Get the free Vacation Leave Cash Out Request Form

Get, Create, Make and Sign vacation leave cash out

How to edit vacation leave cash out online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vacation leave cash out

How to fill out vacation leave cash out

Who needs vacation leave cash out?

A comprehensive guide to the vacation leave cash out form

Understanding vacation leave cash out

Vacation leave cash out refers to the process by which employees can convert their accrued vacation days into cash. This option allows employees not only to benefit financially from their earned time off but also provides flexibility in managing their leave entitlements. Cashing out vacation leave can be particularly useful for those who may not have the opportunity to use their accrued leave due to workload or personal circumstances.

The primary purpose of cashing out vacation leave is to offer employees a way to access their earned benefits in monetary form, especially if they feel they cannot take the time off. Many employers encourage this option as it helps manage leave balances and reduces potential liabilities associated with untaken vacation days. Understanding how vacation leave accrual works is important, as different companies may have varied policies surrounding accumulation and cash-out processes.

Eligibility requirements for cashing out vacation leave

Eligibility to cash out vacation leave typically depends on individual company policies. Employers set their own rules regarding how much vacation leave can be cashed out and under what conditions. Generally, to qualify for cashing out vacation time, employees must meet specific criteria regarding length of employment and leave balance.

How to calculate your vacation leave cash-out

Calculating your vacation leave cash-out amount involves a few straightforward steps. First, you must review your accrued leave balance to determine how much vacation time you have available. To access your leave records, navigate to your company’s HR portal or request a copy from your HR department.

Next, identify your hourly rate. This process can vary depending on your employment type—salaried employees will calculate a daily rate based on their annual salary, while hourly workers can easily use their existing pay rate. The formula for calculating your cash-out amount is simple: multiply your accrued leave hours by your hourly wage.

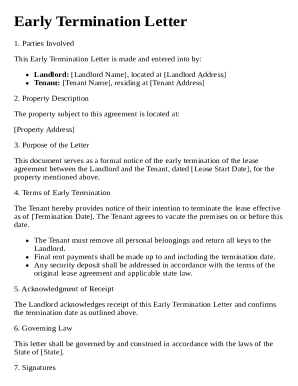

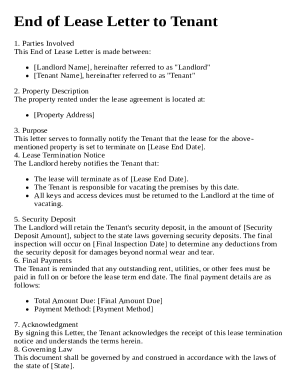

Step-by-step guide to filling out the vacation leave cash out form

Before starting to fill out the vacation leave cash out form, gather the necessary information. This typically includes your personal details such as name, employee ID, and contact information. You’ll also need your employment details like hire date and your department.

Once you have the required information, you can begin to fill out the form. Pay careful attention to each section; notably, ensure that you fill out your personal information section accurately and detail your leave requests correctly. Don’t forget about the acknowledgment and signature requirement, as it is essential for the processing of your request.

Submitting your vacation leave cash out request

When submitting your vacation leave cash out request, consider the recommended methods for ease of processing. Many companies offer online submission platforms where you can directly upload your completed form. Alternatively, you may choose to send the form directly via email to your HR department.

After submission, it's prudent to follow up to confirm the status of your request. Knowing whom to contact for inquiries can aid in resolving any issues swiftly.

Understanding the cash-out process flow

Understanding the cash-out process flow is essential for managing your expectations. Upon submitting your request, it typically goes through several stages of approval, which may include verification of your accrued balance and employment eligibility. Depending on the company, this process can take anywhere from a few days to several weeks.

Keep an eye out for potential delays, which may arise from incomplete paperwork or high volumes of requests during specific times of the year. Knowing how to address these issues proactively can help prevent unnecessary setbacks.

Tax implications of vacation leave cash-out

Tax treatment for vacation leave cash-outs can complicate financial planning. Generally, any funds received through a cash-out will be subject to normal income tax withholding, which means that the cash-out amount is treated as regular income. Factors such as your total earnings for the year and your filing status will influence your actual tax liabilities.

To manage your cash-out for tax efficiency, it’s advisable to consult with a tax professional, especially if you are in a higher tax bracket. They can help you strategize how the cash-out income might impact your overall tax situation.

Frequently asked questions (FAQs) about vacation leave cash outs

As companies differ in their approach to vacation leave cash-outs, several common questions arise. For instance, what if you don’t have enough vacation leave accrued to cash out? Typically, you will need to hold off until you have accumulated sufficient leave days. Many employers have policies capping the number of cash-outs per year, so it’s essential to check your specific company regulations.

Moreover, employees often ask about the fate of their cash-out requests if they leave the company. Generally, companies have policies in place that dictate how accrued leave is handled upon separation. Familiarizing yourself with these rules can prevent unpleasant surprises.

Need help?

If you encounter challenges while navigating the vacation leave cash out form process, assistance is readily available. Your HR department is an essential contact point for inquiries and clarification regarding company policies. Keep their contact information handy for quick resolutions.

Additionally, various online resources and tools can help you understand your rights as an employee regarding cash-out options and benefits. Whether you seek guidance on company-specific regulations or general information about leave policies, ensure you explore all avenues available to you.

Using pdfFiller to effectively manage your vacation leave cash out form

Managing your vacation leave cash out form effectively can be made easy with pdfFiller. This platform offers remarkable document management features that allow you to streamline the process. You can easily create, edit, and sign your cash-out request form online without the hassle of printing and scanning.

Additionally, pdfFiller provides collaborative tools that allow seamless communication with HR. You can invite a colleague or HR representative to review your cash-out form before submission, ensuring that all necessary sections are completed correctly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my vacation leave cash out in Gmail?

How do I make edits in vacation leave cash out without leaving Chrome?

How can I edit vacation leave cash out on a smartphone?

What is vacation leave cash out?

Who is required to file vacation leave cash out?

How to fill out vacation leave cash out?

What is the purpose of vacation leave cash out?

What information must be reported on vacation leave cash out?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.