Get the free Asset Purchase Agreement between Tennessee Valley ...

Get, Create, Make and Sign asset purchase agreement between

How to edit asset purchase agreement between online

Uncompromising security for your PDF editing and eSignature needs

How to fill out asset purchase agreement between

How to fill out asset purchase agreement between

Who needs asset purchase agreement between?

Understanding Asset Purchase Agreements Between Parties

Overview of asset purchase agreement

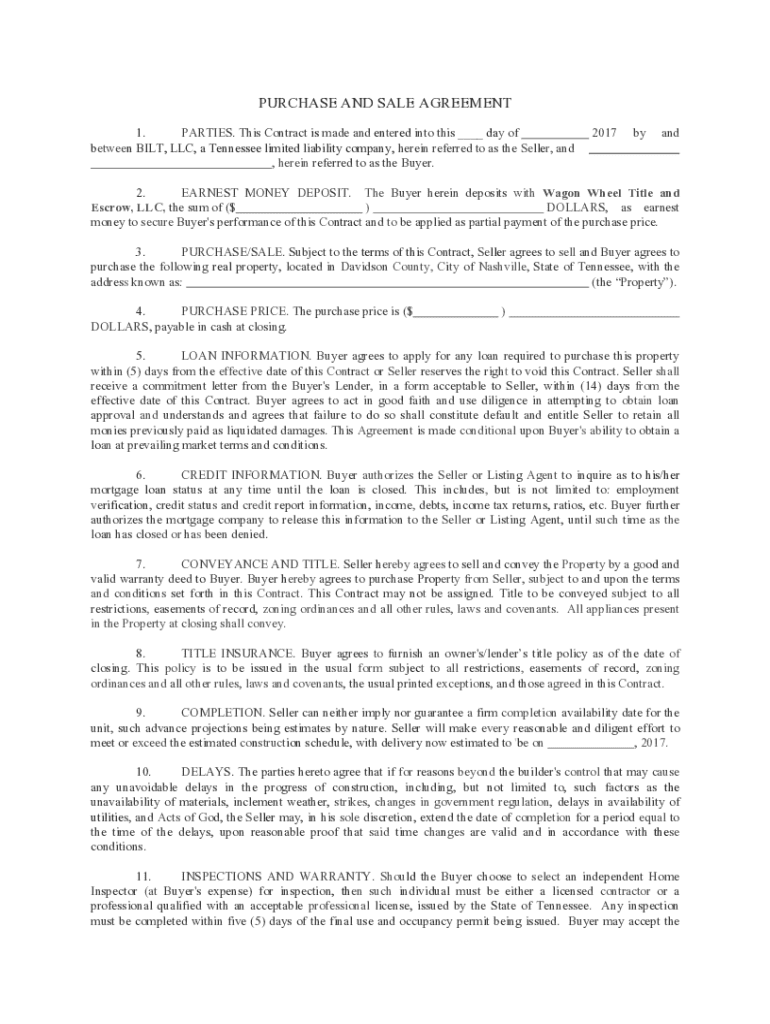

An Asset Purchase Agreement (APA) is a crucial legal document in which the buyer acquires specific assets of a business from the seller. Unlike a stock purchase, which involves buying shares in a company, an APA allows for the selective acquisition of assets tailored to the buyer’s needs. This distinction is significant as it can affect liabilities, taxes, and the overall valuation of the transaction.

The purpose of an asset purchase agreement is to clearly outline what assets are being sold and the terms under which the transaction takes place. This clarity is vital in preventing future disputes and ensuring a smooth transaction. An APA serves to protect both parties by setting forth agreed-upon conditions and terms, making it an essential tool in business transactions.

Key components of an asset purchase agreement

An asset purchase agreement is comprised of several critical components that define the transaction. Understanding these components is essential for both buyers and sellers, as they establish the framework for the deal.

A. Identification of assets

The assets being purchased are the centerpiece of an asset purchase agreement. This section requires a detailed description of each asset, ensuring both parties understand what is included in the sale. Assets can be classified as either tangible or intangible, where tangible assets might include equipment or inventory, while intangible assets could include patents, trademarks, or customer lists.

B. Purchase price and payment terms

Determining the purchase price is often a complex process involving negotiations and evaluations of the business’s worth. This section outlines how the price is established and specifies payment methods, which can vary from a lump sum payment to structured installments over time. Each option has its advantages and considerations for both parties.

. Conditions precedent

Conditions precedent are legal and financial requirements that must be met before the transaction is finalized. These conditions often include obtaining necessary regulatory approvals and satisfying any existing debts or liens on the assets.

. Representations and warranties

Representations and warranties are standard clauses in an APA that clarify the seller's assertions about the assets. They provide assurances regarding the condition, ownership, and legal status of the assets. For instance, the seller might warrant that there are no undisclosed liabilities associated with the assets, thereby protecting the buyer from potential risks.

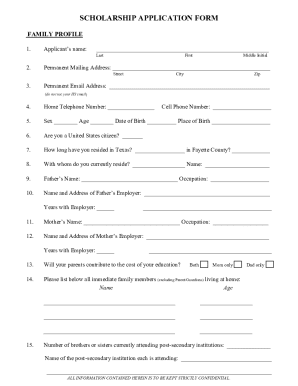

Drafting an asset purchase agreement

Drafting an asset purchase agreement involves significant detail and legal knowledge. Properly creating the document ensures that both parties are clear on expectations and obligations. Several steps should be taken when drafting this important agreement.

A. Initial considerations

Before drafting, evaluating the necessity of legal counsel is crucial. Consulting an attorney with experience in business transactions can prevent costly mistakes. Additionally, gathering all necessary documentation regarding the assets and business operations, such as titles, evaluations, and financial records, will streamline the drafting process.

B. Creating the document

When creating the asset purchase agreement, it’s important to format the document correctly, including headings, dates, and parties involved. Specific terms and conditions should be meticulously detailed to avoid ambiguity, while incorporating boilerplate clauses helps ensure essential legal protections are in place. Key items to include are definitions, limitations of liability, and dispute resolution mechanisms.

. Common pitfalls to avoid

Ensuring completeness and clarity in the asset purchase agreement is vital. Common pitfalls include vague terms, missing signatures, and neglecting to include all necessary exhibits or schedules that outline the specifics of the assets. Maintaining open communication between parties during the drafting phase helps mitigate misunderstandings.

Editing and reviewing the agreement

Editing and reviewing the asset purchase agreement is a critical step before finalizing the transaction. This phase ensures that all details are accurate and that the agreement comprehensively addresses the needs of both parties. Completing a thorough review can prevent disputes and misunderstandings post-signing.

A. Importance of proofreading

Proofreading is essential for verifying the accuracy of all details, including names, asset descriptions, and payment terms. Even minor errors can lead to significant complications. A second opinion from legal experts can provide insights and uncover issues that the primary parties may have overlooked.

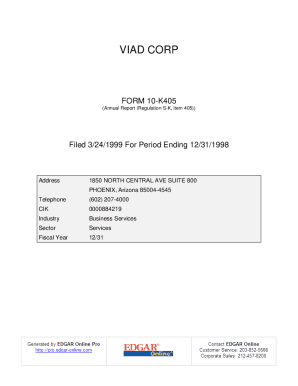

B. Utilizing pdfFiller for document management

pdfFiller offers robust tools that assist in reviewing and editing asset purchase agreements efficiently. Features such as collaborative editing, comments, and version history help streamline the process, allowing stakeholders to work together seamlessly. This platform supports ease of use, ensuring that all parties can access and modify documents as needed.

Signing and executing the agreement

Once the asset purchase agreement has been finalized, the next step is signing and executing the document. This formalizes the transaction, making it legally binding. How parties choose to sign can vary, impacting the overall execution process.

A. Different methods of signing

In today’s digital world, various signing methods are available, including electronic signatures and traditional physical signatures. Electronic signatures, when executed following legal standards, hold the same weight as handwritten ones. This flexibility can expedite the transaction process and enhance convenience, as parties can sign from anywhere in the world.

B. How to use pdfFiller for eSigning

Using pdfFiller for electronic signing is straightforward. Users can upload their asset purchase agreements, add signatures, and date the document all within a few clicks. By leveraging a cloud-based platform, parties can sign remotely, ensuring efficiency and reducing the time needed to execute the agreement.

Post-signing considerations

After signing the asset purchase agreement, several important considerations come into play that can impact the success of the transaction. These steps ensure that both parties fulfill their obligations as outlined in the agreement.

A. Storing the agreement securely

Proper storage of the asset purchase agreement is essential for safeguarding against disputes and ensuring compliance. Best practices include using secure digital solutions, such as pdfFiller, which offers encrypted document management features. Safekeeping the agreement in a reliable location enables quick access in the future.

B. Important follow-up actions

Once the agreement is signed, notifying all involved parties is crucial. Clear communication regarding timelines and responsibilities associated with the agreement helps in implementing its terms effectively. Ensuring compliance with the agreement’s stipulations fosters a healthy relationship between the buyer and seller.

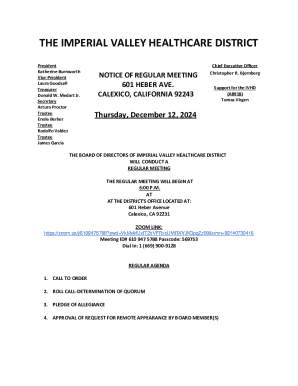

Interactive tools and resources

Leveraging technology can significantly ease the complexities involved in creating and managing an asset purchase agreement. Various tools and resources are available to assist parties in navigating this process.

A. Accessing templates and examples

Finding pre-designed asset purchase agreement templates on pdfFiller can save time and ensure compliance with best practices. These templates can serve as a valuable starting point, allowing users to customize them to fit specific transaction needs.

B. Utilizing calculators or checklists

Tools such as calculators for valuing assets or checklists for preparing for negotiations provide essential support in the process of drafting an asset purchase agreement. These resources help users stay organized and informed throughout the transaction.

. FAQs on asset purchase agreements

Addressing frequently asked questions regarding asset purchase agreements can clarify common concerns and provide quick answers. This resource can be particularly beneficial for parties new to this type of transaction, ensuring they understand the process and implications thoroughly.

Conclusion on best practices

In drafting, signing, and managing an asset purchase agreement, following best practices is essential for ensuring a successful transaction. This includes careful drafting, thorough review, and effective communication between parties. Utilizing tools like pdfFiller not only streamlines the entire process but also enhances efficiency and accuracy, allowing users to conduct business confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify asset purchase agreement between without leaving Google Drive?

How can I get asset purchase agreement between?

How do I complete asset purchase agreement between on an Android device?

What is asset purchase agreement between?

Who is required to file asset purchase agreement between?

How to fill out asset purchase agreement between?

What is the purpose of asset purchase agreement between?

What information must be reported on asset purchase agreement between?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.