Get the free ll 327

Get, Create, Make and Sign ll 327

Editing ll 327 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ll 327

How to fill out ll 327

Who needs ll 327?

A comprehensive guide to the 327 form

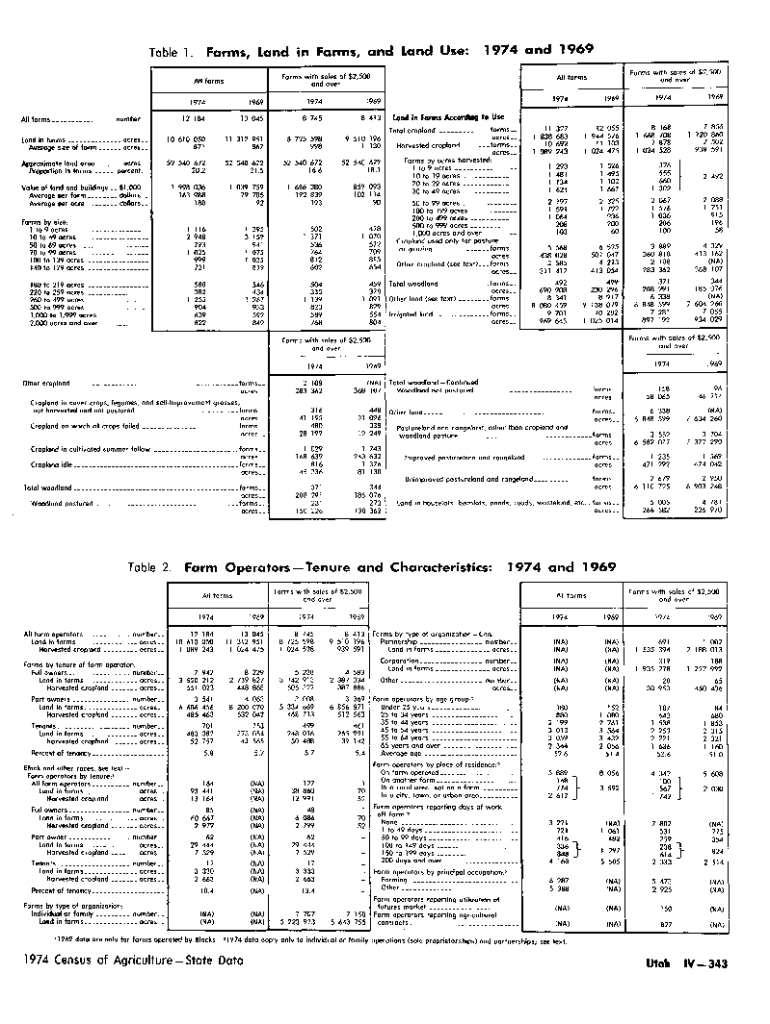

Overview of the 327 form

The LL 327 form is a crucial document utilized in various businesses and organizations, primarily for the purpose of reporting specific financial data. It serves as a standardized means of conveying information essential for auditing, compliance, and operational assessments. Accurate completion of the LL 327 form is vital to ensure that the data provided is precise, thus avoiding potential discrepancies that could lead to regulatory challenges or compliance issues.

In numerous industries, from finance to healthcare, the LL 327 form is employed for various applications, such as tax reporting, internal audits, and financial disclosures. Its significance cannot be understated, as it plays a pivotal role in regulatory compliance and financial accountability across organizations.

Key features of the 327 form

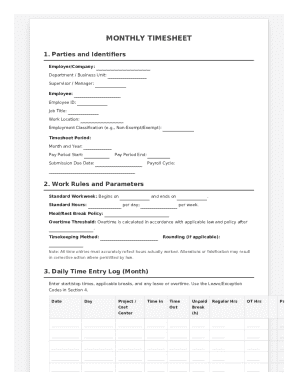

The LL 327 form features a structured layout designed to facilitate easy input and review of data. It consists of several sections, each focusing on specific components required for comprehensive reporting. Understanding the form’s structure is essential for users to ensure accurate and complete submissions.

Step-by-step instructions for completing the 327 form

To successfully complete the LL 327 form, following a structured approach can be beneficial. It starts with gathering the necessary information before diving into the actual form.

Editing and customizing the 327 form

Using pdfFiller's robust editing tools allows users to customize the LL 327 form efficiently. These features help transform a simple document into a comprehensive representation of the required data. Users can easily modify existing text or add new fields as needed, tailoring the form to best meet their needs.

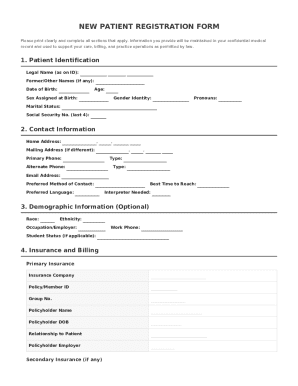

Signing the 327 form

eSignature features in pdfFiller enhance the process of signing the LL 327 form. This feature allows users to electronically sign documents, ensuring that the signature is secure and legally valid. Electronic signing has been adopted widely, streamlining various documentation processes across different sectors.

Submitting the 327 form

Once the LL 327 form is completed and signed, understanding your submission options becomes crucial. Users have flexible choices when it comes to submitting this form, whether electronically or via paper.

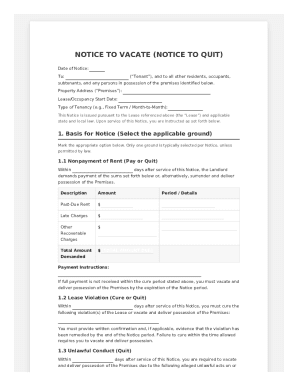

Troubleshooting common issues with the 327 form

Despite careful preparations, users may encounter difficulties when completing the LL 327 form. Understanding common mistakes and how to avoid them is key to a smooth process. Being familiar with potential issues can save time and mitigate frustration.

Best practices for managing your 327 forms

Effectively managing completed LL 327 forms is essential for any individual or organization. Organizing these documents properly enables easier access and future reference, making it simpler in times of need or audit.

Conclusion

The LL 327 form, when utilized effectively, equips users with an organized approach to managing essential financial data. By leveraging resources like pdfFiller, users gain access to efficient tools for editing, signing, and submitting documents seamlessly.

Exploring additional features available through pdfFiller enhances the user experience, ensuring that all documents, including the LL 327 form, are handled proficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ll 327 online?

How do I edit ll 327 in Chrome?

Can I sign the ll 327 electronically in Chrome?

What is ll 327?

Who is required to file ll 327?

How to fill out ll 327?

What is the purpose of ll 327?

What information must be reported on ll 327?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.