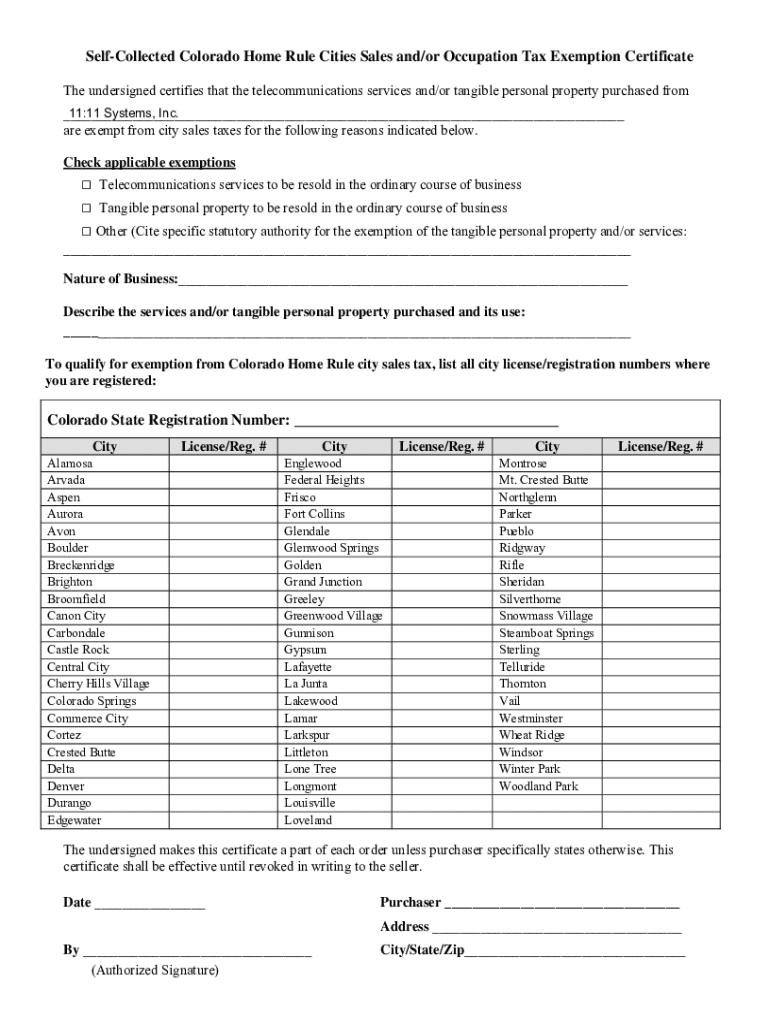

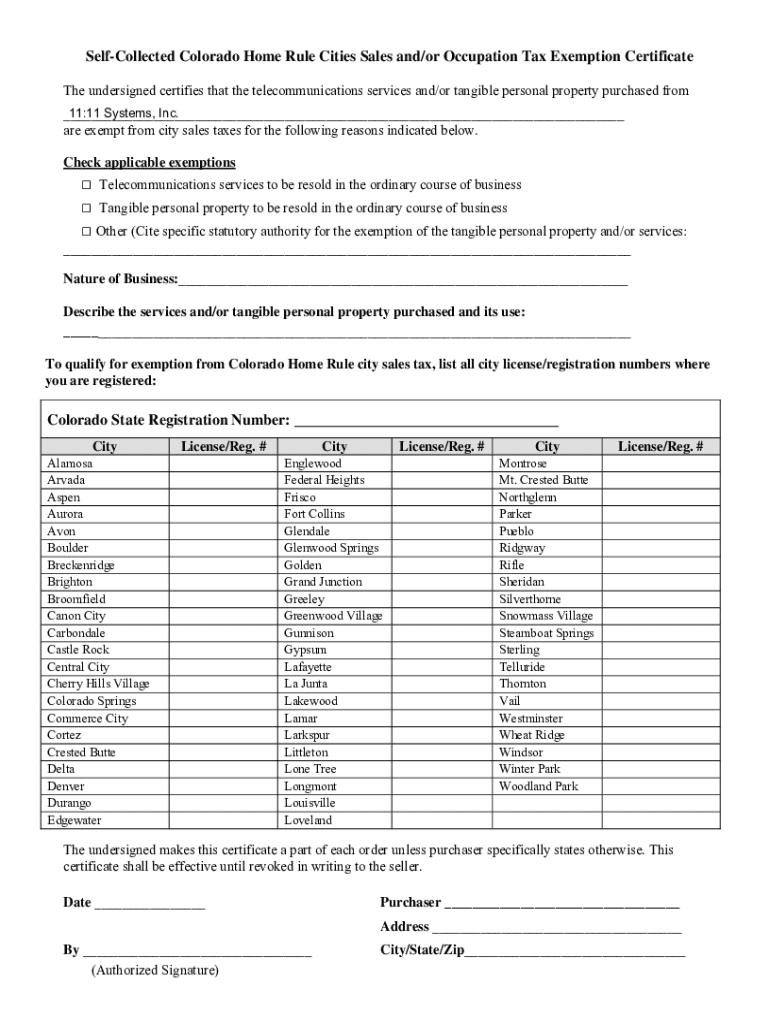

Get the free are exempt from city sales taxes for the following reasons indicated below

Get, Create, Make and Sign are exempt from city

How to edit are exempt from city online

Uncompromising security for your PDF editing and eSignature needs

How to fill out are exempt from city

How to fill out are exempt from city

Who needs are exempt from city?

Are exempt from city form: A comprehensive guide

Understanding the exemption from city forms

Exemption from city forms refers to certain circumstances under which individuals or organizations are not required to complete specific city documentation. These exemptions can result from various factors, including the type of entity filing, its purpose, or financial thresholds. Understanding these exemptions is crucial, as they can alleviate administrative burdens and reduce costs.

Common examples of forms that may be exempted include business licenses for non-profit organizations or specific tax-related forms for veterans and seniors. Knowledge of these exemptions can play a significant role in both reducing operating expenses and ensuring legal compliance with city regulations.

Types of exemptions available

Different categories of exemptions provide tailored relief based on specific needs. Tax-related exemptions are the most common; these can drastically lower the tax burden on eligible entities. Additionally, non-profit organizations often enjoy relief from certain forms significantly, enabling them to allocate more of their resources toward their mission. Specific demographics, such as seniors and veterans, may be entitled to unique exemptions that recognize their contributions to society.

Eligibility for these exemptions varies, often requiring proof of status or purpose. For instance, to secure a tax exemption, an organization must usually provide documentation proving its non-profit status, such as an exemption letter or certificate.

Step-by-step process for requesting exemptions

To successfully file an exemption request, preparation is key. Begin by gathering all necessary documents and information, including financial records, proof of eligibility, and previous tax forms. It’s essential to verify that you qualify for the exemption you're seeking.

Once you have all the required documentation, complete the exemption form. Each section typically requires specific information—make sure to read instructions thoroughly. Double-check your entries to avoid common mistakes like incomplete fields or incorrect financial figures.

Interactive tools for simplifying the process

Utilizing online tools can significantly streamline the exemption request process. For instance, pdfFiller offers interactive features that allow users to fill out forms directly, edit documents, and e-sign them conveniently. These tools can enhance accuracy and efficiency, making the submission process smoother, which is especially beneficial for busy individuals and teams.

Templates on pdfFiller are another invaluable resource. Users can access pre-filled templates that cater to common exemptions. This feature not only saves time but also minimizes errors that may arise from manually creating forms from scratch.

Tracking your exemption request

After submitting your exemption request, it’s essential to track its progress. Following up not only helps ensure that your application is processed but also provides you peace of mind. Depending on local regulations, various methods may be effective for tracking your request.

Using online tracking tools provided by local authorities can streamline this process. Additionally, if you haven’t received updates in a timely manner, contacting the local office handling your exemption can be beneficial.

Common challenges in the exemption process

Navigating the exemption process isn't without its challenges. One major hurdle can arise if your exemption request is denied. Understanding the appeals process is crucial; in many cases, applicants may need to provide additional documentation or clarification to support their case.

Additionally, applicants sometimes run into issues related to missing deadlines, which can delay processing times. If you miss a deadline, reach out to your local office as soon as possible to discuss your options. The sooner you address the situation, the better.

Frequently asked questions (FAQs)

Many individuals have questions regarding the exemption process. One common inquiry is whether anyone can file for an exemption. Generally, eligibility is determined by specific criteria, so not everyone may qualify. The approval process duration also varies; it can take weeks to several months, depending on the local authority's workload and regulations.

After an exemption request is approved, the applicant typically receives confirmation alongside details about ongoing compliance requirements, such as annual renewals or reporting obligations.

Maintaining compliance after receiving an exemption

Once you receive an exemption, it’s important to remain aware of any ongoing obligations that may follow. Many exemptions require annual renewals or periodic reporting to confirm continued eligibility. Failing to comply with these requirements can result in loss of the exemption, leading to unexpected financial burdens.

Moreover, keeping thorough records of your exemption and all related documentation is essential. This practice not only aids in future compliance but can also simplify the renewal process down the line.

Conclusion and final insights

Understanding the landscape of exemptions from city forms is essential for individuals and community organizations alike. Knowledge of the category types, eligibility criteria, and application processes ensures you’re empowered to make informed financial decisions.

Using platforms like pdfFiller enhances your document management experience, allowing for easier edits, e-signatures, and collaborative efforts. Taking the time to understand these processes can alleviate stress and lead to more effective resource allocation for those in need.

Additional links and resources

For further details on local city regulations regarding exemptions, consider visiting the official city website. Contact information for local tax offices can provide additional clarity on any questions related to equitability in exemption processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in are exempt from city without leaving Chrome?

How do I fill out are exempt from city using my mobile device?

How do I complete are exempt from city on an Android device?

What is are exempt from city?

Who is required to file are exempt from city?

How to fill out are exempt from city?

What is the purpose of are exempt from city?

What information must be reported on are exempt from city?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.