Get the free 7642 or by

Get, Create, Make and Sign 7642 or by

Editing 7642 or by online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 7642 or by

How to fill out 7642 or by

Who needs 7642 or by?

7642 or by form: A Comprehensive Guide to Understanding and Managing Form 7642

Understanding Form 7642: An Overview

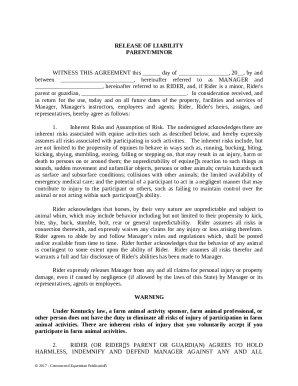

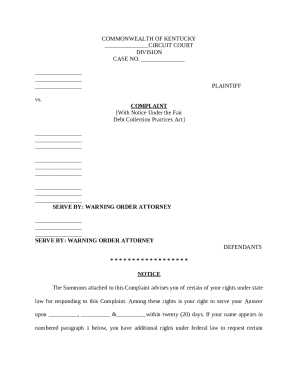

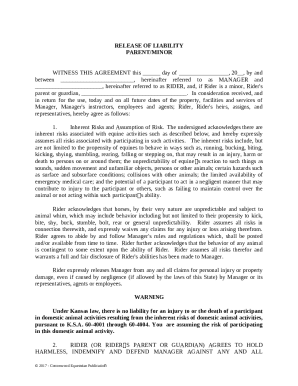

Form 7642 is a vital document widely used in various administrative processes, particularly in fields requiring detailed personal and financial disclosures. This form serves as a structured tool for individuals and businesses to communicate essential information, whether filing taxes, applying for loans, or submitting regulatory documents. Recognizing its significance promotes better compliance and aids in streamlining document-related tasks.

The importance of Form 7642 cannot be understated; it enhances transparency between parties and ensures that critical data is conveyed efficiently. Additionally, leveraging this form simplifies tracking financial activities, especially when combined with document management tools like pdfFiller. The benefits are manifold, from organized record-keeping to reduced chances of error.

Preparing to fill out Form 7642

Before diving into the details of completing Form 7642, it’s crucial to gather all necessary information. This preparatory step can significantly ease the filling process and minimize errors. Key categories of information required include personal details such as your name and address, followed by financial data relevant to the form’s purpose. Additionally, having supporting documents on hand can clarify any points of confusion.

Common mistakes often involve incorrect data entry or failing to read instructions carefully. Review the requirements thoroughly and take your time to avoid these pitfalls.

Step-by-step guide to completing Form 7642

Completing Form 7642 effectively requires an understanding of its structure. The form is divided into essential parts that facilitate a comprehensive collection of data.

Tip for each section: When filling out these parts, ensure that every field is filled out completely and accurately. Double-checking your entries can significantly reduce mistakes, safeguarding against potential delays in processing.

Advanced features of Form 7642 editing

With technological advances, editing Form 7642 has become more accessible and flexible through platforms like pdfFiller. The interactive tools allow you to edit and customize the form directly within the application, addressing any specific needs you might have.

Collaboration doesn't stop at editing; pdfFiller enables users to comment on forms and leave notes for others, improving overall communication and ensuring that all input is considered before finalization.

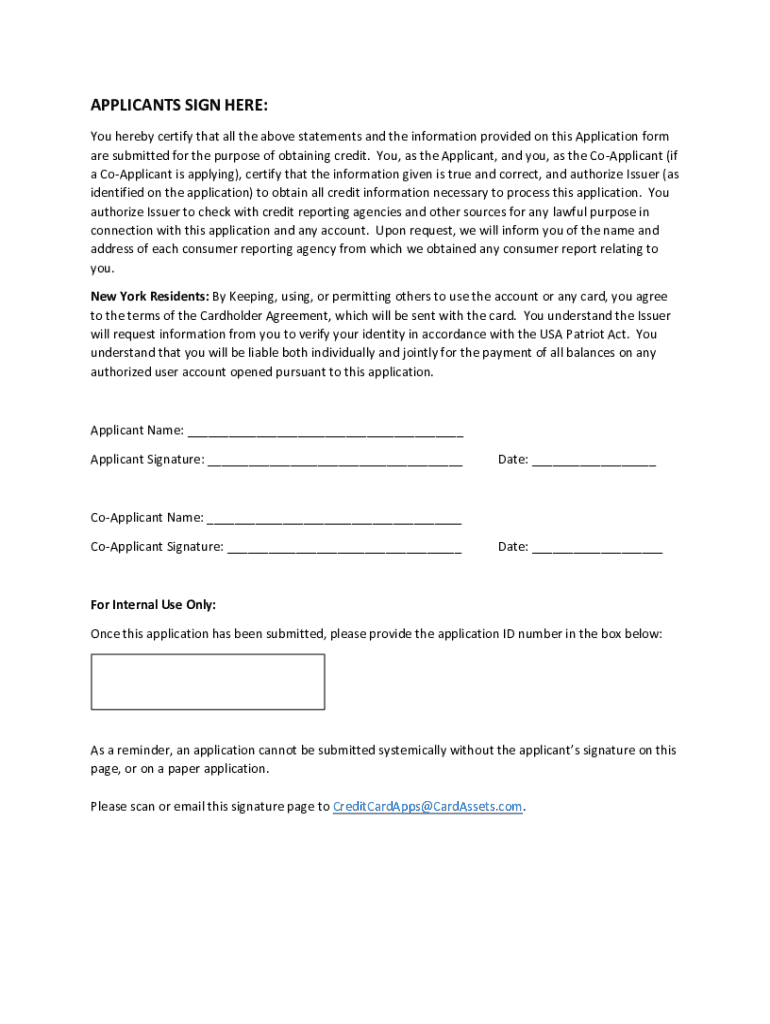

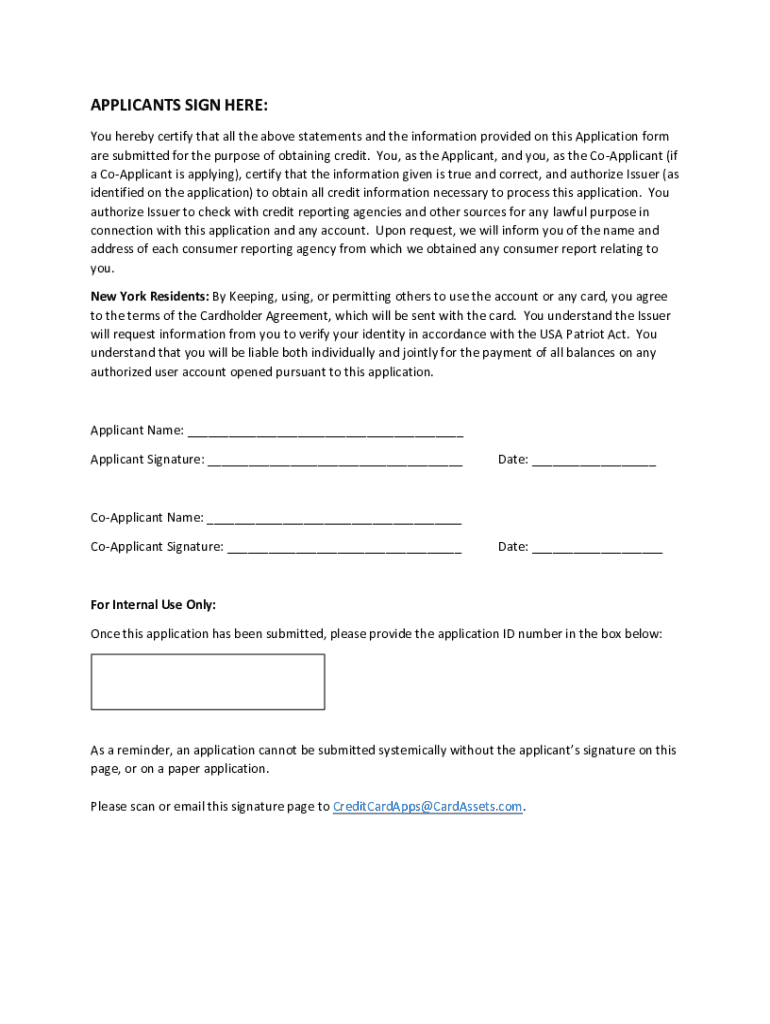

Signing and finalizing Form 7642

Once Form 7642 has been completed to satisfaction, it's time to sign and finalize the document. Under current regulations, you can create a legally binding eSignature that secures your submission legally.

Ensure adherence to any specific submission instructions that might accompany Form 7642 to avoid unnecessary complications.

Managing your completed Form 7642

Proper management of your completed Form 7642 is essential for future reference and compliance. Storing your forms digitally in the cloud offers convenience and organization.

Post-submission collaboration can also be streamlined; if you require input or feedback from others, pdfFiller provides tools for sharing documents easily and requesting feedback from colleagues.

Troubleshooting common issues with Form 7642

Even with preparation and attention to detail, challenges may arise when dealing with Form 7642. Common issues include confusion over specific entries or submission guidelines.

Utilize all support options available to ensure a seamless experience when handling any difficulties related to Form 7642.

Real-life examples and testimonials

The efficacy of Form 7642 shines through in cases where users successfully harness its capabilities for various needs. By reviewing real-life case studies and testimonials, potential submitters can appreciate how others have navigated their form submission processes.

These reflections serve not only as inspiration but also provide insight into practical applications of Form 7642.

Integrating Form 7642 into your workflow

Implementing Form 7642 into your workflow can create efficiency and reduce bottlenecks, especially when paired with pdfFiller's comprehensive document management abilities. The platform supports collaborative processes tailored to both individual needs as well as team settings.

By integrating Form 7642 into your documentation practices, you ensure that your submissions are accurate, timely, and present a professional image.

Exploring further: Additional forms and templates

Exploring related forms and templates extends the utility of Form 7642. Understanding which additional documents may be required for similar processes helps maintain thorough compliance and organizational flow.

This interconnectedness supports a more holistic approach to document management within your workflows.

Best practices for document management with pdfFiller

Maintaining a seamless document workflow depends significantly on adopting best practices in managing Form 7642 and other associated documents. Using pdfFiller, users can secure their documents and enhance their compliance with regulatory standards.

In this age of increasing digital threats, maintaining a focus on document security and compliance can safeguard your organization against potential risks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 7642 or by without leaving Chrome?

Can I create an electronic signature for the 7642 or by in Chrome?

Can I edit 7642 or by on an Android device?

What is 7642 or by?

Who is required to file 7642 or by?

How to fill out 7642 or by?

What is the purpose of 7642 or by?

What information must be reported on 7642 or by?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.