Get the free 1 April 14, 2025 U.S. Department of Agriculture Animal and ...

Get, Create, Make and Sign 1 april 14 2025

Editing 1 april 14 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1 april 14 2025

How to fill out 1 april 14 2025

Who needs 1 april 14 2025?

A Comprehensive Guide to the 1 April 14 2025 Form

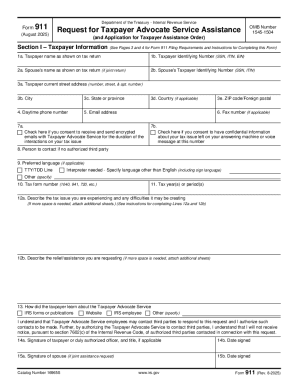

Understanding the 1 April 14 2025 form

The 1 April 14 2025 form serves as a vital document required for specific processes within the United States, particularly in compliance with new tax laws stipulated by the state. It is crucial for ensuring that individuals and organizations provide accurate and comprehensive data during financial reporting and compliance checks. This form not only aids in maintaining transparency but also protects users against potential penalties associated with misreporting.

Its significance cannot be underestimated as it functions as an official record that may be scrutinized during audits or reviews. Users must be informed of its requirements to avoid delays or issues in processing their submissions.

Key features and sections of the form

Understanding the structure of the 1 April 14 2025 form is essential for efficient completion. The form typically includes sections detailing personal information, financial specifics, and requisite declarations. Each section is integral in compiling a full picture of an individual’s or organization’s financial situation.

Who needs to fill out the 1 April 14 2025 form?

The 1 April 14 2025 form is targeted primarily at individuals and organizations within the United States who are required to report certain financial information by a specified date. This encompasses not just individual taxpayers but also businesses, non-profits, and governmental entities that need to comply with state and federal laws.

Specific scenarios for using this form may include individuals filing their annual tax returns, small businesses reporting income or expenditures, and organizations seeking grants or funding. Understanding the precise contexts in which this form is necessary can help users avoid late fees and ensure compliance with legal requirements.

Preparing to fill out the 1 April 14 2025 form

Prior to filling out the 1 April 14 2025 form, it is crucial to gather the necessary documentation to ensure accuracy. Key documents might include previous tax returns, financial statements, identification numbers, and any specific certifications required by state laws in Utah or other applicable jurisdictions. Having these documents on hand can facilitate a smoother completion process.

To collect this information effectively, consider making a checklist of the required documents. One should also consult trusted sources, such as tax professionals or official guidelines from the Utah state tax office. Avoid common pitfalls like submitting outdated financial records or forgetting essential information, which can lead to unnecessary complications.

Step-by-step instructions for completing the form

Completing the 1 April 14 2025 form requires careful attention to detail. Start by filling out Section 1, which captures personal information. Ensure accuracy in your name and contact details, as errors may lead to processing delays.

Moving to Section 2, provide detailed financial information. This section may request data regarding income sources, allowable deductions, and any applicable tax credits. Ensure you double-check financial figures to maintain compliance with tax laws.

Finally, in Section 3, complete all required certifications. This is often the most critical portion of the document, as it asserts that the information provided is credible and accurate. Utilize interactive tools like those available on pdfFiller to streamline this process, including the convenience of auto-fill and pre-made templates.

Editing and customizing the 1 April 14 2025 form

Once you've filled out the 1 April 14 2025 form, the next step is to ensure its accuracy through effective editing. Using pdfFiller allows users to modify the form conveniently. Navigate to the editing tools available, which empower users to cross-check their information or amend any inaccuracies discovered post-completion.

Additionally, adding digital signatures within pdfFiller is straightforward, allowing for a seamless submission process. Collaboration features enable multiple users to engage with the document, ensuring everyone involved can contribute and validate the provided information.

Common mistakes and how to avoid them

Even minor errors on the 1 April 14 2025 form can result in significant complications or delays. Common mistakes include inaccuracies in personal information, misreported financial details, and incomplete certifications. Each of these errors can lead to processing delays or rejection of the form.

To avoid these issues, users should implement best practices for verification before submission. Prepare a checklist that encompasses all essential details required by the guidelines. Moreover, revisiting the Utah tax laws can provide clarity on specific requirements and ensure full compliance with local rules.

FAQs about the 1 April 14 2025 form

Many users have questions about the 1 April 14 2025 form, primarily concerning its purpose and requirements. The most frequently asked queries revolve around who is obligated to file the form and what circumstances necessitate its completion. Understanding these aspects is crucial, especially for those facing tax-related decisions.

Users may also encounter unique situations regarding their filings. For example, if an organization has undergone restructuring or if an individual has recently moved, specific guidance tailored to these scenarios can aid in ensuring compliance and accuracy.

Managing your submitted 1 April 14 2025 form

Post-submission, managing your 1 April 14 2025 form is equally important. Individuals can track their submissions through dedicated e-services provided by the state, allowing them to follow up on their status. This can help mitigate potential concerns, especially if issues arise regarding processing.

For effective document organization, utilizing cloud storage such as that provided by pdfFiller is beneficial. Users can keep track of submitted forms, along with any supporting documents, ensuring they remain organized for future reference or audits.

Contacting support for the 1 April 14 2025 form

Should you encounter challenges while completing or submitting the 1 April 14 2025 form, pdfFiller offers comprehensive support resources. Their platform includes guidance tailored specifically for the form, along with general help options available through customer service.

Moreover, engaging with the community forums related to pdfFiller can prove invaluable. Users often share experiences and strategies that might help others who are navigating similar challenges, creating a supportive environment for best practices and advice.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 1 april 14 2025 online?

How can I edit 1 april 14 2025 on a smartphone?

Can I edit 1 april 14 2025 on an Android device?

What is 1 april 14 2025?

Who is required to file 1 april 14 2025?

How to fill out 1 april 14 2025?

What is the purpose of 1 april 14 2025?

What information must be reported on 1 april 14 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.