Get the free Credit Application FormFill Out and Use This PDF

Get, Create, Make and Sign credit application formfill out

Editing credit application formfill out online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application formfill out

How to fill out credit application formfill out

Who needs credit application formfill out?

Credit application form: Fill out form guide

Understanding the credit application form

A credit application form is a vital document used by lenders to assess an applicant's creditworthiness. Its primary purpose is to collect essential information about the applicant's financial background, allowing lenders to make informed decisions regarding loan approvals. Providing accurate information in these forms is crucial, as any discrepancies can lead to application denial or delays in processing.

Individuals typically encounter credit application forms when applying for loans, credit cards, or financing options for larger purchases such as vehicles or homes. Businesses might also require these forms when seeking credit lines, loans, or leasing agreements. An understanding of how to fill them out correctly can streamline these processes and enhance the chances of approval.

Types of credit application forms

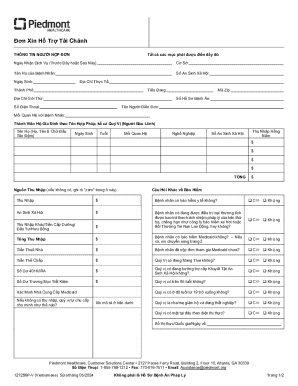

There are various types of credit application forms tailored to specific needs and contexts. Notably, personal credit application forms are designed for individual applicants, while business credit application forms cater to corporations and organizations seeking financial support. Understanding the nuances between these forms is vital to ensure that applicants provide relevant information.

Another key aspect is the distinction between secured and unsecured credit applications. Secured applications require collateral, making them less risky for lenders, whereas unsecured applications do not, often resulting in higher interest rates. Furthermore, applicants may choose to fill out online forms or traditional paper forms. Each method has unique advantages, such as convenience in online submissions and the physical reassurance of having a paper copy.

Preparing to fill out your credit application form

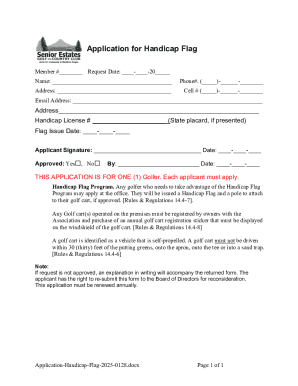

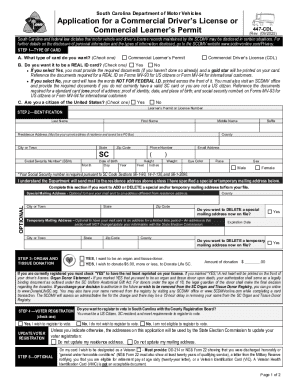

Before diving into the credit application form, gathering the necessary documents and information is essential. Typically, you'll need valid identification, which may include a driver's license or Social Security number, to verify your identity. Financial information is also paramount; you should be prepared to disclose your income, assets, and existing debts to help lenders evaluate your financial situation effectively.

Organizing this information can streamline the application process. Consider creating a checklist of required documents, such as pay stubs, bank statements, and tax returns. By preparing these supporting documents in advance, you can minimize the risk of errors and ensure your application is complete and accurate, thereby enhancing your chances of approval.

Step-by-step guide to completing the credit application form

Accessing the correct credit application form is your first step. Many lenders offer these forms online or allow you to download them as PDFs. Using a user-friendly interface like pdfFiller, applicants can quickly locate and retrieve the necessary forms. Whether you prefer to fill out the application digitally or print a hard copy, having access to your credit application form wherever you are is beneficial.

When filling out the application, pay close attention to each section. You’ll typically begin with personal information, including your name, address, and contact details. Next, provide comprehensive employment and income details—this might involve stating your job title, length of employment, and monthly earnings. The financial obligations section requires you to outline any outstanding debts and financial commitments. Lastly, remember that your signature and the date are required to validate the application, emphasizing the importance of careful reading before submission.

After completing the form, it’s crucial to review everything. Double-check for accuracy and completeness to avoid common mistakes that could delay processing. Basic errors such as typos or incorrect figures could result in setbacks, so take your time to ensure everything is correct.

Utilizing pdfFiller tools for enhanced application submission

PdfFiller offers a suite of tools designed to simplify the credit application process. One standout feature is the inclusion of interactive fields, enabling users to click and fill out forms efficiently. This responsiveness reduces the time spent on data entry and minimizes the risk of overlooking essential details.

The eSignature feature allows users to sign documents digitally—a significant advantage for those who value efficiency. This simplifies submission processes and improves turnaround times. Collaboration options are also available for teams or advisors, allowing multiple parties to work on a credit application seamlessly. Furthermore, with pdfFiller’s document editing capabilities, applicants can make immediate changes or corrections as needed, making the entire process user-centric and flexible.

Submitting your credit application form

Once your credit application form is complete, deciding between digital or printed submission is your next step. Digital submissions are often quicker and may result in faster processing times, whereas printed submissions provide a tangible record. Each option has advantages, so choose the one that best suits your circumstances.

Understanding response timelines is vital. Different lenders have varying processing speeds; generally, you can expect a response within a week, although some may respond much quicker. After submitting your application, follow-up steps are often necessary to track your application status. Staying proactive during this phase can keep you informed and prepared for any additional requirements from the lender.

Managing your credit application history

Keeping track of your credit application history can be a valuable resource. Use pdfFiller to securely store and access completed forms, ensuring that you can easily retrieve your application details whenever necessary. Additionally, incorporating safe document management practices—such as password protection and secure cloud storage—will help safeguard your financial information against unauthorized access.

Regularly updating your application information is critical, particularly if your financial situation changes. Whether you secure a new job or adjust your income, maintaining accurate records helps you portray your financial standing truthfully to lenders, which may increase your chances of approval in future applications.

Common FAQs about credit application forms

When navigating credit application forms, applicants often have various questions. For instance, how long does approval typically take? The answer can depend on the lender, but most respond within a week. Factors influencing credit application decisions may include your current credit score, income stability, and overall financial health—elements closely scrutinized by lenders during the evaluation process.

What should you do if your application is denied? In such cases, it’s essential to review any feedback provided by the lender, as it can guide your next steps. Addressing the reasons for denial—whether they’re related to your credit score or insufficient income—can enhance your applications in the future, paving the way for improved approval rates next time.

Best practices for future credit applications

Continually updating your financial information is a cornerstone for positive outcomes in future credit applications. Regular assessments of your credit report can reveal areas for improvement, such as mitigating existing debts or correcting inaccuracies. This proactive approach not only boosts your credit health but also enhances your chances of obtaining favorable terms when applying for credit.

Building a strong credit profile over time is equally important. This can involve strategic practices, such as ensuring timely payments on existing loans and diversifying your credit types responsibly. Utilizing tracking tools can aid your management of multiple applications, enabling you to monitor progress and organize efforts more effectively.

Leveraging pdfFiller for other document needs

PdfFiller isn’t just about credit applications; it extends to a wide array of forms for any documentation needs. From taxes to employment documents, pdfFiller simplifies your document workflow, giving users seamless access across devices. The versatility it offers can increase efficiency, allowing teams or individuals to focus on what truly matters in their financial journey.

Utilizing a cloud-based document management solution like pdfFiller provides numerous benefits, including enhanced security, easy collaboration, and accessibility from anywhere. This can substantially alleviate the frustrations often associated with document handling, helping users maintain precision and organization in their financial dealings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit application formfill out?

Can I create an electronic signature for the credit application formfill out in Chrome?

Can I edit credit application formfill out on an iOS device?

What is credit application formfill out?

Who is required to file credit application formfill out?

How to fill out credit application formfill out?

What is the purpose of credit application formfill out?

What information must be reported on credit application formfill out?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.