Get the free CO Federal Excise Tax Ultimate Purchaser Certificate

Get, Create, Make and Sign co federal excise tax

How to edit co federal excise tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out co federal excise tax

How to fill out co federal excise tax

Who needs co federal excise tax?

Understanding the CO Federal Excise Tax Form: A Comprehensive Guide

Understanding federal excise tax fundamentals

Federal excise taxes are specific taxes imposed on the sale or use of certain goods and services. These taxes are typically assessed on items like gasoline, alcohol, and firearms, as well as certain activities, such as air transportation. The importance of compliance with federal excise tax regulations cannot be understated, as failure to adhere could result in significant penalties for both individuals and businesses.

For proper understanding, it's crucial to know some key terms associated with excise taxes. "Taxable event" refers to the occurrence that triggers a tax obligation. "Taxbase" is the measure of value or quantity, which the excise tax is applied to. And finally, "exemption" indicates scenarios where certain entities or transactions are not subject to excise tax.

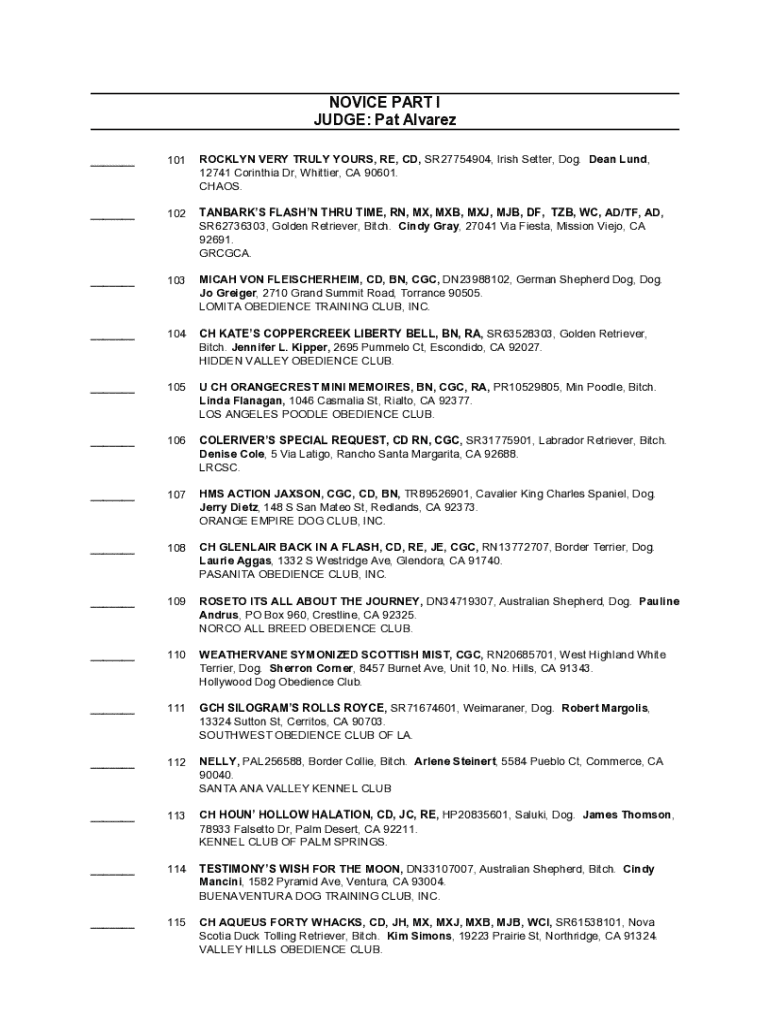

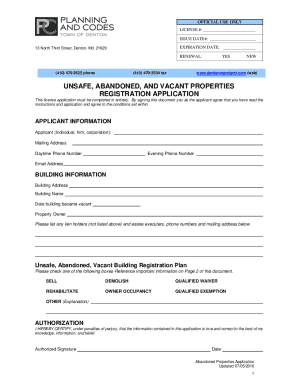

Who needs to file the CO federal excise tax form?

Typically, both individuals and businesses may be required to file the CO federal excise tax form, depending on their activities and purchases. For individuals, common scenarios where one may need to comply include owning firearms, purchasing taxable fuels, or engaging in certain recreational activities involving high-excise items.

On the business side, industries such as wholesale alcohol distribution, transportation, and oil and gas may face federal excise tax obligations. Businesses that manufacture, sell, or import excise tax-affected products like firearms or ammunition are also under scrutiny. It's important to note that certain exemptions may apply, particularly for non-profit organizations or governmental entities.

The CO federal excise tax form explained

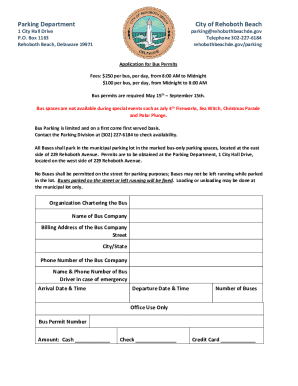

The CO federal excise tax form serves multiple purposes, primarily to report taxable activities and remit any due tax obligations. It represents a commitment to tax compliance and ensures that contributors to the federal revenue system are accurately accounted for.

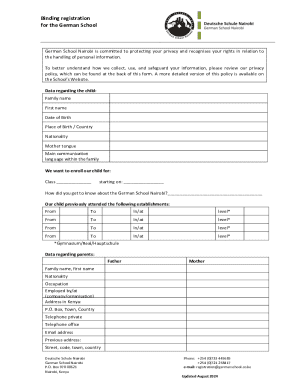

Breaking down the form components, it generally includes: identifying information where taxpayers provide their name, address, and identification numbers; tax calculation sections designed to document and summarize tax liability; and a final signature and declaration confirming the correctness of the provided information.

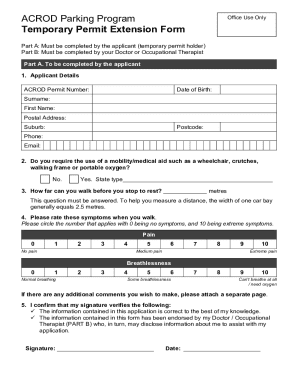

Step-by-step process for filling out the CO federal excise tax form

Gathering the necessary documentation is the first step towards accurately filling out the CO federal excise tax form. Essential documents may include income statements, invoices of taxable purchases, and any supporting evidence for deductions, such as sales tax returns or vendor registrations.

When completing the form, each section should be approached methodically. For accurate reporting, ensure that totals are calculated correctly and that all required signatures are present. Common pitfalls to avoid include underreporting taxable items, failing to classify transactions correctly according to guidelines, and omitting supporting documentation.

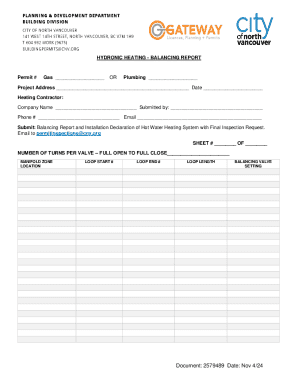

Editing and managing your CO federal excise tax form online

The advent of technology has made it easier to manage tax forms. Utilizing platforms like pdfFiller allows users to edit their CO federal excise tax forms effortlessly. You can upload your form to the service, which offers various features such as annotating, highlighting, or cloud storage for easy access and retrieval.

Saving your forms securely is crucial. With pdfFiller, you can not only save your completed forms but also maintain a history of your filings. This is particularly useful for referencing past submissions or making adjustments for future tax years.

eSigning the CO federal excise tax form

eSigning has become an essential aspect of today’s compliance landscape. By electronically signing the CO federal excise tax form using pdfFiller, users ensure their submission meets legal standards while enhancing the convenience of the filing process. An electronic signature is recognized by law as equivalent to a handwritten one, provided that the signature complies with electronic signature regulations.

To eSign, simply follow the guided prompts within pdfFiller, where you can easily add your digital signature to the form. Be aware of the importance of maintaining a secure record of your eSigned documents, which facilitates transparency and accountability in your tax affairs.

Submitting the CO federal excise tax form

Once the CO federal excise tax form is completed and signed, the next step is submission. Forms can typically be submitted electronically through designated portals or via traditional mail to the appropriate IRS office. Each submission method has its unique benefits; electronic submissions often receive immediate confirmations, while mail submissions should be sent via certified mail to ensure tracking.

Awareness of submission deadlines is key to ensuring compliance. Missing a deadline can incur late fees or additional penalties. Therefore, maintaining a calendar to track important due dates will serve you well, including keeping a lookout for confirmation receipts post-submission to further guarantee peace of mind.

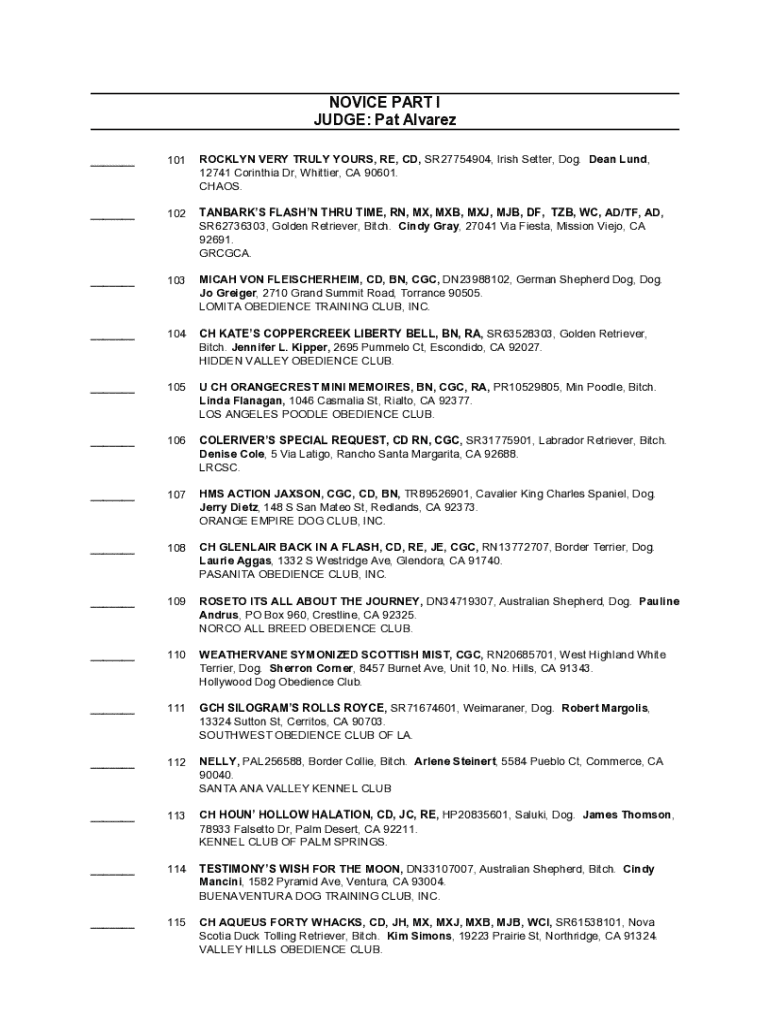

FAQs about the CO federal excise tax form

It's common for individuals and businesses to have questions regarding the CO federal excise tax form. One frequently asked question involves the exemption limits and whether an individual qualifies. Many are surprised to learn that while some may think they are exempt due to low usage, thresholds exist that should be understood to ensure accurate compliance.

Another concern pertains to the complexity of the tax calculation sections. Users often wonder about the most current rates applicable and how to interpret forum instructions. Consulting guidance publications or tax professionals may offer clarity, particularly for those conducting larger transactions involving high taxable amounts.

Managing your tax records and future filings

Keeping accurate records over the year is essential for smooth filing of the CO federal excise tax form come tax season. This involves organizing receipts, invoices, and any communication with vendors related to taxable items. Poor record-keeping can lead to missed deductions or misreported taxes.

pdfFiller can aid in this process by allowing users to archive past returns securely and access them at a glance. Anticipating next year's submission includes reviewing past filings, learning from any errors made, or ensuring that any key changes in business operations are documented and accounted for.

Access additional tools and resources

Resources for navigating the complex landscape of federal excise taxes are vital for compliance. pdfFiller provides access to related excise tax forms and guides, interactive tools that facilitate tax calculations, and comprehensive resources for staying updated about regulatory changes.

The platform encompasses everything from service fee logs to due date guides, ensuring that users are always informed about their taxation responsibilities, especially concerning nuanced areas such as vendor registration or the ammunition tax vendors.

Collaboration features for teams

Large organizations may face additional challenges when filing CO federal excise tax forms due to multiple stakeholders involved. pdfFiller's collaborative features allow teams to work together efficiently on tax documents. Features like shared access and real-time editing enable immediate input from team members, ensuring accuracy and accountability.

These collaborative tools can help streamline the process of compiling necessary supporting documentation and achieving consensus on final submissions, making it easier for organizations to navigate their tax responsibilities smoothly.

Additional support and contact information

The complexities of the CO federal excise tax form warrant access to reliable support. pdfFiller offers customer support to assist users with any inquiries they may encounter while editing, signing, or managing their tax forms. Additionally, engaging with tax professionals can provide valuable insights tailored to your unique circumstances.

Be proactive in seeking help when necessary, whether it's about specific form sections, compliance inquiries, or technical assistance with the pdfFiller platform. The synergy between self-service resources and professional advice will optimize your tax filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find co federal excise tax?

How do I complete co federal excise tax on an iOS device?

How do I fill out co federal excise tax on an Android device?

What is co federal excise tax?

Who is required to file co federal excise tax?

How to fill out co federal excise tax?

What is the purpose of co federal excise tax?

What information must be reported on co federal excise tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.