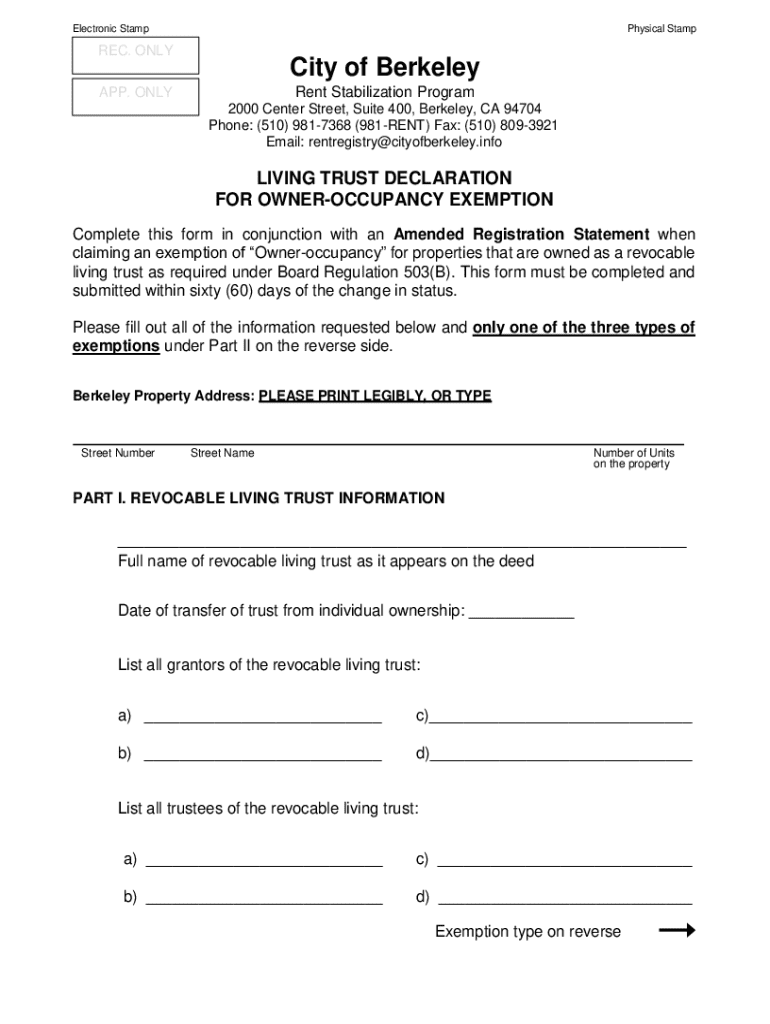

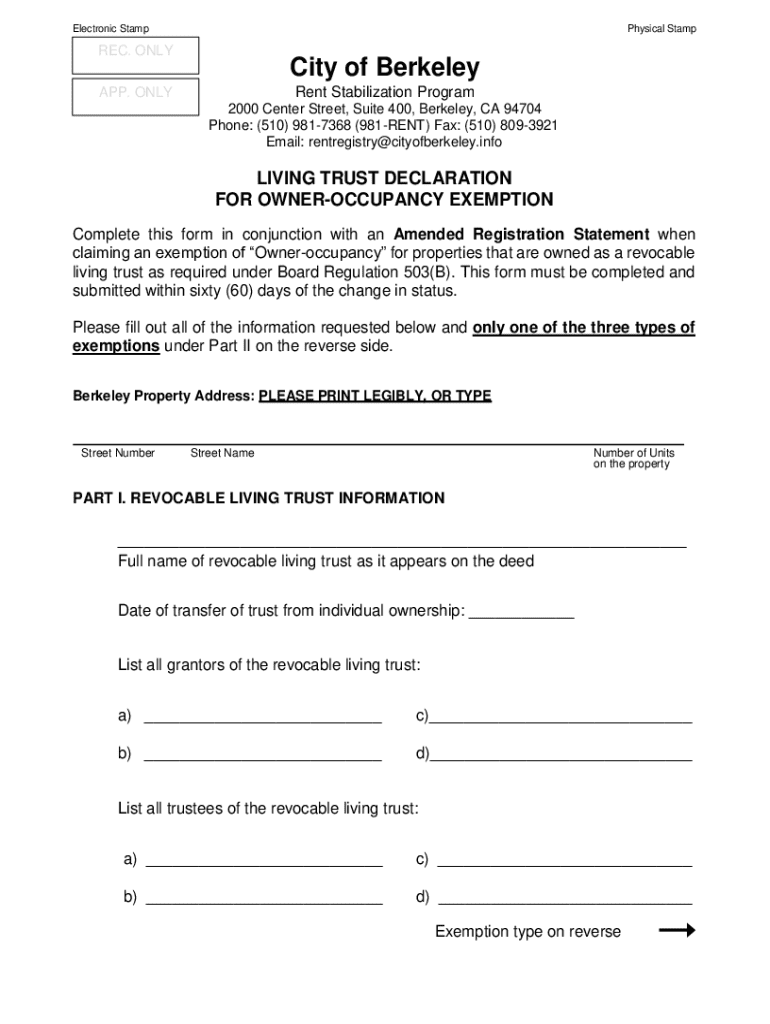

Get the free Initial Registration Statement (IRS)

Get, Create, Make and Sign initial registration statement irs

Editing initial registration statement irs online

Uncompromising security for your PDF editing and eSignature needs

How to fill out initial registration statement irs

How to fill out initial registration statement irs

Who needs initial registration statement irs?

Initial Registration Statement IRS Form: A Comprehensive How-to Guide

Understanding the initial registration statement IRS form

The Initial Registration Statement IRS Form is a crucial document for organizations seeking to establish their federal tax-exempt status. This form is submitted to the Internal Revenue Service (IRS) and serves as an official notice of an organization’s intent to operate as a nonprofit entity. It's designed to collect vital information regarding an organization’s structure, purpose, and financial status, which the IRS uses to determine eligibility for tax-exempt recognition.

The importance of this form cannot be overstated. Without it, an organization cannot legally operate as a tax-exempt entity, which can lead to significant financial repercussions, including taxation on income that should otherwise be exempt. Furthermore, filing the Initial Registration Statement is often the first step in gaining the trust of donors and the community, as it demonstrates a commitment to transparency and compliance with federal regulations.

The IRS requires this form primarily during the establishment of an organization. Organizations typically file it when they begin operations, change their organizational structure, or when they seek tax-exempt status for the first time. Understanding the nuances of this process is vital for smooth registration and operation.

Who needs to file the initial registration statement?

Certain types of entities are required to file the Initial Registration Statement IRS Form, primarily nonprofits, charities, and political organizations. Each of these categories plays a unique role in the community, but they all share a common need for federal tax-exempt status to operate effectively. Nonprofits, for example, include a range of organizations from social clubs to educational institutions. Charities, on the other hand, primarily focus on philanthropic aims, while political organizations engage in electoral activities.

It's also worth noting that some special cases may be exempt from filing the Initial Registration Statement. Organizations that already hold a different form of tax-exempt status or meet specific low-revenue thresholds might find themselves outside the filing requirement. However, it is crucial for organizations to verify these exceptions thoroughly to avoid noncompliance.

Key requirements for filing the form

Successful completion of the Initial Registration Statement requires specific basic information that truly reflects your organization’s identity. Key details include the name and address of the organization, the type of organization, and the applicable tax-exempt status. This foundational information plays a significant role in the IRS’s evaluation.

Supporting documentation is equally important in the process. Organizations should prepare articles of incorporation to establish their legal entity structure. Additionally, bylaws that outline the governance of the organization and recent financial statements provide transparency and legitimacy. Having these documents ready facilitates a smoother filing experience and reduces the risk of the application being delayed or rejected.

Step-by-step guide to filling out the initial registration statement

Filling out the Initial Registration Statement can seem daunting, but breaking it down into manageable steps can help. Here’s a straightforward step-by-step guide:

Interactive tools for form management

Using tools like pdfFiller can streamline the process of managing your Initial Registration Statement. With online editing and signing capabilities, pdfFiller transforms a potentially tedious process into a seamless experience. The platform allows you to fill out and edit the form from anywhere, ensuring you can access it at your convenience.

Additionally, collaboration options enable teams to work together effectively. Multiple users can access the document, make edits, and provide input in real-time, ensuring that everyone is on the same page and reducing the possibility of oversights.

Understanding the review process

After you submit your Initial Registration Statement, it enters a review process. The IRS will assess the application, which can take several weeks to several months, depending on the complexity of the organization and the backlog at the IRS. It’s crucial to remain patient during this time while the IRS verifies the information provided.

To keep track of your application status, you can reach out to the IRS or check their online tracking system if available. Being proactive in following up can help you address any inquiries or issues that might arise during the review.

Common challenges and FAQs

Organizations sometimes face challenges during the application process, leading to common questions. For instance, if an application is rejected, organizations should carefully review the reason for rejection as outlined by the IRS. They must quickly address and rectify the issues before reapplying.

Another common concern is how to make corrections post-submission. Organizations have the option to submit an amendment, detailing any changes or updates needed, which should be done as soon as possible to ensure compliance.

Lastly, if your organization undergoes significant changes — such as new leadership or bylaws — these must be reported to the IRS. Understanding these requirements can help avoid pitfalls in maintaining your status.

Laws and regulations surrounding initial registration

Filing the Initial Registration Statement is not just a procedural step; it sits within a larger framework of laws and regulations that govern nonprofit operations in the United States. Federal regulations primarily dictate the tax-exempt status and appropriate financial practices. Following guidelines set by the IRS is essential not only for legality but also to uphold public trust.

State laws also impose specific requirements. Organizations must familiarize themselves with local regulations regarding fundraising, reporting, and governance to ensure full compliance across all levels. Negligence in adhering to these laws can result in penalties or loss of tax-exempt status.

Maintaining compliance post-registration

Once you successfully file your Initial Registration Statement and attain tax-exempt status, compliance doesn’t cease. Organizations are required to file annual reports and tax forms, depending on their revenue, to maintain their status. Regular internal audits and checks can help ensure adherence to robust financial practices.

Additionally, any changes within the organization — such as changes in leadership, mission, or structure — must be reported to the IRS promptly. Failure to do so may jeopardize the nonprofit’s status and lead to financial ramifications down the line.

Using pdfFiller for ongoing document management

pdfFiller offers several benefits for organizations looking to maintain ongoing document management efficiently. The cloud-based platform allows users to store, edit, and share documents easily, ensuring accessibility from any location. As forms change or new requirements arise, pdfFiller allows for seamless transitions between different templates and forms needed for compliance.

Utilizing such a platform not only saves time but also helps ensure that all documents are current and comply with necessary regulations, which is paramount for operating as a reputable nonprofit organization.

Feedback and quality assurance

Collecting user feedback regarding the Initial Registration Statement filing process can provide essential insights for improving future submissions. Organizations should share their experiences and any issues they encountered, as this can help develop better support channels and resources for others in the future.

Transparent communication and feedback contribute to refining the registration process and addressing common pain points in a timely manner. A streamlined filing experience reflects positively on both the IRS and the organizations they serve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my initial registration statement irs directly from Gmail?

Where do I find initial registration statement irs?

How do I edit initial registration statement irs online?

What is initial registration statement irs?

Who is required to file initial registration statement irs?

How to fill out initial registration statement irs?

What is the purpose of initial registration statement irs?

What information must be reported on initial registration statement irs?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.