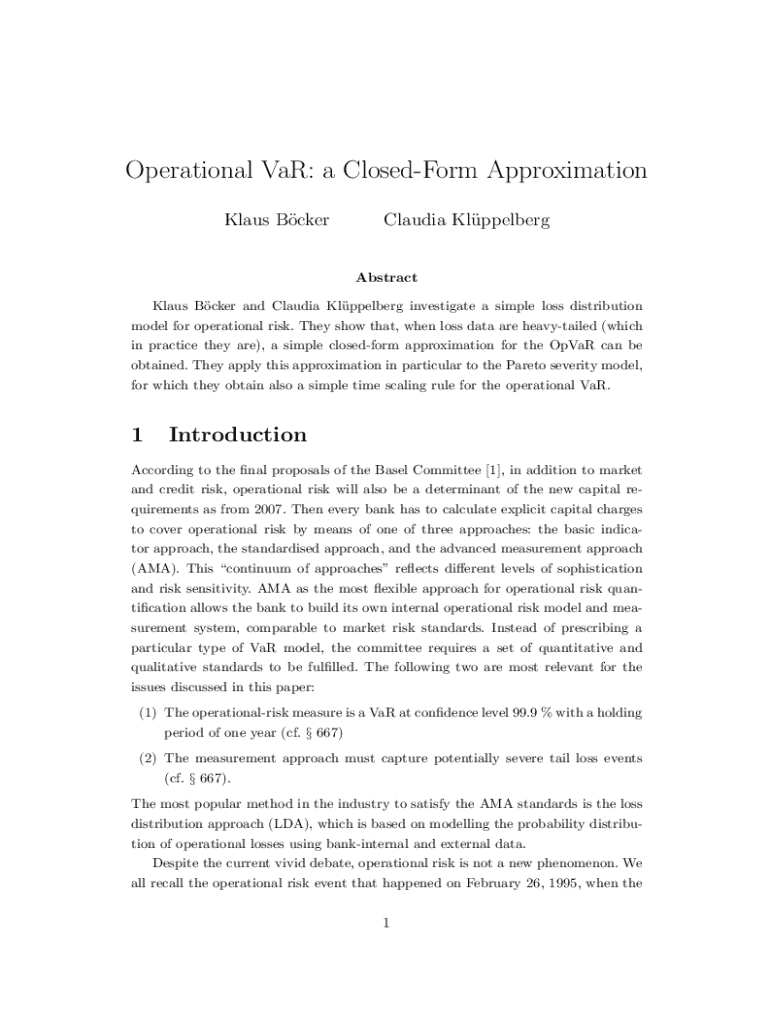

Get the free Operational VaR: a Closed-Form Approximation

Get, Create, Make and Sign operational var a closed-form

How to edit operational var a closed-form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out operational var a closed-form

How to fill out operational var a closed-form

Who needs operational var a closed-form?

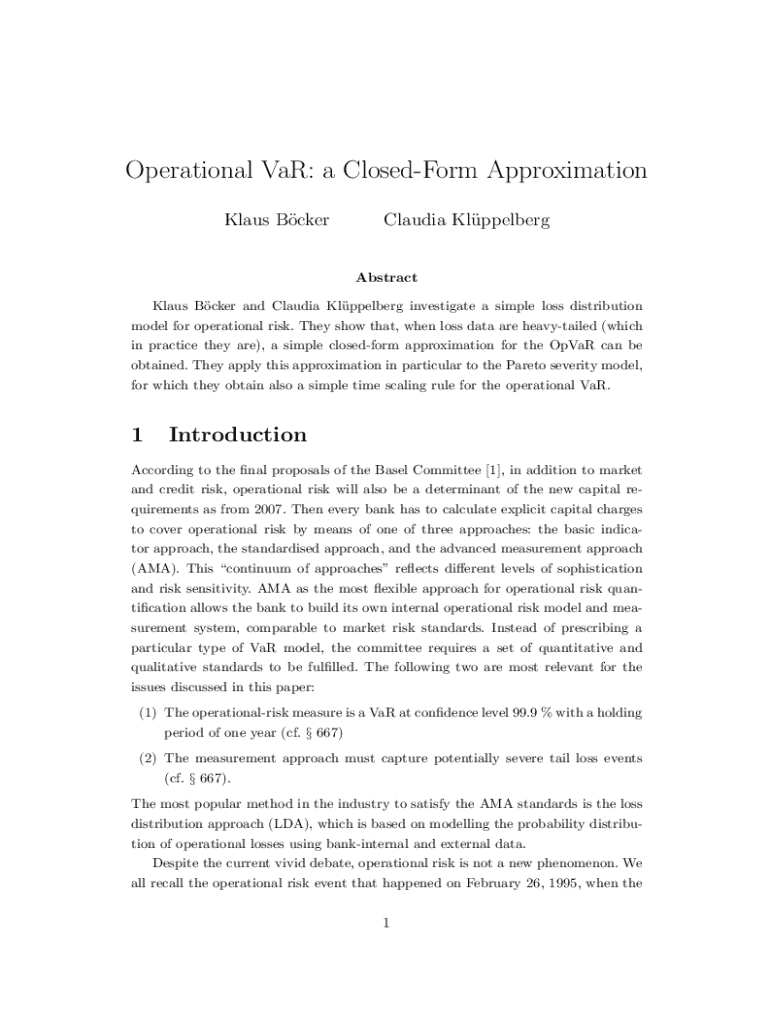

Operational VaR: A Closed-Form Approach

Understanding operational value at risk (VaR)

Operational Value at Risk (VaR) quantifies the potential loss of a firm from operational risks, which include risks arising from inadequate or failed internal processes, people, and systems, or from external events. Unlike market or credit risk, operational risk can stem from unpredictable and varied sources, making its assessment paramount for businesses. A closed-form approach allows risk professionals to derive insights quickly and accurately, crucial for making real-time decisions.

When analyzing risks, it’s vital to distinguish between operational, market, and credit risks. Market risk involves potential losses due to fluctuations in market prices, while credit risk pertains to the possibility of default by borrowers. Operational risk is unique, as it flows from internal structural weaknesses and external uncertainties. The importance of a closed-form approach cannot be overstated; it provides precise estimates without the computational burden of simulation methods.

Theoretical foundations of operational VaR

The theoretical underpinnings of operational VaR are grounded in established risk management theories that seek to quantify uncertainty. Several assumptions guide these closed-form approximations, with the understanding that operational losses may follow heavy-tailed distributions. This implies that extreme events, though rare, can occur with significant consequences. Understanding these characteristics is crucial for effectively modeling operational VaR.

Mathematical concepts, such as cumulative distribution functions and expected shortfall, are essential for calculating operational VaR. Furthermore, existing literature often highlights that these heavy-tailed distributions offer better representation of the nature of operational losses compared to normal distributions. Knowing the intricacies involved is vital for risk managers who aim to develop meaningful risk frameworks.

The closed-form approximation explained

Closed-form solutions offer a definitive expression that can be calculated directly without iterative methods or extensive simulations. This characteristic makes them exceptionally beneficial for operational VaR. With advantages such as computational efficiency and ease of implementation, closed-form models simplify the assessment of operational risks. By contrast, alternative methodologies like simulation and historical approaches can require extensive resources and time, which isn’t always feasible.

For risk managers, the appeal of closed-form approximations lies in their ability to produce results that are both immediate and reliable. Closed-form VaR calculations need fewer assumptions about the loss distribution, streamlining the process. Comparing these approaches highlights their inherent differences, revealing how closed-form solutions stand out in risk management frameworks, particularly in high-stakes operational environments.

Implementing the closed-form model

Implementing the closed-form model for Operational VaR involves a structured approach, ensuring that every phase from data collection to calculations is systematically executed. A strong starting point is understanding your loss distribution, followed by selecting the most appropriate model. The Pareto Severity Model, which effectively encapsulates rare but severe operational losses, serves as a valuable tool during this process.

Applying the closed-form formula requires incorporating severity parameters to customize it according to your organization's specific risk profile. Time scaling is another essential aspect, requiring adjustments to the VaR values to reflect different time horizons adequately. This step increases the model's applicability in varied operational contexts. Below is an itemized step-by-step guide for implementation:

To illustrate this process, consider a case where a financial institution experiences losses categorized by the Pareto distribution. By collecting historical data on operational losses, applying the closed-form formula, and analyzing the results, it becomes possible to derive actionable insights tailored to that organization’s specific risk landscape.

Practical applications of operational VaR

Closed-form VaR is particularly beneficial in environments characterized by high-frequency operational risks. For instance, companies in the financial sector, which consistently face operational uncertainties, can greatly enhance their risk management strategies using this approach. Real case scenarios demonstrate how businesses have swiftly adopted closed-form VaR for risk assessments and gained insights that drive their operational decisions.

Despite its advantages, several common pitfalls exist. Misunderstanding the underlying assumptions can lead to miscalculated risks, while overlooking external factors may skew results. Therefore, ensuring a comprehensive understanding of operational risk characteristics, as they relate to the closed-form model, is crucial for avoiding misconceptions that could lead to ineffective risk management.

Tools and resources for operational VaR calculation

Utilizing effective tools can significantly enhance the efficiency of calculating operational VaR. Services like pdfFiller offer advantages in document management that streamline the risk evaluation process. Its features allow teams to edit PDFs collaboratively, which is critical when aggregate data and documents relating to operational risk management must be shared and analyzed expeditively.

Furthermore, interactive tools available through pdfFiller can aid in calculating operational VaR, ultimately leading to precise risk evaluations. Templates are also available to help users document their operational VaR analysis effectively, ensuring clarity and consistency in reporting. This aspect not only enhances the quality of analysis but also meets privacy and security metrics necessary for compliance in risk management.

Best practices for managing operational risk with PDF solutions

Best practices for managing operational risk include streamlining document processes, from data entry to final report generation. pdfFiller offers functionalities that facilitate these processes, ensuring that users maintain efficiency and high-quality documentation throughout. Collaboration features allow teams to work cohesively on risk assessments, which is especially crucial in an environment where multiple stakeholders are involved in decision-making.

Additionally, using eSigning features strengthens compliance in risk management documentation, ensuring that all necessary rights and terms are adhered to under various regulatory frameworks. Furthermore, by integrating these best practices into operational frameworks, businesses can create resilient systems capable of effectively managing risks and reducing operational vulnerabilities.

Future trends in operational VaR and risk management

Looking forward, the operational VaR landscape is shaped by evolving regulatory requirements, which dictate how organizations must assess and manage operational risks. Compliance demands are likely to intensify, prompting businesses to enhance their reporting standards and methodologies. In this context, embracing technological innovations like AI and machine learning can equip organizations with the analytical capabilities needed to improve risk assessment and decision-making.

Preparation for these changes is essential. Organizations should begin investing in risk management frameworks that incorporate flexibility and adaptability, ensuring they remain compliant and can respond quickly to the dynamic risk environment. Knowledge acquisition through ongoing training, coupled with robust document management solutions, will be key in mastering the nuances of operational VaR moving into 2025 and beyond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find operational var a closed-form?

How do I make edits in operational var a closed-form without leaving Chrome?

How do I fill out operational var a closed-form on an Android device?

What is operational var a closed-form?

Who is required to file operational var a closed-form?

How to fill out operational var a closed-form?

What is the purpose of operational var a closed-form?

What information must be reported on operational var a closed-form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.