Get the free Form W-1121

Get, Create, Make and Sign form w-1121

Editing form w-1121 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form w-1121

How to fill out form w-1121

Who needs form w-1121?

How to Fill Out Form W-1121

Overview of Form W-1121

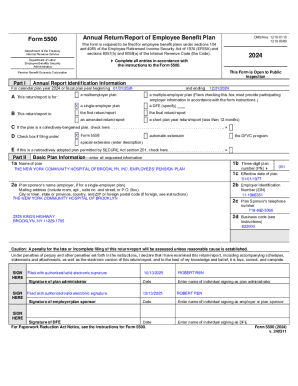

Form W-1121 is a crucial tax document that individuals and businesses must understand when dealing with specific tax obligations in the United States. This form serves multiple purposes, particularly for those who are looking to request federal tax refund offsets or request claims against erroneous withholdings. A clear understanding of this form is essential for accurate tax reporting and ensuring compliance with IRS regulations.

Certain demographics, such as students managing financial services or individuals engaged in temporary employment, should utilize Form W-1121 to streamline their tax-related processes. Additionally, it is pertinent for anyone who has received incorrect tax documentations like a W-2. By utilizing Form W-1121, individuals can mitigate potential tax liabilities and navigate the complexities associated with tax refund claims of their federal income.

Preparing to complete Form W-1121

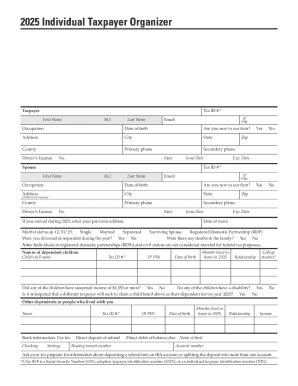

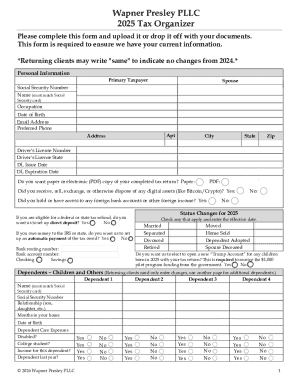

Before filling out Form W-1121, it is crucial to gather all necessary identification and financial documents. This includes items such as Social Security numbers, copies of previous tax returns, and pay stubs from employment, especially those tied to a W-2. Having accurate and complete information on hand ensures smoother processing of the form.

Additionally, when addressing claims on Form W-1121, prepare to compile relevant documentation, such as proof of the income in question and evidence of any erroneous withholdings. Understanding the legal and tax implications of errors and claims can directly influence financial outcomes; therefore, familiarize yourself with how these nuances apply to your unique situation.

Step-by-step instructions for filling out Form W-1121

Filling out Form W-1121 can seem daunting, but breaking it down into manageable steps can simplify the process significantly. Start by gathering your personal information and ensure that you are in a quiet environment where you can focus uninterrupted.

Step 1: Personal information

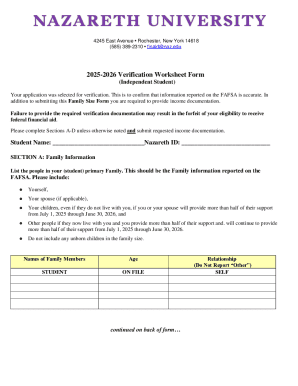

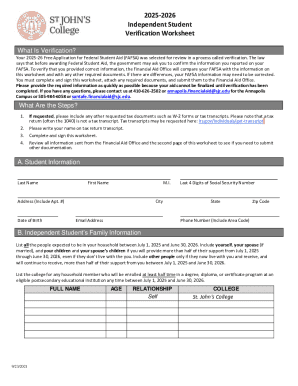

On the top section of Form W-1121, you will be required to provide your name, address, and any relevant identification details. Be meticulous in filling out these fields to avoid any discrepancies. Next, you will need to select your filing status, which will usually be indicated in a checklist format within the form.

Step 2: Income reporting

Moving on to income reporting, detail all your sources of income as specified. This will include wages, unemployment benefits, and other earnings relevant to your filing. Deductions can also be reported in a separate section; familiarize yourself with what is allowable to accurately complete this part.

Step 3: Claiming credits or refunds

In this section, outline any eligible credits that you are claiming. Examples include education credits or earned income credits, which can significantly affect your refund status. Each credit will come with its set of instructions that you must follow closely to avoid mistakes.

Step 4: Reviewing your application

Once you’ve filled out Form W-1121, take the time to review your entries. Accuracy is paramount; missing or incorrect information can lead to delays or even a rejection of your claim. Look for common errors such as miscalculated deductions or missing signatures.

Step 5: Signing the form

Before you submit the form, ensure you eSign it if you are using a service like pdfFiller, or physically sign and date it if filling out a paper version. Double-check that all fields have been completed and that it is ready for submission.

Editing and managing Form W-1121 with pdfFiller

When you need to make changes to your Form W-1121, pdfFiller's user-friendly interface can facilitate smooth editing. Upload your completed form to the platform and utilize the editing tools to modify anything that requires correction. Navigating through pdfFiller is straightforward, allowing you to ease into the editing process seamlessly.

With pdfFiller, managing multiple versions of your form is simple. You can save drafts and final versions easily, ensuring that you don’t lose important information. Version control features allow you to keep track of changes made to the document, so you can always refer back to previous versions if necessary.

Collaborating on Form W-1121

Collaborative features in pdfFiller enhance teamwork efficiency when filling out Form W-1121. By inviting team members to review or edit the form, you can gather diverse input and reach a well-rounded outcome. Team contributions can help spot errors and ensure compliance with IRS guidelines.

To maximize the effectiveness of collaboration, emphasize communication. Use comments and track changes features in pdfFiller to facilitate discussions on specific points within the document. Finalizing the form together not only guarantees accuracy but also reinforces a team-oriented approach.

Submitting Form W-1121

When you are ready to submit Form W-1121, you have a couple of options: postal mail or electronic submission. Each method has its pros and cons. Postal mail can take longer but is straightforward, while electronic submission offers speed and confirmation of receipt, reducing the chance of your application getting lost.

Regardless of the method chosen, ensure that you keep a copy of the submitted form for your records. Moreover, tracking your submission status can provide peace of mind; check to confirm receipt with IRS or relevant tax authorities.

Troubleshooting common issues

During the tax filing process, issues may arise with Form W-1121. Common problems often include missing information errors, which can delay processing times. Careful attention to detail during the completion of the form is essential to avoid these pitfalls.

If your form is rejected, contact support at pdfFiller for assistance in understanding the reasons for rejection. Their team can guide you through correcting issues, ensuring you can resubmit your claim as quickly as possible.

Additional tips for managing tax and financial documents

Organizing your tax documents is essential for seamless submission and compliance. Utilize folders to categorize documents related to Form W-1121, receipts, and any other pertinent forms. Effective organization can significantly reduce stress during tax season.

pdfFiller not only supports Form W-1121 but also offers templates for a variety of other necessary tax forms. Expanding your use of this platform can streamline all your financial documentation processes, providing a centralized location for managing documents securely.

Learning from others: Case studies and testimonials

Many users of Form W-1121 have shared success stories regarding their experiences. Examples illustrate how proper usage of the form expedited tax refund processes and resolved discrepancies effectively. Learning from these examples can provide valuable insights into common practices that enhance the likelihood of successful claims.

Community feedback often reveals tips for avoiding common pitfalls and strategies that improve overall efficiency when handling tax-related documents. Engaging with testimonials from other users fosters a supportive environment for your tax filing journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form w-1121 to be eSigned by others?

How do I make changes in form w-1121?

How do I complete form w-1121 on an Android device?

What is form w-1121?

Who is required to file form w-1121?

How to fill out form w-1121?

What is the purpose of form w-1121?

What information must be reported on form w-1121?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.