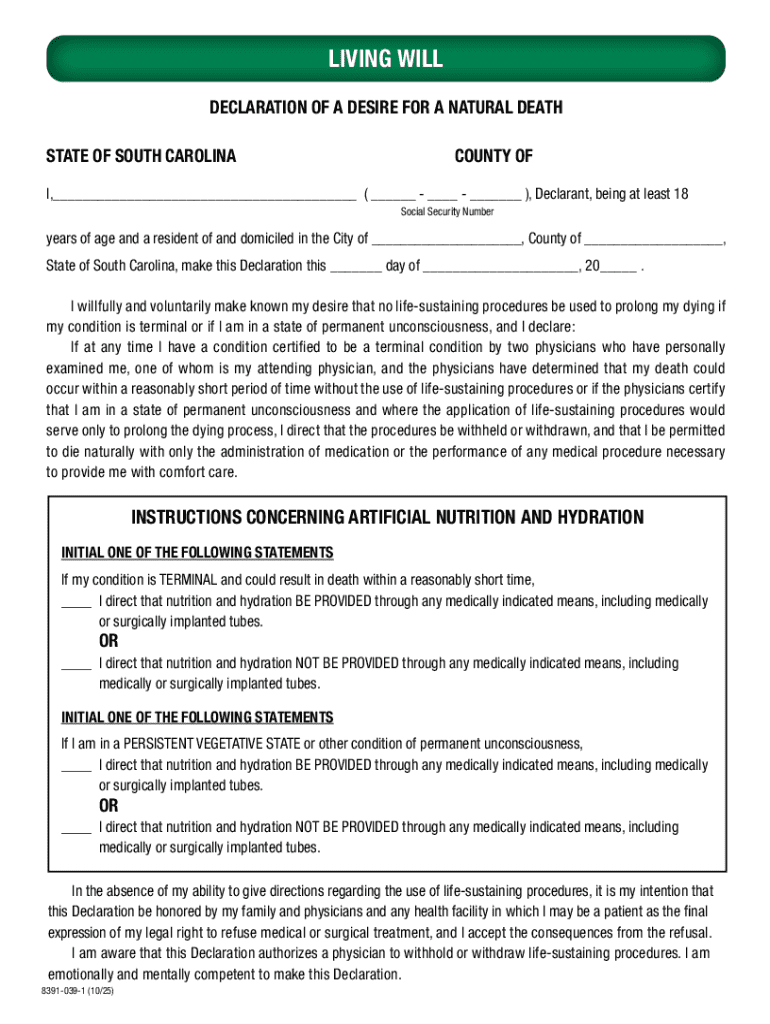

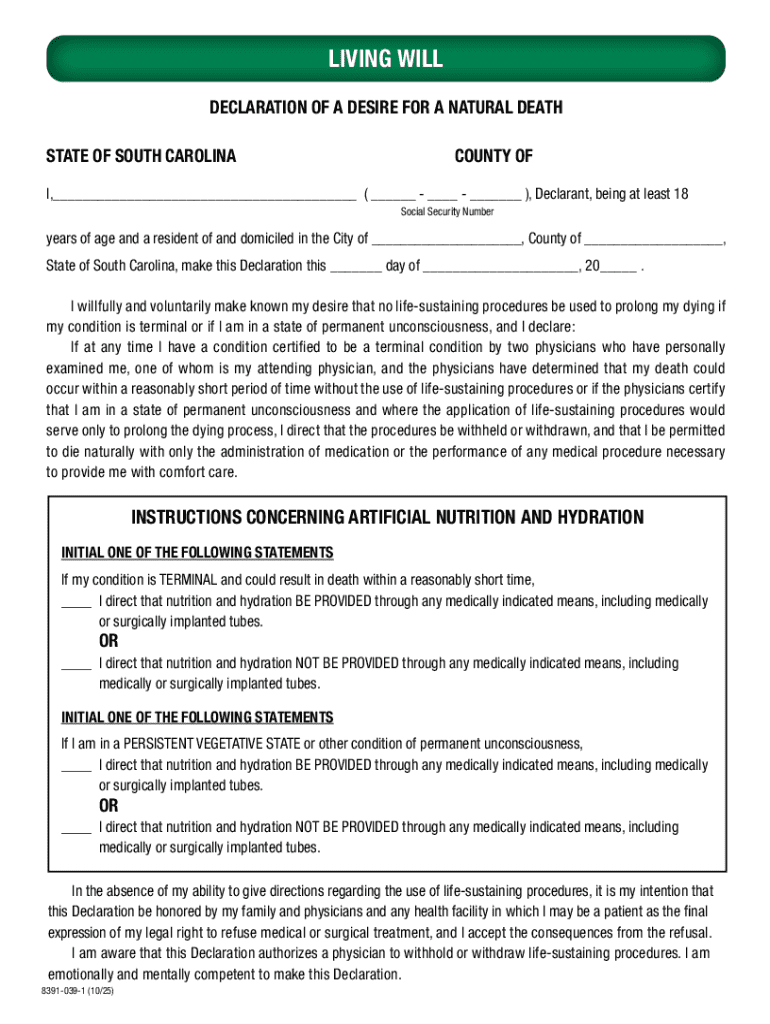

Get the free Form 2.1.1 Declaration of Desire for a Natural Death

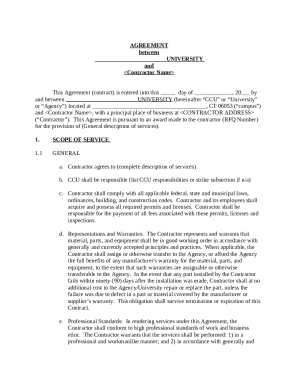

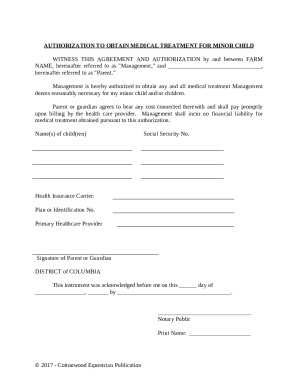

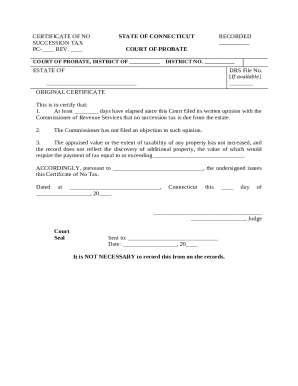

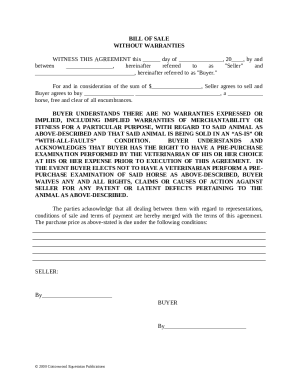

Get, Create, Make and Sign form 211 declaration of

How to edit form 211 declaration of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 211 declaration of

How to fill out form 211 declaration of

Who needs form 211 declaration of?

Form 211 Declaration of Form: A Comprehensive Guide

Understanding Form 211: Overview and Purpose

Form 211, also known as the 'Application for Award for Original Information,' is a critical tool used by individuals to report tax fraud to the IRS. This form plays an essential role in the IRS Whistleblower Program, which incentivizes citizens to come forward with information on tax violations, including tax evasion and other forms of fraud. By filing Form 211, whistleblowers can not only assist in identifying unlawful tax practices but may also qualify for financial rewards based on the funds recovered as a result of their information.

The IRS Whistleblower Program was established to encourage individuals to report underreported income or false deductions on tax returns. Form 211 is fundamental to this process, as it lays out the necessary information required by the IRS to investigate claims thoroughly and ensure that rewards are distributed accordingly.

Eligibility criteria for submitting Form 211

Any individual who possesses information regarding tax violations can submit Form 211. This includes employees, former employees, or anyone who has observed unethical tax practices. However, for a claim to be valid, the reported violation must be substantial enough to result in significant tax underpayment, usually over $2 million, or involve individuals whose information could lead to tax recovery.

Qualifying violations may include fraudulent tax returns, unreported income, or participation in schemes that evade tax responsibilities. To ensure a successful submission, it’s crucial to gather relevant documentation and evidence that supports your claim, such as detailed notes, corroborations from other witnesses, and any records that substantiate the fraud.

Step-by-step guide to completing Form 211

Completing Form 211 accurately is crucial for a successful submission. The form is divided into several parts, each focusing on different aspects of the claim. Understanding each section will greatly enhance your chances of getting your claim approved.

Part 1: Informant’s Information

In the first part of the form, you need to provide your personal information, including your name, address, and contact details. It is vital to ensure that the information provided is accurate, as the IRS will use these details for any follow-up communications regarding your claim.

Tip: Be honest when filling out your information. Any discrepancies can lead to delays or complications in the review process.

Part 2: Information about Allegations

In this section, you must describe the nature of the tax violation. Detail the specific activities that constituted fraud, the individuals or entities involved, and the dates when these actions took place. The more specific your account, the better the IRS can assess the validity of the claim.

Thoroughly compiling evidence is imperative. This can include bank statements, correspondence, business records, and any other documents that support your claims about the violation.

Part 3: Claim for Award

In the final part, you will calculate any potential reward. The IRS may offer a reward based on the amount of tax collected as a result of the information provided. It's essential to understand the criteria used for calculating these awards, as the IRS typically provides between 15% to 30% of the recovered amount. This part of the form is where you assert what you believe to be fair compensation for the information you have provided.

Submitting your Form 211 claim

Once you have completed Form 211, the next step is submission. The IRS allows both electronic and paper submissions. To submit electronically, your claim can be filed through email or an online portal managed by the IRS. Paper submissions must be sent to the designated address outlined in the form instructions.

Ensure that all sections are filled out completely before submission. Common mistakes include leaving sections blank or failing to provide adequate evidence. Whatever method you choose, maintaining confidentiality is crucial. You can request anonymity as a whistleblower, although it may limit the rewards you can obtain.

Post-submission process: What happens next?

After submitting your Form 211, the IRS will initiate a review process to evaluate the information provided. This process can be lengthy, often taking several months or even up to a year, depending on the complexity of the allegations and evidence.

During this time, the IRS may reach out for further information, requesting clarification or additional evidence to support your claim. It’s crucial to respond promptly to any inquiries, as this can significantly affect the outcome of your case.

Understanding award determinations and payments

The IRS uses specific criteria to determine the awards granted to whistleblowers who submit Form 211. Factors affecting award size include the total amount of tax collected due to the whistleblowing and the extent of the informant's contribution to uncovering the fraud. Generally, claims with substantial documentation and clear evidence tend to yield higher rewards.

If you disagree with the award amount determined by the IRS, it is possible to contest the decision. You must provide compelling evidence that supports a higher reward. This might include more documentation or supporting statements from individuals familiar with the case.

Managing communication with the IRS

Effective communication is key when dealing with the IRS after submitting Form 211. Maintaining an up-to-date contact information helps ensure that you receive any correspondence in a timely manner. A good practice is to document all communications and keep thorough notes of any discussions or correspondences, which can be useful referential material.

If you need to follow up on your claim status, approach the communication respectfully and clearly outline your inquiry. Remember that patience is essential, as the IRS deals with numerous cases at one time.

Common questions and concerns about Form 211

It's normal to feel anxious about whistleblower retaliation when considering submitting Form 211. However, numerous legal protections are in place to safeguard informants. The IRS is committed to keeping identities confidential unless disclosure is legally unavoidable. Understanding these protections can help mitigate fears of retaliation.

Furthermore, there are many myths surrounding confidentiality. For example, many believe that all whistleblower reports must be anonymous to ensure protection, which is not true. While anonymity can be granted, it often limits potential rewards. Therefore, informants must weigh the benefits and risks of their choices carefully.

Utilizing pdfFiller’s tools for form management

pdfFiller provides an efficient solution for managing Form 211. Users can easily fill out, edit, and sign the form using pdfFiller's user-friendly interface. The platform's cloud-based environment allows for seamless accessibility from anywhere, ensuring that users can manage their documents with ease.

In addition, pdfFiller offers collaboration features that enable teams to work together on submissions securely. This is particularly useful for organizations requiring multiple team members to contribute to the finalized report. Secure storage options also ensure that sensitive documents remain protected throughout the process.

Case studies: Successful whistleblower claims

Real-life examples underscore the impact of Form 211 submissions. In various instances, whistleblowers have reported substantial tax fraud, leading to significant recoveries for the IRS. These cases illustrate how pivotal accurate information and thorough documentation can be in unraveling illegal activities and enforcing tax law.

For instance, a recent case involved a former employee reporting falsified income statements affecting a large corporation, leading to a recovery in the millions. The whistleblower, guided through the submission process effectively, not only contributed to tax enforcement but also received a reward that reflected their invaluable contribution.

Further steps and considerations

Remaining informed is essential for anyone considering filing Form 211. Staying updated on IRS developments can provide insights that may affect the nuances of the submission process. It is also helpful to engage in continuous education around tax compliance and your rights as a whistleblower.

Ultimately, those who uncover violations should feel empowered to act. Reporting tax fraud is not just about potential rewards; it’s about contributing to a fair tax system and ensuring accountability. The IRS relies on whistleblowers, and your contribution may be more impactful than you realize.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 211 declaration of to be eSigned by others?

How do I edit form 211 declaration of in Chrome?

Can I create an electronic signature for signing my form 211 declaration of in Gmail?

What is form 211 declaration of?

Who is required to file form 211 declaration of?

How to fill out form 211 declaration of?

What is the purpose of form 211 declaration of?

What information must be reported on form 211 declaration of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.