IA DoR IA 126 2025-2026 free printable template

Get, Create, Make and Sign IA DoR IA 126

How to edit IA DoR IA 126 online

Uncompromising security for your PDF editing and eSignature needs

IA DoR IA 126 Form Versions

How to fill out IA DoR IA 126

How to fill out 2025 ia 126

Who needs 2025 ia 126?

Your Comprehensive Guide to the 2025 IA 126 Form

Overview of the 2025 IA 126 Form

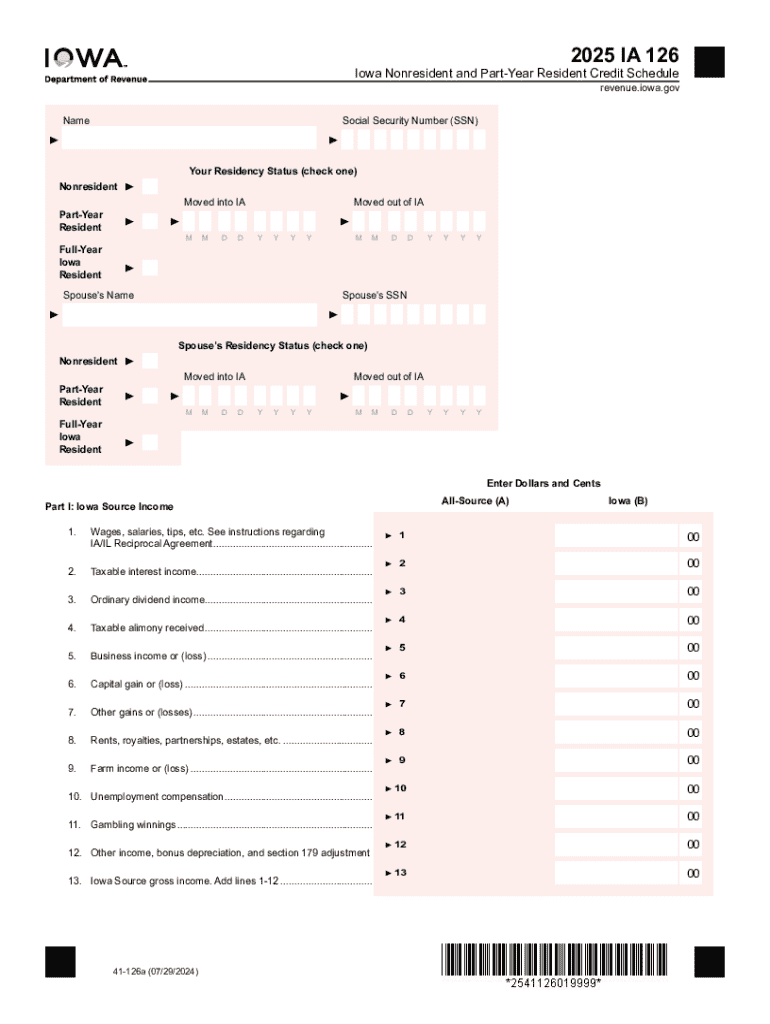

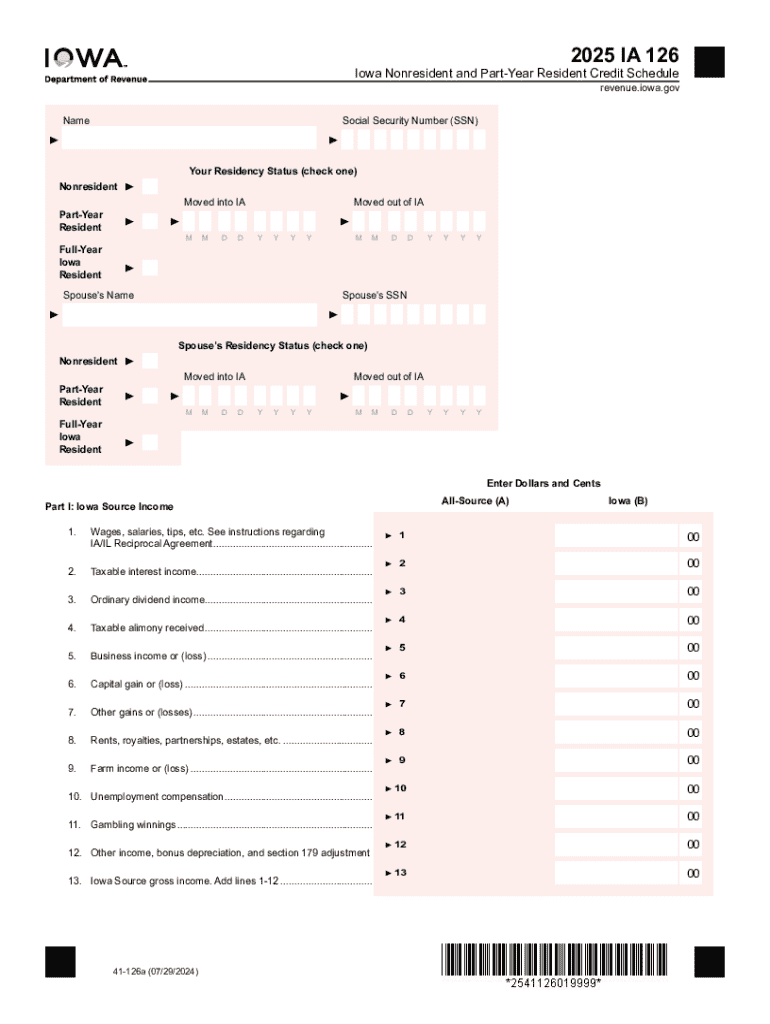

The 2025 IA 126 Form is a tax document specifically designed for nonresident and part-year resident taxpayers in Iowa. It serves as a crucial tool for reporting income earned within the state and determining the appropriate tax liability. Understanding the nuances of this form is essential for compliance and to avoid potential penalties.

Importance of the IA 126 Form for nonresident and part-year resident tax filers

Filing the IA 126 Form is particularly significant for nonresidents and part-year residents as it ensures that you only pay taxes on income sourced from Iowa. By accurately reporting your income and claiming eligible deductions, you can minimize your tax liability. Furthermore, timely submission of this form protects you from penalties.

Key features of pdfFiller's document solutions

pdfFiller offers a robust platform for managing the 2025 IA 126 Form. With features such as seamless editing, eSigning, and easy collaboration, pdfFiller simplifies the filing process. Users can access the form anytime, from anywhere, ensuring convenience and efficiency.

Understanding the 2025 IA 126 Form

The IA 126 Form is instrumental for nonresidents and part-year residents to report Iowa-sourced income. This ensures transparency and compliance with state tax regulations. Therefore, understanding who is required to file is crucial.

Typically, individuals who earned income in Iowa during the tax year but are not considered full-time residents need to file this form. This includes those who might have worked temporarily in Iowa or have income from Iowa-based sources while living elsewhere.

Eligibility requirements

Eligibility to file the 2025 IA 126 Form depends on several criteria, including residency status and the nature of income. If you have earned income in Iowa, you typically need to file, even if you resided in another state for the entire year.

Certain exemptions may apply, such as those with minimal income or specific types of income that are not subject to Iowa tax. Always reference the latest guidelines provided by the Iowa Department of Revenue to ensure compliance.

General instructions for completing the 2025 IA 126

Completing the 2025 IA 126 Form can seem daunting, but breaking it down into manageable steps can facilitate a smoother process. To begin, access the form on pdfFiller and use its interactive tools to guide you through each section.

It's advisable to gather all relevant documentation, such as W-2s and 1099s, prior to starting your form. This preparation will help ensure that you accurately report all income and applicable deductions.

Detailed line-by-line breakdown

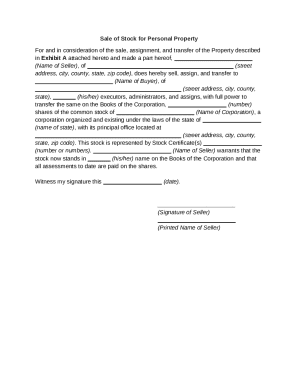

The IA 126 Form consists of several sections that need to be filled out accurately. Starting with Section 1: Personal Information, you must provide your full name, mailing address, and Social Security number. This information is essential for identification and processing your tax return.

In Section 2: Income Reporting, you will detail various types of income. This includes wages, salaries, taxable interest income, and other income sources. Proper documentation, such as pay stubs, is crucial for substantiating your reported income.

Deductions and credits

Section 3 covers deductions and credits, offering taxpayers opportunities to reduce their taxable income. Familiarize yourself with available deductions and confirm your eligibility through the Iowa Department of Revenue's guidelines. Deductions can include costs related to education or specific employment expenses.

Credits, on the other hand, directly reduce your tax liability. Ensure to understand the criteria for credits to maximize your filing efficiency.

Calculating tax liability

Depending on your reported income, you will calculate the taxes owed in Section 4. Iowa has specific tax rates for nonresidents, so familiarizing yourself with these rates is critical for an accurate tax assessment. Ensure to account for all deductions to obtain the correct figure.

Use the Iowa tax tables provided with the form to determine the accurate tax due based on your taxable income. Failure to accurately determine your tax can lead to unforeseen penalties.

Interactive tools and resources

pdfFiller provides excellent resources for completing the IA 126 Form. The platform’s editing features allow users to make changes easily. Simply fill in the required fields and leverage pdfFiller's tools to ensure your form looks polished and professional.

Team filing is also made efficient through collaborative options. PdfFiller allows multiple users to access the document simultaneously, which is particularly beneficial for team filings in organizational settings.

eSigning the IA 126 Form

Electronic signatures have become a standard practice in document submission, including tax forms. With pdfFiller, you can eSign the IA 126 Form quickly and easily. eSigning not only saves time but enhances the security of your submission.

To eSign via pdfFiller, follow the simple step-by-step instructions provided within the platform. Ensure that all necessary parties sign off before finalizing the form for submission.

FAQs about the 2025 IA 126 Form

It’s common to have questions during the tax filing process, especially regarding the IA 126 Form. Many individuals worry about making mistakes on their forms.

If you find an error post-submission, methods exist to rectify those mistakes. Most commonly, you will need to submit an amended form. Additionally, it’s crucial to be aware of filing deadlines to avoid penalties.

Staying compliant after submission

After you’ve submitted the 2025 IA 126 Form, maintaining compliance continues. Record-keeping is crucial for future reference. It’s recommended to keep your tax documents organized and accessible for at least three years.

Tracking your submission status can provide peace of mind. Ways to confirm receipt include following up with the Iowa Department of Revenue or checking online if they offer a verification tool for submitted forms.

Final tips for a smooth filing experience

To ensure a smooth experience when filing the 2025 IA 126 Form, avoid common pitfalls. Double-check entries to minimize errors in personal information and income calculations.

Focus on accurate reporting of income and take advantage of all available deductions and credits. Lastly, engage with pdfFiller’s support for any questions and utilize available community forums for shared experiences and solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IA DoR IA 126 for eSignature?

How do I edit IA DoR IA 126 online?

How do I fill out IA DoR IA 126 using my mobile device?

What is 2025 ia 126?

Who is required to file 2025 ia 126?

How to fill out 2025 ia 126?

What is the purpose of 2025 ia 126?

What information must be reported on 2025 ia 126?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.