms electronically?

Yes, New Jersey allows for electronic submission of many payroll tax forms. This option facilitates faster processing and confirmation of receipt, making it a preferred method for most businesses.

Where to seek help if ’ confused?

If you find yourself needing assistance with payroll tax forms, the New Jersey Division of Taxation is an excellent resource. Additionally, consulting a tax professional can provide tailored advice on navigating complexities.

What to do in case of an audit?

If your business is selected for an audit concerning payroll tax forms, it’s important to remain calm and organized. Gather all relevant documentation, including copies of filed forms, and consult a tax professional for guidance on the audit process.

Next steps for payroll management

To manage payroll efficiently, regular updates on regulations are critical. Hiring a competent payroll administrator can also streamline processes and ensure compliance with ever-changing tax laws.

Regular update practices

Set a schedule for regular training sessions or informational updates pertaining to payroll processes and changes. This proactive approach will yield benefits in compliance and operational efficiency.

Leveraging pdfFiller for ongoing needs

Aside from payroll-related forms, pdfFiller can be employed to manage a variety of other essential documents, enhancing your organization’s workflow and document management practices.

Contact and support options

For any issues related to payroll tax forms or their management, reaching out to pdfFiller's customer support can provide timely solutions. Their resources and guidance can help ensure that your experience is as smooth as possible.

Accessing support for payroll tax issues

pdfFiller offers various support channels. Whether you prefer direct communication through email or chat, their support team is ready to assist with specific issues, queries, and technical support.

Community and help resources

Utilizing online forums and community support can greatly support your payroll management journey. Many experienced users share insights and solutions to common problems, offering a collaborative approach to overcoming challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send payroll tax formsnewark nj for eSignature?

How can I edit payroll tax formsnewark nj on a smartphone?

Can I edit payroll tax formsnewark nj on an iOS device?

What is payroll tax forms newark nj?

Who is required to file payroll tax forms newark nj?

How to fill out payroll tax forms newark nj?

What is the purpose of payroll tax forms newark nj?

What information must be reported on payroll tax forms newark nj?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.