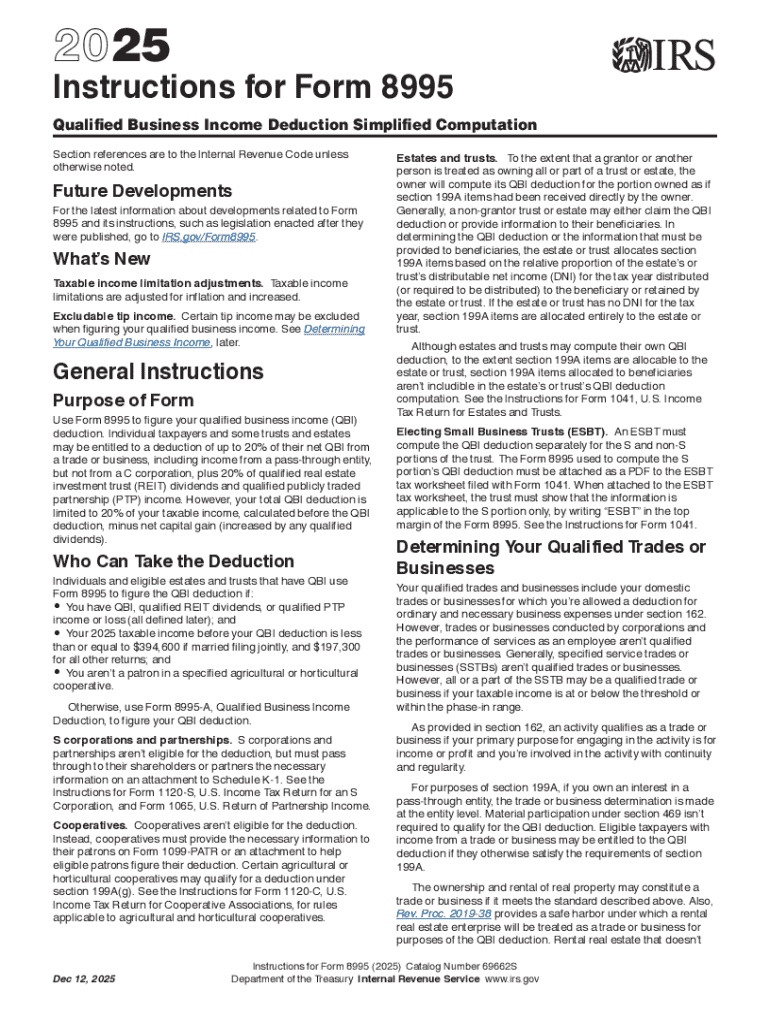

Get the free 2025 Instructions for Form 8995. Instructions for Form 8995, Qualified Business Inco...

Get, Create, Make and Sign 2025 instructions for form

How to edit 2025 instructions for form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 instructions for form

How to fill out 2025 instructions for form

Who needs 2025 instructions for form?

2025 Instructions for Form: A Comprehensive Guide

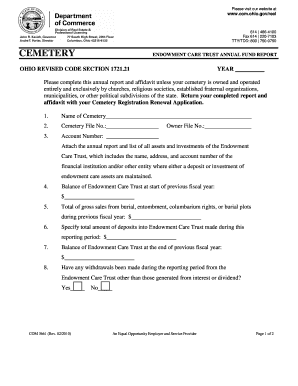

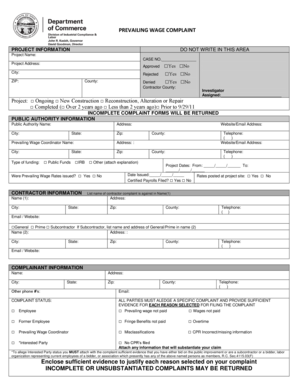

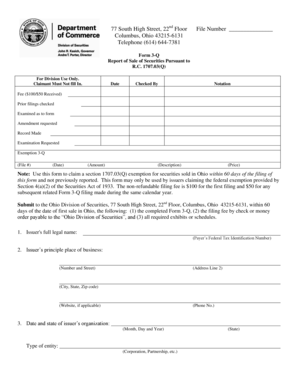

Overview of form 2025

Form 2025 serves as a crucial document for various financial and legal transactions that require clear reporting and compliance. Its primary purpose is to facilitate the accurate and standardized documentation of transfers involving real estate as well as other relevant properties. Correctly filling out Form 2025 is not just a procedural formality; inaccuracies can lead to penalties or complications in the transfer process.

For 2025, several key changes have been implemented compared to previous years, which users must understand to ensure compliance and efficiency in their filings. Staying informed about these changes will be necessary for individuals and entities looking to avoid issues related to their submissions.

Eligibility criteria

Form 2025 is not exclusively for one group; it caters to both individuals and organizations. Individuals engaging in property transactions or transfers, whether as a transferor or transferee, are required to use Form 2025. Organizations that handle property transactions, such as real estate firms, are also required to submit this form when relevant.

Common scenarios necessitating the use of Form 2025 include conventional sales, installment sale agreements, failed exchanges, or property transfers between family members for estate planning. Understanding the unique conditions that require this form will help users in preparing their documentation appropriately. Some exceptions apply, particularly in cases involving charitable donations or government transfers, and users should be aware of these special cases.

Detailed instructions for completing form 2025

Completing Form 2025 requires careful attention to detail, with several sections addressing specific aspects of the transfer process. The first section focuses on general information, where users must enter required personal information such as names and addresses. Legal considerations, including property descriptions and transaction dates, must also be accurately provided.

The financial information section requires users to report income accurately, often related to the sale or exchange of property. Necessary supporting documents, such as the sale contract and previous tax records, should be prepared to validate the reported figures. Finally, the declaration and signature section confirms the accuracy of the information provided; users can utilize eSigning options through pdfFiller to streamline this process.

Tips for accurate filing

Avoiding common mistakes can significantly ease the filing process for Form 2025. Users often overlook critical details, such as incorrectly stating legal descriptions or failing to report all income sources accurately. To prevent these errors, double-check entries against supporting documents. Familiarizing yourself with best practices for filling out this form is essential.

The tools offered by pdfFiller enhance accuracy by allowing for edits, annotations, and comments prior to submission. Engaging with these features not only assists users in crafting more precise forms but also allows for collaborative input, which can be particularly beneficial in team settings.

Submitting form 2025

Submitting Form 2025 can be done through several methods. Most individuals choose to submit online for convenience, but mailing is also an option for those preferring traditional methods. Understanding the submission process clearly can prevent delays in processing and potential fines from late filing.

Be aware of submission deadlines to avoid penalties. For example, submissions related to transactions from 2024 may have tight deadlines that extend into early 2025. Tracking submission status after filing is also conveniently managed through pdfFiller, ensuring you always know where your document stands.

Post-submission steps

After submitting Form 2025, you can expect a processing period during which the authorities review the documentation for accuracy and completeness. It is advisable to keep the submission confirmation on hand until the process is fully resolved. Users often have questions surrounding timelines and processing issues, which can be clarified by accessing the frequently asked questions section related to Form 2025.

In case of any complications or issues, contacting support for assistance can be vital. pdfFiller provides direct access to customer support for following up on submissions or resolving queries related to filling or editing the form.

Interactive tools available on pdfFiller

pdfFiller is equipped with several interactive tools to facilitate the efficient completion and management of Form 2025. Form editing features allow users to navigate any necessary changes seamlessly. Educational tutorials on how to edit PDF documents and add signatures can significantly enhance user experience.

Collaboration tools within pdfFiller, such as the ability to share and comment on documents, enable teams to work more effectively on Form 2025. With cloud storage access, users can manage their documents securely, ensuring that vital information is readily available at all times.

Additional assistance

For those seeking further assistance with Form 2025, numerous help resources are available. Users can contact dedicated customer service for direct support or access pdfFiller's tutorials and webinars, which provide practical, hands-on guidance on form usage and best practices for accuracy in filing.

By making these resources available, pdfFiller equips users with the knowledge and tools necessary to ensure a smooth and hassle-free experience when dealing with Form 2025.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2025 instructions for form in Gmail?

How do I complete 2025 instructions for form on an iOS device?

How do I complete 2025 instructions for form on an Android device?

What is 2025 instructions for form?

Who is required to file 2025 instructions for form?

How to fill out 2025 instructions for form?

What is the purpose of 2025 instructions for form?

What information must be reported on 2025 instructions for form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.