Get the free Estate Planning Questionnaire - Army Garrisons

Get, Create, Make and Sign estate planning questionnaire

How to edit estate planning questionnaire online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estate planning questionnaire

How to fill out estate planning questionnaire

Who needs estate planning questionnaire?

Estate Planning Questionnaire Form: A Comprehensive How-to Guide

Understanding estate planning

Estate planning is the process of organizing how your assets will be managed and distributed upon your demise. It includes not only the transfer of ownership of assets but also various legal and financial considerations. This process ensures that your wishes are honored, your loved ones are cared for, and you can minimize tax implications. Despite its importance, many individuals delay or avoid estate planning due to misconceptions, such as believing it is only for the wealthy or overly complicated.

Using an estate planning questionnaire form can clarify your goals and priorities, guiding you through the decision-making process. It is a structured approach to gather your thoughts and necessary details, making the creation of a comprehensive estate plan more accessible.

Why use an estate planning questionnaire form?

Utilizing an estate planning questionnaire form provides several benefits. Primarily, it streamlines the estate planning process by ensuring you consider and document all aspects of your estate. The form prompts you to think critically about your assets, their allocation, and the care of your dependents. By having a written record, you minimize misunderstandings or disputes later on.

Key components of the estate planning questionnaire form

An estate planning questionnaire form typically contains several key components necessary for effective planning. Each section is designed to capture pertinent details to aid in developing an estate plan that reflects your wishes.

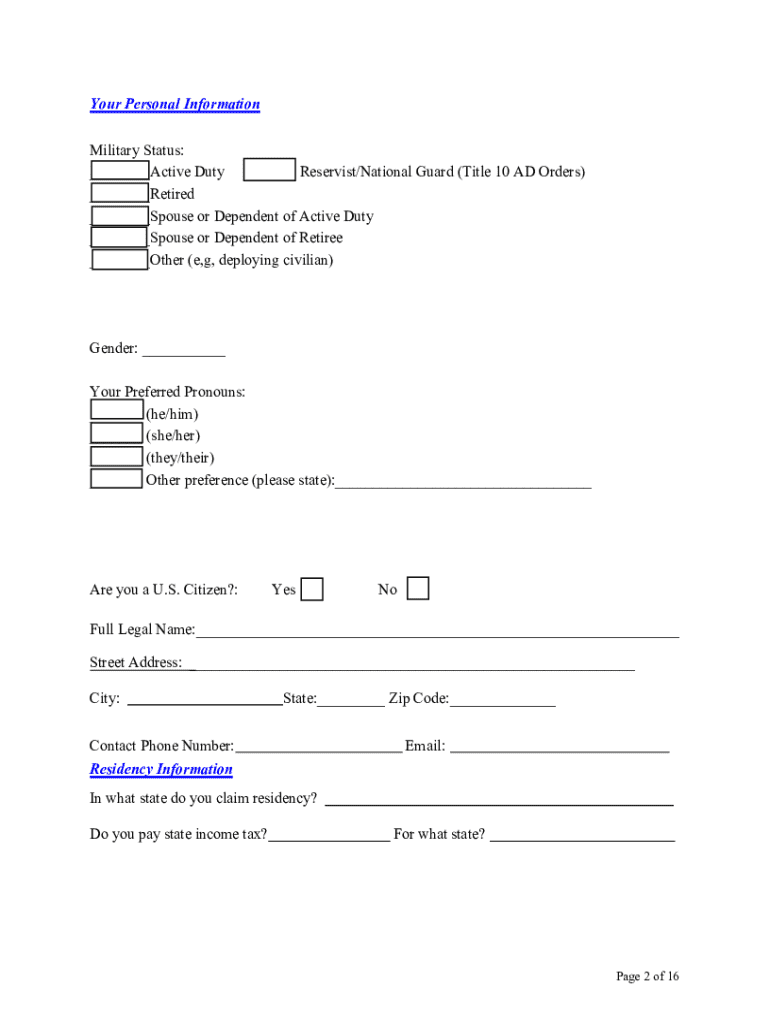

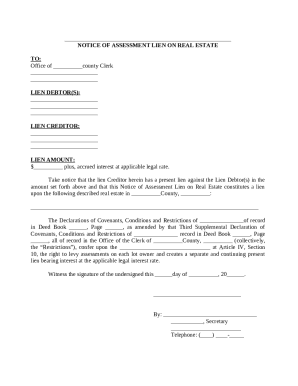

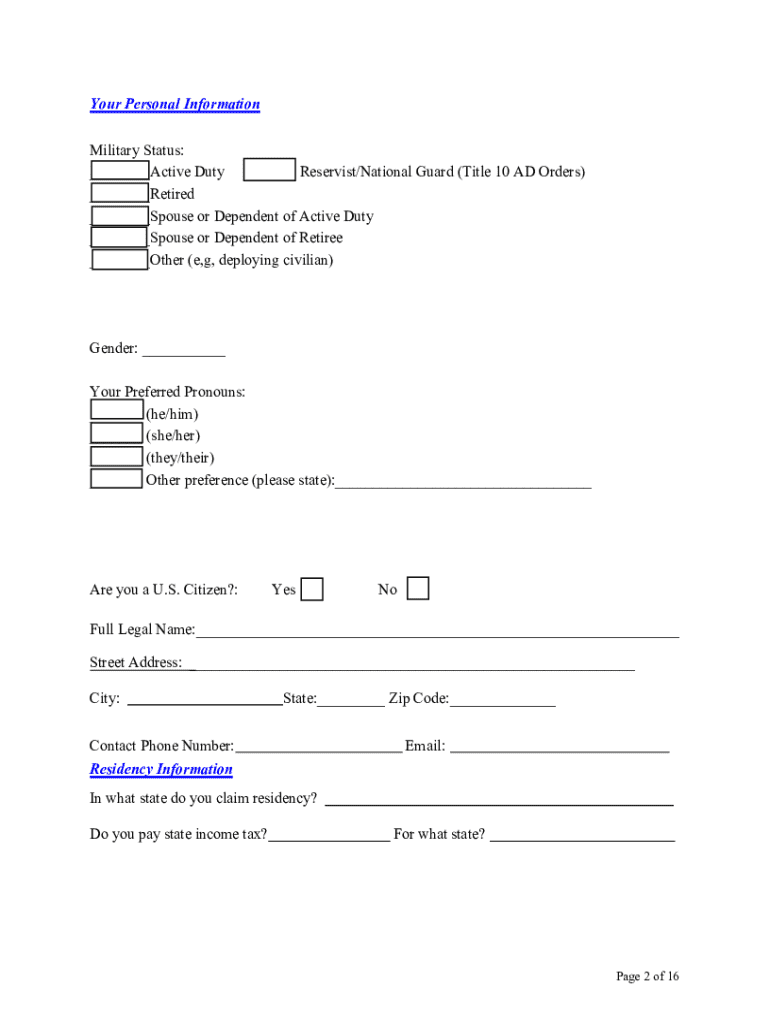

Personal information section

The initial section covers essential personal details such as your name, address, and contact information. Additionally, you’ll need to list your family, including spouses, children, and other dependents, to establish who will be directly affected by your estate decisions.

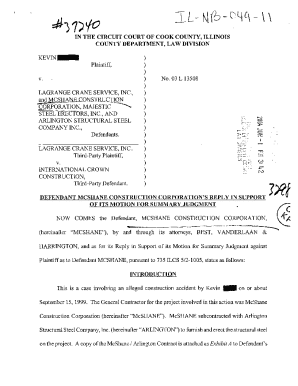

Assets and property distribution

A crucial aspect of the questionnaire involves documenting your assets. This includes real estate, bank accounts, investments, and personal property. The form will also guide you in articulating your preferences on how each asset should be distributed, whether through gifts, sales, or bequests to specific individuals or charities.

Guardianship and care for minors

For those with children, specifying a guardian is vital. The questionnaire includes questions on your preferences for guardianship, ensuring that your children are cared for by someone you trust in the event you can’t fulfill that role.

Health care directives

Health care directives, including living wills and medical powers of attorney, are critical components of comprehensive estate planning. The questionnaire prompts you to consider your medical treatment preferences and who can make decisions on your behalf should you become incapacitated.

Final wishes and distribution

Finally, the form covers your final wishes, including specific instructions for memorial services, distribution of sentimental items, and any other last requests.

Filling out the estate planning questionnaire form

Filling out your estate planning questionnaire form is a manageable process when approached step by step. Start by accessing the form on pdfFiller, where an array of interactive tools simplifies the completion process.

Common challenges may arise, particularly with legal terminology that can be confusing. Ensure transparency and honesty in your responses, as discrepancies can lead to legal complications later. Don’t hesitate to reach out to family members or legal advisors for clarity.

Interactive tools available

pdfFiller offers an interactive platform with various features to assist you in filling out the form effectively. You can utilize editing tools to add notes, highlight important sections, or even collaborate with family members or legal advisors in real-time. This collaboration feature ensures that you receive input from those who may be affected by your estate plan, promoting transparency and shared understanding.

Editing and customizing your estate planning documents

Once your estate planning questionnaire form is filled out, the next step is to edit and customize your documents on pdfFiller. This platform provides various tools that allow you to modify text, add specific considerations, and personalize your documents according to your wishes.

Collaborating with family or legal advisors further enriches this process. By sharing your forms via pdfFiller’s secure platform, you allow trusted individuals to offer insights or revisions, which can help prevent misunderstandings later and guarantee that everyone is on the same page.

Signing and managing your estate planning documents

As you complete your estate planning process, eSigning your documents on pdfFiller is a secure and legal option. Digital signatures are increasingly recognized in the legal landscape, providing an efficient way to formalize your wishes without the need for physical presence.

Managing and storing your estate planning documents securely is crucial. By taking advantage of cloud storage, you can organize your documents and access them from anywhere, ensuring that your estate plan is always within reach when needed.

Related forms and templates on pdfFiller

In addition to the estate planning questionnaire form, pdfFiller offers a plethora of related templates such as wills, powers of attorney, and trusts. These documents allow you to expand your estate planning beyond the basics and create a fully comprehensive plan tailored to your needs.

The integrated system ensures that information entered in the estate planning questionnaire is reflected across all related documents, promoting consistency and clarity in your estate planning approach. Regular cross-referencing information is advisable to ensure that your selections align across all forms.

FAQs about estate planning questionnaire forms

As you navigate the estate planning questionnaire form, you may have several common questions. Recognizing its purpose is essential—this form is your initial step toward establishing a clear and legally sound estate plan that reflects your intentions.

Should you face challenges when using the form, pdfFiller’s customer service is readily available to assist you. Don’t hesitate to reach out for support if you encounter technical issues or require guidance on specific sections.

Finalizing your estate planning process

Completing the estate planning questionnaire form is a significant milestone, but it is crucial to understand that it is only the beginning of the process. The next steps involve taking the information gathered and converting it into legally binding documents, such as wills and trusts. It’s important to review and update your estate plan regularly, particularly after major life events, such as marriage, divorce, or the birth of a child.

Laws surrounding estate planning can evolve, potentially impacting your plans. Thus, staying informed about legal changes and any updates to your financial situation is vital for effective estate planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit estate planning questionnaire from Google Drive?

How can I send estate planning questionnaire for eSignature?

How do I complete estate planning questionnaire on an iOS device?

What is estate planning questionnaire?

Who is required to file estate planning questionnaire?

How to fill out estate planning questionnaire?

What is the purpose of estate planning questionnaire?

What information must be reported on estate planning questionnaire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.